Peloton: Risk Reward Could Be Better Than You Think

Summary

- Peloton Interactive, Inc.'s investment case is very nuanced. There's more to this story than just headlines.

- The bull case can be built on its comparables improving once Peloton gets past its June quarter.

- The bear case remains based on Peloton Interactive, Inc.'s balance sheet.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

NoSystem images/E+ via Getty Images

Investment Thesis

Peloton Interactive, Inc. (NASDAQ:PTON) was a bubble stock. It was a stock to be avoided. We all know this. But I'm not sure that we can now agree that today this is a stock to be avoided.

To be clear, to be less bearish on a stock does not mean that it's an unequivocal buy rating. It's simply what it says on the tin, that the outlook from here is more uncertain and that there are some potential scenarios where there's an upside in the stock.

Further, it's important that we all acknowledge the following conjecture. Just because the stock is down +90% from its highs, does not mean that the stock is undervalued.

But within the gray area that Peloton presently trades at, there are different scenarios that Peloton can take. Personally, if I held the stock, I wouldn't be a seller at this point.

When Would You Change Your Mind?

In hindsight, it was ''obvious'' that Peloton was overvalued. Well, let's be frank, when investing very few things are obvious. The obvious outcomes can only be made in hindsight.

But without looking back, here's what I can say. For my part, I've been bearish on Peloton's prospects for a long while.

But I'm not convinced that today, looking ahead, it's so obvious that the stock is such a risky investment.

Again, to be clear, in investing things are rarely black or white. But in Peloton's case in particular, given its recent fiscal Q2 2023 results, I find myself being slightly less bearish on its near-term prospects.

Comparables Are Set to Improve

This is my key contention; if one were to build a bull case, this would be it.

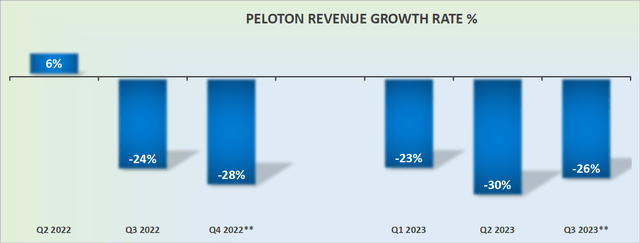

Peloton has one more quarter of challenging comparables, and then, once we get to fiscal Q4 2024, the quarter ending June 2023, its quarterly revenue growth rates are unlikely to be posting such negative y/y revenue growth rates.

That means that the business will reach stability. And within that stability, the business can attempt to better monetize its user base.

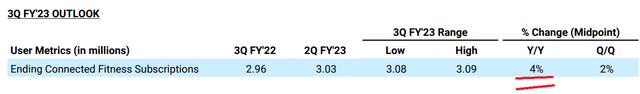

After all, even now, this late into Peloton's business cycle, PTON is still expected to grow its connected fitness subscriptions by 4% y/y. And for me, this is quite insightful, that even now, PTON is still seeing subscriber figures increasing.

Accordingly, it's not all negative when it comes to PTON.

Next, the Bear Case

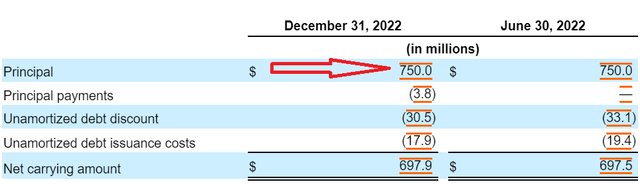

Peloton's balance sheet is in a perilous situation. Namely, Peloton carries $1 billion of convertibles that can be made whole on August 2025.

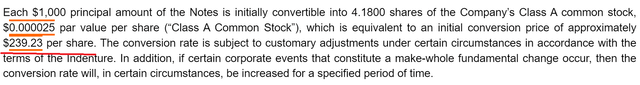

Further complicating matters is that Peloton's convertibles are significantly out of the money, with a conversion price of $239 per share, see below.

Therefore, in practice, this means that in about 2 years, Peloton's convertibles will end up being converted into shares, thereby increasing its total shares outstanding by approximately 25%. Why would the convertibles be exchanged for more shares rather than refinanced for cash?

While it's accurate that Peloton carries $870 million of cash on its balance sheet, I believe that the bulk of that cash will have covenants tied against it to make sure that debt holders are made whole first.

Consequently, putting asides the $1 billion convertibles that have their first conversion date in approximately 2 years, Peloton's balance sheet is left with $120 million of net cash.

Moreover, with interest rates at 4% or higher, I'm not sure that PTON will be able to raise high-yield debt on anything less than 10% rates. If that happened, that would be the nail in its coffin.

The Bottom Line

Peloton Interactive, Inc.'s outlook from here is mixed. While it's popular to be bearish on PTON, if we spend some time to think Peloton through, Peloton's underlying prospects are not so bad.

On the other hand, the main bearish consideration is that its balance sheet is severely restrictive. And with interest rates as high as they are, its ability to refinance its debt on anything other than highly onerous terms simply doesn't leave Peloton Interactive, Inc. with much room to maneuver.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.