Perion: Good Business, But Can't Get Excited At This Price Point

Summary

- Some of Perion’s innate qualities could make it a fine portfolio stock.

- However, we don’t believe a long position at this juncture will be too rewarding.

- A HOLD rating feels fitting.

bpawesome

What's to Like

Perion Network (NASDAQ:PERI), a small-cap stock with expertise in the ad-tech business has a lot of things going for it.

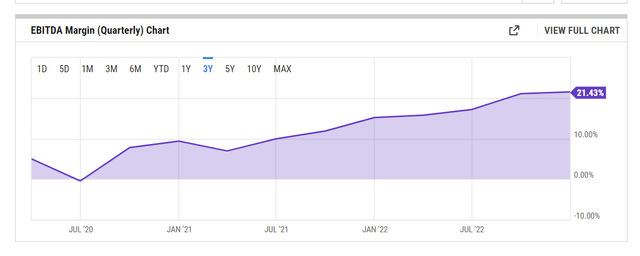

Despite some tricky conditions for the advertising industry in 2022 (2023 will now witness a rebound with digital ad spending poised to grow by double-digits again), Perion has done very well to grow its EBITDA margins. Three years back margins were in negative territory, these days it is well over 20%.

At the heart of this EBITDA margin improvement is Perion's proprietary iHub or Intelligent Hub, which has been instrumental in abetting the expansion of Peri's media margins. iHub offers compelling ad solutions that are coveted by both the demand and supply side, whilst it also helps reduce duplication and inefficiencies. Rather than having siloed units, iHub basically serves as both an ad server, and a centralized real-time bidding platform at the same, thus driving greater cost efficiency.

It's also fair to say that Perion's proprietary cookieless targeting solution - SORT (typically drives up to 2x the results of cookie-based approaches), looks well-poised to profit in an era where privacy will take precedence and legacy third-party cookies will be phased out.

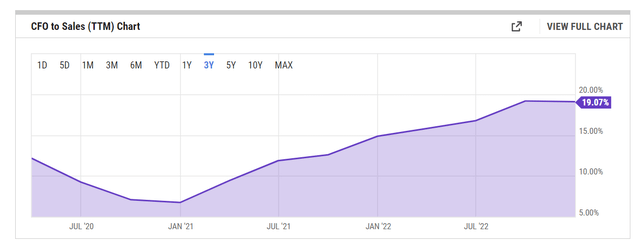

Then there's Perion's hallmark of fast-improving cash generation. Last year, the company's operating cash flow grew by an impressive 72% YoY. Crucially this is not a one-off, rather Perion has been getting better at ensuring greater flow through from its topline to the operating cash flow level. At the end of 2020, it could only convert around 7% of its sales to operating cash flow, but recently it has been trending closer to the 20% mark!

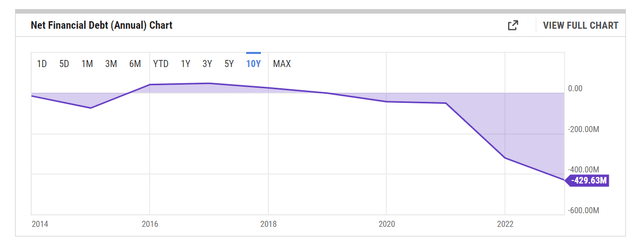

For a company with strong growth ambitions, it's also important to have the requisite balance sheet to supplement that vision. Perion is not overly financially geared and has managed to overturn a net debt position of $23m in FY17 to a whopping net cash position of $429m (as of FY22).

We Have Our Concerns Though

Whilst there's quite a bit to like about the Perion story, I'm not sufficiently convinced that an investment at this juncture will prove to be overly rewarding. Here's why-

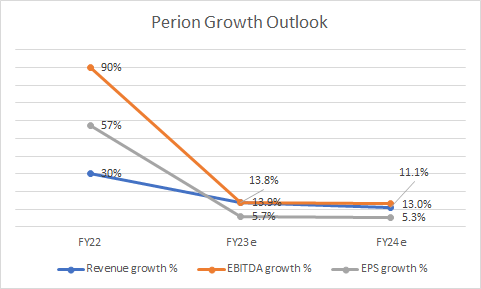

Firstly, considering the strong base effect, it is asking for a lot to expect Perion to keep up its impressive growth track record (since FY20, Peri has delivered 101% EBITDA CAGR on a revenue base that has delivered 40% CAGR during the same period). Indeed, following a year in which revenue grew by 30% and EBITDA grew at 3x the pace of those revenues, growth will slow quite drastically, not just in FY23, but in FY24 as well.

According to consensus estimates, following a year in which the company saw impressive operating leverage, EBITDA growth next year will be closer to the mid-teens level, in line with revenue growth. Meanwhile, earnings growth will only come in at mid-single digits over the next two years, following 30% growth last year!

YCharts

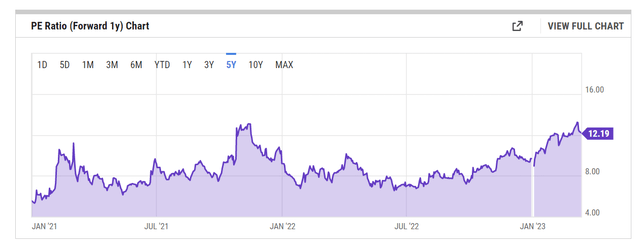

When you study these forward-looking estimates through the prism of valuations, things don't look overly compelling. For context, a mid-single-digit earnings profile over the next two years feels quite underwhelming for a stock that trades at 12.85 forward P/E (based on FY23 estimates), and 12.2 P/E x based on FY24 estimates.

Put another way, you're looking at a pricey enough PEG (Price to earnings growth ratio) of 2.3x. Also consider that the FY24 forward P/E represents quite a steep premium (41%) over the stock's own forward P/E 5-year average of 8.67x!

Then as noted in the previous section, Perion has a solid enough track record of generating ample free cash flow, but if you bring the market cap into consideration, it's fair to wonder if you're entering at the right time. For more clarity do consider that traditionally, Perion's FCF yield over the last five years has averaged over 20% but these days, it is a lot lower at only 7.55%!

I'm also not convinced there are ample near-term catalysts to ensure further outsized gains in Perion's stock. Q1 typically has proven to be the weakest quarter for Perion both from a revenue and operating profit angle (The sell-side community currently expects quarterly revenue to dip from $210m in Q4-22 to $141m in Q1-23, whilst EBITDA will likely come in at $29m, much lower than what was seen in Q4-22 ($48m) so don't expect a blowout then.

The recent change in Perion's top leadership is not ideal either. Whilst I have little reason to doubt Tal Jacobson's competence in managing and running Perion's search monetization solutions, one can't help but wonder if he has the necessary chops to serve as CEO, particularly when things go awry. For the uninitiated, when Doron Gerstel was appointed as CEO of Perion in early 2017, he had already accumulated close to two decades of CEO experience at different tech firms across the globe; Jacobson meanwhile, has no experience of managing at the very top.

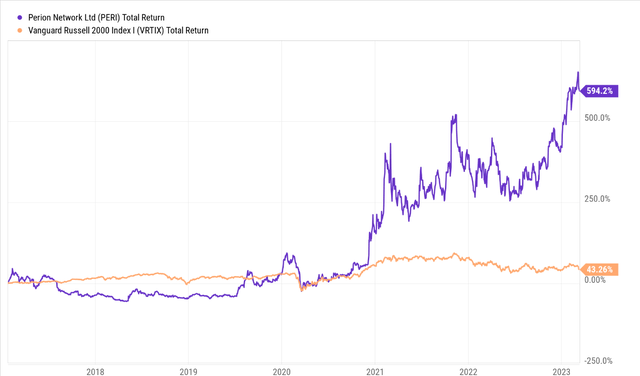

Whilst I wish Jacobson well in his new role, there's no denying the fact that he has big shoes to fill. When Gerstel took over, Perion's stock was trading at the mid-single digit levels; since then, the stock price has expanded by ~6x, trouncing the returns delivered by the Russell 2000 Index.

Finally, if one looks at the relative strength and standalone charts of Perion, there's not an awful lot to get excited about if you're thinking of going long now.

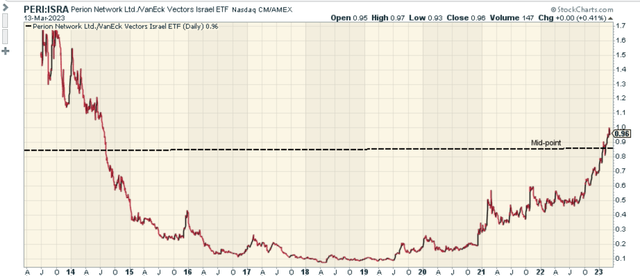

Investors looking for value opportunities in the hotbed of innovation-Israel may have had Perion in their wish lists until 2022 or so, but at this juncture, it's fair to say that the mean-reversion trade in favor of Peri has largely played out. The image below shows that the relative strength ratio of Perion compared to its peers from the VanEck Vectors Israel ETF has now crossed the mid-point of its life-long range.

If we look at Perion's own weekly price imprints, we can see that the stock has been trending up in the shape of an ascending channel. If one were to initiate a long position at the current price point the risk-reward looks very unfavorable, given the proximity towards the upper boundary of the channel, and the wide gap with the lower boundary. Besides, worryingly, last week, we also saw a shooting star reversal candle stick, which typically signals some fatigue in buying pressure.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.