VYM: Simple, Strong Dividend ETF, 3.2% Yield, Cheap Valuation

Summary

- VYM is one of the largest, most well-known dividend ETFs in the market.

- The fund offers investors a growing 3.0% yield, and is cheaply valued.

- An overview of the fund follows.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

We Are

Author's note: This article was released to CEF/ETF Income Laboratory members on February 26th.

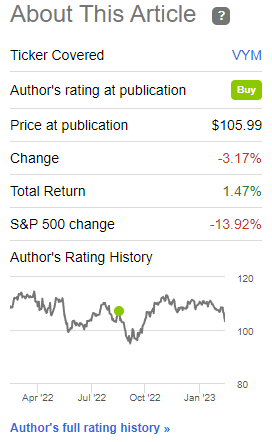

I last covered the Vanguard High Dividend Yield ETF (NYSEARCA:VYM), which invests in high yield U.S. equities, in late 2021. In that article, I argued that VYM's diversified holdings, above-average dividend yield, and competitive valuation made the fund a buy. VYM has significantly outperformed since, as valuations have started to normalize.

VYM Previous Article

Since I last covered VYM, the fund's valuation has become less cheap relative to its peers, although valuations do remain competitive. VYM remains a diversified fund with an above-average, growing 3.2% yield and cheap valuation, so the fund remains a buy, albeit a weaker one than in the past.

VYM - Basics

- Investment Manager: Vanguard

- Underlying Index: FTSE High Dividend Yield Index

- Expense Ratio: 0.06%

- Dividend Yield: 3.15%

VYM - Overview and Investment Thesis

Diversified Holdings

VYM is an index ETF, tracking the FTSE High Dividend Yield Index. It is a simple index, which invests in large-cap U.S. equities with above-average yields, top 50% percentile. Applicable securities must also meet a basic set of criteria to be included in the index, but these are quite lax. So, most large-cap stocks with above-average yields will be included in the index, and in the fund.

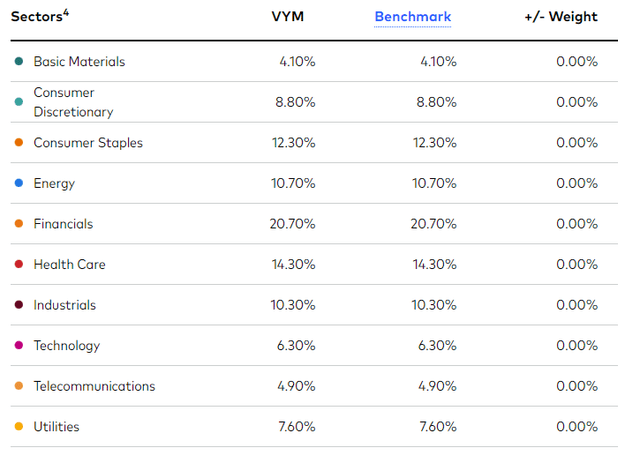

VYM's underlying index is quite broad, which results in a well-diversified fund, with investments in over 400 securities from all relevant industry segments. VYM's diversified holdings decrease portfolio risk and volatility, benefitting investors.

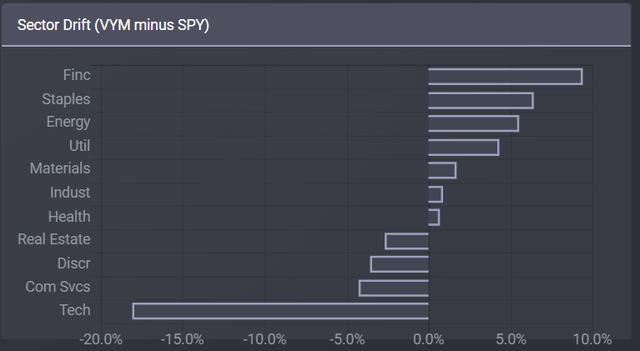

As is the case for most dividend equity funds, VYM is overweight old-economy industries like financials and energy, as these tend to prioritize dividends over CAPEX and other growth initiatives. On the flipside, the fund is massively underweight tech, as said industry tends to prioritize growth over returning cash to shareholders, and so rarely pays strong dividends.

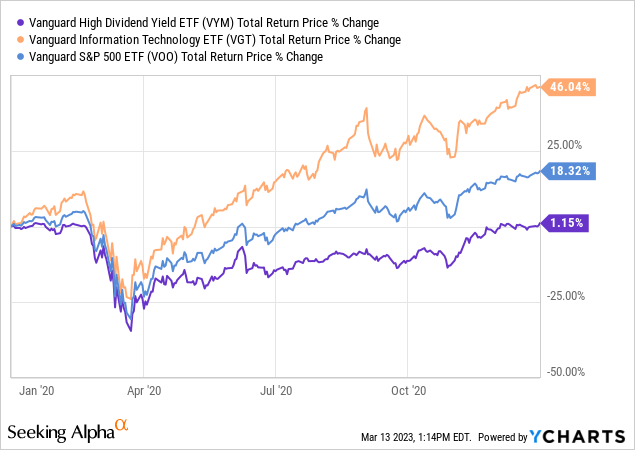

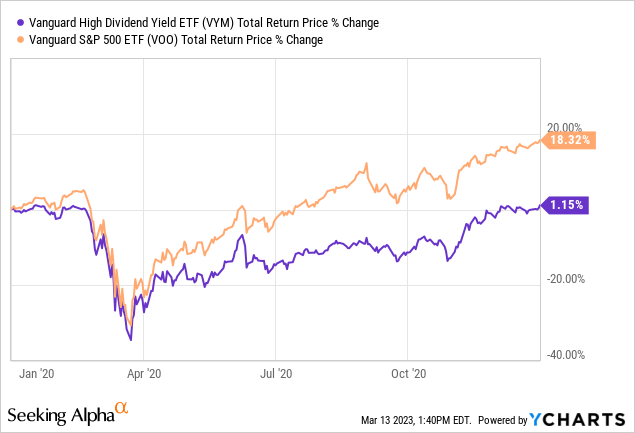

VYM's industry exposures impacts the fund's performance, especially its relative performance. VYM's underweight tech position means the fund tends to underperform when tech outperforms, as was the case in 2020.

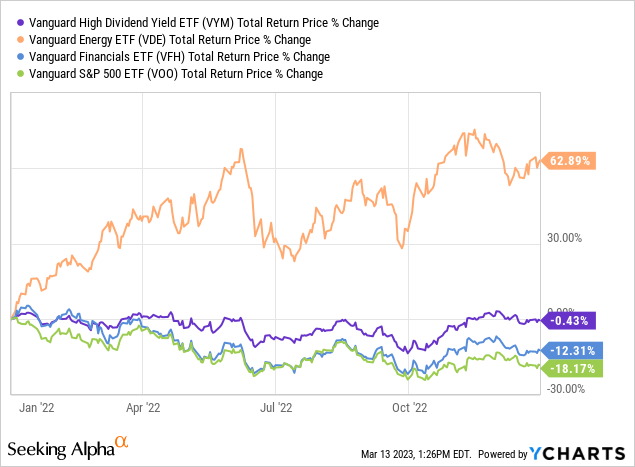

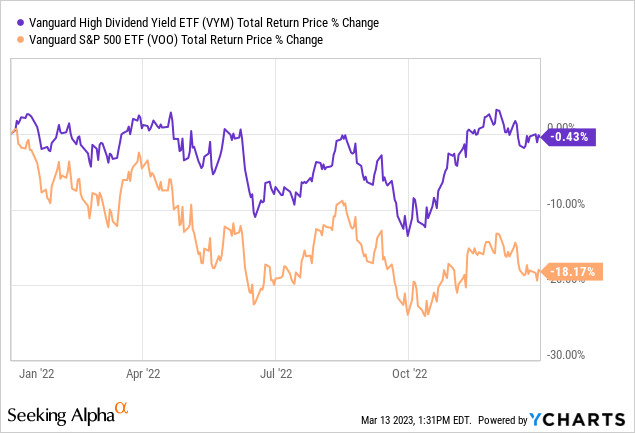

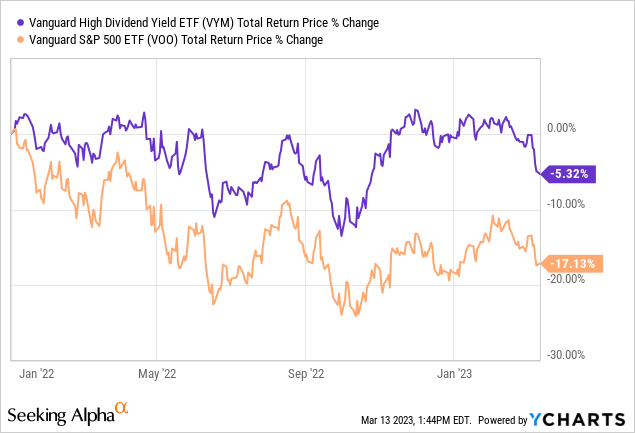

VYM's overweight exposure to old-economy industries means the fund tends to outperform when these outperform, as was the case in 2022.

As tech has outperformed for over a decade, VYM's underweight tech position has been a net negative for the fund in the past, although that might not necessarily be the case moving forward.

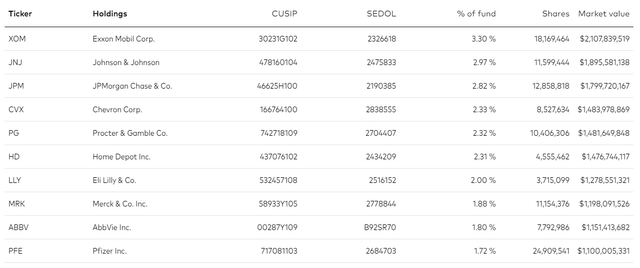

VYM's concentration is about average for an equity index fund, with the fund's top ten holdings accounting for 25% of its value.

As can be seen above, VYM's largest holdings include well-known, blue-chip dividend stocks, including Johnson & Johnson (JNJ), Pfizer (PFE), and AbbVie (ABBV). These companies tend to have strong, resilient business models, and safe, growing dividends. Yields tend to be moderately higher than average too, but are rarely outstanding. Other equity funds, including the Global X SuperDividend ETF (SDIV), focus on stocks with much higher yields, but doing so has its own set of problems.

In my opinion, VYM's portfolio and holdings are perfect for most income investors and retirees.

Above-Average Yield

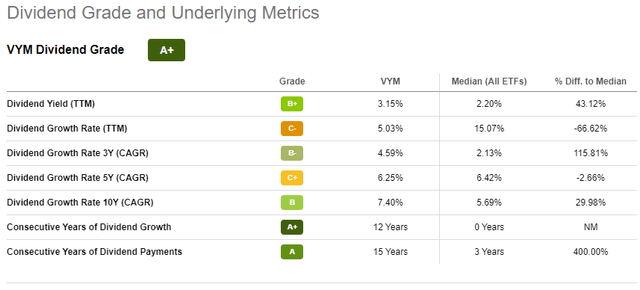

VYM focuses on U.S. equities with above-average dividend yields, which results in an above-average 3.2% yield for the fund. Although the yield is not particularly high on an absolute basis, it is around twice as high as that of most broad-based U.S. equity index funds, including the S&P 500.

VYM's dividends tend to see strong, consistent growth year over year, with dividends growing at a 7.4% CAGR for the past decade.

VYM's strong dividend growth track-record is particularly important for long-term dividend growth investors, who would have seen, and are likely to see, compelling yield on costs from a long-term investment in the fund. As an example, VYM has a 10Y yield on cost of 6.1%, a compelling, if not outstanding figure.

VYM's above-average dividends are a benefit for the fund and its shareholders, and particularly important for income investors.

IN my opinion, VYM's dividends will likely see further growth moving forward, as companies tend to grow their earnings and dividends, especially the high-quality companies included in the fund's portfolio. Growth is ultimately dependent on economic, market, and company conditions, but I'm not seeing any significant issues on any of these.

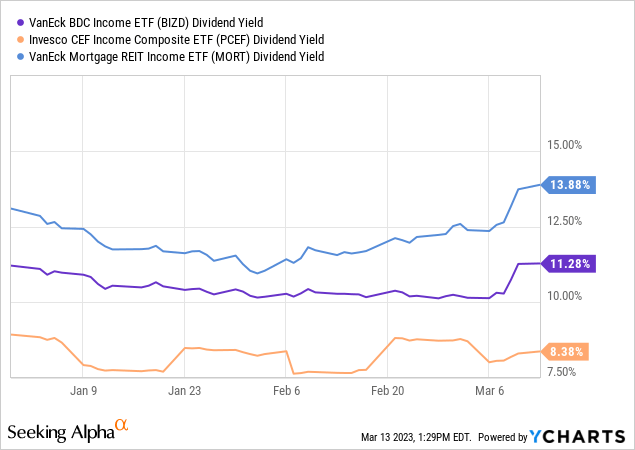

On a more negative note, neither the fund's yield nor its dividend growth are particularly outstanding. VYM provides significantly less income than some of the highest-yielding asset classes in the markets, including BDCs, CEFs, and mREITs.

VYM yields significantly less than these asset classes and funds, as the fund focuses on equities, which are generally not particularly high-yielding securities, and as the fund is quite broad, with very lax inclusion criteria. A more aggressive, concentrated fund focusing on a smaller number of high-yield stocks, think Arbor Realty Trust (ABR) or Enterprise Products Partners (EPD), would yield more than VYM, but would be riskier as well.

In my opinion, more aggressive income investors should consider higher-yielding alternatives to VYM, while those looking for diversification, growth, and a bit more dividend stability might prefer VYM.

Cheap Valuation

VYM focuses on large-cap U.S. equities with above-average dividend yields. Dividend yields are something of a valuation metric, so this results in a fund with a comparatively cheap valuation vis a vis broader large-cap U.S.

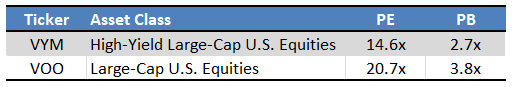

Fund Filings - Chart by Author

VYM's cheap valuation could lead to capital gains and market-beating returns moving forward, contingent on valuations normalizing. Valuations started to normalize in early 2022, with the fund outperforming since said date, as expected.

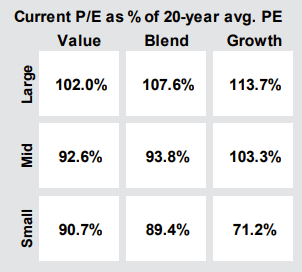

On a more negative note, those gains in 2022 have caused valuations to mostly normalize by now. As per J.P. Morgan, large-cap value U.S. equities, a close analogue to VYM, are trading very slightly above their historical average valuations, but slightly below the average large-cap U.S. equity. Under these conditions, significant capital gains and outperformance is unlikely, but smaller, marginal gains / lower losses seems likelier.

J.P. Morgan Guide to the Markets

VYM's cheap valuation is a small benefit for the fund and its shareholders, but a benefit nonetheless.

VYM - Risks and Drawbacks

Low Tech Exposure

VYM's most important differentiator, and a key risk, is the fund's low tech exposure. VYM's tech holdings account for 6.0% of the fund, versus 26.0% for the S&P 500, and almost 50.0% for the Nasdaq-100. This is the fund's largest sectoral imbalance, by a large margin.

VYM's underweight tech position means the fund should underperform if tech outperforms, as was the case in 2020.

In my opinion, VYM's underweight tech position is only a small risk, as the fund is quite diversified. Others might disagree, especially tech bulls.

Dividend investors should also consider that most dividend equity funds are underweight tech, which might mean their portfolios are lacking exposure to said industry.

Long-Term Underperformance

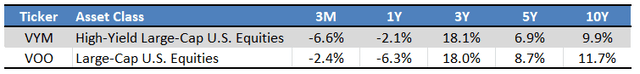

VYM's overall performance track-record is somewhat below-average, with the fund slightly underperforming the S&P 500 long-term. Underperformance is not consistent, with VYM sometimes outperforming, as has been the case these past twelve months. The fund has technically outperformed these past three years as well, but three years ago we were in the throes of the pandemic, so this data point does not seem terribly material, to me at least.

SeekingAlpha - Chart by Author

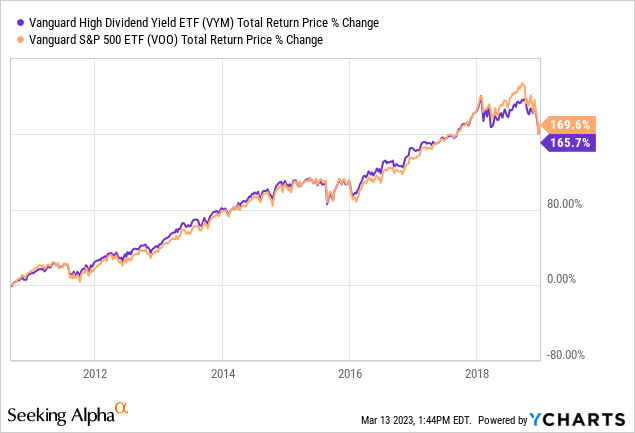

VYM's underperformance was almost entirely due to tech outperformance in 2019-2020, with the fund performing in-line with the S&P 500 before said date:

... and outperforming after:

In my opinion, VYM's overall performance track-record is adequate, so slightly underperforming long-term is not a significant issue. Said underperformance does remain a negative, however.

Conclusion

VYM's diversified holdings, above-average dividend yield, and cheap valuation make the fund a buy.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.