XLV: Quick, It's In A Buying Zone

Summary

- Shares of XLV crossed into a buying zone that has reversed quickly over the past 2 years.

- This can be a great area to add or start an existing position.

- Shorter-term investors/traders could also use this time to experience a potential 5-7% upside.

Nudphon Phuengsuwan

The Health Care Select Sector SPDR (NYSEARCA:XLV) is one of my favorite ETFs for exposure to the health care sector. More importantly, it just crossed into a buying zone historically with 5-7% potential upside in the short term. More on that in a moment, but let's analyze what you're buying first.

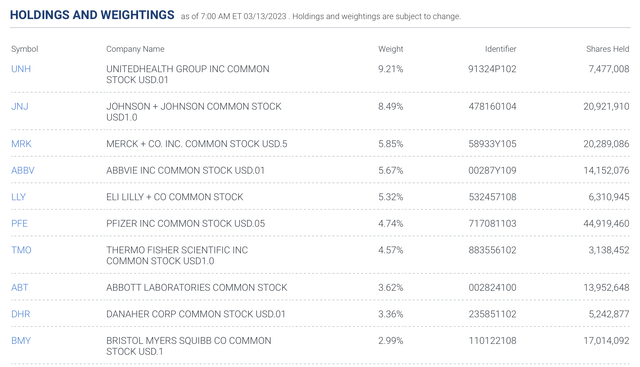

Holdings

The top 10 holdings are the backbone of the health care sector lead by UnitedHealth with a 9.21% weighting, followed closely by Johnson & Johnson at 8.49% weight.

UnitedHealth (UNH)

Forward P/E: 18.46x FWD Dividend Yield: 1.43%

2023 Revenue Growth: 10.95% 2023 EPS Growth: 12.35%

Year to date, the shares of UnitedHealth are down about 10%. The company recently announced a mixed shelf fundraising effort that was light on details - other than it was to be used for working capital, repurchase outstanding securities, repay or refinance debt, finance acquisitions, or for general corporate purposes.

Johnson & Johnson (JNJ)

Forward P/E: 14.43x FWD Dividend Yield: 2.98%

2023 Revenue Growth: 2.82% 2023 EPS Growth: 3.55%

Year to date shares of Johnson & Johnson are down around 14%. Politically parts of Johnson & Johnson's drug business might be under some pressure as the Inflation Reduction Act allows for negotiation of drug prices starting in 2026. Broadly this type of legislation wouldn't slow Johnson & Johnson's main source of growth through acquiring and funding new drugs. In fact, it could force further consolidation of popular drugs to companies like Johnson & Johnson since the profits might be under some pressure.

Merck (MRK)

Forward P/E: 15.25x FWD Dividend Yield: 2.71%

2023 Revenue Growth: -1.85% 2023 EPS Growth: -5.6%

Year to date shares of Merck are down about 5% - however that follows a period of 365 days where shares went up an impressive 35%. The company has some promising later stage trials for several drugs and Seeking Alpha author BiotechValley Insights published an article recently outlining many of them.

AbbVie (ABBV)

Forward P/E: 13.51x FWD Dividend Yield: 3.95%

2023 Revenue Growth: -9.13% 2023 EPS Growth: -19.52%

Year to date shares of AbbVie are down around 6%. Like other drug makers on this list, AbbVie's margins could take a hit with the Inflation Reduction Act allowing for price negotiations of popular drugs. A larger challenge for AbbVie is the fact its popular Humira drug reaches a patent cliff in 2023 and the company is hoping Rinvoq can replace some of the lost revenue. This is the primary reason I almost exclusively get health care exposure through ETFs, because unless you follow a company's pipeline very closely, revenue can severely drop as is the case with AbbVie projected to lose 9% of its revenue Y/Y.

Eli Lilly (LLY)

Forward P/E: 37.11x FWD Dividend Yield: 1.43%

2023 Revenue Growth: 7.45% 2023 EPS Growth: 6.95%

The most expensive multiple of the top 5 holdings lands on Eli Lily trading at a healthy 37x forward earnings. Over the past year the shares are down around 11%. Most of these stocks are under pressure to a certain degree from Washington DC regulations when it comes to pricing, Eli Lilly is the target because of insulin pricing.

As you'd expect with any Sector SPDR ETF you're getting top level exposure to the mega caps, a low expense ratio (0.10%) and collecting a dividend yield of 1.6%.

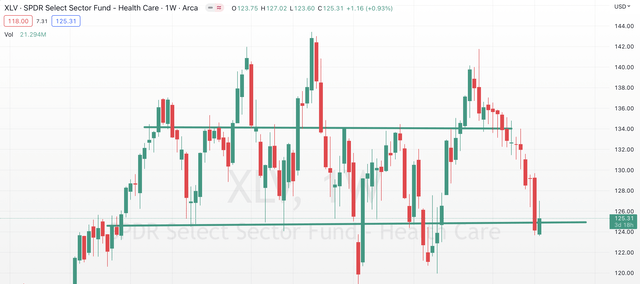

More exciting is the fact the shares of XLV are setting up at a price where for nearly 2 years the shares have reversed.

Since April 2021 whenever shares of XLV trade near or below the $125 area - shares quickly recover. Above is a weekly chart, showing that shares spend just a short time under the $125 area before rebounding, often to the $135 level - or over 7% higher than today's price.

The $125 area is where I consistently add to my existing position as the XLV is my preferred way to gain exposure to the health care sector - as investing into the individual names has proven to be challenging for my skillset.

Shorter-term investors or traders could also take advantage of these areas as well given the technical pattern has held for nearly 2 years.

Either way, XLV is a solid choice based on its track record, low expense ratio and ubiquity as it relates to health care ETF exposure.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of XLV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.