DBO: Oil Prices On The Verge Of Massive Downside Move (Technical Analysis)

Summary

- As the dollar ebbs and flows, oil prices have consolidated.

- I see key support repeatedly being tested on the prompt-month WTI oil futures price.

- Based on the chart feature, I assert a bearish breakdown for Invesco DB Oil ETF is the more likely outcome versus a bullish reversal.

- Key price levels on WTI and DBO are outlined.

limpido

A major move may on the way in the energy market. I'm not talking about cheaply-priced equities, but the underlying commodity itself. Let's take a look at one oil fund.

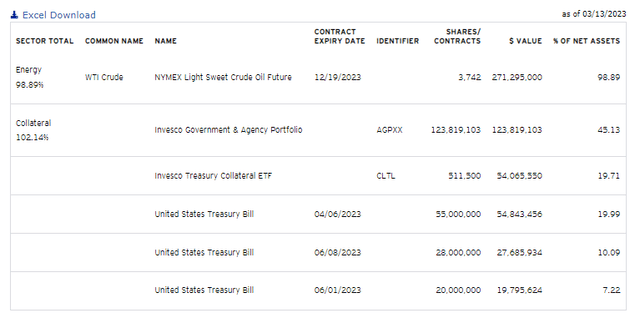

According to the issuer, the Invesco DB Oil ETF (NYSEARCA:DBO) is designed for investors who want a cost-effective and convenient way to invest in commodity futures. The index is rules-based and composed of futures contracts on light sweet crude oil (WTI). DBO and its Index are rebalanced and reconstituted annually in November.

Right now, DBO holds primarily December 2023 expiration WTI futures, so it is not a prompt-month continuous product. The United States Oil Fund (USO) holds nearer-term contracts which will more closely follow WTI's front-month price action that you see on TV and in the printed press.

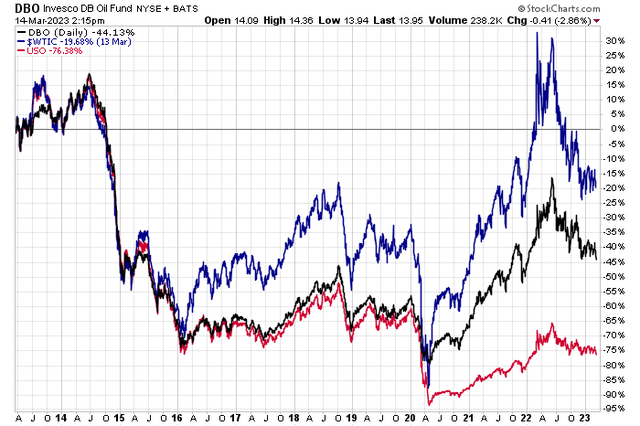

But with DBO, the upside is that you can avoid some of the costly negative roll return that plagues ETPs such as USO. I have found, though, that the United States Gasoline Fund (UGA) usually has less contango in its term structure which causes negative roll yield in commodity future funds.

DBO Holdings: Dec 2023 WTI

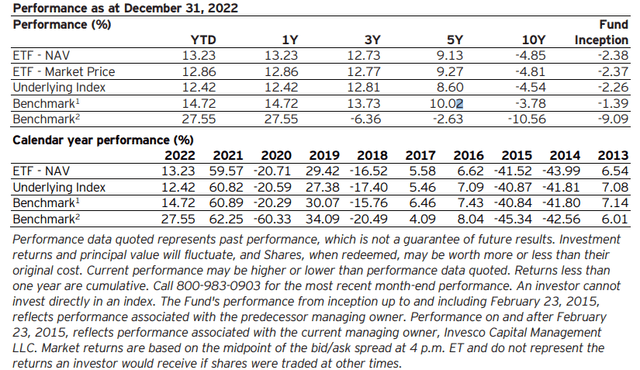

You will find that DBO's performance has been much better than that of USO in the last decade. As of the March 13 close, the continuous prompt month of WTI is down 20% while DBO is off by 44%. That sounds dreadful, but USO is off by a staggering 76%. Fees and negative roll yield eat away at long-run returns, so I suggest using oil ETPs for near-term trading only - not for a long-term investment holding.

DBO Year-End 2022 Returns

10-year Returns: Oil ETPs Poor, But DBO Over USO

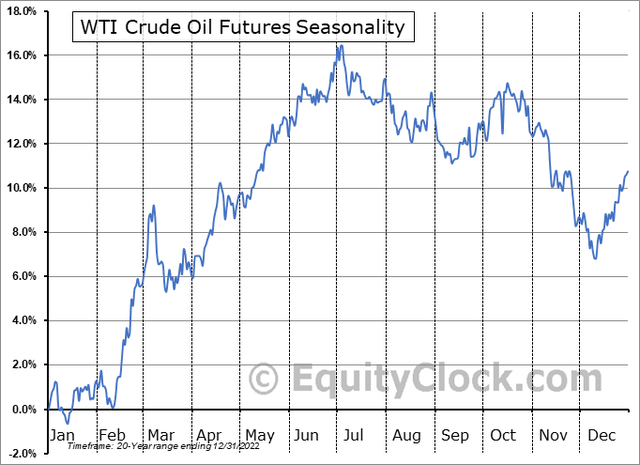

Seasonally, WTI tends to rally now through early July, according to Equity Clock, so this is a key trend to watch. So the bears have their work cut out for them if they want to send oil prices lower. Often, though, it is when seasonality does not hold when significant technical information reveals itself.

Bullish Oil Seasonal Trends Now Through the 4th of July

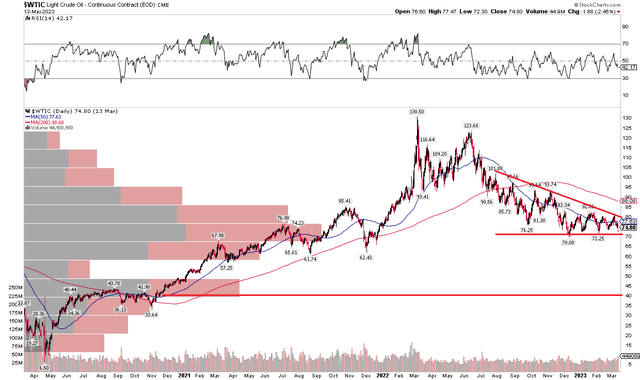

So, here's the meat of the trade. Oil prices have been consolidating in a descending triangle pattern. This comes as oil volatility, as measured by the WTI Oil Volatility Index (OVX) has ventured near 52-week lows, and is just now perking up. I assert that a potentially explosive move in oil is in the offing. And it could be up or down depending on whether WTI rallies above the downtrend resistance line illustrated in the below chart or if it breaks down under a pivotal support line at $70.

Oil Volatility Coming Alive?

A measured move price objective to near $40 would be triggered on a bearish breakdown. With a declining 200-day moving average and this being a consolidation pattern off last year's peak in WTI above $130, I am inclined to believe the smart bet is for a downward move. A rally above $80 would negate the bearish idea.

WTI Continuous Prompt-Month Contract Price History: $70 Pivotal

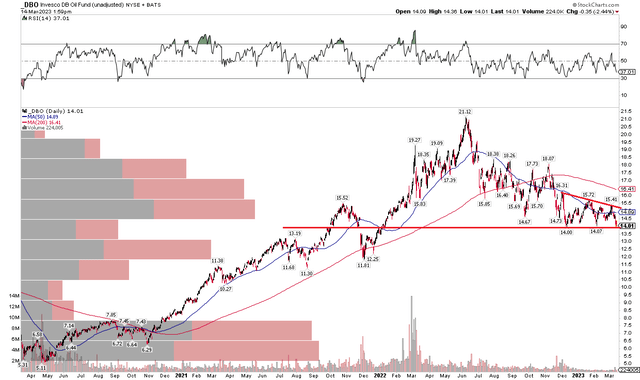

Translating that into the chart of DBO, we see a similar technical pattern, but it is not exactly the same. A decline under $14 should yield a swift $2 further fall, but if we assume that oil may drop some 40%, then that would imply a price target under $9. Of course, I would take profits on a short position in advance of that, but the further this consolidation goes, the more I am skeptical that the bulls can continue to hold support on both the chart of WTI and DBO.

DBO: $14 is the Important Level

The Bottom Line

I assert that oil has significant downside risks. A break above $80 on WTI would negate that thesis, but a breakdown below $70 on prompt-month WTI may yield major downside. Playing Invesco DB Oil ETF from the short side could be a good play here.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.