Western Alliance Bancorporation: Potential Triple-Digit Upside Opportunity For The Brave

Summary

- After losing heavily on Friday already; on Monday, Western Alliance Bank stock crashed by as much as 70%, prompting a trading halt.

- In this article, I will have a look at WAL's finances - highlighting key considerations regarding the bank's balance sheet and income statement.

- The WAL selloff appears more like an emotion-driven response to an unfortunately unique event rather than a reasonable trade anchored on fundamentals.

- As compared to the bank's intrinsic value, WAL's stock could now be undervalued by about 275%.

- With the note that this is a very high-risk trade, I assign a "Strong Buy" recommendation.

olm26250

After losing heavily on Friday already, Western Alliance Bancorporation (NYSE:WAL) stock crashed by as much as 70% on Monday, prompting a trading halt. Investors are undoubtedly scared. But I am enthusiastic about this opportunity as I believe that the sell-off has resulted in WAL's stock now being about 275% undervalued as compared to the bank's intrinsic value. With such an upside potential, the risk/ reward for WAL looks exceptionally attractive - even accounting for the risk of a collapse in the banking system.

In this article, I will have a look at WAL's finances - highlighting key consideration regarding the bank's balance sheet and income statement.

The Balance Sheet Is Fine

Before discussing WAL's balance sheet, let's take a step back and quickly review what happened to SVB Financial Group (SIVB). In a previous article, I have tried to "simply" explain what happened to SVB Financial - here is the abbreviated explanation:

The COVID-crisis prompted an unprecedented liquidity flood. This liquidity flood, which has been seen as a Fed put, provoked a boom in venture capital activity. This boom flushed start-ups and founders with cash, and Silicon Valley Bank, which has positioned itself as the bank for the venture capital market, enjoyed an inflow of deposits ... growing from $61.7 billion in 2019 to $173 billion as of December 2022.

Now, what should SVIB do with these deposits? With a compressed NIM spread (which was another consequence of QE), writing loans was not very attractive. So, SVIB decided to park the excess liquidity in U.S treasury securities and similar low-yield risk-free notes. Although these securities have been considered 'risk free', with the end of QE and start of QT these securities depreciated sharply in lock-step with rising interest rates. (Remember that the value/ price of a bond is inversely related to the interest rate level).

SIVB suddenly needed to struggle with falling prices of its holdings of fixed income securities. Meanwhile, concerns about a depreciating asset base were compounded by an outflow of deposits, as savers were seeking higher yield opportunities than parking cash at a bank. A balance sheet crunch was looming. And after the market woke up to SIVB's struggles, the meltdown materialized quickly.

Thus, it's quite evident that the SVB Financial Group collapse was (to a large extent) provoked by the bank's decision to invest its clients' deposits in "overvalued treasury securities," thereby locking in an extremely low yield and leaving the bank vulnerable to the risk of rising interest rates. Given this information, investors looking for bargain opportunities in the banking sector must consider one critical question: to what extent did a bank expose itself to duration risk in its investment portfolio?

From Q1 2019 to Q4 2022, WAL's deposit base jumped by close to 200%, adding about $35 billion of new deposits. Such a performance would be excellent news in normal times. However, markets have taken note of the deposit expansion and worried that - like SVB - WAL overinvested the excess liquidity in expensive fixed-income securities. But this is not the case for WAL.

Looking at Western Alliance balance sheet, investors note that WAL's investment securities portfolio only added about $5 billion since 2019, allocating only about 15% of the deposit growth to fixed-income investments! Moreover, a look at WAL's latest 10-K filing reveals that 'a significant portion of the portfolio invested in AAA/AA+ rated securities' and 'the average duration of the company's debt securities portfolio is [only] 5.5 years'.

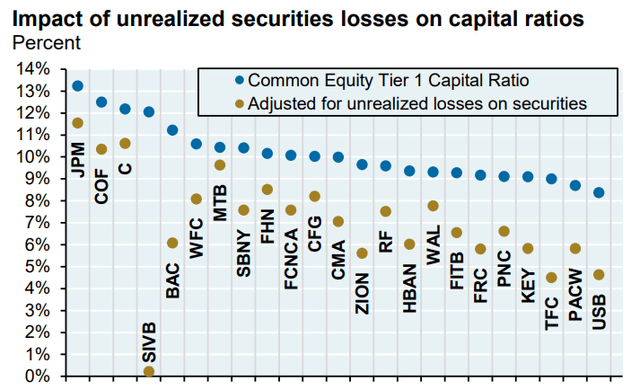

The above duration insight is exciting because of two reasons: First, there will likely not be a liquidity crunch for WAL. And second, WAL's unrealized losses on the portfolio are likely only minor. In fact, JPMorgan's research team did an excellent job modelling the impact of unrealized losses on the capital ratios of selected banks. Referencing the chart below, investors will note that SIVB's adjusted capital ratio dropped to "Zero," while WAL's respective ratio defends a level close to 8 percent!

Steady Revenue Growth, Value Accumulation, And Earnings Expansion

It's true that the primary concern for bank investors at the moment is solvency and liquidity. However, in the event that a bank is able to weather the storm, which I believe WAL is, investors focused on bargain opportunities will begin to ask: what is the value of the bank's operations?

With that frame of reference, WAL offers investors exposure to an outstanding combination of a steady revenue growth, value accumulation, and earnings expansion.

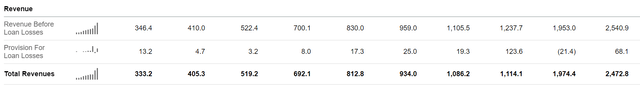

Over the past decade, WAL has expanded its revenue base at a CAGR of about 25%, growing topline to $2.5 billion for FY 2022. Moroever, I would like to point out consistency and stability: that there was no single year when WAL's 't+1 revenue' didn't top the previous years' metric.

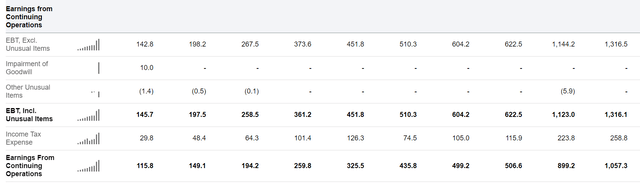

In context of profitability considerations, investors should appreciate that over the past decade WAL has never recorded losses. And, similar to revenue expansion, there no single year when WAL's 't+1 profitability' didn't top the previous years' earnings level. (WAL's earnings are up about tenfold since FY 2013!)

WAL closed FY 2022 with $1.05 billion of operating income. And accordingly, valued at a $2.5 - $3 billion market cap (given the level of volatility it is hard to pinpoint a reference), WAL is trading at a P/E of below x3 - a bargain.

Valuation

That said, in my opinion, banks are prime candidates to be valued with a residual earnings valuation, given that the RE framework anchors on both the income statement and the balance sheet as well as accrual accounting. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders' opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company's capital.

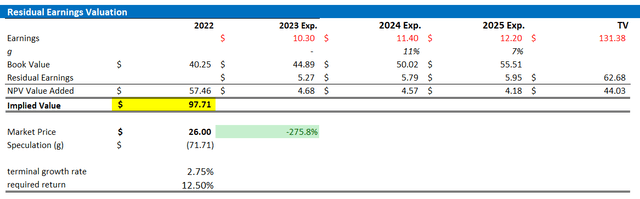

I apply the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal 'till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework - especially for banks.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock's beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of February 28, 2023. My calculation indicates a fair required return of approximately 9.5%. I add 300 basis points of additional risk premium (arbitrary).

- For the terminal growth rate, I apply 2.75% percentage points, which I view as in line with estimated nominal GDP growth in the US.

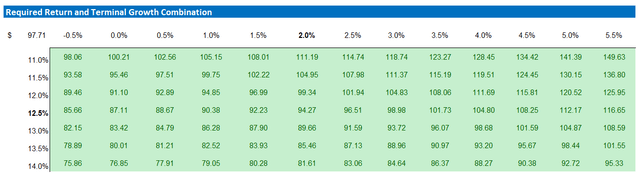

Based on the above assumptions, my calculation returns a base-case target price for WAL of 97.71/share, with almost 300% upside!

Analyst Consensus Estimates; Author's Calculation

I understand that investors might have different assumptions with regards to WAL's required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions.

Analyst Consensus Estimates; Author's Calculation

High Risk!

In my view, the market is currently displaying excessive caution towards some bank stocks, and I am confident that taking calculated risks will eventually yield handsome rewards. However, it's important for investors to recognize that due to balance sheet leverage, banks, including WAL, indeed carry a higher level of tail risk compared to non-banking businesses. In light of recent events, there is a possibility that equity holders in Western Alliance Bank may lose their entire investment. It is up to individual investors to assess whether they are comfortable with such a risk.

Buy The Panic

Upon reviewing Western Alliance Bank's robust balance sheet and strong profitability, it seems that the recent sell-off of the stock was (to a very large extent) driven more by emotional reaction to the unique event of the SVB collapse rather than a rational trade based on fundamentals.

In my opinion, the current price of around $25 per share presents an attractive opportunity to buy WAL stock at a discounted price - but it's very important to note that this trade comes with significant risk.

Reflecting on 275% upside anchored on fundamentals, I assign a "Strong Buy".

This article was written by

Disclosure: I/we have a beneficial long position in the shares of WAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is not financial advise, but expresses the opinions of the author only.