The SVB Fiasco Does The Fed's Job For It

Summary

- The regional bank fiasco has tightened financial conditions overnight.

- That is doing the Fed's job for it, which means we may be close to the terminal Fed Funds rate.

- This will allow the Fed to pause while it evaluates the impact of the rate hikes to date, allowing the disinflationary trend to further entrench.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect. Learn More »

wildpixel

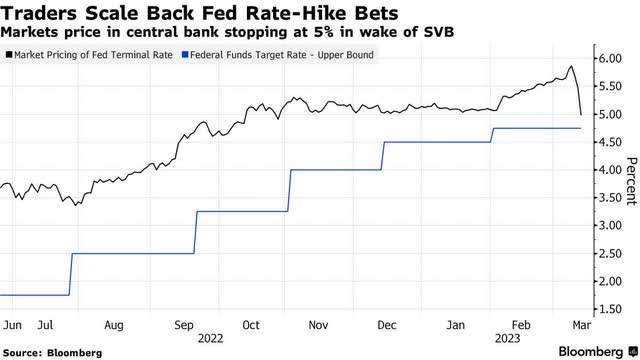

Interest rates across the yield curve have plunged in the wake of the bank failures announced over the past few days with the 2-year Treasury yield falling a full percentage point from 5% to 4%, while the 10-year yield fell from more than 4% to 3.5%. Normally, declining interest rates would be good for stock prices, but these declines are due to a flight to the safety of government debt, as well as concerns about a recession resulting from the fallout. They also indicate that the Federal Reserve is likely to end its rate-hike campaign well in advance of what was expected just one week ago. Rate sensitive sectors performed well yesterday, but the financial sector continued to be under pressure, as investors are concerned about which of the remaining banks might have similar balance sheet issues. Yet this is no longer an issue after the Fed backstopped the financial system with a facility that allows banks to borrow from the Fed, using government debt as collateral, to meet cash demands from depositors.

In fact, there is some upside to this banking debacle in that it is a deflationary event, largely doing the Fed’s job for it. Financial conditions tightened dramatically overnight, which has been the Fed’s goal for some time, as officials relentlessly attempted to jawbone risk asset prices lower over the past several months. Surely, there will be some unwinding of this rapid tightening, as confidence returns to the banking system and these isolated failures move further behind us.

Still, this temporary period of uncertainty likely prevents the Fed from raising interest rates much higher than it already has to slow the rate of economic growth and bring down the rate of inflation. That is good news, because I don’t think there was any need for additional rate increases, as the 450 basis points of tightening over the past year works with a lag and is just starting to have an impact on less rate-sensitive sectors of the economy. The Fed needed to pause to assess the impact of the rate hikes to date, but Chairman Powell was afraid to do so for fear of the melt up it may cause in risk asset prices. I think the recent bank failures require him to do that now, which is why probabilities of rate hikes moving forward have declined sharply.

Lost in the ruckus of the banking issues over the past few days has been the importance of this morning's inflation report. The consensus expects we will see the headline number fall from 6.4% in January to 6% in February, while the core rate falls from 5.6% to 5.5%. Whether we see slightly higher numbers or not, I do not expect the disinflationary downtrend that started nine months ago to be disrupted, and recent developments should hold the Fed to a 25 basis point rate increase next week. That is increasingly looking like it will be the peak in short-term interest rates.

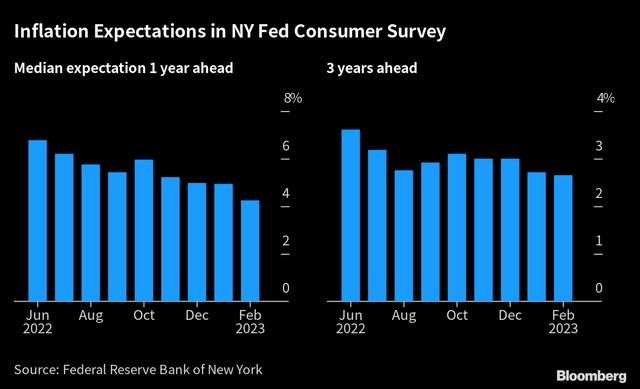

Yesterday, the New York Fed released a survey that showed consumers expect inflation to drop sharply over the coming year. The median expectation one year ahead called for a decline of 0.8% from 5% to 4.2%, while the three-year expectation held steady at 2.7%. That is vitally important to a Fed that wants to anchor inflation expectations. Additionally, this survey was conducted before the banking turmoil.

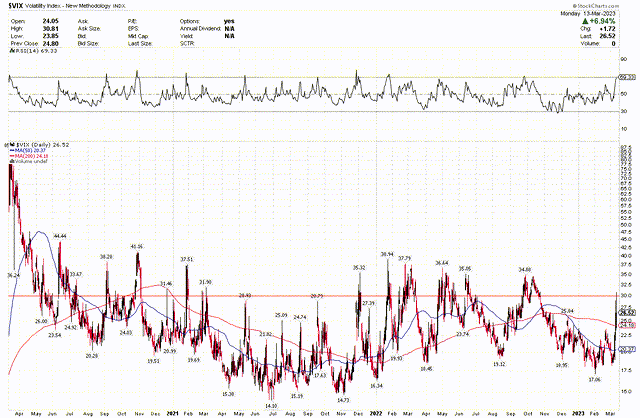

The Volatility Index (VIX) rose above 30 yesterday, which is near levels where it has peaked over the past three years. A spike north of 35 would be more convincing, but we are still within a range where its peak has coincided with a trough in market prices.

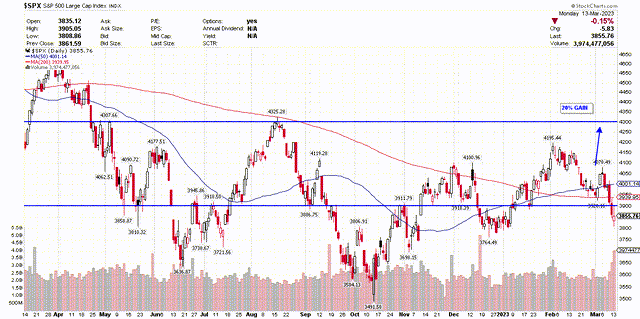

That means we should be able to see the S&P 500 recoup the losses of the past two days to climb back above the 3,900 level. I still see the index recovering to 4,300 as this year progresses.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

This article was written by

Lawrence is the publisher of The Portfolio Architect. He has more than 25 years of experience managing portfolios for individual investors. He began his career as a Financial Consultant in 1993 with Merrill Lynch and worked in the same capacity for several other Wall Street firms before realizing his long-term goal of complete independence when he founded Fuller Asset Management. He graduated from the University of North Carolina at Chapel Hill with a B.A. in Political Science in 1992.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice.

Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.