The GEO Group: A More Sustainable Model Than The Market Is Pricing In

Summary

- Private prisons are here to stay and the market hasn't priced it in.

- The GEO Group, Inc. has started a new asset-light business model that could completely replace the current model.

- The default risk is overblown, and The GEO Group's higher WACC provides an opportunity to buy at a deep discount.

FooTToo

Background

I originally wrote an article on The GEO Group, Inc. (NYSE:GEO) almost two years ago when the stock was at $5.11. If you're not familiar with the company or the original thesis that I came in with, read that article first.

A quick synopsis of the thesis at the time was that the company had just cut its dividend, so yield investors left; whilst, this was seen as a negative by most market participants, I saw it as a positive since the dividend was a significant burden on cashflow. Instead, if the company focused on paying off debt and pivoting the business model to a more sustainable one, it would help in the long run even if there would be some short-term pain. I also saw the trade as a deep value play where The GEO Group, Inc. was going for a significant discount to its book value, and its P/FFO ratio looked far too low for a REIT.

I'm revisiting this thesis and seeing where things are two years later and whether The GEO Group, Inc. is still a buy.

Trade Thesis

While The GEO Group, Inc. stock is up since I wrote the last article I still think that it's a buy. Since the earnings multiple for this company is very low, it once again piqued my interest. Once I dug in, I concluded that the main reasons the market likely values this company at a low multiple is because of the secular risk that private prisons will be disbanded, the high debt load that the company has, and the higher WACC that the company will face in the future.

I believe that the market is underestimating the ability of this company to turn around the business model into one that is more sustainable than private prisons and is overestimating the burden that the debt will have.

Private Prisons: Here To Stay

My belief is that the market is overstating the risk of private prisons being disbanded in the near future.

The first area that the market is weary about is Biden's executive order for the DOJ to stop all private prison use; this order came out two years ago. There are a few loopholes in this, though. The first is that this ban only applies on the federal level, not the state level, so state prisons and county jails can still be run privately on a state-by-state basis. The other is that this executive order didn't apply to ICE.

As can be seen in the above chart, a vast majority of those incarcerated are in state prisons or local jails. This means that Biden's executive order has little impact on the overall prison system, and if need be, private prison companies like the GEO Group could start contracts with state governments to replace the revenue they previously got from the federal government.

Even though the GEO Group had some DOJ contracts, they found another major source of revenue through ICE, which was exempt from this executive order.

Grid News, a media company that focuses on covering major political trends, has a very detailed report that reviews the 8-K for the GEO Group to reveal that a quarter of The GEO Group's revenue in 2021 (and a larger percentage in 2022) was from ICE contracts, and that various facilities previously under the DOJ have been converted into ICE facilities.

The lost contracts do not, however, mean the facilities will be closed for good. As GEO Group’s documents go on to explain: “GEO is Marketing Available Beds in Inventory to Other Agencies.” The company is “currently marketing these facilities to various government agencies,” and though it doesn’t say what agencies specifically, other documents make clear that GEO Group thinks ICE is a prime target for new business at the federal level. (GEO Group does acknowledge that “asset sales” — in other words, sales of the properties — are potentially being “explor[ed]” as well.)

Nearly one-fourth (24 percent) of GEO Group’s global revenues from the third quarter of 2020 to the third quarter of 2021 already came from ICE.

Not just are facilities being converted, but there is also a trend towards more ICE incarcerations due to more migrants crossing the U.S. border from Mexico and because wait times for those migrants to be able to go to court are going up significantly.

Because of all of this, I believe that the market is focusing too much on Biden's executive order rather than focusing on local policies and immigration policy, which are unlikely to change over the next couple of years.

The reality is that most incarcerations on the state level happen in the U.S. Southeast (as can be seen in the above chart), which is primarily Republican-controlled and likely won't get rid of private prison use anytime soon.

I'm making the above points about state prison populations and ICE as I believe that many market participants thought it was the end for private prisons when they saw Biden's executive order even though there are many other sources of private prisons revenues that the GEO Group could go to.

This means that the GEO Group has a long runway prior to private prisons being completely phased out. Even if they are, the government will likely choose to buy out the prisons for what would be deemed fair market value rather than build new prisons which would be far more costly.

New Business Model

A major secular growth opportunity that I see for The GEO Group, Inc. is for it to become a beneficiary of the current, and likely to worsen mental health crisis along with rehabilitation and monitoring for those out of prison.

We have already seen this with their electronic monitoring and supervision service, which is asset-light and has wide margins. This is a large improvement from their prior business model, which was highly capital-intensive because of the ownership of real estate.

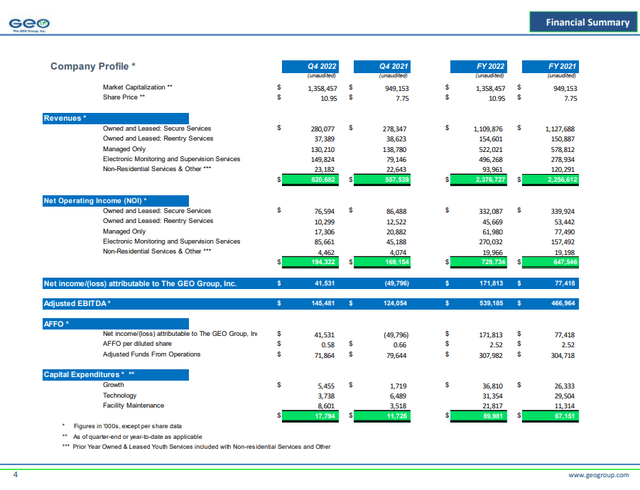

Below is their financial summary:

As can be seen, their Electronic Monitoring and Supervision Services generated ≈ $150mm and NOI of ≈ $86mm in Q4 of 2022. If we were to annualize the quarterly results, it would be ≈ $600mm in revenue and ≈ $344mm in NOI. If we were to do an NOI multiple on the Electronic Monitoring and Supervision Services to the market capitalization of the company, it is 3x NOI.

This is very impressive, because it shows that this business model could completely replace the current private prison model. This back-of-the-envelope calculation for the NOI multiple doesn't take into account potential growth in the service, of which we have seen an almost 100% growth rate from Q4 21 to Q4 22.

This new business model is also asset-light as it cost little to purchase electronic monitoring devices along with little working capital to support this model. This means that the company can get a higher ROCE which in turn means that they will be able to easily expand their service(s) without much capital injection of their own or the need to take on debt. The less capital that needs to be taken out to reinvest in the business can be used to pay out to shareholders via dividends or stock buybacks, which is why I believe that if this long-term business model pivot is successful the GEO Group will be able to once again start dividend payments by 2026.

This also brings potentially more opportunities for The GEO Group, Inc. in both rehabilitation and mental health as both of these would be a vertical expansion on the current Electronic Monitoring and Supervision Services.

The one major risk that I see in this new model is that competition could easily come in as there is no barrier to entry.

Deleveraging Will Strengthen the Balance Sheet and Reduce Liquidity and Default Risk

One of the reasons that I suspect that The GEO Group, Inc. is trading so cheap compared to its peers such as CoreCivic, Inc. (CXW) is that it has a lot of debt and it likely won't be able to refinance it.

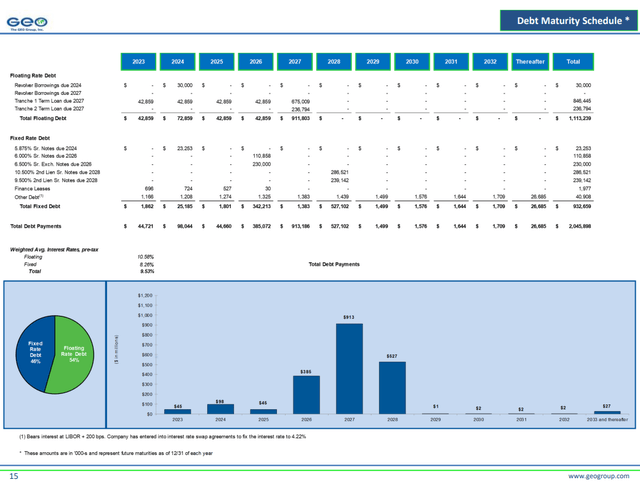

Below is the current debt stack:

Geo Group Debt Maturities (Geo Group)

Until 2026, all debt payments that will have to be made are lower than the TTM net income, so there is no worry about default there. The main worry about default risk is in 2026, 2027, and 2028.

The 2022 NOI was $729mm; if this NOI continues into 2026, 2027, and 2028, then the GEO Group should have no problem paying off debt. The market seems to be worried that they won't be able to maintain the current NOI till then hence there is a large discount to the valuation of the GEO Group over that of CoreCivic. As mentioned earlier in the article I believe this risk is far overstated so I would take advantage of this discount.

Keep in mind that the 2026 note is a convertible so if the stock price is high enough it will get converted to stock and cause dilution which is another worry that the market has. Even with the amount of dilution, the 75% discount in the earnings multiple to CoreCivic isn't justified, in my opinion.

Another reason that the GEO Group trades at a cheap multiple is due to its high and growing WACC. A general rule of thumb is that the higher the WACC of a company, the higher the earnings yield of that company should be. This is because a higher WACC means that the company doesn't have access to cheap leverage and has less access to capital, causing a lower ROE.

Due to the industry that the GEO Group is in, credit institutions like banks don't want to finance their facilities and it's unlikely that they would have much success issuing bonds in the future, at least at a reasonable rate. This means that in the long run, the GEO Group won't be able to take on more debt and will have to either issue more equity or use retained earnings for CAPEX. While this is negative in regard to access to capital, the positive side of having a consistently low valuation is the ability to buy the stock at a high earnings yield and to consistently compound at a high rate of return.

I also see the possibility that many years in the future the GEO Group will pivot away from the current private prison model, making them ESG compliant, which allows them to once again access cheaper capital; I don't believe that the market is taking this possibility into account.

The Bottom Line

The bottom line for The GEO Group, Inc. is simple: the market is pricing in too much bearish sentiment about private prisons, as they will likely continue to be around for many years. Even if private prisons eventually get phased out, The GEO Group, Inc. has already started a new business model that has wide margins and is asset-light, which could replace the old model. In addition, the chance that the GEO Group defaults on its debt is overstated. Due to the low P/FFO multiple that will likely continue to stay low for many years to come, The GEO Group, Inc. provides a great long-term compounder.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.