EastGroup Properties: A Record-Setting 2022 Is A Tough Act To Follow

Summary

- EastGroup Properties is an industrial REIT with a sizeable presence in key markets in the Sunbelt region of the United States.

- In 2022, the company turned in record results, including nearly 15% growth in earnings.

- In a position of strength to start 2023, shares have outperformed related peers on a YTD basis.

- Looking ahead, however, the environment appears more challenged for further growth. With shares already trading at a reasonable multiple, the upside potential may prove limited.

onurdongel

EastGroup Properties (NYSE:EGP) is an industrial real estate investment trust ("REIT") with a strong presence in the Sunbelt region of the United States.

Their top operating market is the State of Texas followed by Florida. Together, the two markets accounted for nearly 60% of their business in 2022. At 21% of net operating income ("NOI"), California is another top state for their operations.

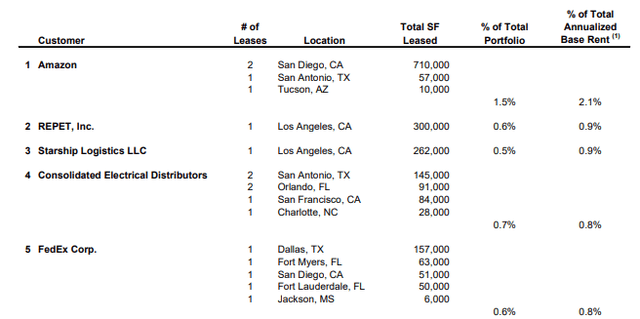

EGP's profile is characterized by a highly diversified tenant base. At 2.1% of annualized base rent ("ABR"), Amazon (AMZN) is their single largest tenant. Aside from AMZN, however, no single tenant represented over 1% of total ABR. And in total, their top 10 tenants accounted for just 8.6% of ABR at the end of 2022.

Q4FY22 Investor Supplement - Partial Summary Of Top Tenants

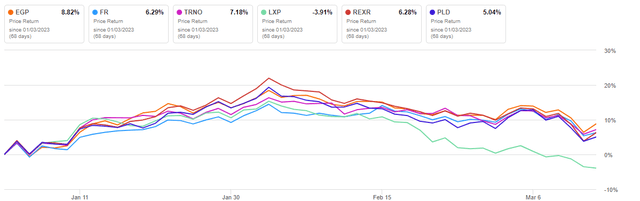

YTD, shares have gained nearly 9%. This outpaces their peers by several notches.

Seeking Alpha - YTD Returns Of EGP Compared To Competitors

The stock, however, is still down about 16% over the past one year. For investors, shares come paired with a dividend payout that is backed by a solid track record of continuity and growth. The most recently released results also validate the ongoing fundamental strength of their operating markets. Looking ahead, however, a more moderated environment seems likely. With shares hovering at a multiple largely in-line with prior periods, investors may find it best to hold on any new or further initiation.

Recent Performance and Current Portfolio Metrics

In Q4 of fiscal 2022, EGP reported funds from operations ("FFO") of $1.82/share. This compares to $1.62/share in the same period last year, representing an increase of 12.3%. A significant contributor to quarterly results was continued rental rate growth. Quarterly releasing spreads, for example, were up 34% on a cash basis.

In addition to rental rate growth, quarterly occupancy rates averaged 98.4% during the period. This represents a 110 basis point ("bps") YOY improvement.

And complementing the strong rental growth and occupancy levels was their steady pace of development conversions. During the period, EGP transferred eight 100% leased development and value-add projects to the operating portfolio.

Within the same-property portfolio, NOI, excluding lease terminations, came in 8.7% higher on a cash basis for the quarter and slightly better for the full year, at 8.9%.

For the full year, EGP logged a 14.9% increase in FFO to $7/share, due largely to the same drivers as the quarter. Releasing spreads, for example, were up 25% on a cash basis. Additionally, average occupancy for the operating portfolio was up 90bps YOY to 98%. This came as they transferred a total of 19 development and value-add projects, with a collective leased rate of 99%.

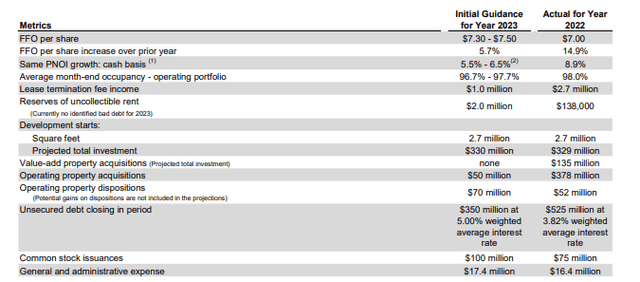

Looking ahead, management sees 2023 FFO at $7.4/share at the midpoint, representing a nearly 6% increase from 2022. Among other considerations, this is on an assumed average occupancy midpoint of 97.2%.

Q4FY22 Investor Supplement - 2023 Guidance

The Bull View

EGP entered 2023 on the winds of a record setting 2022. Average annual occupancy came in at a record 98% in 2022. And on this, the company posted record releasing spreads of 39% and 25% on a GAAP and cash basis, respectively.

Despite a challenging comparable environment, the company is still forecasting modest growth through 2023. Same-property NOI growth on a cash basis, for example, is projected to be 6% at the midpoint. This isn't too far from their actuals for 2022 of 8.9%.

Furthermore, though the transactional market is expected to be more muted, their development activity is largely expected to continue unimpeded. Their strong track record of leasing up these developments upon completion should provide them with a continued runway for growth in future periods.

Concentration in the Sunbelt region of the country should also serve as a positive backstop for industrial rates in their market. Soaring demand for warehouses in border-towns, particularly in Texas, as more manufacturing moves to Mexico should also bode favorably to EGP. Texas, after all, is their largest operating market, at 34% of total NOI.

Complementing their strong financial results is their solid financial foundation, which consists of a stable, investment-grade rating from Moody's as well as an established dividend payout record. Through December 31, 2022, for example, EGP declared their 172nd consecutive quarterly cash dividend.

Furthermore, they have increased or maintained their dividend for 30 consecutive years, with increases in 27 of those years. More recently, the payout has increased for the last 11 years. While the current yield may not be enticing enough to most, the dividend's continuity is a testament to the health of the company's reoccurring cash flows.

The Bear View

While EGP is forecasting strong same-property growth and a modest increase in full year FFO, occupancy is projected to be notably lower in 2023. Granted, at a midpoint of 97.2%, these levels are still historically high. Yet, this is still 80bps lower than in 2022.

In addition, the company is factoring in about 50 to 75bps of bad debt reserve. The occupancy declines paired with the additional reserve could reflect tenant pushback on the current pace of rental rate increases. Though their current mark-to-market currently sits within the 30% range, it's possible for EGP to miss out on this upside in a more recessionary environment.

Given their more concentrated exposure to select markets, they are also at heightened risk of a pullback in any one of their key markets. Texas, Florida, and California, for example, accounted for about 80% of their NOI in 2022. This was followed by Arizona and North Carolina, who together represented 13%.

In prior periods, management has also proved nimble in funding their balance sheet through equity raises under their continuous equity offering program. The pullback in their share price, however, is forcing a pivot to the debt markets.

While they certainly have the capacity within their debt profile, new funding would most likely come at markedly worse terms, given the current rate environment. While not the most significant concern on near-term results, higher interest expense on their new issuances could ultimately weigh on earnings in future periods.

Final Thoughts

EGP's record setting performance in 2022 was a reflection of the strong economic fundamentals in their operating markets, particularly in Texas and Florida, two states that continue to benefit from population trends that accelerated in earnest during the COVID-19 pandemic.

High occupancy levels and a significantly diversified tenant base also provides them with a buffer in the event of a slowdown in any one of their key markets. Tenant diversification is most important, given their highly concentrated geographic footprint.

A strong dividend track record marked with continuity and stable growth also validates the strength of their reoccurring cash flows. At a yield of less than 3.5%, however, the payout is unlikely to have income investors rushing to the stock. As a result, this places greater emphasis on share price appreciation.

And on this, the stock appears fairly valued. Presently, shares trade at a forward multiple of about 21x. While this is down from the nearly 40x commanded in 2021, it is not materially off prior periods dating back to 2018.

Furthermore, the stock is commanding this multiple even as FFO growth is expected to moderate in 2023 on a combination of bad debt considerations and an expected decline in occupancy levels. A greater dependence on the debt markets for funding as opposed to equity raises may also create a greater headwind on earnings growth.

For investors, staying put remains the most viable play on this Sunbelt industrial in my view.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.