TLT: A Sell, The Fed Is Likely To Remain Hawkish

Summary

- Powell has tended to both overreact and underreact to market forces, he's not likely to change course until there are signs of significant price easing.

- The factors driving inflation are likely to persist for some time.

- Interest Rate policy looks to be returning to a period of historic normalcy, the previous decade of low rates is likely going to be seen as an anomaly.

Torsten Asmus

It is always easy to get lost in a moment or period of time. We have often heard over the last ten years about the new normal in the housing market, with interest rate policy, and even with Covid and individuals working at home more. While some systemic changes in economies can be more structural, usually extenuating circumstances end at some point, and policies tend to revert to historic norms.

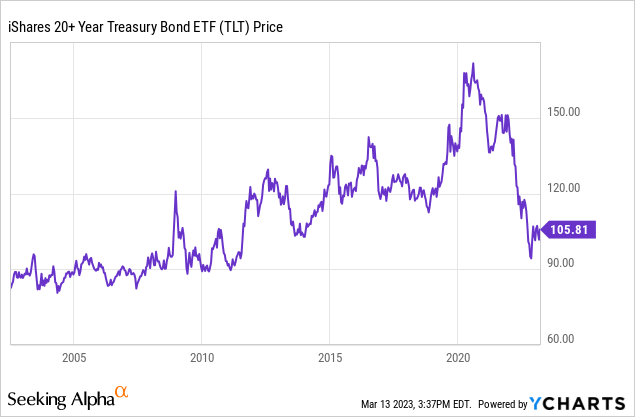

One ETF that tracks longer term interest rates is the iShares 20+ Year Treasury Bond Fund (NASDAQ:TLT). This exchange traded funds has 99.38% of the ETF's holding in government treasuries that are 20 years or longer. The fund HAS $32.48 billion in assets under management, an expense ratio of .15%, and a current yield of 2.65%. This ETF also pays monthly dividends. This iShares fund tracks longer-term US treasuries.

Interest rates have been historically low for most of the last 10 years.

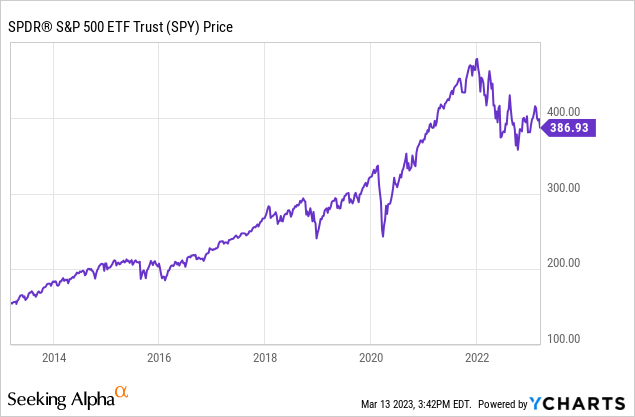

Starting in 2008, Bernanke and the Fed aggressively pursued a policy of quantitative easing and keeping rates low for an extended period of time. Between 2008 and when Covid first hit the US economy in early 2020, the markets performed well as growth rates remained fairly consistent and inflation stayed under control for most of that 10 years.

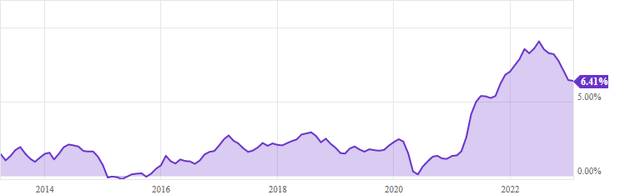

Energy prices spiked briefly in 2008, but overall inflation levels still remained under control for most of the last 10 years. Over the past decade the rate of inflation averaged 1.88% a year, but prices began to rise significantly in March of 2021, and the overall rate of inflation came in at 4.7% in 2021. The rate of inflation was 6.5% in 2021.

A chart of inflation in the US (Ycharts)

Prior to 2021, the highest rate of inflation seen in the US economy was 2.4% in 2018, which followed an inflation rate of 2.1% in 2017. That increase in prices led Powell to continue to aggressively raise rates in 2018.

Today the economic environment is very different than what we saw in previous periods of time for multiple reasons. Labor shortage issues across almost every major industry persist, supply chain issues remain significant even with China beginning to partially open up, and the Russia-Ukraine conflict continues to in particular put pressure on energy and food prices. The overall rate of inflation has remained high in the US economy this year as well. The inflation rate in January came in at 6.4%, barely down from 6.5% in December. Recent inflation data also show the rate of inflation continuing to slow at a tepid pace. The March inflation reading show consumer price growth slowing to 6%, with the consumer price index rising .4%, versus .5% in January.

The consensus amongst economists right now is for the rate of inflation in 2023 to fall to 3.5-4%, which is still a level significantly above the Fed's publicly stated target of 2-2.5%. the iShares 20+ Year Treasury Bond Fund exclusively holds Government bonds that are 20-years or longer. The 20-year treasury currently yields 3.84% and the 30-year treasury current yields 3.71%, these rates will likely have to rise to attract further buyers.

Most economist's expectations for the rate of inflation to further slow also seem overly optimistic for several reasons. First, China continues to have issues opening the country's economy up since the CCP is still pursuing a zero tolerance Covid policy and the vaccines developed in the world's second-largest economy have also haven't been as effective. Asia's slow opening has put significant pressure on the supply chain

Labor shortages also persist across many major industries in the US, wages are likely to continue to rise for some time. The manufacturing industry lost fourteen million jobs during Covid, businesses are still struggling to get basic workers to return to the workforce. The Education industry, law enforcement agencies, and the airline industry are other examples of businesses facing significant issues finding even lesser skilled workers as well. Southwest Airlines recently stated that nearly 5% of the company's fleet remains grounded since management can't find enough pilots even today.

The Fed will also likely be forced to combat inflation without any significant assistance from the White House or Congress for several reasons as well. Republicans took control of the House in 2020, and Biden has struggled to reach even basic compromises with McCarthy and House leadership since they came into power after the recent mid-term elections. Neither the Republican or Democratic party have been willing to make any substantive spending cuts over the last six years either, and major budget reductions are unlikely leading up to a presidential election in 2024. Powell isn't likely to see any significant effort on the fiscal side to reduce inflation over the next two years.

Powell has also been a reactionary Fed Chairman, and he's tended to overreact or underreact to inflationary pressures. Powell clearly overreacted to the fairly tepid 2.4% rate of inflation the US economy was seeing in 2018, and the Fed also referred to inflation as transitory for over year, even after prices began to increase dramatically in early 2021. Powell also recently stated just two weeks ago that the Fed is likely to have to be more aggressive than they previously thought to get inflation under control. He again referenced the Fed's 2% inflation target, and suggested that the process of getting price rises back to the Federal Reserve's target area will take longer than previously expected.

The recent bank failures of Signature Bank and Silicon Valley Bank are also not likely to change the Fed's calculations, since these companies don't likely pose any systemic risk to the overall financial system or the broader economy. Regulators decided to fully protect depositors in both cases, so the fear of a run on the banking system. The Silicon Valley Bank failure was also unique since the company had strong ties to many tech startups that have been struggling to get financial support with rates going up. The total assets of SVB were $209 billion, while Signature Bank had nearly $100 billion. These numbers are not particularly concerning numbers in the context of the overall financial system. Citigroup (C) has over $2 trillion in assets, and JP Morgan (JPM) has over $3 trillion in assets.

The Fed had an easy time keeping rates low for most of the previous decade to support the US economy because inflation was at historically anemic levels during this time period. Still, while the inflation rate is expected to fall from the current elevated levels we are seeing, the multiple factors that have caused prices to rise are not likely to disappear anytime soon. The Biden administration has also shown no willingness to even consider substantive spending cuts, and we are unlikely to see any real bipartisan cooperation on the fiscal side ahead of the upcoming 2024 presidential election. Longer term interest rates are likely to continue to rise and return to a period of historic normalcy in the 4.5-5.5% range over the next several years, the price of longer-term treasury bonds should continue to fall.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.