The Fed Is On The Cusp Of A Gargantuan Mistake

Summary

- It would be a big plus if Bank of America (which is big on the West Coast) or J.P. Morgan (which is not) takes over Silicon Valley Bank with some sort of government backstop.

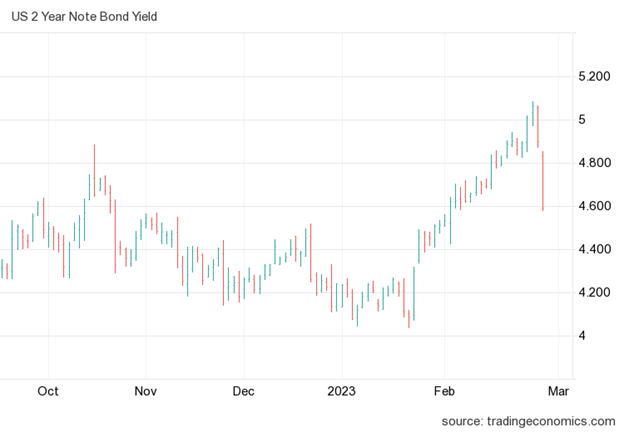

- Treasury rates fell on the news. The 2-year note, the rate most sensitive to Fed policy, declined 50 bps in three trading days to 4.59%.

- Finding a buyer for SVB and the Fed pausing here is the only move to calm markets.

Douglas Rissing

If Fed Chair Jerome Powell does not pause now, or after next week’s – I believe unnecessary – 25 basis point rate hike, he would be making the biggest mistake of his career.

As a reminder, his previous mistakes include (1) overtightening in December 2018, causing a plunge in the stock market in an otherwise healthy economy, then (2) he broke the repo market in September 2019, causing interbank rates to surge, (3) introduced a pro-inflationary framework in the summer of 2020, targeting “average” inflation rates, and then (4) suggested the Fed should not preemptively lean against “transitory” inflation and then (5) carried on QE way too long after inflation was already a problem, with the Fed balance sheet topping out in April 2022.

The only bigger mistake Powell could make after the failure of Silicon Valley Bank (SIVB) last week – the 16th largest in the U.S., with $212 billion in assets before the bank run – is to hike by 50 bps on March 22 and not announce a pause.

I am writing this on Sunday, so I don’t know what Monday will bring. It would be a big plus if Bank of America (BAC) (which is big on the West Coast) or J.P. Morgan (JPM) (which is not) takes over Silicon Valley Bank with some sort of government backstop.

I think it should be J.P. Morgan as it is far more resilient than BofA, and it would help if the U.S. government “gives it to them,” like for $1. They will be getting a footprint in the heart of the tech industry, establishing relationships that would benefit them for decades.

SVB was a classic bank run. They lost $42 billion in deposits in a matter of hours as some big venture capital firms urged their seed companies to pull their money out.

It is crystal clear that SVB management did not handle their interest risk well, causing them to seek a capital raise after a big loss on bonds they had to sell in order to meet redemptions, causing this panic to spiral out of control within a few days.

SVB also did many good things for the growth of the tech sector in this country. Their rapid growth in the last five years basically blindsided management as they forgot how to run the bank more conservatively.

Lending against illiquid collateral and non-public equity stakes of venture capital seed companies will for sure make an excellent business case study at Harvard Business School as to how not to run a bank.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Treasury rates fell on the news. The 2-year note, the rate most sensitive to Fed policy, declined 50 bps in three trading days to 4.59%. If regulators don’t find a buyer for SVB on Monday, the 2-year may decline more, telling the Fed they need to cut rates, not hike them.

Finding a buyer for SVB and the Fed pausing here is the only move to calm markets. The Fed historically tightens until something breaks. Well, things just broke. I am not suggesting this is not the fault of SVB management for not handling their interest rate risk more conservatively, but being behind the curve on inflation is a mistake the Fed has also made.

The stock market is no longer worried about inflation but about contagion in the financial system, so a hot CPI number this week could make investors worry that the Fed will not pause, as they should.

But the Fed should know that inflation is a lagging indicator, and if Powell is worried about hot CPI numbers, I say he should be worried more about the bigger problems in front of him right now, not yesterday’s problems.

P.S. After I wrote this piece, there were some dramatic developments Sunday night. Stay tuned for more.

- Signature Bank (SBNY) has been closed (so another bank has failed).

- All depositors of Silicon Valley Bank and Signature Bank will be fully protected. That should calm down markets.

- Shareholders and certain unsecured debt holders will not be protected, so the bailout has hurt the owners of the banks.

- A new Fed 13 (3) facility was announced with $25 billion from the Exchange Stabilization Fund (ESF) to backstop bank deposits, so more banks can get money without realizing losses on bonds, as their collateral is valued at par.

Navellier & Associates Inc. does not own Silicon Valley Bank (SVB), Bank of America (BAC), or JPMorgan Chase & Co. (JPM) in managed accounts. Ivan Martchev does not personally own Silicon Valley Bank (SVB), Bank of America (BAC), or JPMorgan Chase & Co. (JPM).

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the "About" section of the Navellier & Associates profile that accompany this article.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by