12% Yielding REITs That I Am Buying

Summary

- Some REITs now yield over 12%.

- High yields come with high risk, but we like the risk-to-reward.

- We highlight two undervalued REITs that yield 12-14%.

- We're currently running a sale for our private investing group, High Yield Landlord, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Darren415

REIT dividend yields (VNQ) have expanded very significantly over the past year.

This is because most REITs hiked their dividends in 2022 even as their share prices collapsed.

As a result, it is not unusual now to find REITs yielding as much as 12% or more.

Now, it goes without saying that there is no such thing as a safe >12% dividend yield. These REITs are more speculative than average and a dividend cut is always a risk when a company is priced at such a high yield.

To be honest, most of these REITs probably aren't worth buying, but there are a few exceptions that we like at High Yield Landlord.

They are risky, but they are priced at such low valuations that we like their risk-to-reward.

Below, we highlight two undervalued REITs that yield as much as 14%:

NewLake Capital Partners (OTCQX:NLCP)

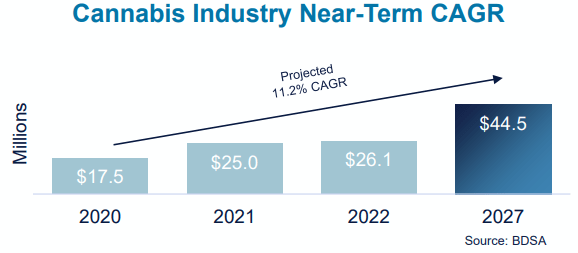

NLCP is a small-cap REIT that specializes in cannabis cultivation facilities.

NewLake Capital Partners

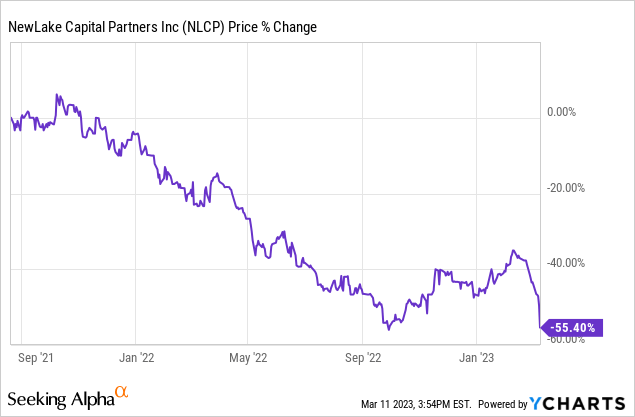

It went public in 2021 and its share price has only dipped lower and lower since then:

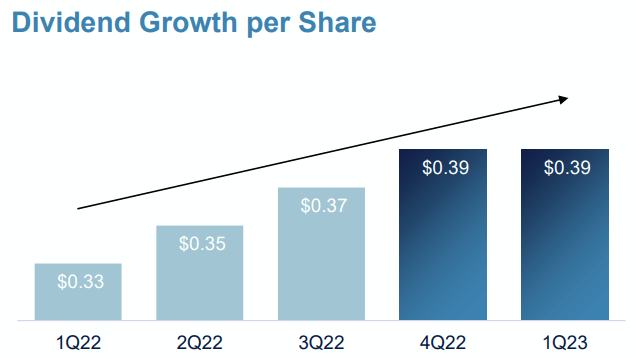

This would leave you thinking that the company is doing poorly, but it has actually grown significantly and hiked its dividend in every quarter since going public:

NewLake Capital Partners

As a result of all these dividend hikes and the collapsing share price, the company is now priced at a 12% dividend yield, which is an all-time high for the company.

Why is the market then pricing it at such a low valuation?

Well, the cannabis space is going through some difficulties and the market fears that some of its tenants will default on their leases.

Some of these fears are certainly warranted. This is a speculative space and when you buy properties at a ~12% cap rate, it is inevitable that you occasionally suffer some credit losses. You take risks to earn returns... and NLCP's largest peer, Innovative Industrial Properties (IIPR), has had quite a few troubled tenants over the past year, which has led many to predict that NLCP would soon face similar difficulties.

They were right.

NLCP just announced its full year results and guidance for 2023. 2022 was a very good year for the company, but they expect to miss some rent payments in early 2023. Overall, they expect to collect 90-93% of their rents in the first quarter of the year.

This caused a panic sell-off.

Obviously, this is bad news, but I think that the market is overreacting. I thought that the market would have known that such issues were inevitable, but apparently not. It seems to have surprised many.

Here is what is reassuring us:

- NLCP owns properties in limited license states. The licenses are tied to the properties, providing them a moat, and this is a rapidly growing sector.

- The issues appear to be temporary and fixable. It just requires some time.

- IIPR, NLCP's closest peer, has managed to find positive resolutions in such situations.

- NLCP has zero debt today and plenty of liquidity to keep acquiring more properties. This should grow cash flow and compensates for the missed payments.

- The management's commentary seemed quite optimistic.

- They decided to maintain their dividend, which clearly signals that it should be sustainable. They also commented the following: "We have a reasonable payout ratio on our dividend, which we have managed conservatively."

NewLake Capital Partners

So it seems that the 12% dividend yield is sustainable despite the near-term challenges. Priced at a steep discount to its net asset value and property replacement cost, we like the risk-to-reward at these levels. If we get a positive resolution of the tenant issues, we could rapidly see 50% upside from here.

Uniti Group (UNIT)

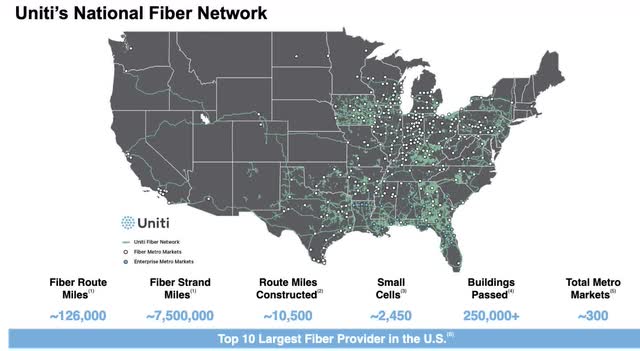

UNIT is an infrastructure REIT just like American Tower (AMT) and Crown Castle (CCI). But instead of investing in towers, it invests mainly in essential fiber infrastructure:

Uniti Group

It is currently priced at a 14% dividend yield.

The company was already priced at a high yield due to tenant risks that we have discussed in a separate article. But then it recently dropped even further because the company's guidance for 2023 disappointed the market.

The guidance implies that its AFFO per share will decline very substantially in 2023:

Uniti Group

This is because of increased interest expenses.

The company is quite heavily leveraged, it has a junk credit rating, and it recently decided to refinance its debt maturities.

This comes at a steep cost as it has to pay high interest rates on the new debt, but on the flip side of things, this gives them a lot of headroom as they have now pushed all major debt maturities until 2027. Here's what the CEO commented on the call:

"2022 was also an important year with respect to positioning Uniti to control its own destiny. We recently completed two successful financings that pushed out our most meaningful debt maturities, while also providing additional liquidity to an increasingly positive free cash flow trajectory. Combined with our organic growth runway and our steady performance, we now have a growth plan that is virtually fully funded aside from potential future refinancings." [emphasis added]

Excluding the impact of the recent refinancing, the 2023 AFFO would have been $1.78 per diluted share, up slightly from 2022.

The higher interest expense and lower profitability are of course disappointing, but this was largely priced into the stock. Even with the lower profitability of 2023, the stock is today priced at just 3x AFFO, or put differently, a 33% AFFO yield, and now they have no major debt maturities for the next 4 years.

And the long-term growth outlook is compelling.

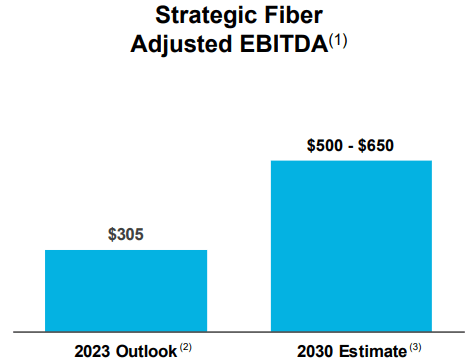

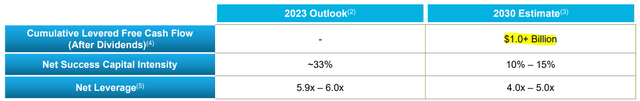

Today, they generate about $925 million of Adj. EBITDA, but they expect their fiber division is expected to double its Adj. EBITDA by 2030, adding another ~$300 million to the total.

Uniti Group

Then they also expect to grow their main division, Uniti Leasing, at a mid single digit growth rate and continue to diversify their business via M&A.

After this period of heavy investing, they also expect to become free cash flow positive by 2026 and to generate a cumulative free cash flow (after dividend payments) of over $1 billion by 2030. That's very significant when you consider that the dividend yield is today nearly 11% and the market cap is just over a billion.

Uniti Group

This should allow them to deleverage their balance sheet and by then, interest rates will have likely also dropped back to lower levels, allowing them to refinance their debt at lower interest rates, regaining some of that cash flow that they recently lost.

The management reaffirmed this on their recent conference call:

"This trajectory leads to substantial deleveraging, resulting in net leverage between 4 to 5 times and roughly doubling the size of our fiber business by 2030. Our fully-funded business plan, no significant near-term debt maturities and long runway for profitable growth afford Uniti, the ability to create value for our shareholders each day." [emphasis added]

The management also seemed decided on maintaining the dividend and wants to eventually even return to dividend growth:

"I mean we're under pressure like a lot of yield stocks. But despite that, we're paying a nice, steady return to our shareholders. I'd like to get to a place where we have the flexibility to raise the dividend and be more of a dividend growth story. And I think there's a time when that comes." [emphasis added]

So in short, today, you get to buy an interest in UNIT's fiber portfolio at a 33% AFFO yield, you get a 14% dividend yield, and the company appears to have solid organic growth prospects from here with no major maturities until 2027.

Not long ago, there were hints of a potential buyout at $15 per share and the management argued that this would undervalue the portfolio. Yet, today, they are priced at less than a third of that and the replacement cost of the assets has only risen since then because of the high inflation and its fiber infrastructure generates recession-resistant cash flow.

What's the catch? It is of course the uncertainty surrounding the future lease renewal with its biggest tenant. We have discussed this in a previous article that you can read by clicking here. As I noted in the introduction, this is a higher risk / higher (potential) reward type of investment.

One last thing: The CEO just recently bought nearly $1 million worth of shares.

Bottom Line

High yield comes with higher risks.

But in these particular cases, I think that the market is rewarding investors with excessive risk premiums by pricing these companies at such low valuations.

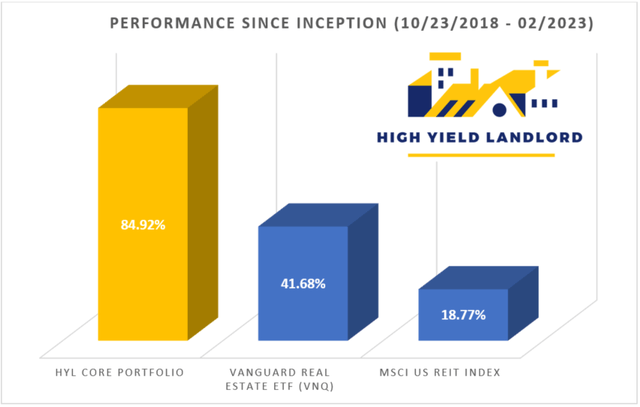

At High Yield Landlord, we invest a small portion of our Portfolio into such higher yielding REITs in order to boost the average yield of our Portfolio.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Disclosure: I/we have a beneficial long position in the shares of UNIT; CCI; NLCP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.