Axon Enterprise: Fantastic Business But Valuation Presents Downside Risk

Summary

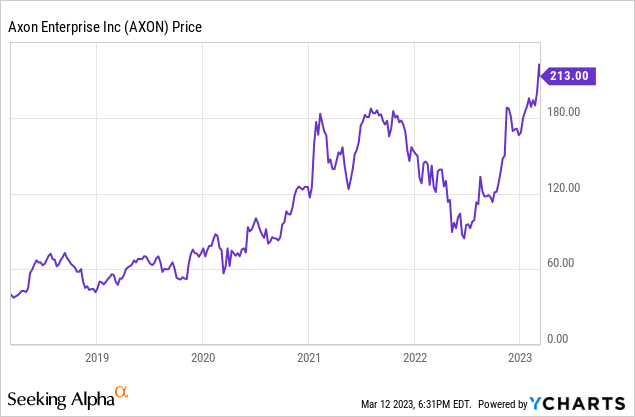

- Axon shares are up 143% since my first bullish article was published in June 2022.

- Axon smashed their 2022 revenue guidance, growing revenues at 38% to $1.19b.

- Axon had 15.1% free cash flow margins in 2022.

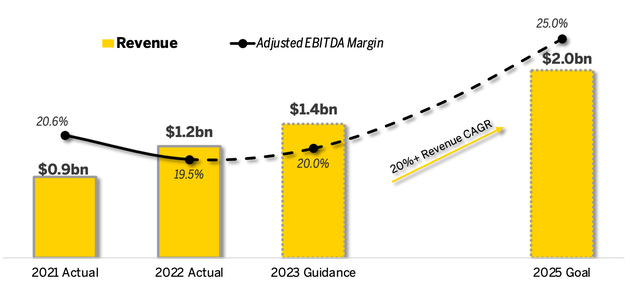

- Management expects revenues to increase at a 20% CAGR through to 2025, with adjusted EBITDA margins to expand from 19.5% to 25%.

- I have updated my rating from "buy" to "hold" based on valuation concerns.

Sascha Schuermann

Axon Enterprise (NASDAQ:AXON) is a US business that provides hardware and software technology solutions for police officers, security officers, military personnel, legal staff, and civilians. Although Axon's first and most recognisable product is the TASER, which acts as a non-lethal alternative to a gun, the business has expanded their product offering substantially over the past decade to also include body cameras, license plate recognition software, and a SaaS-based evidence management platform (Axon Cloud).

I've written several bullish articles on Axon, with shares up 143% since the first article was published (June 2022) and 61% since the second article was published (August 2022). While some of this share price appreciation has undeniably come from multiple expansion, the business is also in a materially stronger position than it was 12 months ago on the back of: 1) accelerating revenue growth, 2) expanding profit margins, 3) reducing stock-based compensation, and 4) new product releases (e.g., TASER 10).

In this short article, I delve into Axon's impressive Q4 2022 results and outline why I've changed my rating of AXON stock from "buy" to "hold".

1) Accelerating revenue growth

Axon has a tendency to under-promise and over-deliver when it comes to revenue guidance and 2022 was no exception. See below the consistent upgrades in revenue guidance over the course of 2022:

| Date of Guidance | 2022 Revenue Guidance | Implied Growth Rate |

| Feb-22 (Q4 2021) | $1.04b | 20% |

| May-22 (Q1 2022) | $1.05-$1.1b | 22-27% |

| Aug-22 (Q2 2022) | $1.07-$1.12b | 24-30% |

| Nov-22 (Q3 2022) | $1.15-$1.16b | 33-34% |

| Feb-23 (Q4 2022) | $1.19b | 38% |

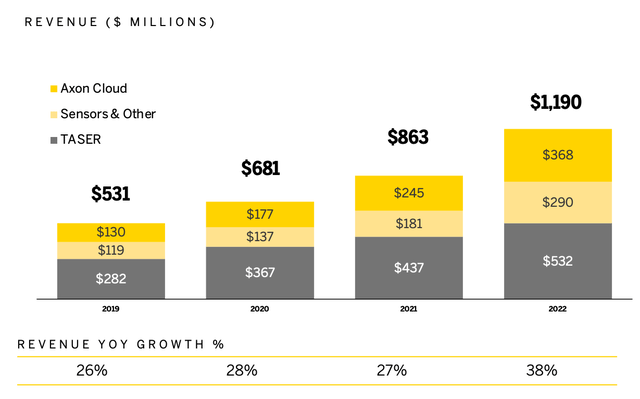

Axon's initial guidance in February 2022 called for $1.04b of revenue, representing 20% YoY growth. However, over the course of each quarter in 2022, Axon upgraded this guidance, culminating in a final 2022 revenue figure of $1.19b (38% YoY growth). This represents a marked acceleration from the 26-28% revenue growth rates achieved from 2019-2021.

For a business of Axon's size, 38% is a very strong growth rate and a testament to product-market fit across all of their core products:

| Product | 2022 Revenue | Revenue Growth | % of Total 2022 Revenue |

| TASER | $532m | 22% | 45% |

| Axon Cloud | $368m | 50% | 31% |

| Sensors & Other | $290m | 60% | 24% |

| Total | $1.19b | 38% | 100% |

While TASER revenue has grown at a healthy 24% CAGR since 2019, Axon Cloud has grown at a phenomenal 41% CAGR, rising from 25% of revenue in 2019 to 31% of revenue in 2022.

Axon Yearly Revenue Chart (Axon Q4 Investor Presentation)

Overall, Axon's business shows no signs of slowing down and Founder and CEO Rick Smith re-iterated in Q4 their commitment to achieve 20%+ revenue CAGR through to 2025. With limited penetration for Axon Cloud globally, and TASERs and body cameras in Europe, Asia, and Latin America, I have no doubt that Axon will achieve this 20% revenue CAGR guidance.

2) Rapidly improving profitability

In the current market where investors are valuing profitability and free cash flow above all, it should be comforting for investors that Axon is GAAP profitable and generates substantial free cash flow.

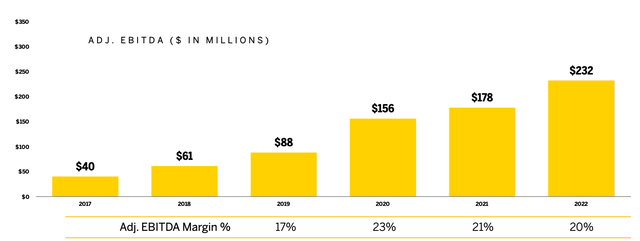

In 2022, Axon generated $232m of adjusted EBITDA (19.5% margin), which increased 30% from 2021. As can be seen below, adjusted EBITDA has expanded considerably from $40m in 2017 to $232m in 2022, representing a 42% CAGR, which has comfortably outpaced revenue growth over this same period.

Axon Yearly Adjusted EBITDA Chart (Axon Q4 Investor Presentation)

Indeed, Axon's 2022 adjusted EBITDA figure smashed their internal guidance, following a similar path to revenue with consistent upgrades each quarter:

| Date of Guidance | 2022 Adjusted EBITDA Guidance | Implied Growth Rate |

| Feb-22 (Q4 2021) | $185-$195m | 4-10% |

| May-22 (Q1 2022) | $190-$200m | 7-12% |

| Aug-22 (Q2 2022) | $200m | 12% |

| Nov-22 (Q3 2022) | $215-$220m | 21-24% |

| Feb-23 (Q4 2022) | $232m | 30% |

Given my rather cynical nature, I must admit I'm not the biggest fan of companies claiming "profitability" based on positive adjusted EBITDA as there are substantial adjustments included in this metric (particularly stock-based compensation which has historically been a concern for Axon). As such, I like to corroborate adjusted EBITDA margins with both net income (GAAP measure) and free cash flow margins.

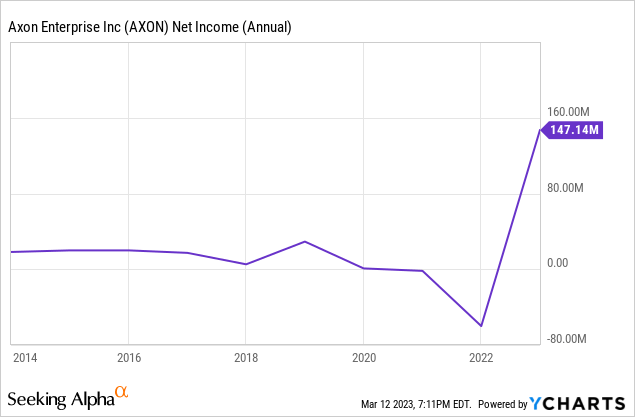

In 2022, Axon generated a healthy $147m of net income (12.4% margin), a substantial increase from the $60m loss reported in 2021. The primary driver of this flip from being unprofitable to profitable was a significant reduction in stock-based compensation (more on this later), rather than a fundamental change in business operations.

As can be seen below, Axon has historically been profitable prior to this sharp increase in stock-based compensation in 2022, with $257m of retained earnings on the balance sheet.

Axon also generated $179m of free cash flow in 2022 which, similar to adjusted EBITDA, has improved materially over the past few years. In the below table, I have used Axon's core free cash flow, rather than adjusted free cash flow which excludes physical investments in their headquarter campus.

| Year | Free Cash Flow | Free Cash Flow Margin (%) |

| 2019 | $49.3m | 9.3% |

| 2020 | ($34.3m) | (5.0%) |

| 2021 | $74.2m | 8.6% |

| 2022 | $179.2m | 15.1% |

This table shows a clear inflection point in Axon's free cash flow margins since 2020 as management have begun to prioritise profitability and provide stricter controls on business spending.

Overall, Axon's adjusted EBITDA, net income, and free cash flow margins remain solid and, in the case of net income and free cash flow, improved substantially from 2021 to 2022. I expect further margin expansion over the course of 2023 as the business continues to realise the operating leverage inherent in their razor and blade business and Axon Cloud business segment.

3) Tighter management of stock-based compensation

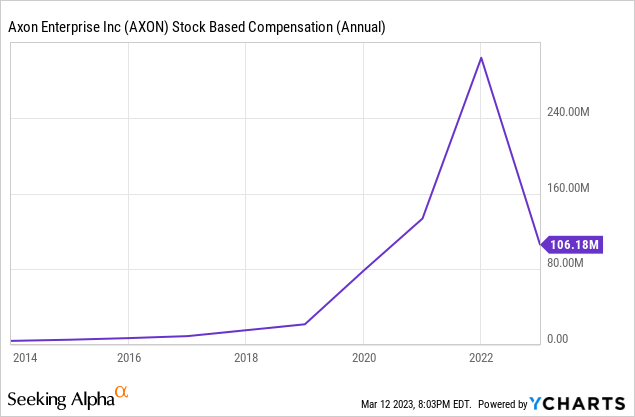

One of my main concerns with Axon has been their excessive stock-based compensation, which arises primarily from CEO Rick Smith's unique compensation package where he receives no fixed salary and is compensated exclusively via stock. However, as most of Rick's CEO performance award has been paid out, Axon reported a material decline in stock-based compensation in 2022, as can be seen below.

In 2021, Axon reported $303m in stock-based compensation (an alarming 35% of revenue); however, this reduced to $106m in 2022 (a more palatable 9% of revenue). In 2023, Axon is guiding towards $140m of stock-based compensation, which would represent slightly under 10% of forecasted revenue.

While these numbers remain high in absolute terms, pleasingly in their Q4 shareholder letter, Axon management laid out their plans to reduce stockholder dilution to a 3% CAGR through to 2025:

We continue to work through already granted equity vesting and exercises which can result in uneven annual levels of dilution, and we are targeting a CAGR for annual dilution of approximately 3% for 2025 and beyond as we work through already granted equity vesting and exercises.

4) Exciting launch of the TASER 10

In Q4, Axon announced the launch of the TASER 10, an upgrade from the TASER 7 which was released in 2018. The main improvements for the TASER 10 include more accurate targeting and an expansion in range to 13.7m (up from 7.6m for the TASER 7).

CEO Rick Smith seemed quite excited about initial traction for the TASER 10 on the Q4 earnings call, which bodes well for future revenue growth:

I would say I have never seen demand this strong in a new TASER launch in my history in the business, which is great news.

- Axon CEO Rick Smith

5) A fortress balance sheet

Axon has a very strong balance sheet with no imminent need for a capital raising.

As of Q4, Axon had $1.09b in cash, cash equivalents and investments, with no debt. If we are highly conservative and treat their convertible note issued in December 2022 as debt, Axon has a net cash position of $402m. With 15% free cash flow margins in 2022 and a renewed focus on profitability, Axon is not constrained for capital and can thus be aggressive with future strategic M&A opportunities.

We want to make sure that when we find something that is appealing from an M&A standpoint, that we're able to be on our front foot and move quickly and smartly going forward on that. We spent a lot of time on that convertible offering talking about what we might look for from an M&A standpoint because that was top of everybody's mind. So a little color is, I think if you look at our M&A history historically, that's probably a pretty good indication where we're really looking for either technology or talent that will support our future product roadmap and or our moonshot goals and mission.

- Axon CFO Brittany Bagley, Q4 earnings call

6) Strong medium-term guidance

Perhaps behind profitability and balance sheet strength, the third most important consideration for investors in the current market climate is business predictability. As I've highlighted earlier, Axon has a demonstrated track-record of underpromising and exceeding their guidance communicated to the market, so I would take all future forecasts with a grain of salt.

Nonetheless, Axon management provided the following guidance for 2025:

- 20%+ revenue CAGR through to 2025.

- Adjusted EBITDA margins of 25% (up from 19.5% in 2022).

Based on the above guidance, Axon expects to generate at least $2b in revenue in 2025 and at least $500m in adjusted EBITDA.

Axon 2025 Guidance (Axon Q4 Shareholder Letter)

7) An update on valuation

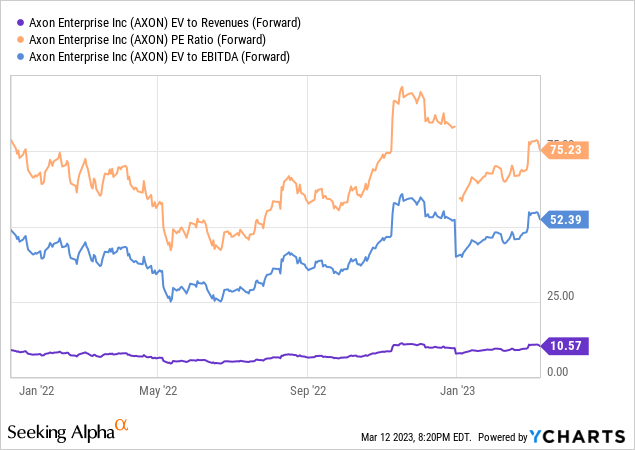

While it's hard to fault the operational performance of Axon, I do have concerns about the valuation. After the 77% increase in share price over the past 12 months, it's hard to argue that Axon is "cheap" on classic valuation metrics. According to YCharts, Axon trades on a forward EV/revenue multiple of 10.6x, a forward EV/EBITDA multiple of 52.4x, and a forward P/E ratio of 75.2x.

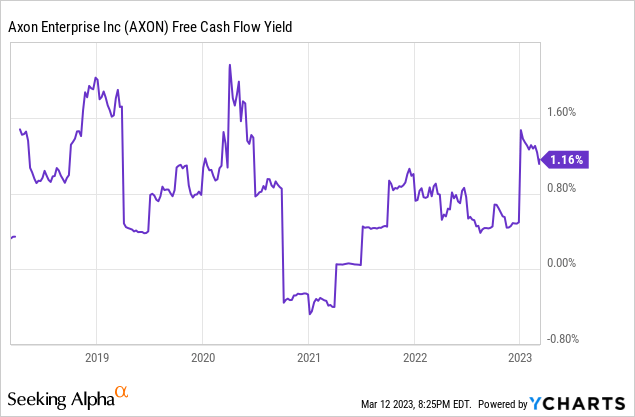

Moreover, despite substantial expansion in free cash flow margin over 2022, Axon trades on a measly 1.2% free cash flow yield, well below the 3.5-4.5% yields offered on US treasury bills (depending on the date and maturity).

If we assume that Axon is able to grow revenues at a 25% CAGR over the next three years (vs. management's guidance for a 20% revenue CAGR), they would generate $2.3b of revenue in 2025. In three years, that would place shares at a 6.6x EV/LTM revenue multiple (5.3x on a forward EV/revenue multiple assuming similar growth rates in 2026).

However, as Axon continues to generate GAAP profits, they will over time become valued based more on P/E and EV/EBITDA ratios as opposed to EV/revenue multiples. If we assume a 15% net income margin in 2025 and 2026 (note: net income margin was 12.4% in 2022 with some one-off gains in strategic investments and marketable securities), Axon would generate around $350m of net income in 2025 and $435m in 2026.

If we apply a very generous forward P/E multiple of 40x in three years' time, Axon would be valued at a market cap of $17.4b, a 12% increase from the current market cap of $15.5b. This calculation implies a 3-4% IRR over a 3-year holding period, roughly in line with current yields offered on US treasury bills. I look to make investments (both new and currently held companies) when I can see a clear path to a 15% IRR, so I won't be adding to my position in Axon at the current valuation.

Conclusion

As a result of the steep run up in share price over the past few years, Axon has grown into my largest personal holding (around 12% of my portfolio). While I have a very high degree of conviction in management's ability to meet (and likely exceed) their 2025 forecasts for $2b of revenue and 25% adjusted EBITDA margins, I have paused adding to my position based on valuation concerns.

However, Axon has a knack for blowing both their own and analyst estimates out of the park, so I wouldn't be surprised to see them grow revenues closer to a 30% CAGR through to 2025 and exceed 25% adjusted EBITDA margins. I've been served well over the past few years living by the following motto: "don't bet against CEO Rick Smith".

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AXON either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.