Curaleaf Still Looking For Profits, Rescheduling Could Worsen It

Summary

- Curaleaf's last 6 quarters have seen anemic revenue growth and declining gross profits.

- The last 11 quarters have seen a gross margin contraction from 70% to 45%.

- The company is not currently well positioned to thrive during the coming price war, but recently they have been making efforts to improve their margins.

Lawrence Glass

Thesis

When cannabis laws change and the federal government moves it from Schedule-1 to anywhere in the 3 to 5 range, it will remove the 280e tax obligation and allow for interstate commerce. As the 50 separate markets all merge into one market, the licensed producers are going to lose most of the pricing power their permits grant them as they all finally to have to truly compete with each other.

I am recommending a Hold for Curaleaf Holdings, Inc. (OTCPK:CURLF) because even though rescheduling will give the entire sector a significant boon, I believe that over the long term it will only make their margins worse and the company will be at risk of becoming less competitive.

Company Background

Curaleaf is headquartered in New York, and currently has the highest quarterly revenue in the industry. The company has a presence in 19 states and focuses its operations in highly populated states including Arizona, Florida, Illinois, Massachusetts, New Jersey, New York, and Pennsylvania.

They operate 147 dispensaries and 28 cultivation sites and have been adjusting their portfolio recently. Looking over the last several months of news shows they have had store openings in Arizona, Illinois, and Maryland, Connecticut, and Florida; and also closed stores in California, Colorado and Oregon.

The Coming Price War

For a preview of what the cannabis sector in the United States will look like, look to Canada. The euphoria phase that the United States is ramping up into, already happened in Canada in late 2018. Competition and overproduction have led to a situation where most of the growers are forced to sell flower at a loss before it expires. The Canadian cannabis sector is in a period of cannibalistic consolidation where mergers and bankruptcies are common and toxic dilution is rampant.

The producers in the United States are used to operating as quasi-monopolies where they have significant control over both supply and price. As the downgrading from Schedule-1 will also remove the barrier to moving cannabis across most state lines. I believe that just like what already happened in Canada, the same need to compete for customers will also drive these United States based operators into a price war. These companies are going to start undercutting each other.

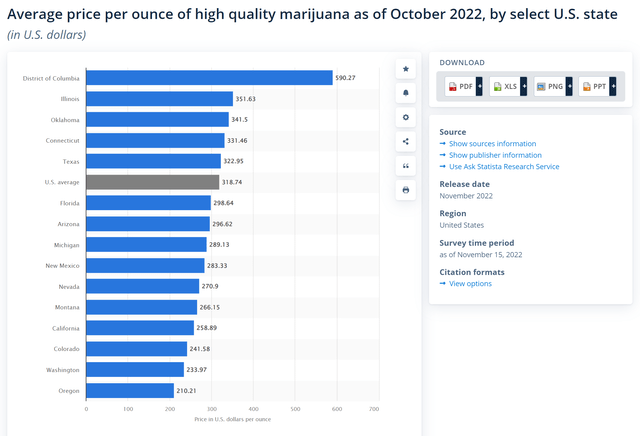

Matej Mikulic - Statista

How well to you think the growers in Illinois or Oklahoma are going to do once they have to compete with cannabis prices from the Pacific Northwest? These $340 to $350 per ounce markets will have to compete against $210 to $233 per ounce markets, what do you expect is going to happen to their margins?

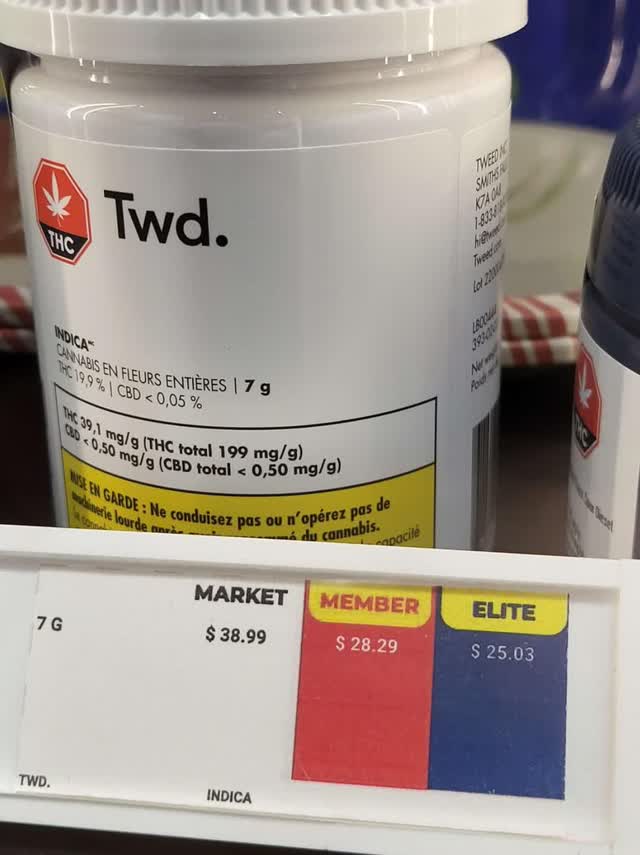

Johnny Stonks

The above picture was taken at a Canna Cabana so those are in Canadian dollars. Up in Canada, they are selling cannabis to end-use consumers for $100.12 CAD per ounce. That comes out to about $75 USD.

Financials

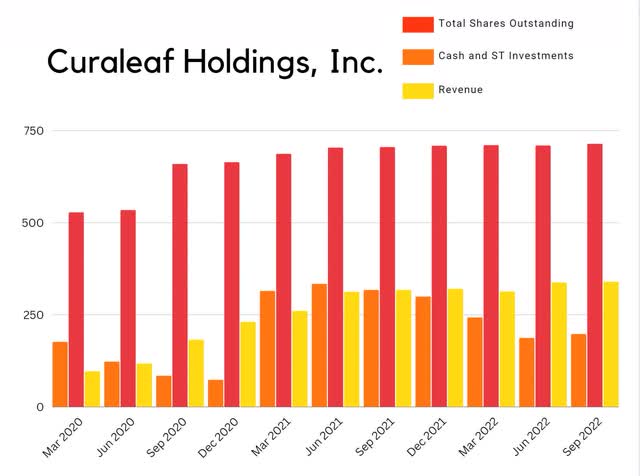

As of their most recent quarterly report, the company has $197.7M in total cash and short term investments and lost $54.7M from ongoing operations. The company exhibited strong revenue growth up until the second quarter of 2022, but it has become anemic since then.

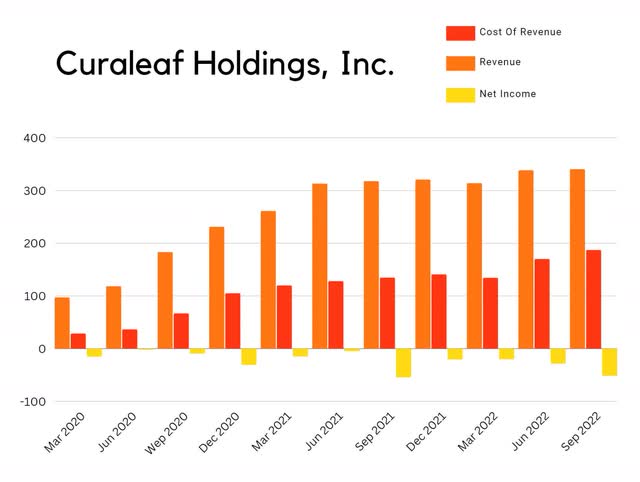

CURLF Revenues (Blake Downer)

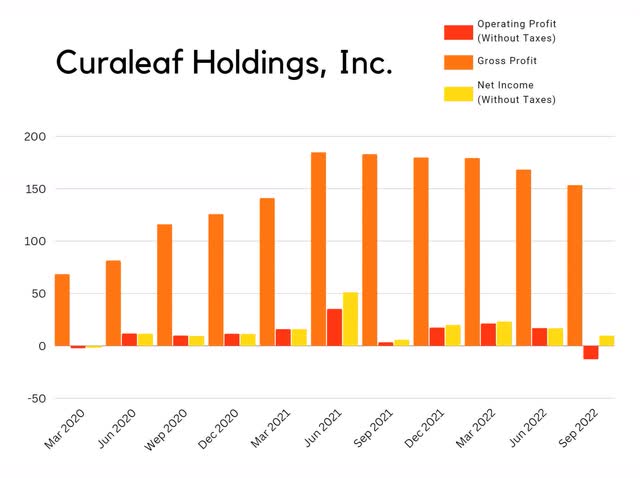

Taking a look at their quarterly profits, this company has significant gross profit. Unfortunately, the 280e tax obligation means they are not allowed to deduct expenses and it has crippled the company's ability to make money. Gross Profit has been slowly declining for the last 6 quarters.

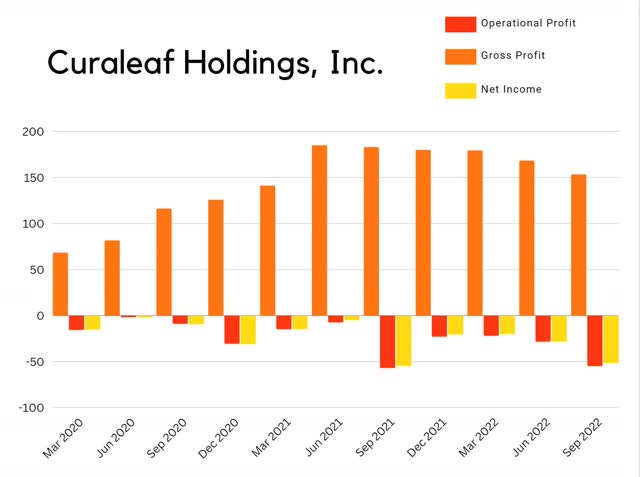

CURLF Profits (Blake Downer)

While looking over what their profits would be like without the tax burden, it becomes clear that this company is fairly operationally healthy. Without 280e, the company would be showing inconsistent profits.

CURLF Profits Without Taxes (Blake Downer)

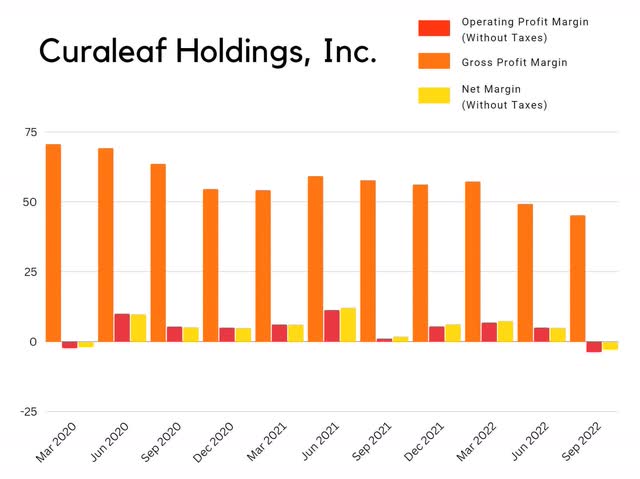

I keep talking about what I think the post rescheduling environment might look like so let's look at what margins would be if taxes were removed. I find it rather alarming that this company has poor revenue growth and declining gross margins. If this continues for long enough, the company will eventually be forced into a situation where they have to dilute to stay operational.

CURF Margins Without Taxes (Blake Downer)

I also like to look at the Float-Cash-Revenue relationship of companies to see how these trends have been playing out. When share count went up, it came with a rise in revenue, so that dilution was accretive. For a company with a brutal tax obligation, cash has also stayed relatively stable, this is surprisingly healthy looking.

CURLF Float - Cash - Revenue (Blake Downer)

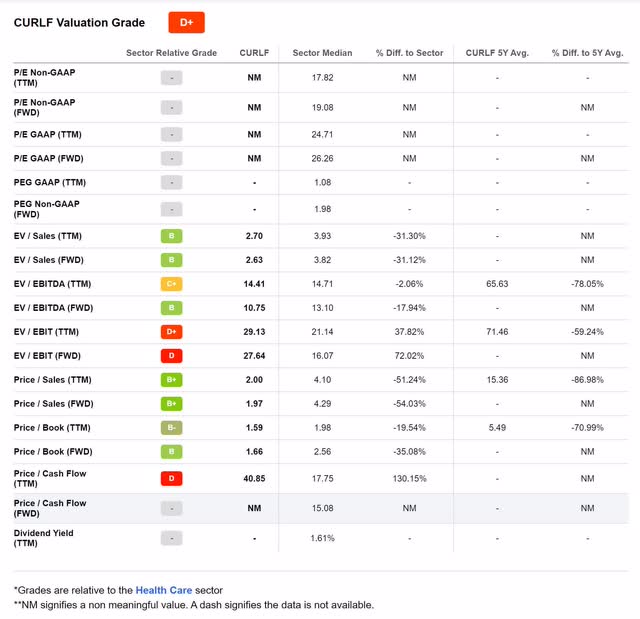

Valuation

As of March 10th 2023, Curaleaf was trading for $3.71 per share and had a market cap of $2.62B. Cannabis is a maturing sector and unfortunately it's always compared against Health Care or Pharmaceuticals and so its relative valuations always look poor. This is why most of the individual valuations are showing the company as undervalued, yet the overall valuation earned a D+ from Seeking Alpha. This company has significant sales but poor cash flow.

CURLF Valuation (Seeking Alpha)

Risks

At the present burn rate, the company has about a year of cash left, I expect the next sector rally to happen before then, but it may not.

The entire cannabis sector is impatiently waiting for the DHHS and the attorney general to announce their findings. If they chose to adopt the same attitude about cannabis as we do alcohol or tobacco and remove it from the list of controlled substances, then ultra-cheap Canadian flower will flood the United States market. If this happens, the United States cannabis ecosystem will very quickly start to look like Canada's; most of the US based producers will be forced to operate at a loss until they go out of business.

Catalysts

The upcoming sector wide rally will give Curaleaf a brief window of opportunity to find a business model that is operationally viable in a post-rescheduling environment. After 280e is removed, there will be a period of time where their large gross margins are going to directly generate into huge EPS raises. I expect this company, along with most of the rest of the sector, to do large at the market offerings into the euphoria of the rally. The amount of time they will have to make the transition will depend on how efficiently they spend that money, and how quickly the price of wholesale cannabis drops. I feel they will have both the time and the cash on hand to perform a major operational pivot.

Conclusion

If the DHHS and the attorney general chose to reschedule it into the 3 to 5 range, and limit imports, Curaleaf, along with the entire rest of the sector, will enter a new phase of competition. If they play their cards right, the company has the potential to leverage its significant size and ability to fund raise to gain competitive advantages over the rest of the sector.

I do not presently have a position in Curaleaf but I am planning on buying out-of-the-money LEAPS calls on this company and several others when the news of rescheduling hits. I will hold them through the expected EPS rises, and sell them if I see a significant drop in the wholesale price of flower. I expect to see sector-wide margin expansions, followed by competition induced contractions.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.