Danaos: Net Cash Position Sets The Stage For The Long Term

Summary

- After a remarkable performance in 2022, Danaos is poised to achieve yet another year of record profits.

- Through an assertive deleveraging strategy, DAC stock is expected to attain a net cash position in the near future.

- The absence of significant capital returns may be disappointing, but management is laying the foundation for long-term success.

- Looking for a portfolio of ideas like this one? Members of Wheel of Fortune get exclusive access to our subscriber-only portfolios. Learn More »

David Taljat

We have covered Danaos (NYSE:DAC) multiple times over the past several quarters, supporting the stock's bullish case on the basis of the company's excellent earnings outlook and healthy financial position.

While we have been right with regard to Danaos' earnings and deleveraging progress, we probably overestimated the company's capital return potential. See, Danaos' financial performance was incredible in fiscal 2022, and we even expect another year of record or near-record earnings in 2023. However, it appears that the management's prudent capital allocation strategy and focus on fleet renewal/expansion are likely to limit how much of Danaos' hefty earnings are to be returned to shareholders.

Combined with the fact that interest rates have increased at a faster-than-expected pace compared to past estimates, which implies that the cost of equity has grown and that investors require higher tangible returns to feel compensated, it makes total sense why shares of Danaos have traded rather uninspiringly over the past few quarters.

This is especially true given that the company's peers offer much higher yields, further discouraging investors from seeing the appeal in Danaos' investment case. Take Global Ship Lease (GSL), for instance, whose shares have considerably outperformed Danaos lately due to a much greater mix of share repurchases and dividends. Even the much smaller Euroseas (ESEA), whose more undersized operations can come with additional risks, has performed modestly better due to its double-digit dividend yield.

Nevertheless, whether Danaos' massive profits are being allocated toward deleveraging or advanced payments for the company's newbuild vessels compared to dividend raises or share repurchases, one thing is for certain:

The company is dedicated to enhancing shareholder value while also safeguarding investors from potential industry challenges in the medium term and positioning itself for significant profit potential during the next favorable cycle.

It's All About Capital Allocation

Danaos made bank last year, backed by its exceptional leases, which were signed near record rates, as well as its investment gains, a great portion of which were in the form of dividend payments by its now-sold equity stake in ZIM Integrated Shipping Services (ZIM).

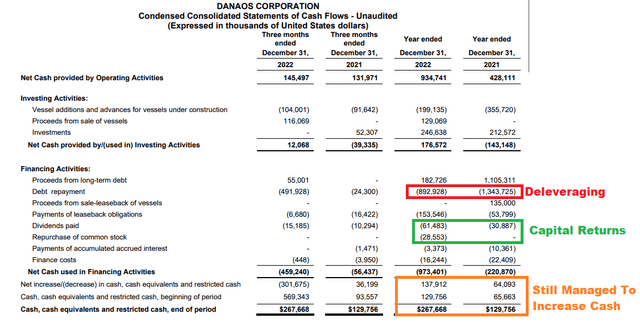

Management used the majority of these funds to reduce its debt levels. Capital returns did grow significantly compared to fiscal 2021 but were still a fraction of the company's operating cash flows. Still, along with the proceeds from the sale of vessels at very attractive price levels, which partially offset the advances for vessels under construction, the company was still able to increase its cash position during the year, despite the aggressive deleveraging.

Danaos' Cash Flow Statement (FY2022 Earnings Release)

In fact, with a liquidity north of $650 million and a net leverage of just 0.3X at the end of the quarter, Danaos is currently in the best financial position it has ever been. And, although I cannot confirm with certainty, it appears that Danaos might have the (or one of the, if we are cautious) healthiest balance sheets among all shipping companies that are publicly traded.

Danaos' Liquidity & Leverage (Investor Presentation)

As you can probably tell, based on Danaos' current lease charter backlog and deleveraging trajectory, the company will reach a net cash position, possibly during the first half of this year. When was the last time you saw a company in the shipping industry with a net cash position and a $2.1 billion charter backlog that is covering 93% of operating days this year already?

When asked during the Q4 earnings call about the company developing into a net cash position, Mr. John Coustas, Danaos' CEO, said:

(slightly edited for readability)

Well,...[we] will pretty soon be at net zero debt. Of course, this is not something that we intend to keep. On the other hand, shipping is a kind of a cyclical business. The container market has just entered the downturn and we will be following exactly what is happening to see at which moment we think the time is right in order to make some acquisitions.

It's very difficult to give you a specific kind of timeline. Overall, there is a lot of uncertainty in the world. And one thing that we need really to realize is that we are moving after many, many years into a significantly higher interest rate environment, which makes, let's say, breakeven calculation for assets, quite different than what they were, let's say, in the previous decade. So, people are not sure yet what will be the peak interest rate and how long it's going to last. So, we will be monitoring all these factors. And exactly because of our very strong position, we are not in a hurry to make sure that we make our call right.

The takeaway is this:

- Danaos having a net cash position with rates on the rise is great for the company. Management deleveraged just in time before growing interest expenses would have started eroding earnings.

- Management is not in a hurry to start utilizing the ample room it has (from a debt/equity standpoint) to start undertaking debt again, given the current macro/interest rate uncertainties.

- But, the company certainly doesn't intend to retain a net cash position "forever", and they certainly intend to keep growing/renewing the fleet.

It might seem like a poor decision to keep growing the fleet, considering that charter rates have fallen near their pre-pandemic levels. However, it's worth noting that these new, high-quality new builds (specifically the six vessels Danaos will be welcoming next year) will attract significantly higher interest from liners. Danaos will likely be able to lease these ships at above-index rates for above-average durations due to the efficiencies these new vessels offer.

Right now, there is still employment interest by liners for containerships, but time charters rarely go beyond 12 months due to the ongoing trading environment. However, when it comes to the six upcoming new builds, Mr. Coustas had this to say:

When we are talking about new buildings, we are easily talking 3 years to 5 years, even now. As I have said, we are not in a hurry because we don't really need a charter in order to secure finance for the ships. We are funding these vessels from our own resources. So, we are fortunate that we are able really to wait and to see exactly what's going to be the best employment for these ships.

Given that these ships will not bear interest expenses and that they will likely be leased for several years out at attractive rates, it's reasonable to assume that the ongoing advancements being paid for the vessels will eventually be accretive to earnings-per-share in the coming years.

A Company Build For Long-Term Success

I am disappointed about the lack of significant capital returns during the peak of an industry cycle as much as the next DAC investors. However, nobody can doubt management is carefully positioning the company for long-term success in a prudent manner.

The current charter backlog remains massive, and even if a great portion of these funds were to be allocated toward Danaos' fleet renewal/expansion, the lack of interest expenses attached to old and new ships means that Danaos should be quite profitable post-2023-2024, even with notably weaker charter backlog than the current one. Of course, it's hard to quantify this, but it only makes sense to assume that management is making the most accretive capital allocation moves on a risk-adjusted basis - especially given shareholder and management interests are mostly aligned in this one.

Risks & Conclusion

Regarding Danaos' risks, one concern I have is that the 5.3% yield may not be "enough" to satisfy investors in this environment, which could allow shares to slip further lower. In my view, sophisticated shipping investors and analysts are well-aware that Danaos is steeply undervalued, so I don't believe the stock will be driven significantly lower "for the sake of trading at a higher yield". However, it's always a possibility, given the higher yields one can find in shipping these days.

Another risk to Danaos' investment is the market perceiving the stock as "dead money". With no additional catalysts to drive the stock higher apart from its existing value case, investors may think that if Danaos were to trade higher, it would already have done so. This is true especially given that there are more dynamic and exciting opportunities in shipping today, specifically regarding tankers.

Finally, at Danaos' current price levels, let alone at possibly lower price levels, there is a chance that the company could be taken private. This is another risk, as we could see Danaos being stolen at a fraction of its book value. We have seen such cases occurring in shipping in the past.

Wheel of FORTUNE is a most comprehensive service, covering all asset-classes: common stocks, preferred shares, bonds, options, currencies, commodities, ETFs, and CEFs.

- WoF is 1 out-of-only 3 services with 50+ reviews that have a 5* rating.

- WoF is 1 out-of-only 7 services with 25+ reviews that have a 5* rating.

- Single, uncorrelated, trading ideas [ >250/year, on average].

- Managed portfolios, aim at outperforming SPY on a risk-adjusted basis.

Join The Wheel. Build & Protect Your Fortune.

This article was written by

Hi there!

I hold a BSc in Banking and Finance. Here, on Seeking Alpha, I cover a variety of growth stocks and income stocks, including identifying those with the highest expected return potential, and a solid margin of safety.

Currently contributing as Promoting Author to the "Wheel of Fortune" marketplace.

Feel free to contact me at any time, and follow me here on S.A. for regular content and updates!

Happy investing!

Nick

Disclosure: I/we have a beneficial long position in the shares of DAC, GSL, ESEA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.