DPG: A Bastion Of Stability In Uncertain Times, But A Pricey One

Summary

- Investors are undoubtedly looking for some safety considering that we have seen three bank failures in less than a week.

- Duff & Phelps Utility and Infrastructure Fund invest in a portfolio of utilities and infrastructure companies that should be able to provide this safety considering their inherent stability.

- The fund outperformed the utility index last year.

- The 10.26% yield appears sustainable, which is surprising.

- The Duff & Phelps Utility and Infrastructure Fund is incredibly expensive today, as it trades at a double-digit premium to the net asset value.

- This idea was discussed in more depth with members of my private investing community, Energy Profits in Dividends. Learn More »

shaunl

The past week has been interesting, to say the least. We have seen three bank failures in the United States and there are a few more banks that are considered to be at risk of failure. This has caused a massive flight to safety, as both gold and bitcoin were up substantially yesterday, and bitcoin is up further overnight. Unfortunately, all of these assets have no yield, so more income-oriented investors may be wondering where they can safely store money and earn some semblance of yield.

One option that has been used by retirees and other conservative investors for decades is utilities. These companies provide services that are generally considered to be necessities for modern life, so their cash flows tend to be remarkably stable over time. In addition, because the services they provide are considered necessities, they will almost certainly have government support in a worst-case scenario. Of course, conservative utilities have never experienced anything close to the runs and bad investments that have taken down banks over the years. In addition to all of us, utilities are fairly well-known for boasting fairly high dividend yields. Unfortunately, the Russell 1000 Utilities RIC 22.5/45 Capped Index (IDU) only yields 2.56% today, which is less than a good money market fund. This is largely a function of the fact that the market is still significantly overvalued despite the decline that occurred last year.

One solution to this problem is to invest in a closed-end fund ("CEF") that specializes in investing in utilities. These funds are not particularly well-followed in the market, but they should be as they provide a great way to easily acquire a diversified portfolio of assets that can usually deliver a higher yield than pretty much anything else, including the underlying assets.

In this article, we will discuss the Duff & Phelps Utility and Infrastructure Fund (NYSE:DPG), which is one fund that falls into this category. As of the time of writing, this fund yields 10.26%, which is much more in line with the yields that we like here at Energy Profits in Dividends than the utility index. I have discussed this fund before, but several months have passed since that time so naturally quite a few things have changed. This article will focus specifically on these changes as well as provide an updated analysis of the fund's finances as we attempt to determine if this fund could be a good addition to a portfolio today.

About The Fund

According to the fund's webpage, the Duff & Phelps Utility and Infrastructure Fund has the stated objective of providing its investors with a high level of total return, although the fund explicitly states that it will aim to deliver this total return in the form of current income paid to investors along with the growth of current income. This is not especially surprising for a utility fund that invests primarily in common equity. In fact, the fund is exclusively invested in common stock:

CEF Connect

The reason that an emphasis on total return is not surprising given this situation is that common equity is by its very nature a total return vehicle. After all, most investors that purchase common stock do so with the intent of receiving both capital gains and income via dividends. However, utilities tend to have fairly low growth rates compared to companies in many other sectors. One of the reasons for this is that most people already have electricity, natural gas, or other utility services in their homes, and the population growth rate of the United States is very low:

Year | Population of U.S. | YOY Growth |

2023 | 339,996,563 | 0.5% |

2022 | 338,289,857 | 0.38% |

2021 | 336,997,624 | 0.31% |

2020 | 335,942,003 | 0.49% |

(data from United Nations.)

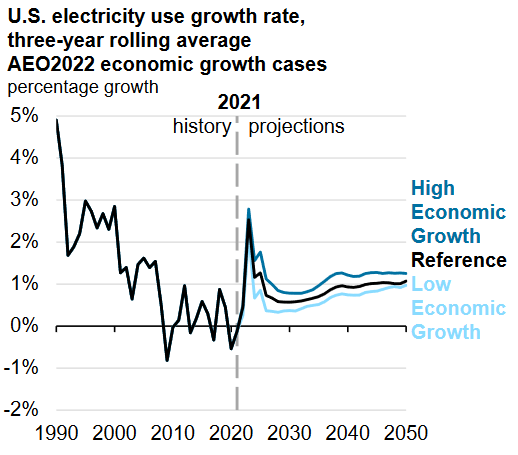

As a result, a utility's ability to generate growth by adding more customers is quite limited. As I pointed out in an article yesterday, it is possible for utilities to grow by their customers increasing their consumption of electricity but even this tends to be very tepid growth. The average American household simply does not increase its electric consumption significantly from year to year. The United States Energy Information Administration confirms this, as the organization currently projects that the electric consumption of the nation as a whole will only grow at a 1% to 2% growth rate through 2050:

U.S. Energy Information Administration

This could certainly change if electric cars become common, but as I have pointed out in various previous articles, I doubt that will ever occur as strongly as some prognosticators predict. The point of all this is that because electric and other utilities tend to have low growth rates, their potential for significant capital gains is limited compared to something like a high-growth technology company. As a result, utilities tend to pay out a large proportion of their cash flows to investors. As their stock prices do not usually have high multiples due to the low growth, they usually have fairly high yields. Thus, utility investors receive most of their total return via the dividends that they receive from their utility investments.

The Duff & Phelps Utility and Infrastructure Fund also states that it aims to deliver income growth. This is something that is very nice to see during inflationary times, such as the one that we are currently experiencing in the United States and abroad. After all, inflation is constantly reducing the number of goods and services that we can purchase with the dividend that we receive from a given company. This is a big problem for those of us that are depending on our portfolio incomes to cover some or all of our bills since it essentially means that we are getting poorer and poorer with the passage of time. The fact that the fund tries to increase its income helps to offset this effect since the higher amount of income should mean that our purchasing power remains at least more stable. It is not uncommon for utilities to increase their dividends on an annual basis, so the fund should not have real difficulty increasing its income over time simply by maintaining a portfolio of utilities. Unfortunately, many utilities have not been increasing their dividends by nearly enough to completely offset inflation lately. This will hopefully change at some point when and if the Federal Reserve finally manages to get inflation under control. I make no promises on when this will occur though as it has a long way to go and the fact that the Federal government continues to run high deficits does not make its task any easier.

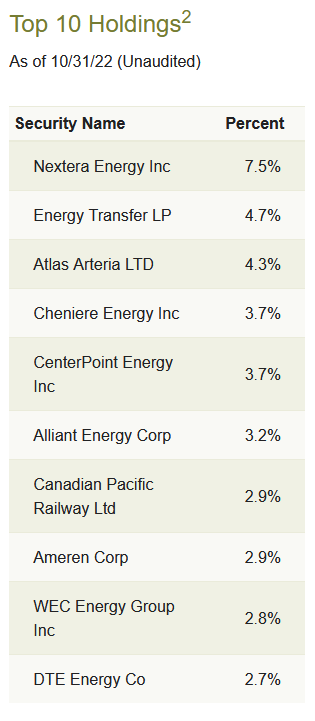

As my long-time readers are no doubt well aware, I have spent a great deal of time and effort over the past few years analyzing and publishing reports on utility companies on Seeking Alpha. As such, regular readers will likely be familiar with the largest names in the fund. Here they are:

Duff & Phelps

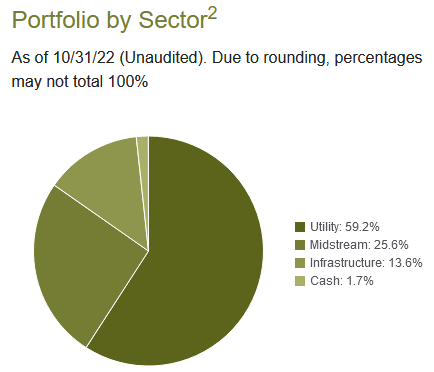

This is certainly interesting, to say the least, as it is nowhere close to what we would expect from a utility fund. In fact, we only see six utilities on this list: NextEra Energy (NEE), CenterPoint Energy (CNP), Alliant Energy (LNT), Ameren (AEE), WEC Energy Group (WEC), and DTE Energy (DTE). We also see here Energy Transfer (ET), which is one of the largest midstream master limited partnerships in the United States, Atlas Arteria (OTCPK:MAQAF), which is an Australian toll road operator, Cheniere Energy (LNG), which is a producer of liquefied natural gas, and Canadian Pacific Railway (CP), which is a railroad operator. The fact that several of these companies are not utilities emphasizes the fact that the Duff & Phelps Utility and Infrastructure Fund is technically more than just a utility fund, although 59.2% of the fund is invested in utilities:

Duff & Phelps

The nice thing about the non-utility companies though is that they share many of the characteristics that we appreciate with utilities. In particular, these companies tend to enjoy remarkably stable cash flows over time. This is particularly true with midstream companies and liquefied natural gas producers. That is because these firms typically operate under long-term contracts in which the price and volumes are guaranteed. Thus, cash flows tend to not vary too much. Railroads and toll road operators tend to have relatively stable cash flows too, but not quite to the same degree. Overall though, we can clearly see that the Duff & Phelps Utility and Infrastructure Fund is investing in companies that should be incredibly safe over extended periods of time. This is exactly the kind of thing that risk-averse investors such as retirees should be able to appreciate.

There have only been two major changes to the largest positions in the fund since the last time that we reviewed it. These are that Public Service Enterprise Group (PEG) and MPLX (MPLX) were removed and replaced with Atlas Arteria and WEC Energy Group. I am not certain about the need for these changes, particularly the removal of MPLX as that is one of the best midstream partnerships available in the market today. With that said, WEC does allow us to keep the natural gas exposure that we like with MPLX so the biggest sacrifice may be the fact that MPLX has a much higher yield, so the fund's income actually went down with this change. We also see that several of the fund's major holdings had their weightings change compared to several months ago, but that could easily be explained by one company outperforming another in the market.

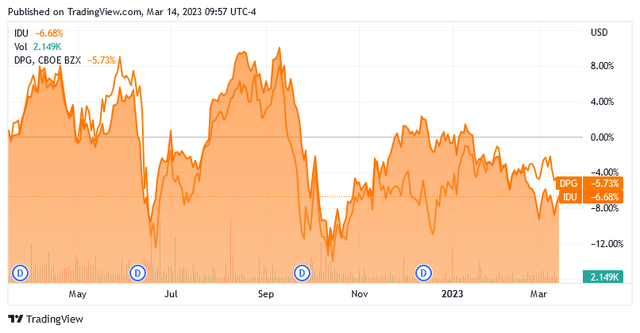

The fact that there do not appear to be a great many changes to the fund's portfolio over the few months that passed between the release dates of the fund's holdings could lead us to expect that the fund would have a very low turnover rate. This is partially true, as the fund's 50.00% annual turnover is about average for an equity closed-end fund. This is important because of the fact that it costs money to trade stocks and other expenses. These expenses are billed directly to the fund's shareholders, so they create a drag on the performance of the portfolio and make management's job more difficult. After all, the fund's managers will need to generate a sufficiently high return to cover the additional costs of the trading expenses and still have enough left over to deliver investors a return that they deem acceptable. There are very few management teams that manage to achieve this over an extended period of time, which is one reason why actively managed funds tend to underperform their benchmark indices. With that said, DPG has managed to outperform the U.S. Utilities Index over the past twelve months:

The performance difference between the two assets becomes even starker when we consider that the Duff & Phelps closed-end fund has a substantially higher yield. Thus, its total return is much higher than the index fund over the period. However, as we saw earlier, the Duff & Phelps Utility and Infrastructure Fund invests in more than just utilities, so this is not a perfect comparison. In particular, the energy companies in the portfolio delivered a much higher total return over the period than utilities so that almost certainly benefited the fund relative to the index.

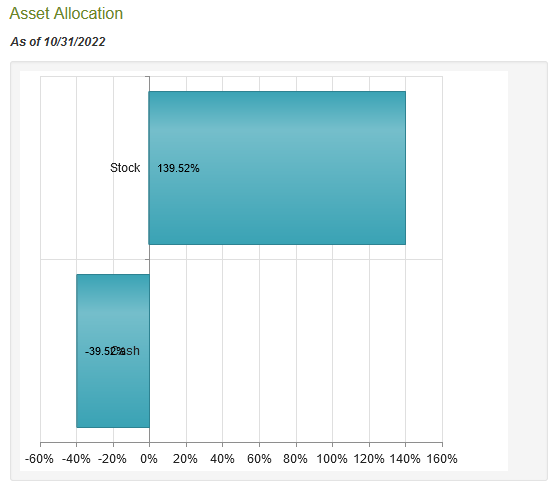

Leverage

Earlier in this article, I stated that closed-end funds like the Duff & Phelps Utility and Infrastructure Fund have the ability to generate a higher yield than any of the underlying assets actually possess. One method that is employed to accomplish this is the use of leverage. Basically, the fund borrows money and then uses that borrowed money to purchase shares of utilities and other assets. As long as the total return that it receives on the purchased assets is greater than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will usually be the case.

Unfortunately, the use of debt in this fashion can be a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to too much risk. I do not typically like to see a fund's leverage exceed a third of its assets for this reason. The Duff & Phelps Utility and Infrastructure Fund, fortunately, satisfies this requirement. As of the time of writing, the fund's levered assets comprise 30.61% of its assets. It, therefore, appears that this fund is utilizing a reasonable balance between risk and reward.

Distribution Analysis

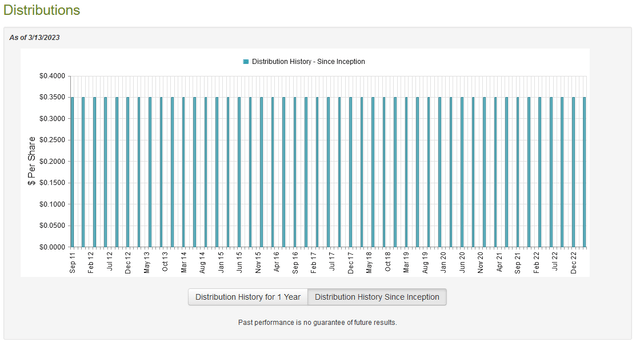

As stated in the introduction, the primary objective of the Duff & Phelps Utility and Infrastructure Fund is to provide its investors with a high level of total return that consists mostly of current income. In order to achieve this objective, the fund purchases shares of utilities and other infrastructure companies. As one of the defining characteristics of both utilities and infrastructure firms is that they have reasonably high yields, this provides the fund with a source of income. It then applies a layer of leverage to artificially boost the yield of the portfolio above that of the companies in the portfolio. As such, we might assume that the fund will pay out a fairly high yield to its investors. This is certainly the case as the fund pays out a quarterly distribution of $0.35 per share ($1.40 per share annually), which gives it a 10.26% yield at the current price. The fund has been remarkably consistent about its distribution over the years, as it has paid out the same amount since 2011:

That is a better track record than almost any other closed-end fund in the market. Unfortunately, we do not see any of the distribution growth that the fund states as part of its objective. That means that an investor who spends all of the distribution will see their purchasing power decline due to inflation over time. That is disappointing, although it can easily be overcome by reinvesting part of the distribution received. The fact that the fund does have such a strong track record for consistency will likely appeal to any investor that is seeking a steady source of income, though. As is always the case, we need to ensure that the fund can actually afford the distribution that it pays out. After all, we do not want it to be forced to cut the distribution since that would both reduce our incomes and almost certainly cause the fund's share price to decline.

Fortunately, we do have a reasonably recent document that we can consult for the purposes of our analysis. The fund's most recent financial report corresponds to the full-year period that ended on October 31, 2022. This is a much newer report than was available to us the last time that we discussed this fund so it should give us a better idea of how well the fund weathered the market volatility last year than the previous report did. Unfortunately, we still do not have information about its financial performance over the past four months, but such delays are common with closed-end funds. During the full-year period, the Duff & Phelps Utility and Infrastructure Fund received $25,167,877 in dividends and distributions from the assets in its portfolio. However, some of this money was classified as a return of capital for tax purposes and thus not income. As a result, the fund only reported total income of $17,378,250 over the year. It paid its expenses out of this amount, which left it with $4,392,301 available for investors. As might be immediately guessed, that was nowhere close to enough to cover the $53,251,215 that the fund actually paid out in distributions. At first glance, this could be concerning as the fund's net investment income was substantially less than its distribution.

However, a fund like this does have other methods through which it can obtain the money that it needs to cover the distribution. As already mentioned, the fund did receive $8,776,799 in distributions from master limited partnerships that was not considered income. That is not enough to cover the distribution even when combined with the net investment income, though. Thus, we need to look at capital gains to make up the difference. Unfortunately, 2022 was not a great year for the market and the fund was generally unsuccessful at this task. It did report net realized gains of $19,381,434 but this was offset by $36,400,820 net unrealized losses during the year. The fund's assets declined by $64,224,281 over the course of the year once we account for all inflows and outflows. That is disappointing as it indicates that the fund is failing to cover its distribution. However, on November 1, 2020, the Duff & Phelps Utility and Infrastructure Fund had $459,201,059 in assets, which increased to $464,927,813 as of the close of business on October 31, 2022. Thus, the fund actually did manage to cover the distributions in both years when we look at the long term. As long as the fund's performance does not substantially decline, it should be able to maintain its payout.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Duff & Phelps Utility and Infrastructure Fund, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of all the fund's assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a situation implies that we are buying the fund's assets for less than they are actually worth. This is, unfortunately, not the case with this fund today. As of March 13, 2023 (the most recent date for which data is currently available), the Duff & Phelps Utility and Infrastructure Fund has a net asset value of $11.59 per share but the shares currently trade for $13.47 per share. That gives the shares a 16.22% premium to net asset value at the current price. That is a substantial premium that is well above the 15.29% premium that the shares have traded at over the past month. This is a good fund, but that is an extremely high price to pay for it. It would almost certainly be best to wait until the valuation drops to a more reasonable valuation before buying in.

Conclusion

In conclusion, utilities and infrastructure companies can offer investors a safe haven in times of uncertainty, such as we saw over the past week with multiple bank failures. The Duff & Phelps Utility and Infrastructure Fund invests in a portfolio of these companies and provides investors with a very high yield. The fact that the fund's distribution has been stable for more than a decade is undoubtedly appealing, as is the fact that it appears to be sustainable. The only real downside here is that it is incredibly expensive to get these good things. The Duff & Phelps Utility and Infrastructure Fund would definitely be a buy at a more reasonable price, however.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Disclosure: I/we have a beneficial long position in the shares of MPLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was originally published to Energy Profits in Dividends during the morning of March 14, 2023. Subscribers to the service have had since that time to act upon it.