NASDAQ-100 Index: Why You Should Start Buying Now

Summary

- The NASDAQ-100 index has a long history of strong performance, outperforming the S&P 500 significantly over a long period of time.

- Timing the market is a sucker’s game and it only makes sense to start building exposure now and avoid missing out on the next market rally.

- Technology stocks will continue to outperform other sectors, with artificial intelligence being the next leg of innovation and growth in the sector.

MF3d

Overview

The Invesco NASDAQ 100 ETF (NASDAQ: QQQM) is an ETF that tracks the performance of the NASDAQ-100 index. The fund invests in the 100 largest companies listed on NASDAQ. As a reminder, the NASDAQ-100 Index does not include financial companies and is heavily weighted towards large-capitalization technology stocks like Apple, Microsoft and Amazon. The fund has a total expense ratio of 0.15% per annum, which is the cheapest ETF available tracking the NASDAQ-100 Index according to etfdb.com.

Performance

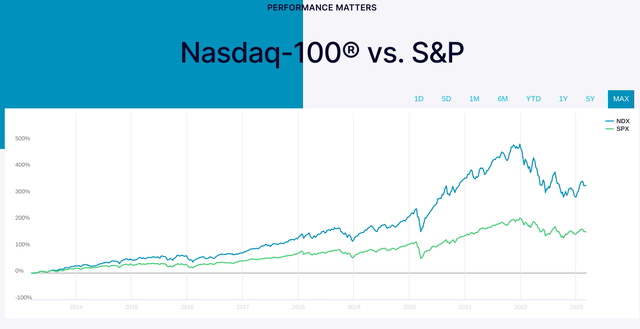

The NASDAQ-100 and S&P 500 are two of the most popular equity indexes to get exposure to U.S stocks. With a heavy allocation towards the fast-growing technology sector, the NASDAQ-100 performance surpassed the S&P 500 index by a wide margin between December 31, 2007, and March 31, 2022 – as seen in the graph below.

The NASDAQ-100 Index has returned 17.22% per annum over the last 10 years, compared with 9.55% per annum for the S&P 500. The outperformance is significant, especially when considering the compounding effect over a long period of team. On the negative side, the fund was created in 2020 and therefore does not have a long history of tracking the NASDAQ-100 Index which investors can assess. However, I believe that the low expense ratio compensates for this risk.

Portfolio

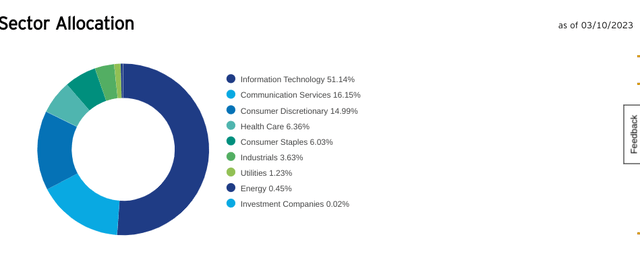

The QQQM fund has a 50% sector allocation to Information Technology, with Communication Services (16.15%) and Consumer Discretionary (14.99%) being the second and third largest sector allocations.

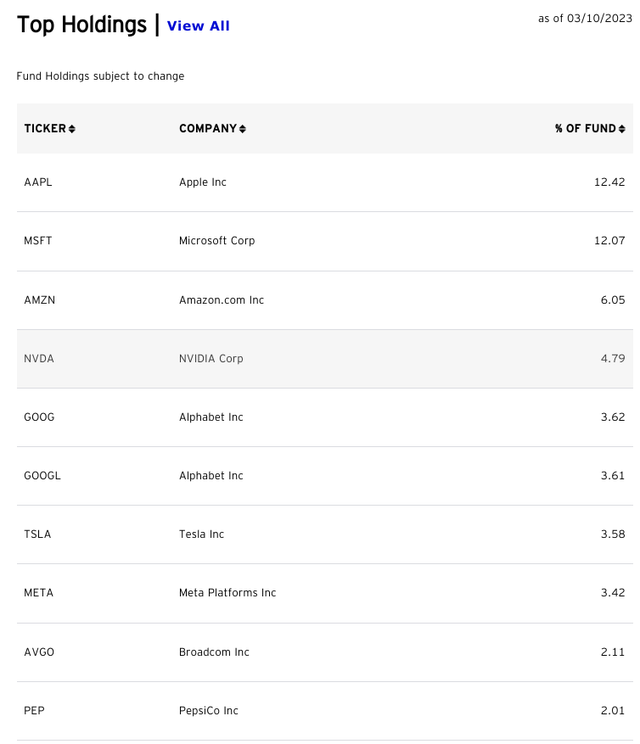

The fund’s top 10 holdings constitute nearly 50% of the portfolio, with the 5 largest holdings representing at least 40% of portfolio exposures - Apple Inc, Microsoft Corp, Amazon.com Inc., Nvidia Corp. and Alphabet Inc. The performance of the fund is strongly linked to the performance of these companies.

There have been some positive analyst calls on the top 5 holdings recently. Morgan Stanley sees Apple rallying more than 20%, and Bank of America recently named its top picks to get exposure to AI, which includes Microsoft (partial owner of ChatGPT) and Alphabet.

Reasons to buy the NASDAQ-100 Index

The NASDAQ-100 index has a long history of strong performance, outperforming the S&P 500 significantly over a long period of time. With a heavy allocation to the technology sector, the NASDAQ-100 index has benefitted from the rise in technology stocks such as Apple, Microsoft and Alphabet. I believe that technology stocks will continue to outperform other sectors, with artificial intelligence being the next leg of innovation and growth in the sector.

The QQQM fund has fallen by more than 25% from a high of $166.07 in November 2021 and the current share price is a great opportunity to invest in for the long term. It is difficult to say when the QQQM fund will bottom out, but I believe that we are getting close. Timing the market is a sucker’s game and it only makes sense to start building exposure now and avoid missing out on the next market rally. After a long bear market, I believe that the stock market rally will happen quickly and most investors trying to time the market will miss out.

The fall in the share price can be attributed to interest rate increases from the Federal Reserve, which has been desperately trying to tame high inflation in the United States. Technology stocks are usually valued using discounted cash flow models, which are extremely sensitive to changes in the risk-free rate of return. As the Federal Reserve increases the fed funds rate, this has a direct impact on the yield of U.S Treasuries, which are often used as a proxy for the risk-free rate of return.

As the risk-free rate of return increases, future cash flows become less valuable, and this has depressed the valuation of technology stocks. Additionally, as interest rates increase, U.S Treasuries have become temporarily more attractive, and money has flowed out of the stock market towards the bond market. I believe that technology stocks and the NASDAQ-100 Index will bottom out when we reach the end of the hiking cycle (potentially earlier as the stock market is forward-looking).

Trying to time when this will happen is impossible. However, it makes sense to start slowly building exposure now. But do not go all in and instead choose to average down. There is a possibility that the NASDAQ-100 index will fall further if there are any inflation surprises, so investors should take the opportunity to buy more long-term exposure if the share price falls. Be greedy when others are fearful.

Conclusion

I will finish with a quote and a reminder to investors that we should always take a long-term view. If you look at the NASDAQ-100 performance graph above, you will notice that it goes from the bottom left to the top right driven by a long history of economic growth and American innovation. Therefore:

“Never bet against America – Warren Buffett”

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.