ZIM Integrated Shipping: Last Major Payday Ahead

Summary

- Israel-based liner company ZIM Integrated Shipping Services Ltd. reported better-than-expected fourth quarter results with decent profitability and strong free cash flow generation.

- While the board of directors declared a generous $6.40 final cash dividend for 2022, investors need to prepare for much lower pay-outs going forward.

- Despite challenging industry conditions, management expects ZIM to remain profitable this year albeit at substantially reduced levels.

- Even under a best-case scenario, the company's forward dividend yield is likely to be in the single digits based on an assumed ex-dividend share price of $15.

- With no cash burn from operations expected for this year and considering the company's massive cash position, I am upgrading shares from "Sell" to "Hold."

alvarez

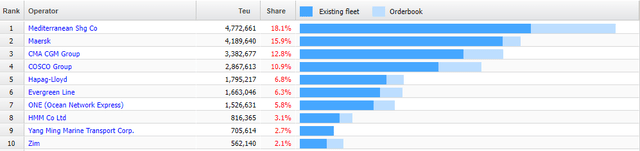

Last year, Israel-based liner company ZIM Integrated Shipping Services (NYSE:ZIM), or "ZIM," attracted strong retail investor interest. This was due to its eye-catchingly high pay-outs and the fact that the company remains the only large U.S. exchange-listed container liner:

Alphaliner

While ZIM barely makes the Top 10 of the world's largest liner companies, the company has pocketed its fair share of the recent container shipping bonanza.

Since listing on the Big Board in early 2021, ZIM has declared a whopping $38.40 per share in dividends.

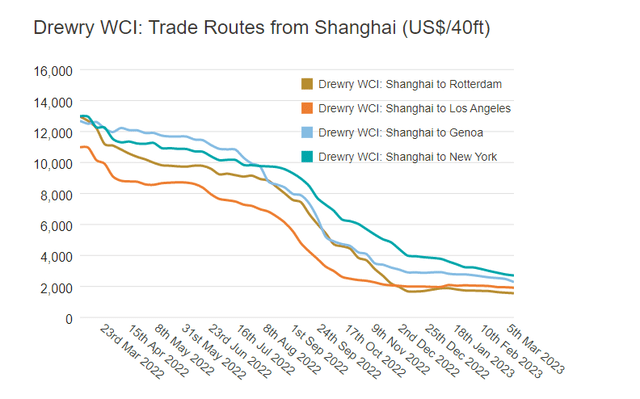

Like all liner companies, ZIM has been enjoying record-high earnings and cash flows for most of the past two years, but with container rates now back at pre-pandemic levels and significantly increased operating expenses relative to 2019, industry earnings are widely expected to fall off a cliff this year.

Drewry Supply Chain Advisors

Tightening monetary policy, a shift in consumer spending, elevated U.S. inventories and easing of port congestion are some of the main factors behind the ongoing drop.

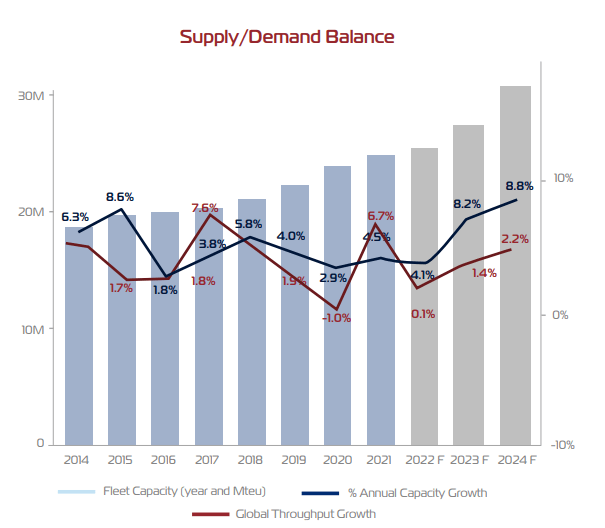

In addition, the industry will be challenged to absorb a host of scheduled newbuild deliveries until the end of 2024:

Company Presentation / Alphaliner

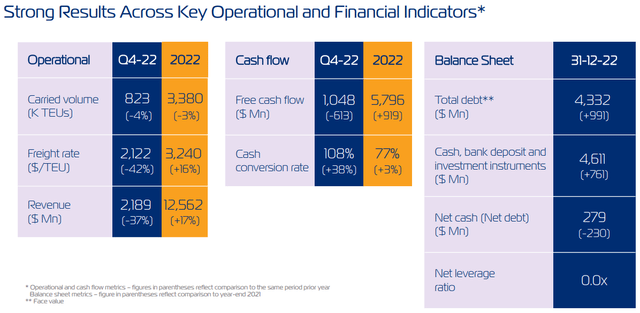

On Monday, ZIM reported better-than-expected fourth quarter results with decent profitability and strong free cash flow generation:

Company Presentation

In addition, the company decided to reward shareholders with an impressive $6.40 cash dividend per share:

In accordance with the Company's dividend policy, ZIM's Board of Directors declared a cash dividend of approximately $769 million, or $6.40 per ordinary share. Together with prior dividend distributions made on account of 2022, dividend distributions for the year totaled approximately 44% of the year's net income.

The dividend will be paid on April 3, 2023, to holders of ZIM ordinary shares as of March 24, 2023. Since the foregoing declared dividend amount per share constitutes more than 25% of the Company's ordinary share price on the declaration date (March 13, 2023), per the instructions of the NYSE, the ex-dividend date with respect to this dividend distribution will be April 4, 2023. Shareholders who wish to receive the dividend must hold their ZIM shares until the ex-dividend date.

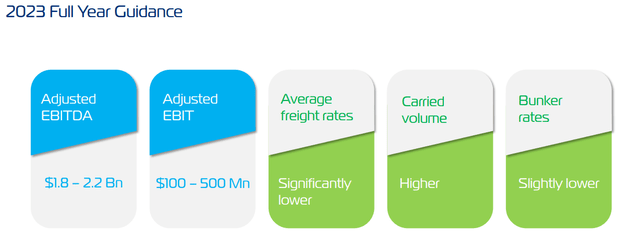

Unfortunately, the upcoming dividend payment is likely to remain the last major payday for the time being as evidenced by management's guidance for 2023:

Company Presentation

Using the mid-point of the Adjusted EBIT range and deducting $100 million in assumed interest and tax expense would result in ZIM generating $200 million in net income for 2023.

Unfortunately, my assumption for interest expenses might prove too low as ongoing newbuild deliveries will increase lease obligations very substantially over the course of the year.

Please note that ZIM distributes dividends on a quarterly basis at a rate of approximately 30% of net quarterly income, with the total cumulative annual dividend targeted between 30% and 50% of the company's annual net income.

On the conference call, management guided for anticipated improvements in the second half of the year which prompted a number of analyst questions regarding potential losses in H1 but CFO Xavier Destriau declined to provide additional granularity on the expected earnings trajectory over the course of this year:

(...) Yes, we, as we said that we expect the second half to be an improvement compared to the first. We do not, as you know, provide the calendar view. When it comes to the guidance, you were asking whether that meant that we were expecting EBIT losses in the early part of 2023. Not necessarily that, we didn't say that.

At least in my opinion, given the general lack of visibility and a host of newbuild deliveries scheduled for the second half of the year, projecting improvements for H2 appears to be a rather bold statement by management at this point.

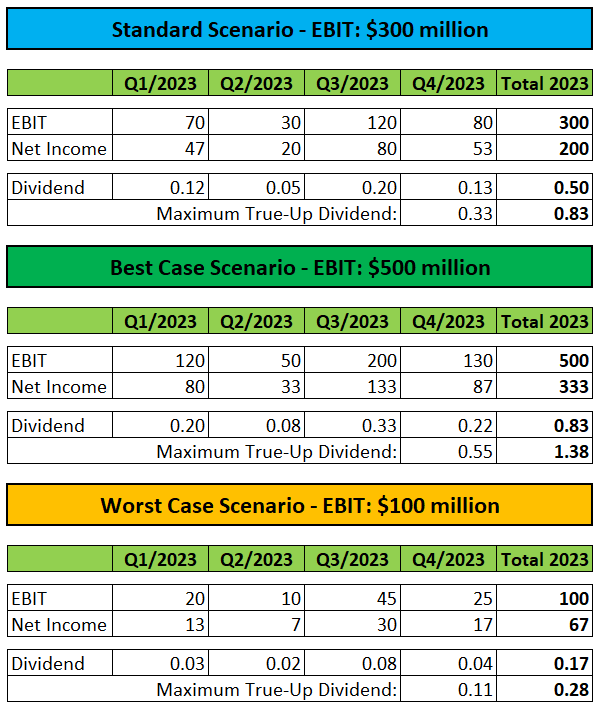

Anyway, assuming approximately two thirds of ZIM's earnings to be generated in the second half of the year would result in the following scenarios for net income and quarterly dividend payments:

Company Press Releases / Author's Assumptions

Using an ex-dividend share price of $15, even the best case scenario would result in an annual dividend yield of below 10% which isn't particularly enticing in the current interest rate environment.

But in reality, I would expect the company's 2023 dividend to be a far cry from the $1.38 best case scenario provided above due to challenging industry conditions and higher interest expense.

Year-to-date, ZIM has taken delivery of 5 newbuilds with another 41 expected to arrive until the end of 2024. That said, management hinted to potential delays for some of the company's newbuild 15,000 TEU vessels scheduled for delivery over the course of this year.

On the call, management made quite clear that ZIM is likely to keep a good chunk of the 58 vessels coming up for renewal until the end of 2024:

As to whether we will let go all of those for 58 vessels we will see is not a one-for-one. I think this is what we need also to bear in mind, very likely that the smaller capacity vessel the feeder size, type of shifts that currently we employ are we deployed mainly on the Intra-Asia business as a feeder in line but also as an Intra-Asia in our own traditional services. Those vessels are needed by the company to maintain servicing those areas where we think there is, by the way, quite significant opportunity for growth.

So, what will happen is, there will be a cascading effect, we will take on larger capacity vessels, those will come and replace ships that will be redeployed elsewhere. So, we start with the 15,000 TEU ship that will come and replace the 10,000 TEU that we currently employ on the Asia, U.S., East Coast, those will go and upsize the ZXB and so on and so forth. And then at the end of the day, we will let go some vessels that will be in the Panamax size type of segments mainly.

So, the big ships will keep on the Big East, West trade. The smaller feeder-sized vessels will be very much needed also in the regional trains where we operate.

With 41 mostly large-scale vessels still scheduled for delivery, the company's capacity is likely to increase materially until the end of 2024 but at least unit economics should improve going forward.

Management also provided color on required down payments upon newbuild deliveries (emphasis added by author):

We have the commitment to pay down at delivery each of the LNG vessels that we have ordered via down payment, as you know, $13 million per ship for the 15,000 TEU vessels and $20 million per ship for the 7,000 TEU vessel. So that adds up to roughly $140 million in 2023 and another $350 million in 2024, according to the current delivery schedule.

At the end of Q4, ZIM reported approximately $4.6 billion in cash, bank deposits and investment instruments or $38.30 per share.

Total debt was slightly above $4.3 billion and consists mostly of lease obligations for the company's chartered-in vessels.

That said, investors need to be prepared for ZIM's debt levels to increase substantially over the next couple of quarters as more newbuilds with long-term charter commitments are delivered into the fleet.

While the upcoming dividend payment and above-discussed capex commitments will reduce cash on hand to approximately $3.7 billion, the company's 2023 guidance doesn't point to ZIM burning cash from operations this year which would be quite an achievement in the current market environment.

Bottom Line

While ZIM Integrated Shipping Services reported better-than-expected fourth quarter results and declared a generous final dividend for 2022, investors need to prepare for much lower distribution levels going forward.

As the hefty pay-outs have attracted a large number of retail investors over the course of the last year, I wouldn't be surprised to see selling pressure resuming following the final, large payday in early April as dividends going forward are likely to be a tiny fraction of the levels witnessed in recent quarters.

That said, with no cash burn apparently expected for this year and $3.7 billion in remaining cash on hand after accounting for the final 2022 dividend payment and stated capex commitments, I am upgrading the company's shares from "Sell" to "Hold."

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.