Regional Banks Get Crushed, BTO Gets To An 8.6% Yield

Summary

- Silicon Valley Bank sent shockwaves through the regional banks.

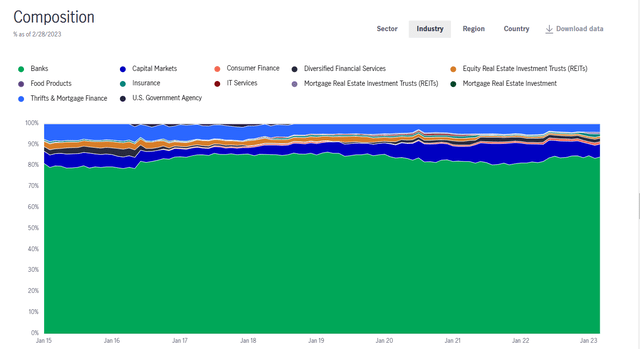

- BTO, a fund which we have refused to pay a premium for, finally dropped to a discount.

- We look at risks and rewards of buying in here.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

Captured When Silicon Valley Bank Was On The Brink Of Failure

Justin Sullivan

John Hancock Financial Opportunity Fund (NYSE:BTO), has been a fascinating fund to follow. Very few closed end funds have done as well as this one over long periods of time. So this obviously has a huge fan base. Today we will summarize our earlier views on this one and tell you what the tea leaves our telling us today.

First Coverage

When we first looked at it, we gave it a "meh" rating. Oh yes, we admired the longer term performance but were just appalled at the combination of the bad valuations for banks alongside poorer valuation for the fund (the big premium). Additionally the fund stayed out of what we thought would be the best part of the financial sector, i.e. insurance and reinsurance. We were not interested in buying anything in financials that did not at least have exposure to those two subsectors. Specifically we said,

At this point, our thinking is that the banks are generally on the relatively expensive side and we are reluctant to hit the buy rating on a fund focused at buying mainly those. We actually think many insurance and reinsurance stocks are very well priced and relative exposure there may not be the worst thing in the world. The 10% premium with the large management fees are additional negatives in an overextended market.

Source: Right Fund, But Not The Right Time

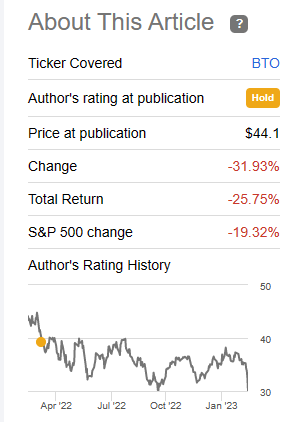

The fund has got a solid clubbing since then and those chasing the dividends got a 32% drawdown in 15 months.

Seeking Alpha

More importantly, the iShares U.S. Insurance ETF (IAK), a sector which we favored, outperformed BTO by about 32%.

Where do we go from here?

Fund Basics

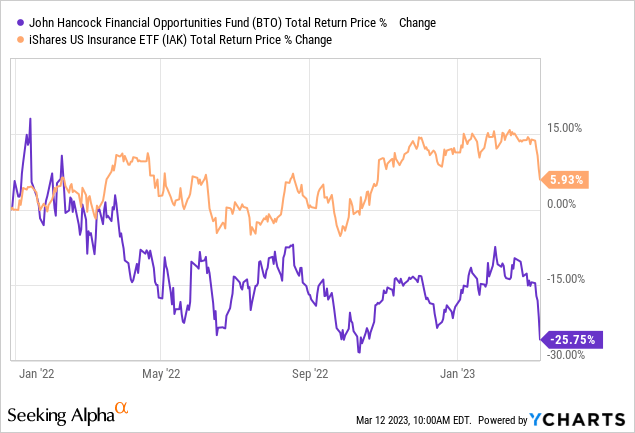

While the name may not explicitly declare it, BTO is a regional bank fund and that has generally held true in the past. The latest holdings, though, have a few surprises.

BTO Website

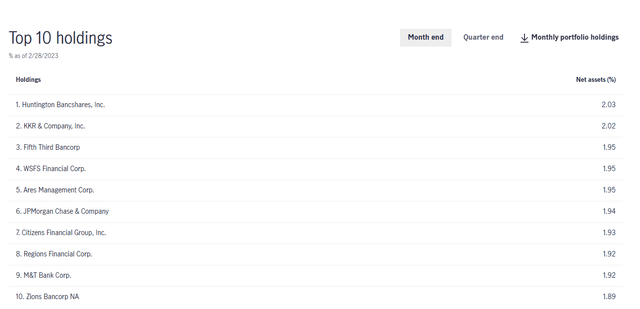

While Huntington Bancshares Inc. (HBAN) and Fifth Third Bancorp (FITB) are holdings you would expect right at the top, two asset managers and a "too-big-to-fail" bank right at the top is unusual. KKR & Co. Inc. (KKR), Ares Management Corp. (ARES) and JPMorgan Chase & Co. (JPM) are a little outside the regular roster for BTO. Overall though, the fund has not changed its sector allocation much. Banks, Capital Markets and Thrifts & Mortgage Finance continue to be the dominant subsectors.

BTO Website

Insurance and reinsurance remain virtually non-existent.

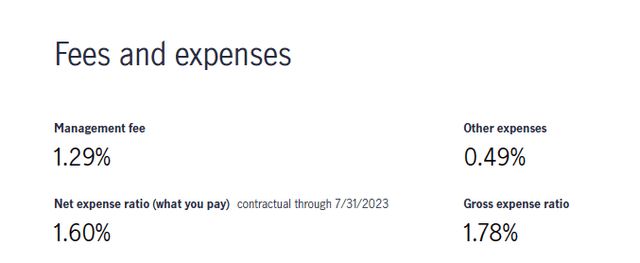

Fees

BTO's fees are capped currently at 1.6% and this runs through July of this year.

BTO Website

That is a fair amount for the fund and we think that the cap will get extended in this era of shunning active management for passive funds.

Performance

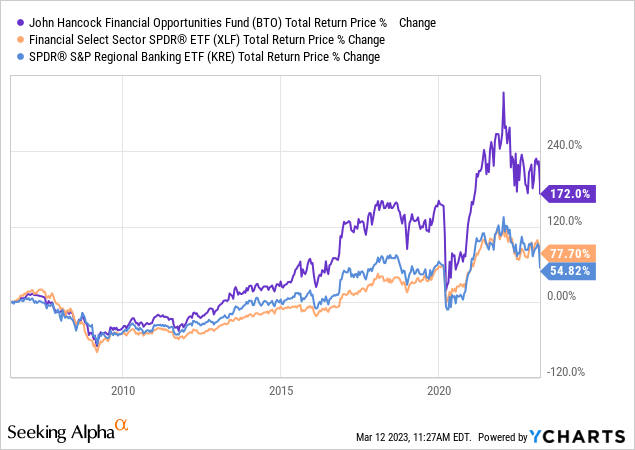

BTO has delivered over long periods of time and has handily thrashed the S&P composite 1500 banks index. We drew up the last 16 years against Financial Select Sector SPDR (XLF) and SPDR S&P Regional Banking ETF (KRE).

BTO delivered and it was by a huge margin. This kind of outperformance is extremely rare and overcoming the drag of large fees is difficult. The managers are consistently able to pick out the best values in regional banking and deserve kudos for this.

Outlook

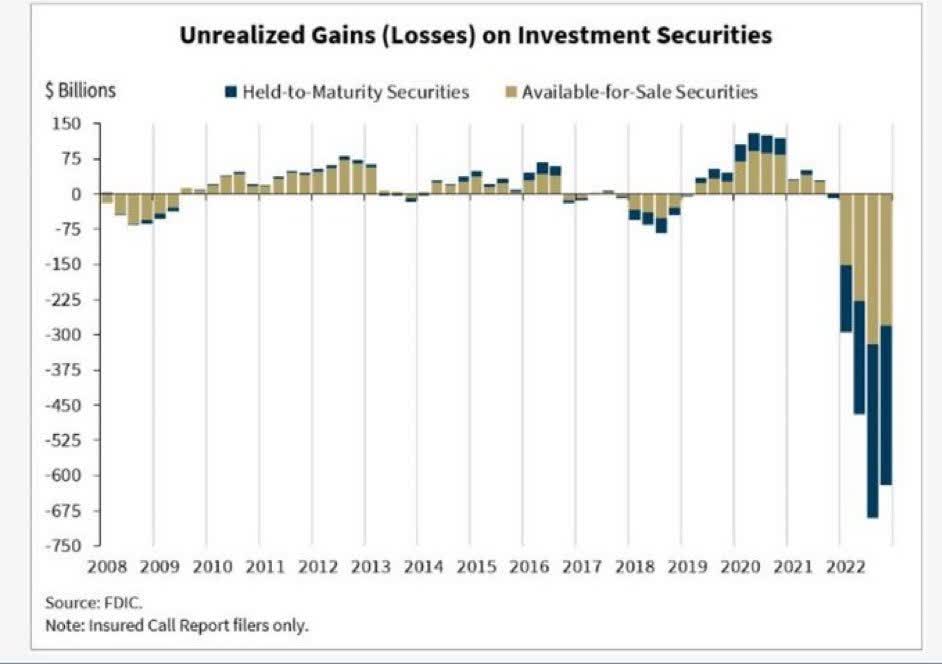

SVB Financial Group (SIVB) was unique and showed the worst risk management practices one could dream of. In essence SIVB was the corporate version of "yield chasing". That said, banks in general are also facing some risks. The issue here is twofold. Banks are not paying investors enough interest relative to Treasuries. Banks have a lot of mark to market losses on their own bond holdings.

FDIC

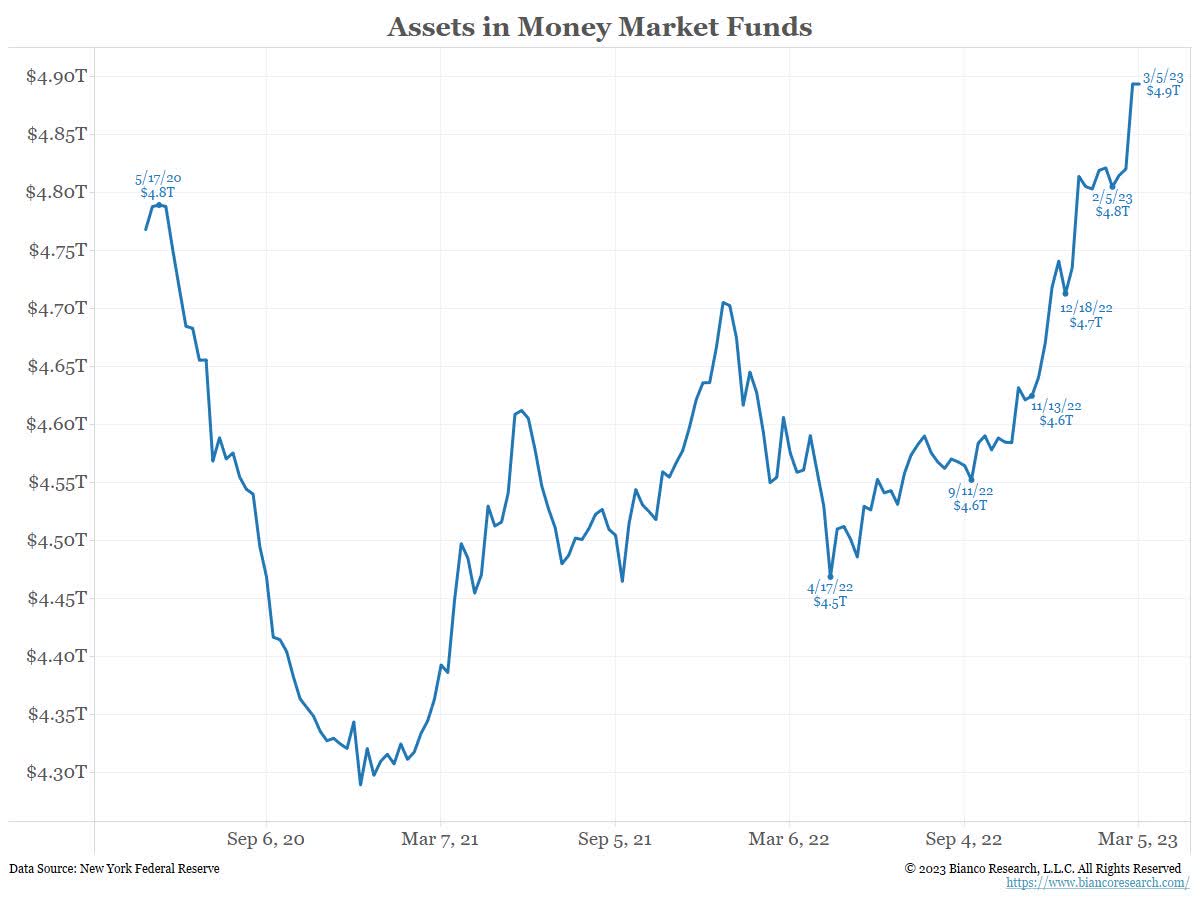

So far, they have tried to not to fight for deposits and have kept rates extremely low. But they will have to fight a lot harder now. Fund movements into money market funds are accelerating and remember that this has a multiplier effect on bank assets.

Jim Bianco-Twitter

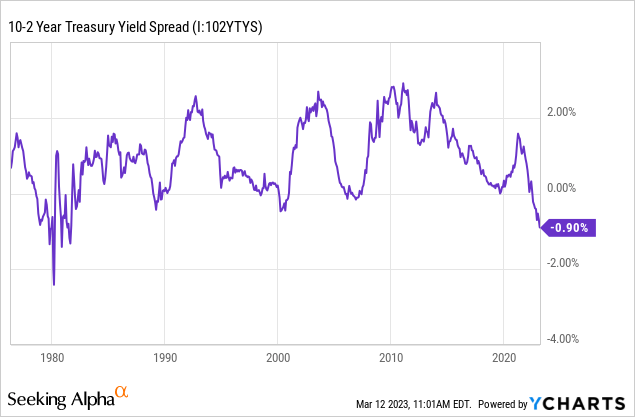

An extension of this is that every single earnings estimate out there for banks is plain wrong. In a more realistic situation where the Fed pauses after 50 basis points more and the 10 Year rate rises another 50 basis points, the curve would be still very inverted.

If banks fight to hold deposits here, which they will, you can expect at least a 40% drop in earnings, without considering recession write-offs. So while financials are cheap by many metrics, don't assume they are a lay-up.

Verdict

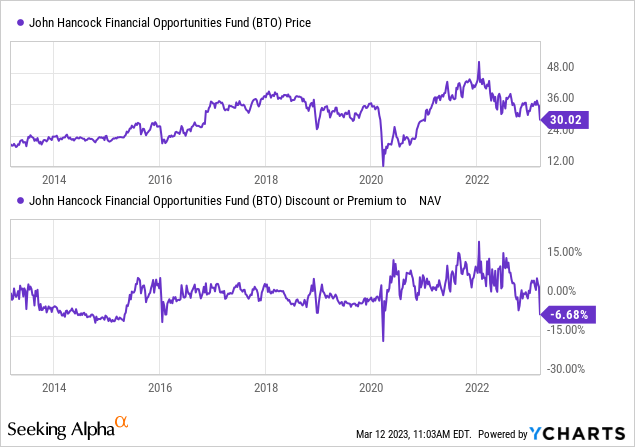

BTO has cured the biggest problem with the fund. The 10% premium has gone to a small discount. Do note that the number shown below (6.68%) is inaccurate as the NAV is based on March 9, 2023, but the price is based on March 10, 2023.

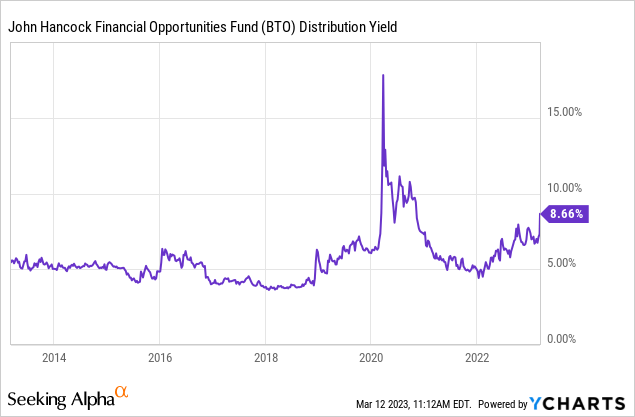

But we estimate that the fund is still at a slight discount (based on KRE movement on the day) and that is certainly a far better entry point than chasing it for the yield at a premium. You are also getting an 8.66% yield and that is better than what it gave you for most of the past decade.

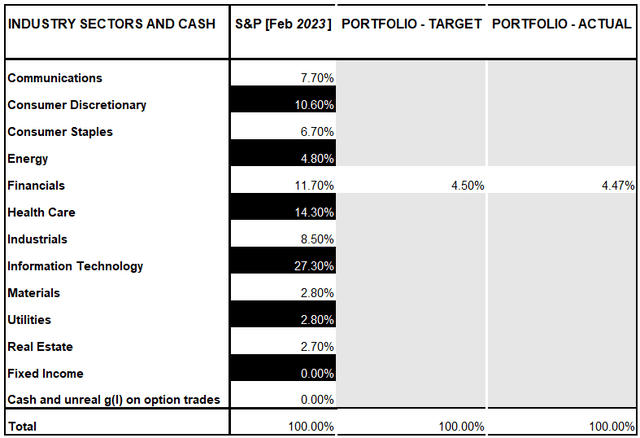

Those positives aside, we don't think though that this is a buy point. We believe regional banking issues are in the early phase and earnings compression is still in its infancy. There is room to push all of these banks lower as net interest margins compress and recession write-offs surface. We think BTO NAV could easily drop another 20% over the next year and the discount could widen to 15%. We do own financials in our portfolio but are heavily underweight versus the index.

Conservative Income Portfolio

Even there the larger position is focused towards insurance and reinsurance, where the yield curve is irrelevant and only absolute interest rates matter. We recently upped our fixed income target and aim to reinvest maturing covered call proceeds into that area. Interestingly, BTO has also decided that it wants more fixed income for itself.

BOSTON, Dec. 15, 2022 /CNW/ - The John Hancock Financial Opportunities Fund (the "Fund"), advised by John Hancock Investment Management LLC (the "Adviser") and subadvised by Manulife Investment Management (US) LLC, announced today that the Board of Trustees (the "Board") has approved a change to the Fund's investment policies. This change provides additional flexibility with respect to investments in investment grade securities, which the Adviser believes is in the best interest of the Fund's shareholders.

Under the revised investment policies, the Fund will be allowed to invest in investment grade securities beyond defensive purposes. The Fund will be allowed to invest in investment grade securities for lower volatility and yields that potentially meet or exceed the Fund's distribution.

The change announced today will become effective as of December 15, 2022.

Source: John Hancock Press Release

We continue to rate BTO CEF at a hold/neutral, though we suspect that 2023 will land a buy rating from us at some point.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.