Wheaton Precious Metals: A Solid Streamer That Deserves More Attention

Summary

- Wheaton Precious Metals Corp. generated revenues of $236.05 million during Q4 2022, down 15.2% year-over-year. The adjusted income was $103.74 million, or $0.23 per share.

- Wheaton sold 293,234 GEOs during 2022, down from 312,465 GEOS the prior year. It was a weak production on the decline for the last four quarters.

- I believe it is safe to accumulate Wheaton Precious Metals Corp. shares between $38 and $39.5, with possible lower support at $37.1.

- Looking for a helping hand in the market? Members of The Gold And Oil Corner get exclusive ideas and guidance to navigate any climate. Learn More »

rticknor

Introduction

The Canadian company Wheaton Precious Metals Corp. (NYSE: WPM) released its fourth-quarter 2022 results on March 10, 2023.

Note: This article updates my previous article published on December 4, 2022. I have been following WPM quarterly results since Sep. 2018.

WPM has 20 operating mines and 12 development projects throughout the Americas.

WPM Assets location Presentation (WPM March Presentation)

1 - A quick snapshot of the fourth quarter and FY22

The company generated revenues of $236.05 million during 4Q22, down 15.2% year-over-year. The adjusted income was $103.74 million, or $0.23 per share. The results were short of analysts' expectations.

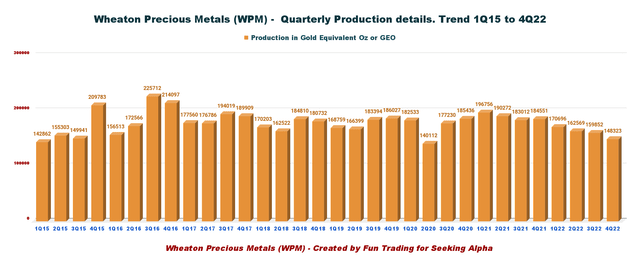

The company produced 148,323 GEOs in 4Q22, down 19.6% from the prior-year quarter’s 184,551 GEOs. Production was weak primarily due to lower output from Salobo, Peñasquito, and Voisey’s Bay, the closure of the Stratoni and 777 mines, and the termination of the Keno Hill and Yauliyacu PMPAs.

CEO Randy Smallwood said in the conference call:

During 2022, we remained extremely active as we added more streams, optimized our current portfolio and made several industry-leading commitments on the sustainability front. While gold held historically high levels throughout the year, inflationary pressures had a significant impact on traditional miners, resulting in their margins being compressed.

2 - Stock performance

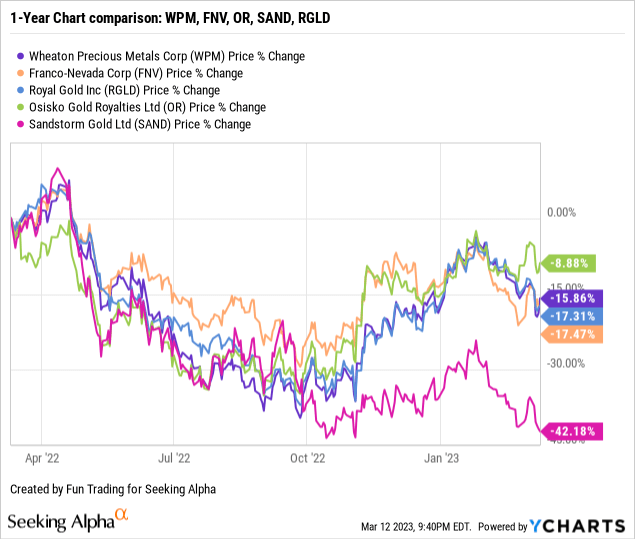

Wheaton Precious Metals is part of my core long-term streamer, along with Franco-Nevada (FNV). WPM is down 16% on a one-year basis, in line with FNV and Royal Gold (RGLD).

3 - Investment Thesis

WPM is one of my long-term investments in the royalties & streams segment with Franco-Nevada. I also own a small long-term position with Sandstorm Gold (SAND).

WPM is highly correlated to the gold price, representing 50.4% of the total revenues in 4Q22.

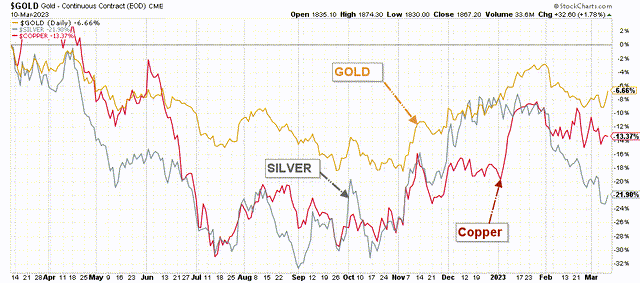

However, while gold dropped about 6% on a one-year basis, streamers and gold miners dropped more significantly, showing a weak correlation between gold and the industry.

The gold price turned bullish last week after some critical job data indicated that the FED had more time to fix the inflation problem and will not hike aggressively even though it might hike three times in 2023 with a final rate of over 5.3%.

Also, the recent bank turmoil may temper any hawkish move from the Fed, even if the CPI number on Tuesday could indicate that inflationary pressures are still concerning.

WPM Gold, Silver, Copper 1-Year chart (Fun Trading StockCharts)

In conclusion, the gold sector is highly volatile and unpredictable. Thus, the best strategy to respond to such a trend is regularly trading short-term LIFO, at least 30%-40% of your long-term position.

This dual strategy has been my dominant strategy in my marketplace, "The Gold and Oil Corner." I believe it is the most rewarding strategy to maximize your profit while reducing risks significantly.

Wheaton Precious Metals: Financials And Production History ending in 4Q22

| Wheaton Precious | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Total Revenues in $ Million | 278.20 | 307.24 | 302.92 | 218.84 | 236.05 |

| Net Income in $ Million | 291.82 | 157.47 | 149.07 | 196.46 | 166.13 |

| EBITDA $ Million | 352.35 | 215.96 | 210.74 | 264.62 | 212.80* |

| EPS diluted in $/share | 0.65 | 0.35 | 0.33 | 0.43 | 0.38 |

| Cash from operating activities in $ Million | 195.29 | 210.54 | 206.36 | 154.50 | 172.03 |

| Capital Expenditure in $ Million | 304.05 | 46.00 | 15.55 | 47.56 | 44.32 |

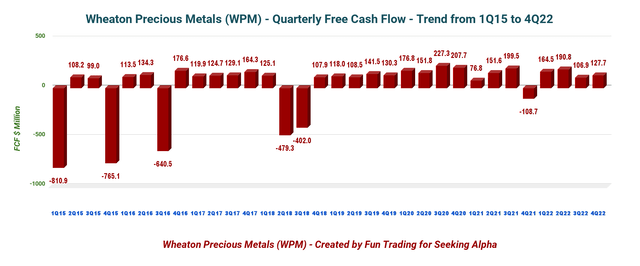

| Free Cash Flow in $ Million | -108.76 | 164.54 | 190.81 | 106.93 | 127.68* |

| Total cash $ Million | 226.05 | 376.16 | 448.63 | 494.62 | 696.09 |

| Long-term debt in $ Million | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Dividend per share in $ | 0.15 | 0.15 | 0.15 | 0.15 | 0.15 |

| Shares outstanding (diluted) in Million | 451.2 | 452.0 | 452.4 | 452.39 | 452.78 |

| Production details | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Production in Gold Equivalent K Oz GEO | 184.6 | 170.7 | 162.6 | 159.9 | 148.3 |

| Production in Silver Equivalent Oz SEO | 13,421 | 12,853 | 12,193 | 11,989 | n/a |

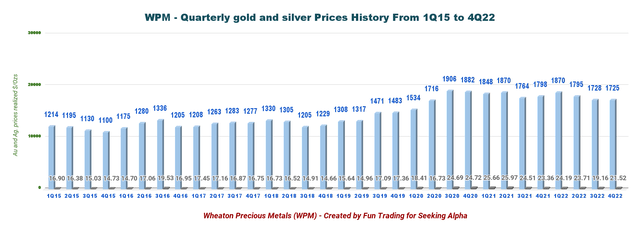

| Gold price realized $/Oz | 1,798 | 1,870 | 1,795 | 1,728 | 1,725 |

| Silver price realized $/Oz | 23.36 | 24.19 | 23.71 | 19.16 | 21.52 |

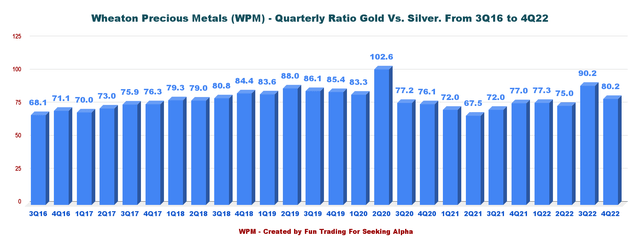

| The gold/silver ratio | 77.0 | 77.3 | 75.0 | 90.2 | 80.2 |

Source: Company release.

* Estimated by Fun Trading.

Note: WPM sold its GEO at $1,660 per ounce.

Analysis: Revenues, Earnings Details, Free Cash Flow, Debt, And Gold Production Details

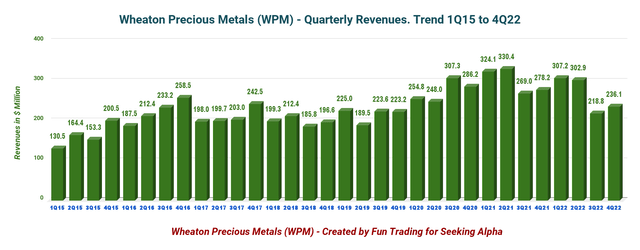

1 - Revenues: Wheaton Precious Metals posted $236.05 million in revenue for 4Q22

WPM Quarterly Revenues history (Fun Trading) The fourth quarter of 2022 yielded revenue of $236.05 million (50.4% gold, 45% silver, 2.8% palladium, and 1.8% cobalt), down 15.2% on a year-over-year basis and up 7.9% sequentially.

The adjusted net earnings were $103.44 million, or $0.23 per share, down 21% YoY. Gross margin was $121 million, with the $29 million decrease driven by the lower revenue, partially offset by a lower cost of sales.

The decline in attributable gold production was primarily due to lower Salobo, Peñasquito, and Voisey’s Bay production. Also, the closure of the Stratoni and 777 mines and the termination of the Keno Hill and Yauliyacu PMPAs affected production.

In the press release,

During the fourth quarter of 2022, the company received $132 million in exchange for the termination of the Yauliyacu stream to dispersed $60 million in dividends, invested $31 million relative to the Goose Project, and $13 million relative to the Curipamba Project,

Cash from operating activities for the third quarter of 2022 was $172.03 million compared to $195.29 million in the prior year.

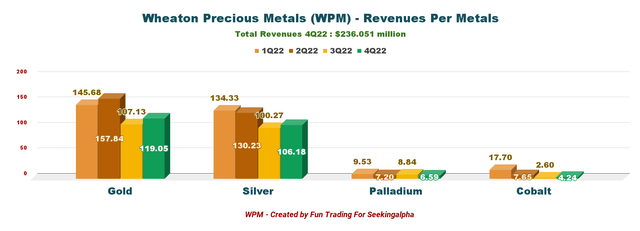

Below is shown the revenue per metal for the last four quarters (Cobalt production started in 1Q21):

WPM Quarterly revenues per metal history (Fun Trading)

The gold price dropped sequentially to $1,725 per Au ounce, while the silver price dropped to $21.52 per Ag ounce. Palladium was $1,939 per ounce, and Cobalt was $22.62 per ounce.

Please see the chart below:

WPM Gold and Silver price history (Fun Trading)

Finally, WPM sold its production at $1,660 per GEO.

2 - Free cash flow was estimated at $127.68 million in 4Q22

WPM Quarterly Free cash flow history (Fun Trading)

On December 31, 2021, the trailing 12-month free cash flow ("FCF") was $589.96 million, and the fourth quarter of 2022 was estimated at $127.68 million.

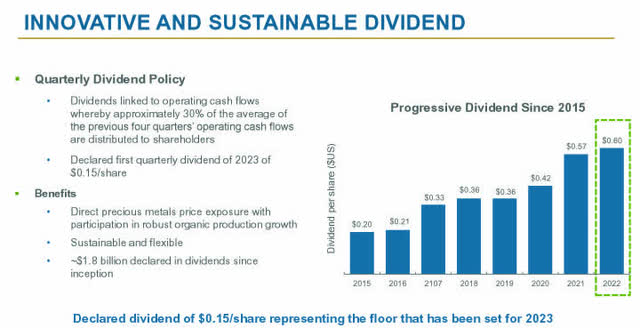

The Board of Directors declared a quarterly dividend of $0.15 per common share, or a yield of 1.48%. The dividends are linked to operating cash flows.

WPM Dividend policy (WPM Presentation)

Note: Wheaton Precious Metals is a Canadian company, and dividends are subject to Canadian tax (15%) taken directly for non-Canadian investors, reducing the amount paid to investors not from Canada. In some cases, it can be different. Please, contact your broker.

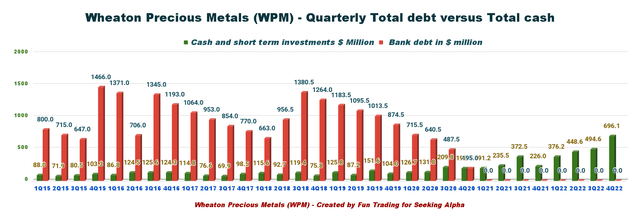

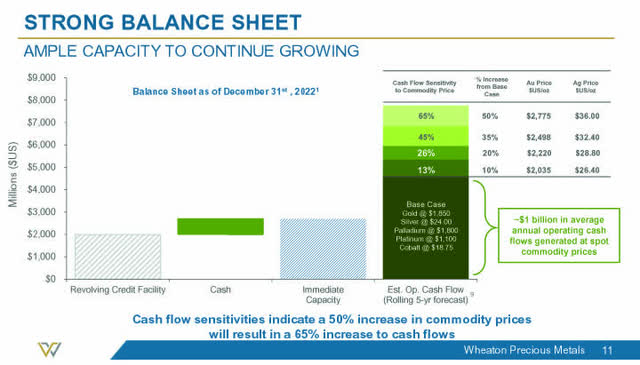

3 - Available capital, no debt, and $2 billion in liquidity

On December 31, 2022, Wheaton Precious Metals had cash and cash equivalents of $696.09 million and no debt outstanding under its Revolving Facility, which is excellent backing from a long-term investor's perspective. Cash position has been growing steadily since 4Q21.

The company has a $2 billion revolver facility extended to July 18, 2027. Total liquidity of nearly $2.7 billion.

The chart below shows a significant net cash position:

WPM Quarterly Cash versus Debt history (Fun Trading) Also, WPM owns total long-term equity investments of $255.54 million (fair value) in 4Q22 (Bear Creek, Sabina, Kutcho, Hecla, and others). WPM Balance sheet presentation (WPM Presentation) CEO Randy Smallwood said in the conference call: We completed the previously announced sale of the Yauliyacu stream back to Glencore for $132 million, a continuation of our portfolio optimization efforts, which also saw sale of Keno Hill stream for $141 million earlier in the year. The sale of Yauliyacu and Keno Hill streams contributed to the overall quality of our portfolio, where now 93% of Wheaton's production comes from assets that fall in the lowest half of the cost curve. WPM Quarterly Gold Equivalent production history (Fun Trading) This quarter's gold equivalent production was 148,323 GEOs compared to 184,551 GEOs last year, a significant drop due to sales. The company sold 293,234 GEOs during 2022, down from 312,465 GEOS the prior year. It was a weak production on the decline for the last four quarters.

4 - Production in gold equivalent ounce and trend details

Wheaton's metals production in 4Q22 was:

- 70,099 Au ounces

- 5.352 M Ag ounces

- 3,869 Pd ounces

- 128 Lbs of Cobalt

WPM Quarterly Gold Silver ration history (Fun Trading) The gold/silver ratio is 1:80.2 this quarter (see chart above).

5 - 2023 Guidance

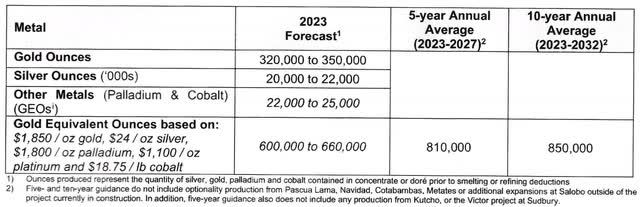

Wheaton's estimated attributable production for 2023 is forecast to be 320K to 350K ounces of gold, 20 to 22 million ounces of silver, and 22K to 25K gold equivalent ounces ("GEOs") of other metals, resulting in the production of approximately 600K to 660K GEOs.

WPM 2023 OUTLOOK (WPM press release)

Furthermore, Mining operation Wes Carson said in the conference call:

For the five year period ending in 2027, the company estimates that average production will amount to 810,000 GEOs and for the 10 year period ending in 2032, the company estimates that the average annual production will amount to 850,000 GEOs. This includes organic growth of over 40% with total production from our current portfolio increasing to over 900,000 GEOs by 2027.

A great long-term forecast confirms the investment thesis.

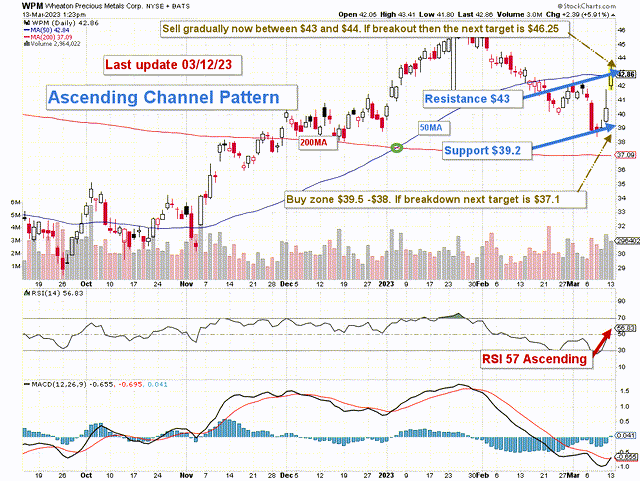

Technical Analysis and Commentary

WPM TA Chart short-term (Fun Trading StockCharts)

Note: The chart is adjusted for the dividend.

WPM forms an ascending channel pattern with resistance at $43.00 and support at $39.2.

Ascending channel patterns are short-term bullish in that a stock moves higher within an ascending channel, however those patterns often form within longer-term downtrends as continuation patterns.

The trading strategy is to sell about 30%-40% of your position between $43 and $44 with potential higher resistance at $46.25.

I believe it is safe to accumulate Wheaton Precious Metals Corp. stock between $38 and $39.5 with possible lower support is $37.1.

The gold price turned bullish last week after the market believed the FED might hike interest rates by 25 points despite stubborn inflationary pressures and a hot job market in the USA.

However, some analysts believe the Fed may turn hawkish and increase interest rates by 50 points this month. The following CPI number expected on Tuesday will be decisive.

The gold price could be under pressure again if the Fed confirms its desire to tackle inflation and hike again by 50 points with more rates hike than expected. Finally, the recent collapse of three banks in the USA may turn positive for gold by preventing the Fed from hiking interest rates due to turmoil.

Thus, the dominant strategy I regularly promote in my marketplace, "The Gold and Oil Corner," is to keep a core long-term position and use about 30%-40% to trade LIFO while waiting for a higher final price target for your core long-term position above $50.

Trading LIFO allows you to sell your most recent purchases, assuming a profit while keeping your long-term position until it is up enough to consider selling it.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks.

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.

This article was written by

I am a former test & measurement doctor engineer (geodetic metrology). I was interested in quantum metrology for a while.

I live mostly in Sweden with my loving wife.

I have also managed an old and broad private family Portfolio successfully -- now officially retired but still active -- and trade personally a medium-size portfolio for over 40 years.

“Logic will get you from A to B. Imagination will take you everywhere.” Einstein.

Note: I am not a financial advisor. All articles are my honest opinion. It is your responsibility to conduct your own due diligence before investing or trading.

Disclosure: I/we have a beneficial long position in the shares of WPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade short-term WPM and hold a long-term position, as explained in my article.