Galiano Gold: You Get The Asanko Gold Mine For Free

Summary

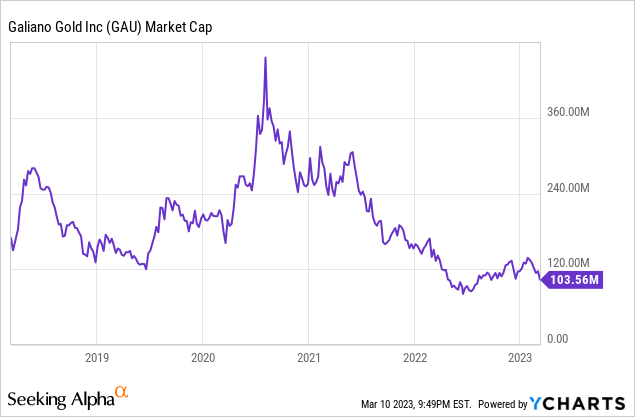

- GAU has declined by more than 75% over the last few years.

- There were several issues at the Asanko gold mine in the first half of 2022 that negatively impacted the performance of GAU.

- The outlook has dramatically improved since then, as 2022 production blew away guidance, reserves were reinstated, and an updated mine plan was released.

- GAU has ~US$102 million in cash, gold, and receivables and no debt. It's market cap is US$103.5 million, as investors are getting the Asanko mine for free.

- Gold Fields could still consider GAU an attractive acquisition target, even though risks are elevated now in Ghana.

- Looking for more investing ideas like this one? Get them exclusively at The Gold Edge. Learn More »

Marti157900/iStock via Getty Images

Galiano Gold's (NYSE:GAU) market cap has contracted by more than 75% since the 2020 peak in its stock price, falling from over US$400 million a few years ago to just over US$100 million today. The gold sector has been under pressure during this time, as the physical metal is well off (over $200) its 2020 highs, and the HUI (an index of gold miners) is down over 40%. GAU has been negatively impacted as a result, but company-specific issues have led to further losses and contributed to its underperformance. However, Galiano is now trading at cash value, and recent news shows a much-improved outlook for its Asanko gold mine, which the market has yet to acknowledge. As a result, investors have an opportunity to buy GAU at a substantial discount to fair value, with cash and liquidity fully supporting the stock price. Let's get into the details.

Ownership Structure And Location Of Asanko Mine

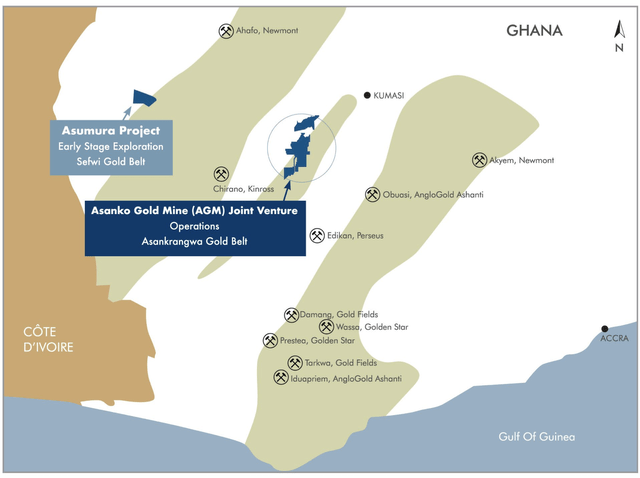

Galiano owns 50% of a JV on the Asanko gold mine in Ghana, with Gold Fields (GFI) owning the other half. Technically, the two parties each have a 45% economic interest, with the Ghanaian government holding a 10% free-carried interest. Galiano is the operator of the mine.

The Asanko mine is located between two highly prospective gold belts in the region and is close to many large-scale producing gold mines such as Obuasi, Ahafo, Damang, and Tarkwa (the latter two both owned by Gold Fields). It's highly prospective ground.

Galiano Gold

Issues In 2022

The Asanko mine has been in production since 2016, but there were several issues last year:

1. In February 2022, GAU warned that gold recoveries at the mine had been lower than expected at the Esaase pit (the main source of ore at the time), and it saw an increase in gold grades in the tailings leaving the processing facility. Normally, the gold grade in the tailings is 0.10 g/t, but assays at the time indicated 0.40g/t in the tailings.

The previous technical report stated that test work identified an abundance of organic carbon in the plant feed, which could be hindering the absorption of gold (i.e., preg-robbing).

2. A month later, the metallurgical uncertainty of the material mined from Esaase resulted in the company reclassifying reserves back to the resource category, and it needed to conduct more test work before reserves could be reinstated.

Galiano also announced at the time a sharp drop in M&I resources, mostly due to the remodeling of the Esaase geological model, which saw M&I Resource grade and tonnage at Esaase decline 25% from the previous estimate. There were now 912,000 ounces of gold at Esaase, compared to 2.35 million ounces in the 2019 estimate.

As a side note, I wasn't surprised by the decline in grade and resources at Esaase, as I told subscribers of The Gold Edge in an update on GAU in November 2021:

The main risks that I see are uncertainty with the mine plan due to Nkran and a potential decline in grade and resources at Esaase when the updated reserve/resource estimate is released next quarter. Esaase accounts for over half of the current reserves. I'm actually factoring in a decline at Esaase.

The net decline in total resources was only 600,000 ounces (from 3.5 million ounces to 2.9 million ounces), thanks to other deposits partially offsetting the losses at Esaase. Certainly not detrimental, and there were still a host of ounces. Still, the market was only focused on the loss of ounces and reduced grade at Esaase.

In the same press release, the company disclosed that while technical work was ongoing, it only planned to continue mining the Esaase and Akwasiso pits until Q2 2022, and then Galiano would begin processing a portion of the existing stockpiles. As a result, gold production for last year was only expected to be about half (or 110,000 ounces) of the 210,000 ounces produced in 2021.

3. There are several open-pit deposits at the Asanko mine, with the high-grade Nkran deposit being a key future source of ore. However, Nkran requires a substantial amount of waste stripping to access the remaining high-grade mineralization, and there was uncertainty about how Galiano would mine the open pit deposit, if it could be deferred until later in the mine life, or perhaps mined via underground.

Nothing was going right for GAU early last year, and there were many unanswered questions.

The Dramatically Improved Outlook For The Asanko Mine

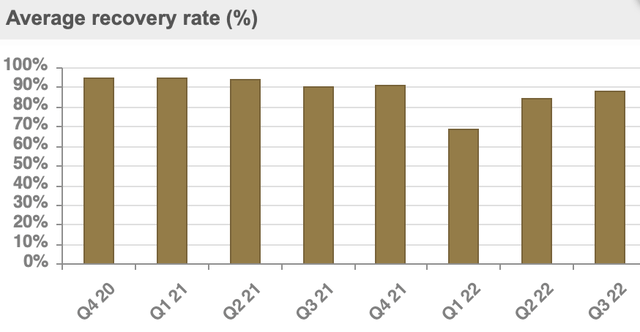

In the summer of 2022, Galiano reported encouraging results from its recovery test work, and a few months later, it stated that overall weighted average gold recoveries of 87% were achieved for the Esaase deposit, with results in line with the previous metallurgical test work completed on the Esaase deposit.

The company also said:

On the back of this program, in-house test work and recent plant optimizations, we can conclude that although a portion of the Esaase deposit is prone to lower recovery, the relative contribution of this material is not significant and can be effectively managed on a go forward basis.

Most importantly, the results would allow Galiano to reinstate mineral reserves.

The rebound in the average recovery rate for the Asanko mine in Q2 and Q3 2022 does support the results of the test work and indicate that what occurred in the first quarter of last year was only a one-quarter anomaly.

Galiano Gold

Thanks to the reversal in recoveries and strong operational performance, the company blew away production guidance last year, as full-year gold production for 2022 was 170,342 ounces vs. the original guidance of 100,000 – 120,000 ounces.

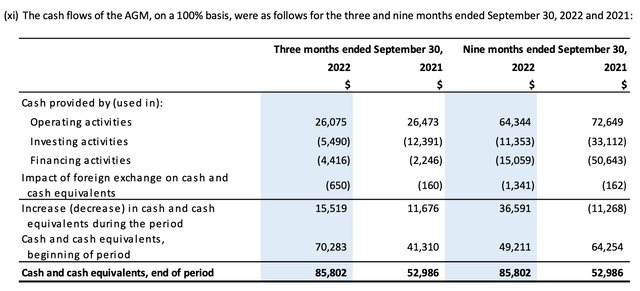

When the company first issued guidance in March 2022, it estimated operating cash flow of just US$10 million for the year at prevailing gold prices (which at the time were over $1,900 per ounce), yet operating cash flow through the first nine months of 2022 was $64.3 million (Q4 financial results won't be reported for a few more weeks, but I expect robust OCF last quarter as well given the production, AISC, and cash balance data already released). The Asanko mine was expected to burn cash in 2022, potentially $30+ million, but instead, it generated significant free cash flow. It's also proof that the Asanko mine still has the ability to generate cash even when it's not fully optimized.

Galiano Gold

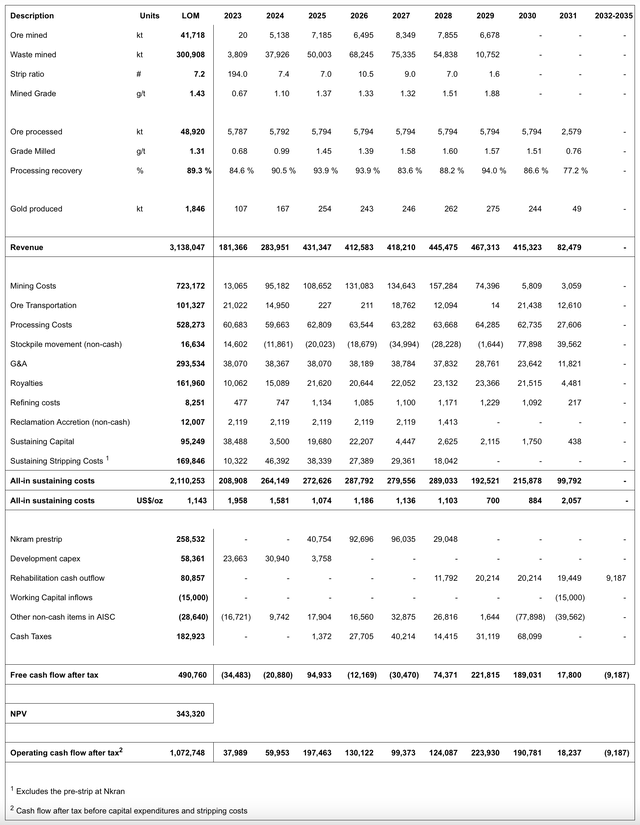

We finally have a better idea of the mines potential going forward, as last month Galiano released an updated mine plan for Asanko, which included the reinstatement of reserves.

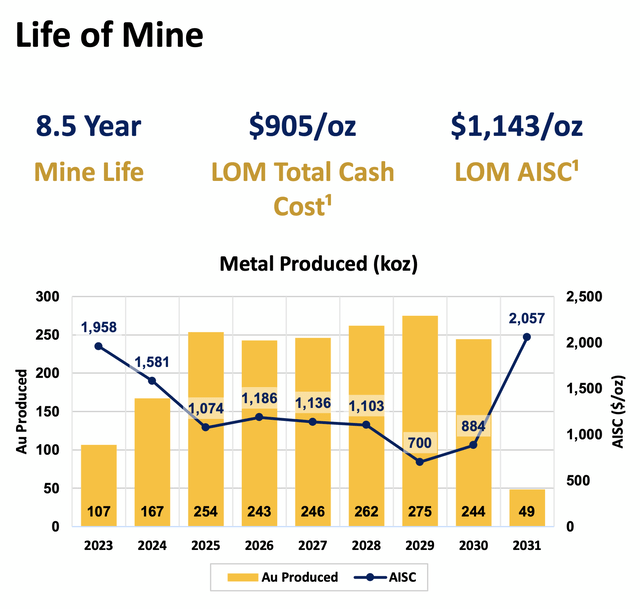

The updated life of mine estimates 217,000 ounces of gold production per year over 8.5 years at an AISC of $1,143 per ounce, with over 2 million ounces of reserves mined. The first few years will see lower production and elevated AISC as low-grade stockpiled material will be processed in 2023 while waste stripping commences at the Abore pit (one of several pits that will be mined), but then production surges to 250,000 ounces per year in 2025 and remains at that level through 2030, while AISC will average ~$1,000 per ounce during those high-production years.

Galiano Gold

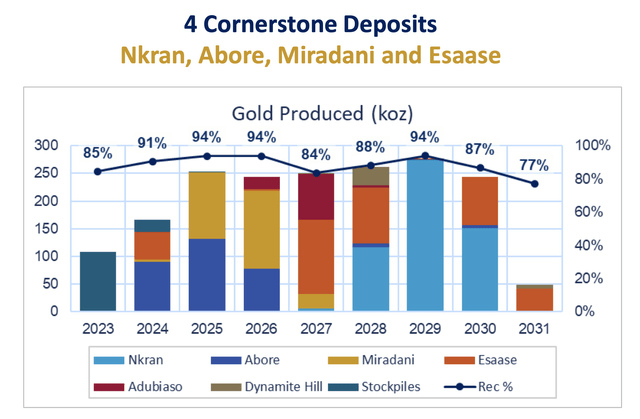

Ore will be sourced mostly from the Nkran, Abore, Miradani, and Esaase deposits, with Nkran now scheduled to come online in the latter half of the mine plan.

Galiano Gold

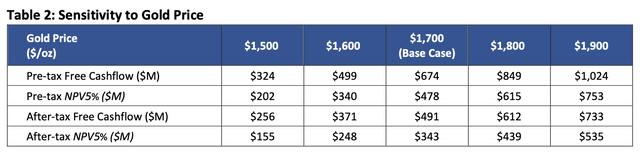

At $1,800 gold (slightly below the current gold price), the Asanko mine will generate US$612 million of after-tax free cash flow and has an after-tax NPV (5%) of US$439 million on a 100% basis.

Galiano Gold

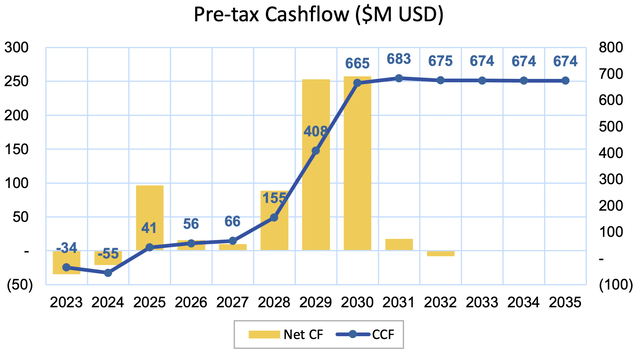

The Main Drawback

The mine plan does have one drawback, as what isn't reflected in the LOM production and AISC graph is how most of the cash flow is backend-weighted. The pre-tax cash flow estimate at $1,700 shows just $66 million of cumulative free cash flow over the next five years, as 90% of the cash flow won't be realized until 2028-2030. This is mostly due to the significant pre-strip required at the Nkran pit, which was the issue in the previous mine plan as well.

Galiano Gold

The table below shows all of the operational and economic metrics over the life of mine. Beneath the AISC section, you can see the Nkran stripping costs during 2025-2028, which will total a whopping $258.5 million, including over $90 million of stripping in both 2026 and 2027. That's why the mine won't generate much cash flow during those years, even though production will be 250,000 ounces per year at a strong AISC margin.

Galiano Gold

However, there is high-grade gold under the Nkran pit, and Galiano is doing trade-off studies for an underground operation, which would substantially reduce the required stripping. The good news is since Nkran is now later in the mine life (instead of earlier in the previous mine plan), this gives Galiano ample time to drill more at Nkran, potentially prove up a lot more ounces underground, and modify the plan before waste stripping begins.

Galiano Gold

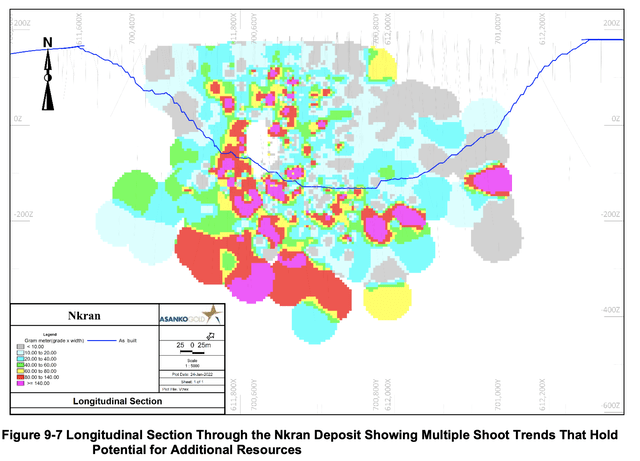

The previous technical report released last year stated the following:

A number of possible high grade shoot controls have been interpreted at Nkran, all plunging shallow to steeply northeast (Figure 9-7). These high-grade structures, if repeated at depth, could represent a significant step change for the AGM resource potential. Deep drilling to explore for these structures is recommended.

Look at those plumes of ultra-high grade (on a gram per meter measurement) mineralization beneath the Nkran pit.

Galiano Gold

Even if Nkran is mined via open pit, Asanko will still generate considerable free cash flow over its remaining life of mine. The questions are can the economics be improved and cash flow brought forward?

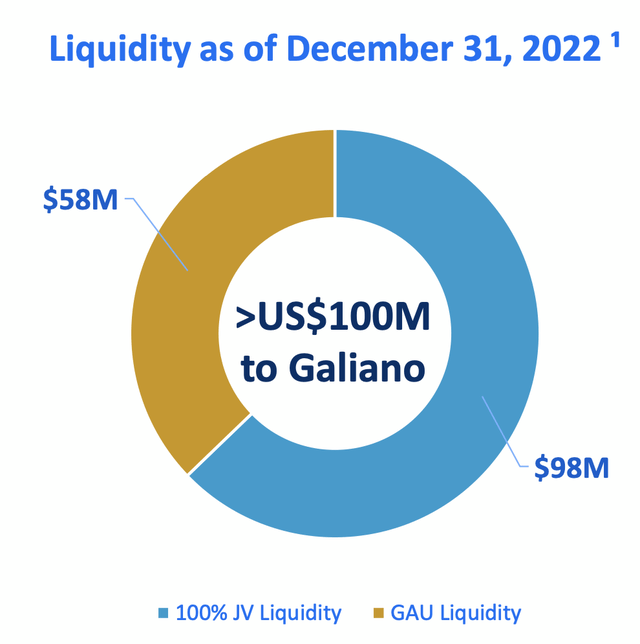

The Valuation

GAU ended 2022 with cash and cash equivalents of US$56.1 million, plus about US$2 million in receivables, or US$58 million of liquidity at the corporate level and zero debt. The JV ended the year with US$97.6 million in cash, gold sales receivable, and doré, with zero debt. That's about US$44 million of additional liquidity for GAU at the JV level, most of which is cash. In total, GAU has ~US$102 million in cash, gold, and receivables and no debt.

Galiano Gold

As noted earlier, the company's market cap is US$103.5 million, meaning that investors are applying zero value to the Asanko gold mine. At $1,800 gold, the 45% economic interest in the asset will generate US$275 million of after-tax free cash flow for Asanko, with an after-tax NPV of almost US$200 million, which equates to roughly $1 per share of value for Galiano. GAU trades at just under $0.50, implying a fair value of ~$1.50 per share, or more than 3x its current price.

This is a fully built mine that's in operation, generated substantial OCF and FCF last year, has 8.5 years of mine life remaining, game-changing exploration potential at depth at Nkran, and there are an additional ~2.5 million ounces of gold resources that aren't included in the current mine plan. And investors that buy GAU are getting it all for free.

That's how cheap GAU is at the moment.

An important side note is the company stated in the LOM press release that despite the capital-intensive year in 2023, the JV is estimated to break even in terms of cash flow, assuming production achieves the top end of guidance at prevailing metal prices. In other words, the JV's cash balance should remain stable while the mine ramps back up to over 200,000 ounces, and including the JV's cash balance is appropriate when valuing GAU.

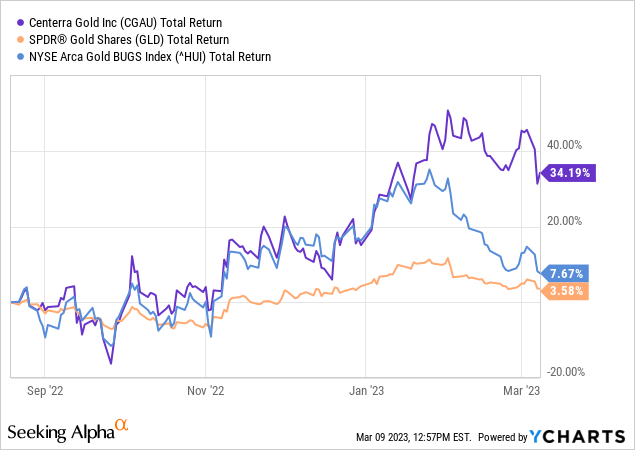

Investors simply don't understand the value of GAU. It's similar to Centerra Gold (CGAU) back in August 2022. As I said in my article at the time, CGAU was trading at the most extreme discount that I'd ever seen in a mid-tier producer. Since then, CGAU has increased by 34%, and it's not because of a surging gold price.

I've never seen a small-cap gold producer trade at this extreme of a discount, either. Like CGAU, GAU doesn't need higher gold prices to be significantly re-rated.

Almost all gold miners are trading at a discount to fair value, with many of the small and mid-caps at around 0.4-0.6x NAV. Even if we assign a 0.5x NAV to Galiano, that still equates to a ~$0.75 stock price (or a ~50% gain) to get in line with the group.

Will Gold Fields Buy Galiano?

Gold Fields has a sizable presence in Ghana (almost 800,000 ounces of attributable gold production per year from the country in 2021 and 2022), and with the Yamana Gold (AUY) merger falling through and this new mine plan on Asanko showing a robust return, it opens the door for an acquisition. GFI needs to do something to grow its production or keep it stable after Salares Norte ramps up.

Considering the cash on hand at GAU and the joint venture, and factoring in the NPV of the Asanko mine at current gold prices, GFI could offer a 50% premium for GAU and still get it at a 50% discount to fair value.

While it could be argued that Asanko is too small of an operation to have a meaningful impact on Gold Field's production, when you consider 1) the value in GAU, 2) the mine will generate over $600 million of free cash flow over the next eight years, and most importantly, 3) the 2.5 million ounces of additional resources show the potential for an expanded mine plan, it could be of interest to GFI. One also has to consider the IRR of a deal like this, which is much higher than anything else GFI is likely looking at.

While Gold Fields is dealing with an audit in Ghana, as the government is claiming the company owes back taxes, and the interim-CEO has expressed his concerns about the political and economic climate in the country as a result, these matters always get resolved (and it's just another day in the mining industry). If it somehow doesn't, which would make GFI acquiring GAU less of a possibility, then I wouldn't be surprised if Galiano acquires Gold Fields' stake in the Asanko mine, which would also be a positive development for GAU. Either way, the JV ownership should be consolidated, and I don't think the joint venture will continue under this structure.

The Risk

Ghana is dealing with extreme financial stress at the moment. It has defaulted on its debt and is currently trying to restructure a substantial amount of its liabilities while also battling a 50% inflation rate.

Ghana is one of the best mining jurisdictions in Africa, one of the most democratic countries on the continent, and one of the fastest-growing economies in the world. When it comes to the resource sector, the country states there must be a careful balance between ensuring that its citizens receive the maximum benefits from their resources while also making sure that Ghana is attracting the needed capital and technology for the effective exploitation of those resources. Companies like Galiano and Gold Fields have been successfully operating in Ghana for years — decades when it comes to GFI.

Ghana is its own country with its own economic principles and shouldn't be lumped in with other countries in Africa that have turned to effectively nationalizing resources via extreme tax rates and ownership sharing. Still, there is always an elevated risk when the host country is facing financial stress, and if those hardships persist, then the mining sector in Ghana could potentially see an increase in taxes and/or royalties paid to the government.

However, given the valuation of GAU, the cash on hand offers substantial downside protection in any negative event (whether that's from a tax standpoint or operationally).

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Interested in becoming a member of The Gold Edge?

Join now and save 20% on an annual subscription.

This article was written by

I’m a private investor with a strong track record of outperformance, and also currently work as a research consultant for high-net-worth clients who invest in the precious metals sector.

My focus was mostly on Tech/Internet when I started investing, but almost 20 years ago I became extremely interested in the gold and silver sector as I anticipated a major bull run.

I’ve been doing in-depth research on gold and silver miners since then. I'm familiar with their stories, their stock patterns, their highs and lows, their operations/projects, their successes and failures, their management teams and turnover at the top, and all other facets of these precious metal companies.

This sector is my singular focus as I expect a massive bull market will unfold. These mining stocks are the cheapest they have been in over a decade, some in fact, are near multi-decade lows as they are oversold and significantly undervalued. I expect strong appreciation in these mining stocks as the bull market in gold and silver recommences.

I believe in buying value, and not chasing the next hot stock. I use several basic investing principles, the main one being buying the balance sheet. I wait for opportunities to present themselves and then establish positions. I believe in doing your homework, and I have a very research intensive focus.

*Disclaimer* I am not a Certified Financial Advisor. My research and articles should not be interpreted as a recommendation to purchase, sell, or hold any security at any time. The accuracy, completeness, or timeliness of the information posted in my articles is not guaranteed. Do not rely on any statement that I make in my articles. All readers and subscribers should always conduct their own research and should consult a professional financial advisor when it comes to making investment decisions.

Disclosure: I/we have a beneficial long position in the shares of GAU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.