CII: This Covered Call CEF Has A Lot To Offer Investors Today

Summary

- CII uses a covered call strategy to provide investors with a very high yield.

- The fund's strategy works pretty well in flat or declining markets, which should result in it outperforming in 2023.

- The fund is heavily weighted toward major technology companies, which is a risk as these companies have been underperforming in the market.

- The 6.86% yield is much better than the S&P 500 Index and should be reasonably sustainable.

- The fund is currently trading at an attractive discount to the net asset value.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

Wirestock/iStock via Getty Images

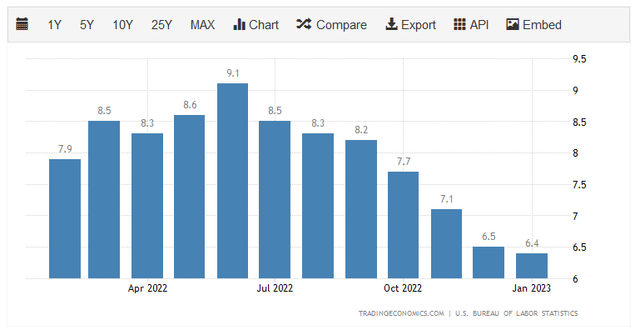

There can be little doubt that one of the biggest problems that have been facing most Americans over the past eighteen months or so is the incredibly high rate of inflation that has been plaguing the economy. There has not been a single month over the past year in which the consumer price index was at least 6.4% higher than in the year-ago month:

Trading Economics

This represents the highest rate of inflation that the country has seen in more than forty years. As two of the areas that have been most severely affected are food and energy, which are necessities, the effect has been even more devastating for people of limited means. This is one of the reasons why we have seen an uptick in the number of people taking on second jobs or entering the gig economy. I speculated in a recent blog post that this is one of the factors that has been keeping the job market strong in the face of incredibly high layoffs in a few sectors. In short, people are desperately in need of more income, as real wage growth has been negative for nearly two years.

Fortunately, as investors, we have other options that we can pursue to obtain the extra income that we need to support ourselves and maintain our lifestyles. After all, we have the option of putting our money to work for us. One of the best ways to do this is to purchase shares of a closed-end fund that specializes in the generation of income. These funds are not exactly well-followed by many investors, which is a shame because they offer a great many attractive characteristics. For example, they provide an easy way to obtain a diversified portfolio of assets and can employ certain strategies that allow them to deliver higher yields than pretty much anything else in the market.

In this article, we will discuss the BlackRock Enhanced Capital and Income Fund (NYSE:CII), which yields 6.86% at the current price. This is obviously an impressive yield that far surpasses the 1.64% yield of the S&P 500 Index (SPY) so this fund appears to offer a way to generate some income. As some readers may recall, I have discussed this fund before and this thesis did indeed prove to be true. However, that previous discussion was a few months ago so naturally, a few things have changed. In particular, the fund has released an updated financial report that we will want to take a look at. This article will focus specifically on these changes as well as provide an updated analysis of its suitability for an income portfolio.

About The Fund

According to the fund’s webpage, the BlackRock Enhanced Capital and Income Fund has the stated objective of providing its investors with a combination of current income and capital gains. This objective was surprisingly difficult to find on the fund’s website as I actually had to download the fact sheet to check on it. For some reason, the fund is no longer listing this objective in the “Investment Approach” section of the webpage. The fund’s strategy to achieve its objective is not exactly what would be expected, though. It describes its strategy thusly,

“The Trust seeks to achieve its investment objective by investing in a portfolio of equity securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust also seeks to achieve its investment objective by employing a strategy of writing (selling) call and put options.”

In short, this is basically a covered call fund. That is somewhat apparent by the fund’s name as usually when we see “Enhanced” in the name of an equity fund, it is selling covered call options. That is a very common strategy for generating income. Basically, the fund will buy the equity and then sell a call option against that position. The goal of this is for the fund to receive the upfront premium paid by the option buyer and then have the option expire worthlessly. The fund will then sell another call option in exchange for another sale premium. If done correctly, this is almost like converting the stock of any company into a high-yielding dividend play.

The fact that this fund uses options may frighten off some risk-averse investors. After all, we have all heard horror stories about the high risks of options. However, a covered call writing strategy is quite safe. This is because the fund already owns the stocks that it would have to sell if the option gets exercised against it in a worst-case scenario. Thus, the worst thing that could happen is that the fund has to sell some of the stock in its portfolio. If it executes the strategy well, it could still get a gain from this sale, just not as large of a gain as it would receive in the absence of the covered call. It will not have to go out into the market and pay any price to purchase the stock to deliver to the option buyer, which is where the real risk of option strategies comes into play. Thus, the strategy is overall quite a safe way to generate income.

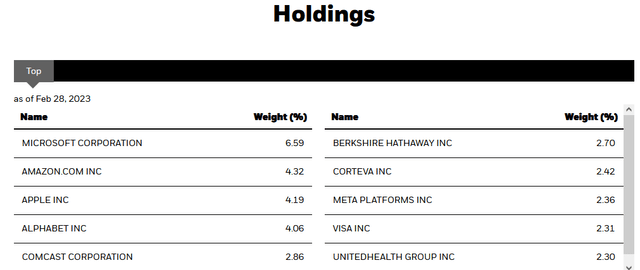

The largest positions in the fund will likely be familiar names to most readers as many of them are among the largest companies in the world. Here they are:

BlackRock

With the possible exception of Corteva (CTVA), I doubt that there is any single company on this list that is unfamiliar. We see here several of the mega-cap technology companies with Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), Alphabet (GOOG), and Meta Platforms (META). These companies have all been stock market darlings over the past decade or so and have had thousands of articles published about them by numerous authors here at Seeking Alpha over the years. I must admit though that their presence is a bit strange in an income fund since only Microsoft and Apple pay a dividend and even then their dividends are quite meager. The fund’s primary source of income is the premiums from its covered call strategy though, so that makes their presence more understandable. After all, all of these companies tend to be volatile enough to command fairly attractive prices in the options market. The real unfortunate thing here though is that these companies have been greatly affected by the market volatility over the past year and a half. We can see this by looking at their market returns over the past twelve months:

Company | TTM Stock Return |

Microsoft | -12.96% |

Amazon | -38.20% |

Apple | -6.32% |

Alphabet | -30.25% |

Meta Platforms | -8.04% |

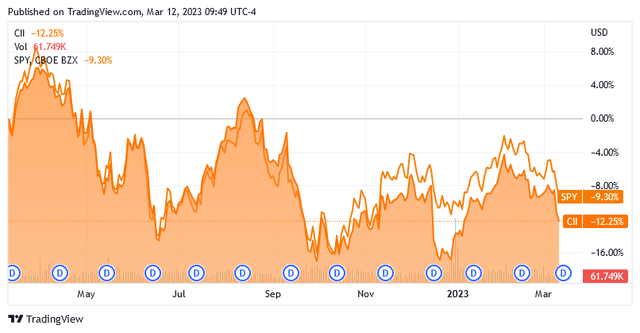

These returns are certainly more attractive than they were in the full-year 2022 period, but that is not surprising since we saw a bull run back in January and the biggest declines for most of these companies in 2022 took place prior to March. The S&P 500 index is only down 9.30% over the same period though so three out of five of these companies still underperformed the market during the time period. The substantial weighting to these five technology firms could be one reason why the fund underperformed the index over the trailing twelve-month period:

Seeking Alpha

However, the BlackRock fund does have a higher yield and when we factor that in, it actually outperformed the S&P 500 over the period in terms of total return. This is not uncommon for a fund that is employing a covered call writing strategy. This is because the call premiums that are received help to offset the market declines. In addition, when the market declines, the odds that it will have a call exercised against it go down and thus the fund can avoid being forced to sell its stock.

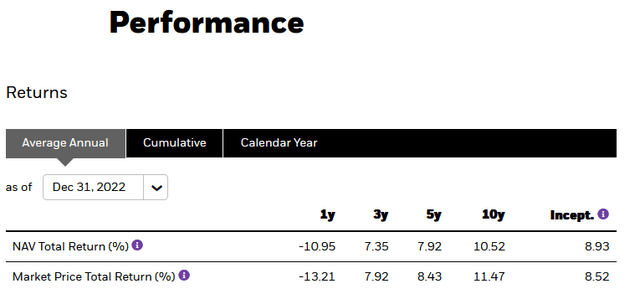

There have been surprisingly few changes to the fund’s largest positions since we last looked at it, although the weightings have changed quite a lot. The only major change here is that Ross Stores (ROST) was replaced with Meta Platforms among the fund’s largest positions. All the remaining companies shown above were still in the fund’s largest holdings a few months ago. As the weighting changes that we see could be caused by one stock outperforming another in the market, one may start to believe that the fund has a very low turnover rate. This is actually true, as the fund’s 32.00% annual turnover last year is one of the lowest ones that I have seen in an equity closed-end fund. The reason that this is important is that it costs money to trade stocks or other assets, which is billed directly to the fund’s shareholders. This creates a drag on the fund’s performance since management will have to generate sufficient returns to cover all of these costs and still have enough money left over to give the investors an acceptable return. There are few actively managed funds that accomplish this goal on a regular basis. As we have just seen, this fund did manage to beat the S&P 500 Index in terms of total return over the past year but that does not mean that it will always accomplish that goal. One of the characteristics of covered call-writing strategies is that they work very well during bear markets and during flat markets, however, they tend to underperform during bull markets because the call-writing strategy limits the upside potential. This is generally visible by looking at this fund’s performance over time:

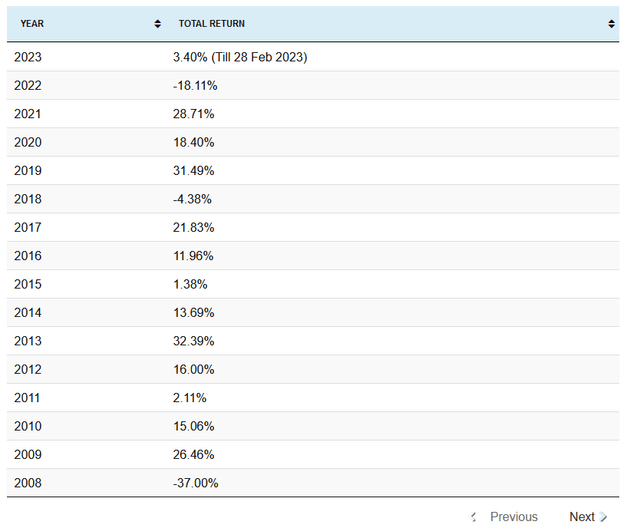

BlackRock

As we can see, the fund did indeed outperform during the 2022 bear market, but the S&P 500 generally delivered higher returns in most of the past ten years:

Finasko

Personally, I doubt that 2023 will give us an incredibly strong bull market. The powerful returns that we saw in most of the above years were at least partially caused by low interest rates that caused money to flow out of bank accounts and money market securities into anything offering a return. As interest rates are likely to remain elevated this year, it is unlikely that we will see anything better than a flat market. Thus, the BlackRock Enhanced Capital and Income Fund could prove to be a good holding this year as its covered call-writing strategy should allow it to outperform.

Distribution Analysis

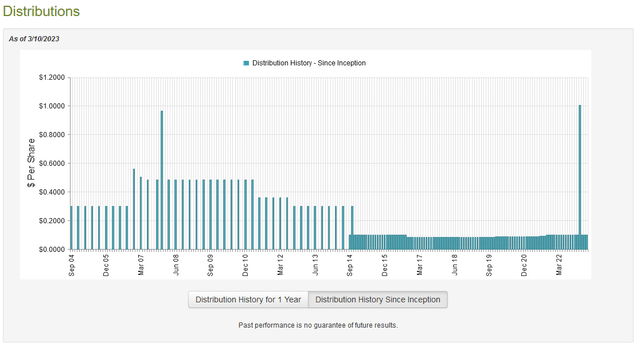

As stated earlier in this article, the primary objective of the BlackRock Enhanced Capital and Income Fund is to provide its investors with a combination of current income and gains. In order to accomplish this, the fund primarily utilizes a covered call writing strategy, which when executed properly results in a remarkably high yield. As such, we might assume that this fund itself will have a fairly high yield. This is certainly the case as the fund currently pays a monthly distribution of $0.0995 per share ($1.194 per share annually), which gives it a 6.86% yield at the current price. This is admittedly not an especially high yield for a closed-end fund, but it is still quite attractive. Unfortunately, the fund’s distribution has varied quite a lot over its history:

CEF Connect

This is something that may prove to be a bit of a turn-off for those investors that are looking for a stable and secure source of income to use to pay their bills. However, in practice, it has done much better than numerous other closed-end funds in maintaining a relatively steady distribution. With that said though, the fund’s history is not exactly the most important thing for anyone buying today. This is because an investor purchasing shares of the fund today will be receiving the current distribution at the current yield. Thus, the most important thing is how well the fund can maintain its current distribution, not its past track record. This is something that we should investigate before investing since we do not want to be the victims of a distribution cut.

Fortunately, we do have an incredibly recent document that we can consult for this purpose. The fund’s most recent financial report corresponds to the full-year period that ended on December 31, 2022. This is therefore a much more recent report than was available the last time that we reviewed this fund and as such should give us a much better idea of how well it navigated the challenging conditions that were dominant over the course of 2022. During the full-year period, the BlackRock Enhanced Capital and Income Fund received a total of $10,532,392 in dividends from the assets in its portfolio. Once we net out the amount that the fund had to pay due to foreign withholding taxes, it had a total investment income of $10,392,441 during the period. It paid its expenses out of this amount, which left it with $2,696,846 available for investors. This is a fairly paltry amount given the size of this fund and, as might be expected, it was not nearly enough to cover the $92,693,757 that it actually paid out in distributions over the course of the year. At first glance, this may be concerning since it clearly indicates that the fund did not have nearly enough net investment income to cover its distributions.

However, the net investment income does not tell the entire story about the fund’s finances. As stated earlier, this fund earns a considerable amount of money through its call-writing strategy but call premiums are not included in net investment income. These are either considered a return of capital or a capital gain, depending on the situation. In addition to this, the fund might have capital gains from the stocks in its portfolio, which it can use to cover the costs of its distributions. As might be expected from the weak market in 2022, the fund was generally unsuccessful at earning capital gains, although it did do better than we might think. During the full-year period, the fund achieved net realized gains of $100,213,617, but this was offset by $211,028,139 net unrealized losses. The fund’s assets declined by $200,811,433 after taking all inflows and outflows into account. While this is disappointing, the fund did have sufficient net investment income and net realized gains to cover the distributions. It is probably okay in terms of its ability to cover the payout, but still keep in mind that the smaller the fund’s asset base, the more difficult it will be to earn sufficient returns to cover the distribution. We will want to keep an eye on this but for now, everything looks fine.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Enhanced Capital and Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. This is therefore the amount that the fund’s investors would receive if it were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of March 9, 2023 (the most recent date for which data is available as of the time of writing), the BlackRock Enhanced Capital and Income Fund has a net asset value of $18.17 per share but the shares only trade for $17.40 per share. That gives the fund’s shares a 4.24% discount to the net asset value at the current price. This is much better than the 0.50% discount that the shares traded for on average over the past month, so the price certainly seems reasonable today.

Conclusion

In conclusion, the BlackRock Enhanced Capital and Income Fund uses a covered call writing strategy in order to provide its investors with a high level of income. This strategy works quite well during flat or declining markets, which is likely to be what we see over the course of 2023. The fund did manage to deliver a higher total return than the broader market over the past twelve months, but it may not prove to be as strong of a holding during raging bull markets. The current 6.86% yield appears sustainable, and the price appears to be right. Overall, this looks like a pretty good fund to park money into for now.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CII over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.