Silvergate (Pref & Equity) Is Now A Classic Liquidation Opportunity

Summary

- Silvergate Preferred Stock now looks like a buying opportunity.

- Most of the assets are highly liquid and marketable assets.

- The fact that the FDIC did not take over Silverbank is a good sign for positive liquidation value.

ChristinLola

In November, I was one of the first to write an article predicting that Silvergate could face a bank run. Now, I'm positive on the preferred stock (NYSE:SI.PA) with a liquidation value of $25 in any scenario and believe the upside on the equity could become interesting, with a liquidation value between $.30-$6.40 per share. I'm not going to go into what happened with Silvergate (NYSE:SI) as this has been described in detail in previous post. What's important now is what the liquidation value is going to be and when investors will get their recovery.

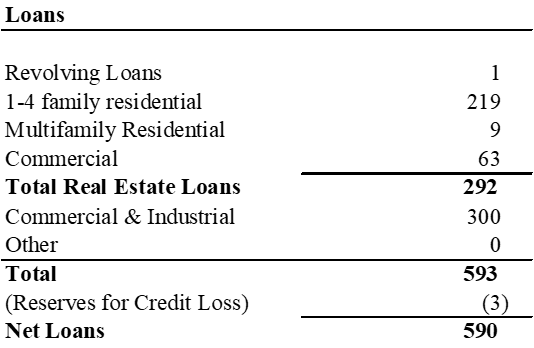

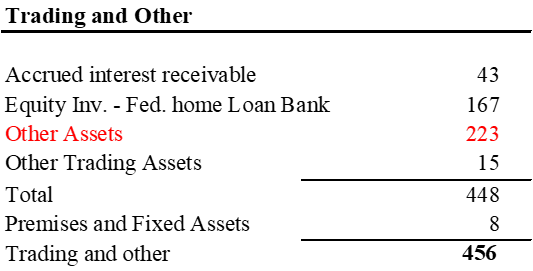

(Figures in $MM)

Author

Assets

On the asset side Silvergate owns cash, securities, loans, and trading and other assets.

Cash - It has a 100% recovery.

Securities - As of December 31, 2022, Silvergate sold most of their illiquid securities and most of the holdings are US Treasury Notes and Guaranteed Securities. These holdings totaled $5.733 billion. I believe the recovery for these securities will be 98-99% given that these securities are relatively liquid and high quality.

Author; Call Report

Loans - As of December 31, 2022, Silvergate had a loan book of $590 million. This includes $300 million of SEN leverage loans. The SEN loan to MicroStrategy has solid terms. The loan bears an interest rate of S+370 and needs to maintain an LTV of 50% and it secured by $410 million of bitcoin. I believe this loan should be marketable at a slight discount. I estimate that the recovery for the loan book will be between 93-97%.

Author; Call Report

Other assets - Are a bit of a black box. A good portion of the value of this bucket is from equity in the federal home loan banks. I believe the recovery of this should be 100%. There are $223mm of other assets, which I believe include deferred tax assets related to losses or tax loss carryforwards. The value of the tax loss carryforwards equals the present value of tax savings and the acquirers cost of capital - which makes them tricky to value. Eventually, Silvergate will turn into a liquidating vehicle and a company will acquire Silvergate mainly for the value of these tax loss carryforwards. This is what occurred in Washington Mutual. For now, I'm assuming a $50 million recovery for other assets.

Author; Call Report

Combined the gross recovery of the assets is $372-$502 million. I estimate that there will be liquidation costs of 10% of gross recovery value.

In addition to liquidation costs, Silvergate also faces lawsuits and fines related to the KYC/AML debacle from Silvergate sending deposits to Alameda Research for the benefit of FTX. I have no idea what the true costs of these lawsuits will be but I'm assuming a range of $50-$125 million in costs.

In conclusion, my liquidation recovery range for the preferred stock is $25 in any scenario and for the common stock a recovery range of $.3-$6.40. The preferred stock is the better buy and the stock may become interesting in the $.50 range.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SI.PA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.