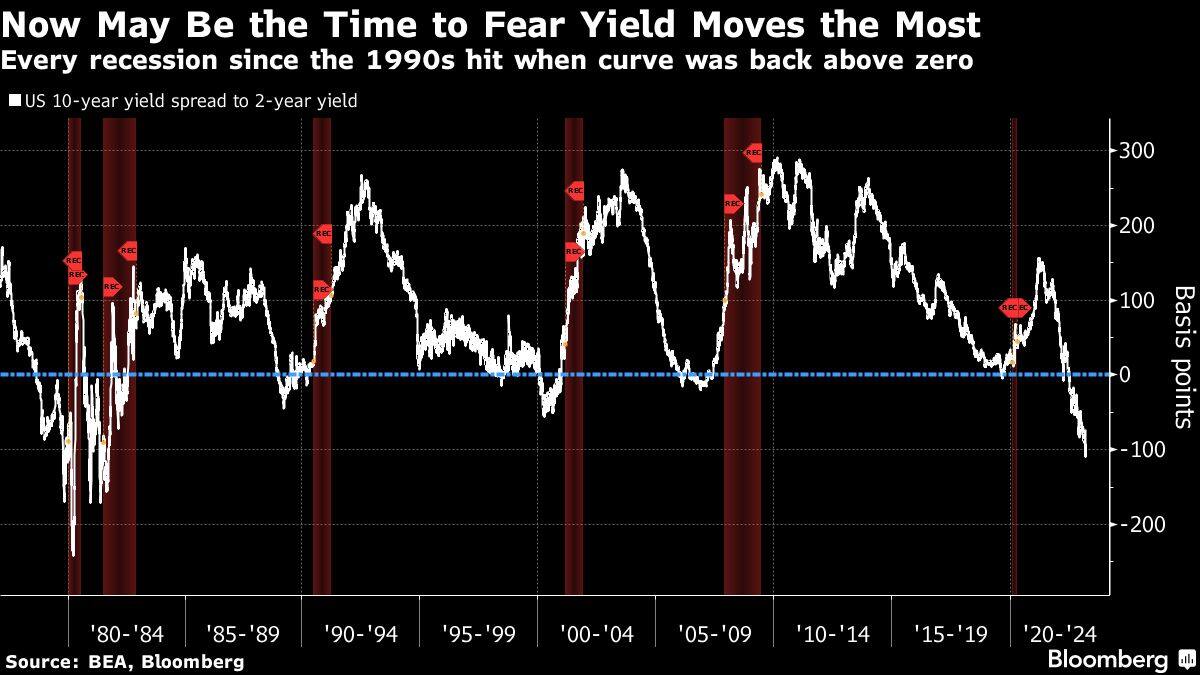

The recent performance of the US Treasuries yield curve is “highly suggestive of imminent recession,” according to DoubleLine Capital LP Chief Investment Officer Jeffrey Gundlach.

Two-year Treasury yields slumped as much as 24 basis points on Monday amid bets that the Federal Reserve will scale back interest-rate hikes. That sent the yield curve climbing 16 basis points, the most since March 2020. Short-end yields had jumped to the highest level since 2007 last week.

UST yield curve now aggressively steepening after sustained inversion is highly suggestive of imminent recession.

— Jeffrey Gundlach (@TruthGundlach) March 13, 2023

Goldman Sach Group Inc. no longer expects the Fed to increase rates next week amid concerns about financial strains at the US regional bank level. The two-year yield fell to 4.34%, set for its steepest three-day decline since October 1987.

No more 5% yields in the US Treasury market.

And it’s 4% yields once again on the endangered species list.

— Jeffrey Gundlach (@TruthGundlach) March 13, 2023