TAIL: This Quirky ETF Is Again Entering Its Prime Time

Summary

- TAIL is an ETF that combines US Treasury Bonds with a bear market "kicker" in the form of a laddered set of SPX put options.

- TAIL is somewhat of a sleeping giant at times like this, given the nature of "tail risk" options.

- After a long period where this ETF was largely irrelevant, I recently initiated a position, as it might just be hitting its sweet spot again. I rate TAIL a Buy.

Galeanu Mihai

By Rob Isbitts

Cambria ETF Trust - Cambria Tail Risk ETF (BATS:TAIL) is an ETF that might just be coming into its own, again. This is an ETF that can help a portfolio in 2 very different ways. First, at its core, it is simply an investment in 10-year US Treasury Bonds, supplemented by a modest position in Treasury Inflation-Protected Securities. But the real "kicker" in TAIL, and the reason that investors should know about it during bear markets, is that its other segment is a laddered group of put options on the S&P 500 Index.

This gives TAIL an opportunity to do what inverse ETFs do during times of market stress: give investors something that can go up when the market goes down. To me, there is nothing more heart-warming in bear markets than knowing that there are vehicles like TAIL that allow me to not only defend and hedge, but also to exploit steep, sudden market drops. After all, to investors of a certain age and stage of life (retired, pre-retired or who have accumulated most of what they think they need to no longer work for a living) there is nothing more satisfying than knowing you have a way to try to prevent being bitten by "left tail risk." That is, the type of market declines that come along rarely, but make wealth disappear quickly. Think 2020 and 1987 (briefly in both cases) and 2000-2003 and 2007-2009 (drawn out bear markets).

TAIL is always on my watchlist, but I took a position on Friday because there's a good reward/risk trade-off in both of its components (T-Bonds and S&P 500 put options). In other words, a bond rally that occurs simultaneously with an equity market decline is the best of both worlds for TAIL. I rate it a Buy.

Strategy

TAIL is a defensive-minded ETF that aims to reduce the risk of major loss in down stock markets. It uses a combination of out of the money put options (i.e., puts whose strike price is below the market price at purchase). The puts are combined with an investment in US Treasuries.

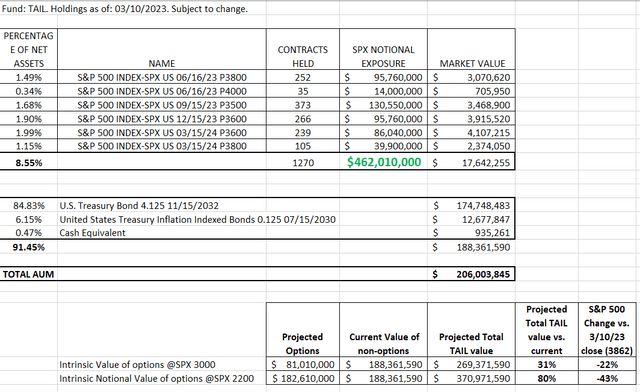

Holding Analysis

TAIL invests about 90% of its assets in US Treasury bonds. Most of that is in the current 10-year bond, which currently carries a 4.125% coupon and matures on 11/15/2032. There is also a modest (6%) allocation to TIPS, and the remaining portfolio (about 9% as of this writing) is allocated across 6 different SPX put contracts. Those contracts expire between June of 2023 and March of 2024, and have strike prices between 3,500 and 4,000.

Strengths

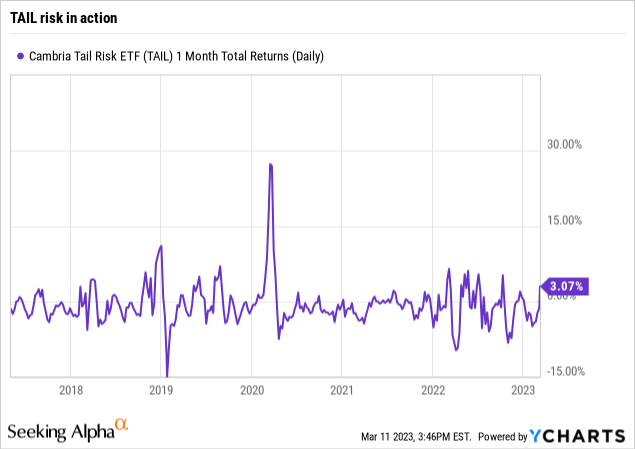

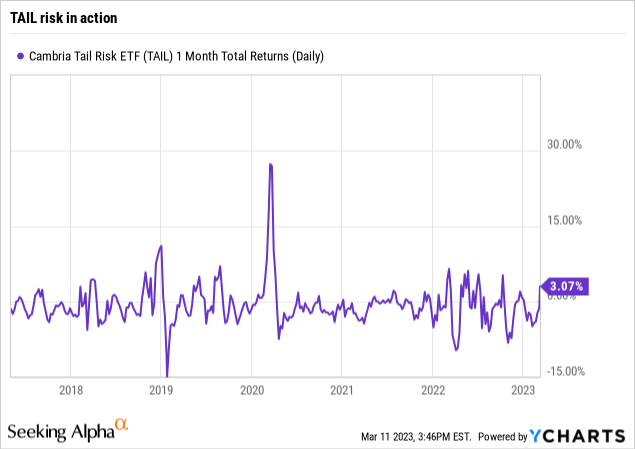

What's the best reason to consider TAIL as part of an all-weather portfolio? Because it can do this! Below is a chart of TAIL's full history but what stands out is 2020's "tail risk event." That is when the S&P 500 fell 33% in just 5 weeks. TAIL acted similarly to a single inverse S&P 500 ETF, such as ProShares Short S&P 500 (SH).

TAIL risk in action (Seeking Alpha and Ycharts)

But TAIL is not a competitor to securities like that one. It is complementary, because it has the heavy bond component, and the options are such that their value increases gradually, then all at once if the stock market really breaks. Those put options also act as a floor under the portfolio, since investors get that tail risk profit potential, but the options can't lose more in value than the roughly 10% of the portfolio they typically make up.

Weaknesses

The biggest drawback of TAIL is structural. And, it is something that has frustrated me nearly any time I don't own it in my portfolio (I've owned it several times over the years). The 90% in bonds carries too much duration risk. 10-year US Treasuries' total return over the 2021-2022 period, as depicted in the factsheet from SPGlobal.com, was about a 20% loss, with a loss of more than 16% in 2022 alone. During periods like that, I consider TAIL to be un-investable. Bond rates have been low across the board, and as I see it, the market could use an ETF that is simply short-term US Treasury securities paired with put options. But unless someone hires me to run it and raises the money to seed it, I'll need to wait for someone else to get it done. I hope it happens, because until it does, it is hard to hold TAIL for more than tactical purposes, for the same reason intermediate-term bonds are still a risk-laden situation.

Opportunities

I could just tell you that the "opportunity" with TAIL right now is that the stock market is poised to drop further, powering the put options' value. Or, I could discuss the potential for investors to rush into US Treasuries, which would help the cause for TAIL shareholders.

But actually, the big opportunity here is that not only are those 2 scenarios increasingly likely, but there's a third that I've detailed below.

TAIL risk analysis (Data from cambriafunds.com. Analysis by Rob Isbitts, Modern Income Investor.)

In the table I created (above), I calculated the notional exposure of TAIL's put options. This is how much short exposure to the S&P 500 that TAIL effectively controls. While there are all types of analytics investors apply to option investing, I prefer to keep it simple. And that's what I did above. The bottom line of that analysis is that the notional exposure represented by the current TAIL put option portfolio is more than twice that of the ETF's assets. And, if you look at the last section of the table, I estimated (without the Greek option analytics) what might be the projected value of TAIL if the stock market fell suddenly, as it did in 2020, 2018, 1987 and several other times over the decade. The steeper the decline, the better the chance that TAIL can outperform a single-inverse ETF in a stock market drop. I have not even accounted for any gain on the 90% of TAIL invested in bonds.

While this is admittedly a raw projection, my intention is to point out that market conditions are aligning with what makes TAIL most effective. It has been a while, but I have pleasant memories of owning it in early 2020, and see real potential here again.

Threats

The main threat to TAIL is higher interest rates. That could produce a similar scenario to 2021 and 2022, only with a bit more coupon cushion. The other possibility is that the options market could continue to operate in ways that are not in line with historical trends, though the options are a fraction of the fund's allocation versus the bonds. The volatility index (VIX), which drives the price of S&P 500 options, has been less reactive to changes in the market than it has been in the past. This has been the subject of some debate in the industry. I'm hesitant to say it is a danger to TAIL in the near future, but it is something I'm monitoring, since I track this ETF closely.

Conclusions

ETF Quality Opinion

Obviously, this is a must-follow for me. TAIL is part of a stable of bear-market exploiters that are getting warmer, so to speak.

ETF Investment Opinion

As noted above, I initiated a modest position in TAIL in my personal portfolio late last week. I rate this ETF a Buy.

If US Treasuries rally across the curve, and the stock market continues its breakdown, I can see a path to making this a more robust allocation. This is about as exciting as it gets for TAIL. But as with all investing, price action needs to follow through in order for this potential to be realized.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TAIL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.