TEAF: A Unique Infrastructure Fund, Deep Discount, 8.44% Distribution Yield

Summary

- TEAF invests in essential infrastructure projects, both public and private.

- The fund trades at a deep and attractive discount, presenting a potential investment opportunity.

- The fund sports an attractive 8.44% distribution yield but will largely rely on the underlying portfolio performing well.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Petmal

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on February 26th, 2023.

Ecofin Sustainable and Social Impact Term Fund (NYSE:TEAF) carries a unique exposure to private, clean energy projects. However, they still have a sizeable allocation to fossil fuels, primarily natural gas. This type of exposure meant it held up quite well in 2022 when the rest of the market and most other sectors were in a bear market.

Additionally, the fund also has "social impact" investments. These can include senior living and school investments. That adds to the fund's uniqueness in that limited CEFs focus on these types of infrastructure buildings - despite being essential just the same.

Since our last update, the fund has performed poorly. Though the broader market also didn't perform too well either.

TEAF Performance Since Previous Update (Seeking Alpha)

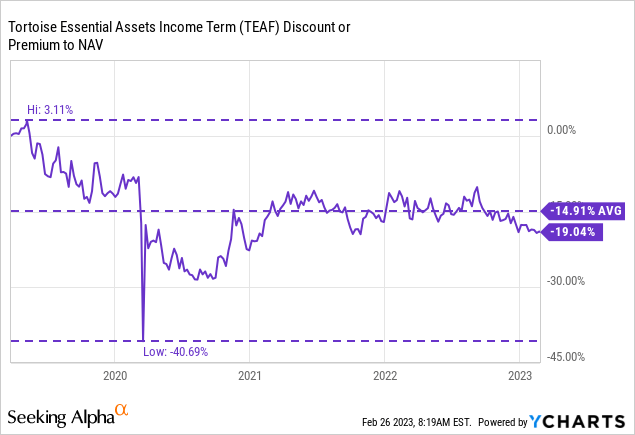

That being said, a meaningful portion of the drop here came from the fund's discount widening alone. That means the fund's share price dropped further than the underlying portfolio. With CEFs, that's a common theme that can often be exploited. With significant private investments in this fund, it's likely to trade at a discount regularly until closer to its termination date. The reason for this is that there's always a bit more uncertainty in terms of the actual value of private investment. Additionally, some projects they invest in are ideas or make no or limited profits. All that being said, I believe this fund is much more interesting at this time, so I feel comfortable moving up the rating to a "Buy" from a "Hold."

The Basics

- 1-Year Z-score: -1.77

- Discount: -19.04%

- Distribution Yield: 8.44%

- Expense Ratio: 1.89%

- Leverage: 12.10%

- Managed Assets: $250.8 million

- Structure: Term (anticipated liquidation date around March 27th, 2031)

Tortoise launched TEAF with the goal of "attractive total return potential with emphasis on current income and uncorrelated assets." Additionally, "access to differentiated direct investments in essential assets" and "investments intangible, long-lived assets and services." TEAF is also targeting a "positive social and economic impact."

The fund's expense ratio is quite high at 1.89%. However, that isn't unusual for a fund that incorporates private investments. They utilize a mild amount of leverage, which increases costs and risks nonetheless. The total expense ratio comes to 2.17% when including the leverage expense.

Utilizing a credit facility for their leverage comes with the downside of being based on a variable rate. For TEAF, this is 1-month LIBOR plus 0.80%. As the Fed has raised interest rates, their leverage costs have also risen. We should expect the total expense ratio to rise from their last fiscal year. Their fiscal year-end is November.

Performance - Essential Infrastructure, Energy Transition

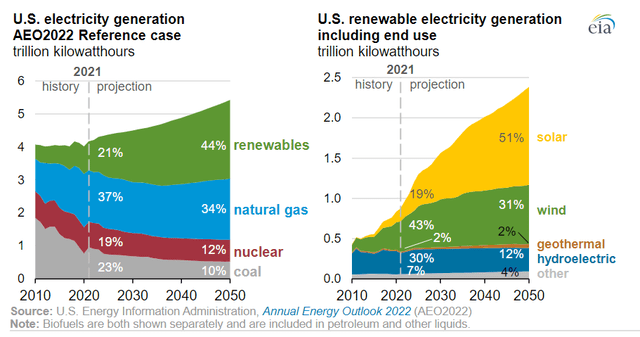

Exposure to both clean energy projects and natural gas means they are split between a portfolio that's essential now and becoming more relevant in the future. Of course, talking on this subject can become quite heated as it has become politicized. Whether someone supports it or not, the projections point toward renewables becoming a larger part of the pie in terms of electricity generation.

U.S. Electricity Generation Projections (EIA)

Solar and wind are particularly large contributors to the renewable energy projection sleeve. Natural gas also remains in strong demand, which is where TEAF can benefit as they are set up to capture the upside in this trend. They carry significant solar exposure but also material exposure to natural gas companies.

The fund performed relatively well in the last year thanks to the energy exposure. It wasn't enough to provide positive results, but generally better than what we saw in the broader market. Over the last year, it would appear to be the clean energy portion of their portfolio that would have been a drag. The SPDR Energy ETF (XLE) provided strong results as energy rebounded. Even the Alerian MLP ETF (AMLP) provided some strong total returns in the last year.

The performance and comparison below can give us a general idea of how TEAF performed relative to these areas of traditional energy and clean investments. However, it isn't the most appropriate benchmark due to its flexibility to invest across asset classes and incorporate social infrastructure.

YCharts

Private investments can be a more exciting part of the portfolio, yielding sizeable returns. However, it can also produce sizeable flops. The sizeable flops and added uncertainty will see a fund focused on private investments carry a discount. For TEAF, it's been dropping to a particularly large discount, making it more appealing now.

YCharts

Only through 2020 did the fund carry a larger discount. As most probably remember, the overall market volatility and uncertainty of COVID sent CEF discounts to the widest discounts we have seen in years.

Distribution - 8.39% Yield Dependent On Portfolio Performance

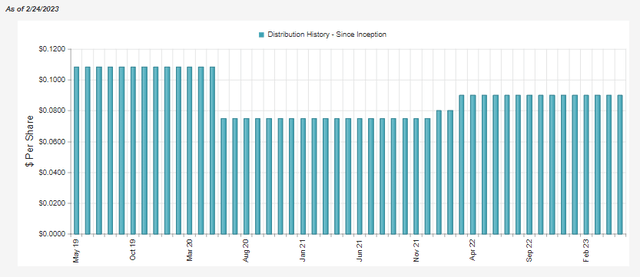

The fund cut its distribution during COVID. They've since bumped it up a couple of times but not back to the initial level.

TEAF Distribution History (CEFConnect)

As is the case with most funds that carry heavy equity exposure, capital gains will be important in covering this distribution. Although, MLP exposure can help juice up the cash flow to the fund with relatively larger distribution yields themselves. Another area that helps is the fund's private investments, primarily investing in bonds with yields between 10 and 16%. That can help provide steadier income.

Since the fund's decline in 2022 was relatively shallow, its yield hasn't become too elevated. The NAV rate comes in at 6.81%, with the share price yield coming in at 8.44%, thanks to the incredibly large discount. I believe that should bode well with the fund continuing to pay the current distribution.

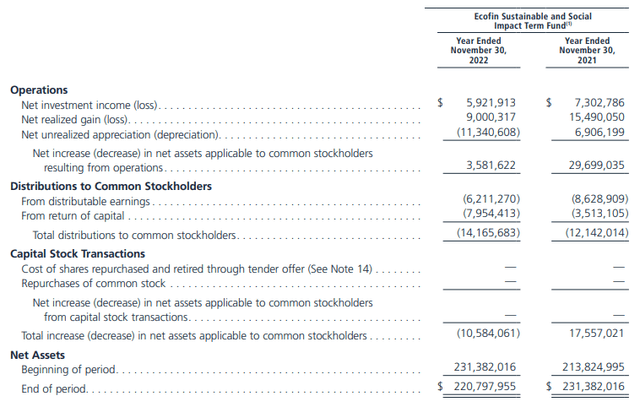

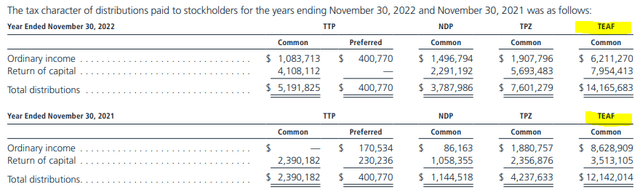

That being said, we see that NII coverage comes to 41.8%, which is fairly strong for a fund with a high allocation to equities. Even further, the fund carries MLPs and other energy investments that traditionally distribute out return of capital. These ROC distributions can be added to the NII to come up with the distributable cash flow or net distributable income.

For TEAF, in their last fiscal year, ROC distributions were $4,599,443. When including that with the NII, we see that NDI jumps to 74.27%. That makes me more confident that they will keep the distribution where it is currently - though never guaranteed.

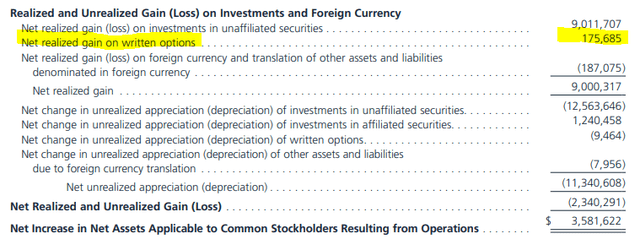

This fund also utilizes some option writing in its fund. That can create a regular source of capital gains, whether we are in a bear, bull, or flat market. That being said, it's been a fairly small amount.

TEAF Realized/Unrealized Gains/Losses (Tortoise (highlights from author))

With return of capital distributions it receives, it's only natural that some of the distributions that TEAF pays will also be classified as return of capital. This means that not all of the ROC we see in TEAF would necessarily be considered "destructive" ROC.

TEAF Distribution Tax Classifications (Tortoise (highlight from author))

TEAF's Portfolio

Since the portfolio has become more established since its launch, it doesn't change too drastically between updates. The turnover rate came down to 18.08% in the last fiscal year. That dropped from 68.31% in 2021 to 73.22% in 2020.

The fund's asset exposure at the end of their fiscal year was: 51.8% allocated to common stocks, private investments at 20.4%, corporate bonds at 17.4%, MLPs at 10.9%, preferred stock at 2.1%, municipal bonds at 4.7% and construction notes at 5.1%. So we can see how diverse the fund is and that they have the flexibility to invest about anywhere they want.

They also listed 0.0% to Transition SA Warrant ($110.3k fair value) and 0.2% in short-term investments, the First American Government Obligations Fund Class X.

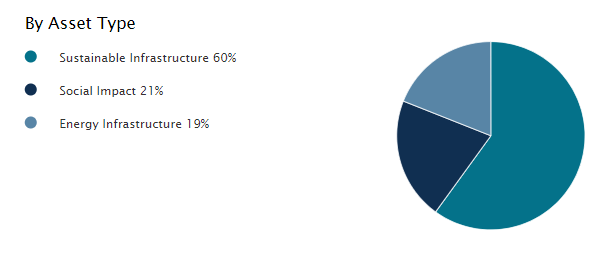

The fund carries its portfolio at a split of 52% public and 48% private at the end of January 31st, 2023. Within that, the breakdown of the fund is heaviest in sustainable infrastructure.

TEAF Asset Breakdown (Tortoise)

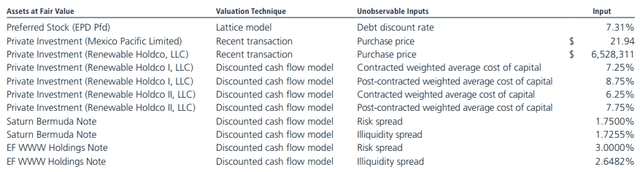

Despite the sizeable allocation to private investments, only around 24.5% of the portfolio would be classified as level 3 assets. These parts of the portfolio can often be a point where valuations become a little ambiguous. This is because level 3 assets are valued with "significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments."

This can add a bit of uncertainty as to the true valuation. Here's the breakdown of the level 3 securities and their valuation technique. This is primarily allocated to their private investments, but also construction notes and preferred stock.

TEAF Private Investment Valuation (Tortoise)

Some of these are illiquid as they have restrictions on selling too. 40.3% of TEAF's portfolio was considered restricted securities.

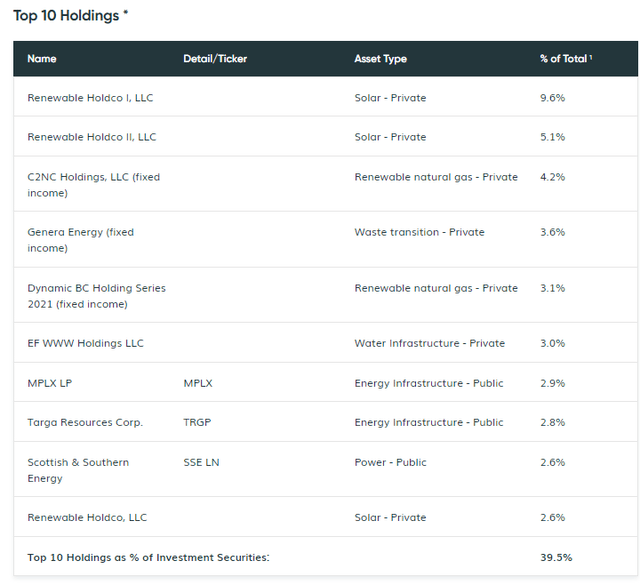

The portfolio is heavily skewed towards its top ten holdings. In fact, the top holding makes up a material portion of the entire portfolio on its own.

TEAF Top Ten Holdings (Tortoise)

The Renewable Holdco I has regularly been the fund's largest holding, perhaps unsurprisingly, given its sizeable allocation. Renewable Holdco II follows this. We even have a Renewable Holdco as the tenth largest position, as it was previously too. As stated under the asset type, these are solar investments. These are also affiliated investments, as TEAF wholly owns TEAAF Solar Holdco, LLC, which makes these private investments.

As of November 30, 2022, TEAF has committed $63,444,315 to TEAF Solar Holdco, LLC, a wholly-owned investment of TEAF. TEAF Solar Holdco, LLC wholly owns each of Renewable Holdco, LLC and Renewable Holdco I, LLC, which owns and operates renewable energy assets. TEAF Solar Holdco, LLC owns a majority partnership interest in Renewable Holdco II, LLC. Renewable Holdco, LLC and Renewable Holdco II, LLC’s acquisition of the commercial and industrial solar portfolio is ongoing. Renewable Holdco I, LLC acquired the commercial and industrial solar portfolio in September 2019.

As of November 30, 2022, TEAF has provided $3,770,670 to TEAF Solar Holdco I, LLC, a wholly-owned investment of TEAF. TEAF Solar Holdco I, LLC has committed to $6,667,100 of debt funding to Saturn Solar Bermuda 1, Ltd. through a construction note. Under the terms of the note Tortoise Solar Holdco I, LLC receives cash payments monthly at an annual rate of 10%. As of November 30, 2022, $3,510,000 of the construction note had been funded, and $3,157,100 unfunded.

Since our last update, the fund has been fairly busy with making another six private investments.

TEAF Private Investments (Tortoise)

They aren't particularly large investments, the largest being the Ativo of Albuquerque investment at just over $2 million. This is a debt investment subordinate secured taxable note Series 2022A. This is an example of the fund's 'idea' investment in that it is a "...to-be-constructed senior living community..." Meaning that it isn't operating yet, but they noted that there was a need as occupancy levels of senior housing in the area have levels exceeding 90%. For TEAF, this comes with a maturity date of January 1st, 2028, with a cash yield of 12%.

Conclusion

TEAF is a unique investment that incorporates sustainable infrastructure, focusing on clean energy and other social projects. These projects tend to be private and can entail additional risk as they are projects that might just be getting built and are illiquid. They still invest in traditional fossil fuels, primarily natural gas MLP and energy investments. The fund carries a large discount and offers investors an attractive distribution yield.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Disclosure: I/we have a beneficial long position in the shares of TEAF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.