SP500: Financial Stability Vs. Sticky Inflation

Summary

- The CPI report for February is likely to confirm the sticky inflation well above the 2% target.

- The Fed is unlikely to cut rates in response to the current bout of financial instability.

- S&P 500 is still deeply overvalued with the forward P/E ratio over 18.

insta_photos

The SVB Financial Group (SIVB) collapse on Friday is the first casualty of the Fed's monetary tightening campaign. So, now we could be facing a period of financial instability, which could force the Fed to pause and possibly reverse the interest rate hikes. On the other hand, the underlying inflation seems to be accelerating, which requires the Fed to possibly increase the pace of monetary tightening. It's a tough choice, and the resolution will likely have a significant effect on the financial markets.

Next week, the first thing on Monday, we will get the feel if the financial instability deepens with more "bank runs" and the potential SVB exposure effects. Also on Monday, the Fed holds the emergency meeting:

A closed meeting of the Board of Governors of the Federal Reserve System will be held under expedited procedures at 11:30 a.m. on March 13, 2023. Matter(s) considered: Review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks.

On Tuesday, we will get the CPI report for February, which will give us the sense whether the brief period of disinflation has faded.

February CPI report preview

Let's start with CPI report. The current market consensus for core CPI is 5.5% for February, which is just a tick below the January reading of 5.5%. The monthly change in core CPI is expected to remain constant at 0.4%. These consensus expectations are consistent with the thesis that core inflation is plateauing at a very high level, after the brief period of disinflation.

Trading Economics

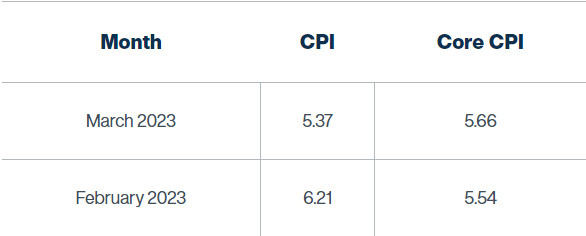

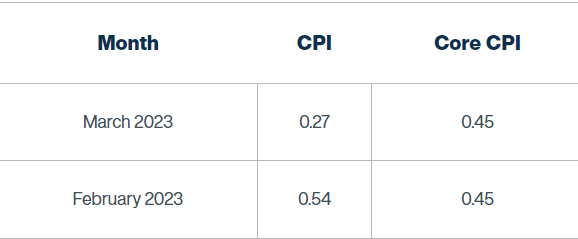

However, the Cleveland Fed Inflation Nowcast model is even more pessimistic. The InflationNowcast model predicts 5.54% core CPI in February, which could be rounded down to 5.5% consensus, but also at risk to be rounded up to 5.6%. More importantly, the Nowcast model sees a significant acceleration in the core CPI to 5.66% in March, as the table below shows. This is consistent with the thesis that core inflation is actually accelerating.

Cleveland Fed

Cleveland Fed

Note, the headline CPI is expected to sharply fall in March to 5.37% yoy, and to only 0.27% month over month. However, this is due to the base effect, as last year in March the price of oil spiked as Russia invaded Ukraine.

The Fed's focus is clearly in the core inflation, specifically the service inflation ex housing which depends on the labor market strength. The February labor report was strong, although the wage growth slowed somewhat. However, this could be likely due to the composition effect - new jobs created are mostly lower paid jobs.

The point is that the core inflation is expected to remain sticky, well above the Fed's 2% target, which requires possibly even an acceleration of the pace of interest rate hikes.

The financial stability issue

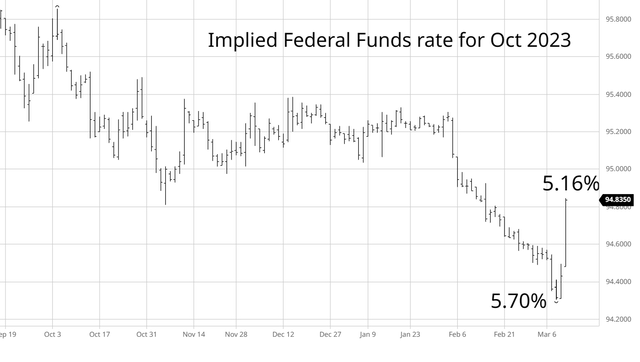

In fact, as of Wednesday last week, the Federal Funds futures were pricing the Federal Funds rate at 5.7% by October 2023, and many analysts were calling for the 6% Federal Funds rate. Additionally, the probability of the accelerated pace of interest rate hikes was very high, with the 50bpt hike in March more likely than 25bpt hike.

However, as the chart below shows, on Friday after the SVB fallout, the market sharply repriced the expected monetary policy expectations down to 5.16% Federal Funds rate by October 2023.

Barchart

Obviously, the market now sees the financial stability risk as more important than the sticky inflation.

But what is exactly the source of the current bout of financial instability?

In a nutshell, banks have not increased the savings rate on deposits as the Federal Funds rate increased. So, naturally, customers are withdrawing their deposits and buying higher yielding Treasury Bills. So, it's likely that this process will continue, which could force more banks to sell more Treasury bonds and realize large losses.

So, what can the Fed do? This specific problem can be solved by the Fed directly lowering the rates, and pushing the bond prices higher. This reduces the unrealized losses and reduces the savings rate/TBill yield differential to slow the deposit withdrawals.

Alternatively, the Fed can continue to focus on inflation, while "forcing" the banks to increase the savings rate according to the Federal Funds rate level. At the same time, the Fed can stand ready to lend to the banks directly via the Fed's discount window. However, the discount rate for the Fed's loan is essentially the Federal Funds rate. This is exactly the topic of the Fed's emergency meeting - the discount rate level for the Fed's window bank loans.

So, the issue here is not liquidity, it's the bank's greed and unwillingness to accept that the cost of capital has increased. Thus, I expect the Fed to refocus on inflation.

However, if this is only the beginning of the lagged effects of the Fed's aggressive monetary tightening in 2022, the next "shoe" to drop could be the credit risk related to bad loans. But, we are not there yet, as long as the unemployment rate remains low.

Implications for investors

The Fed was clear - inflation is the primary objective and "there will be some pain". So, this is the pain promised, and more is coming.

The CPI report is likely to confirm that inflation remains sticky well above the 2% target. The Fed will stand ready to provide capital to the banks and the Fed's window at the appropriate discount rate. I don't expect any pivot in monetary policy going forward, as long as the labor market remains tight.

S&P 500 (SP500) (SPX) is caught between the financial instability and the sticky inflation at the forward PE ratio above 18 - that's deeply overvalued. One way or the other, the valuation multiple has to come down to the 15-16 level, and given the expected earnings revision as the recession approaches, there is still considerable downside to S&P500.

There is simply no other way out of current situation, unless the Fed completely abandons the 2% inflation target and reinflates the bubble. That's the bullish thesis. Noted.

This article was written by

Disclosure: I/we have a beneficial short position in the shares of SPX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.