DIAX Vs. DIA: Dow Jones Stocks With Or Without Option Strategy

Summary

- The Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX) invests in the Dow Jones Average stocks and trades possible appreciation for higher current yield via their option strategy.

- This article will compare DJIA against what investors get by investing in the SPDR Dow Jones Industrial Average ETF (DIA); the same stocks but no option strategy.

- While providing a higher yield and more downside protection, DIAX is giving up 400bps in return consistently. There are better income-generating equity funds to own: Sell DIAX.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

travelpixpro

(This article was co-produced with Hoya Capital Real Estate)

Introduction

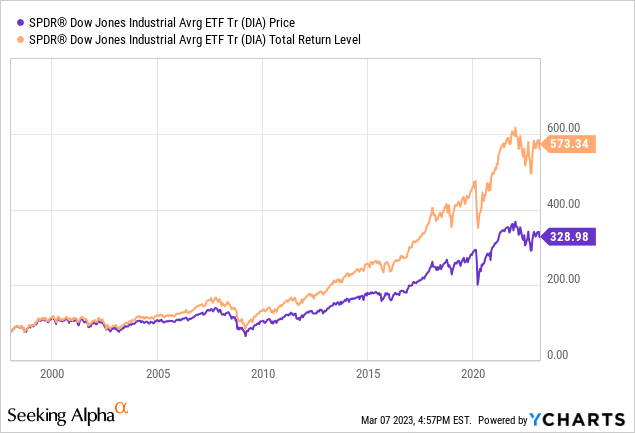

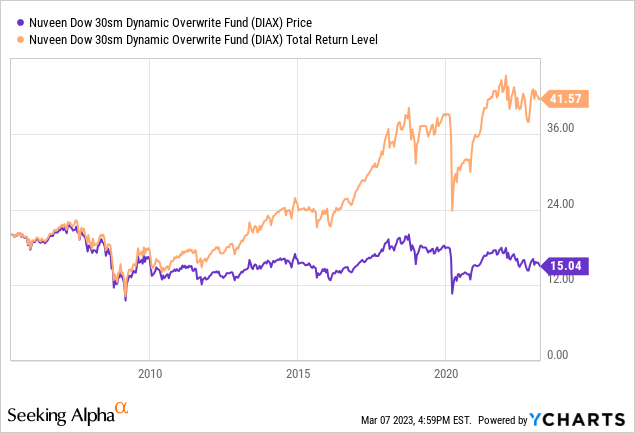

Before the FOMC started pushing up short-term interest rates in 2022, income investors were getting squeezed unless they entered the riskier parts of the fixed income market or turned to option-writing equity funds. One fund writing Calls against the Dow Jones Industrial Average is the Nuveen Dow 30SM Dynamic Overwrite Fund (NYSE:DIAX), which I review here. I will also review the SPDR Dow Jones Industrial Average ETF (NYSEARCA:DIA) and then compare if investors benefited from DIAX’s income-enhancing strategy. While history is only a year, the results are typical for this pairing type: more income coupled with lower return compared to the standard ETF.

SPDR Dow Jones Industrial Average ETF review

Seeking Alpha describes this ETF as:

The SPDR Dow Jones Industrial Average ETF Trust was launched by and is managed by State Street Global Advisors. The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Dow Jones Industrial Average (the “DJIA”). The Trust’s Portfolio consists of substantially all of the component common stocks that comprise the DJIA, which are weighted in accordance with the terms of the Trust Agreement. DIA started in 1998.

Source: seekingalpha.com DIA

DIA has $28.7b in AUM and provides investors with a 1.9% yield. The ETF comes with 16bps in fees.

Index review

S&P Dow Jones describes their index as:

The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

Source: spglobal.com Index

The DJIA was first calculated in 1896, only the Dow Jones Transportation Average is older. The DJIA expanded to 30 stocks in 1928. Its unique feature is the price-weighted nature of the Index: Higher the price; larger the weight in the Index. Thus, when a stock splits, its effect on the index is diminished. It also explains, IMHO, why stocks with extremely high prices will never be considered. Since 1896, I calculated the DJIA has had an average price gain of 5%; since 1987, the Annualized Total Return is about 11%.

The DJIA is managed by an in-house Committee and the following describes the maintenance process.

While stock selection is not governed by quantitative rules, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors. Since the indexes are price weighted, the Index Committee evaluates stock price when considering a company for inclusion. The Index Committee monitors whether the highest-priced stock in the index has a price more than 10 times that of the lowest. Maintaining adequate sector representation within the index is also a consideration in the selection process for the Dow Jones Industrial Average. Companies should be incorporated and headquartered in the U.S., and a plurality of revenues should be derived from the U.S. Changes to the indices are made on an as-needed basis. There is no annual or semi-annual reconstitution. Rather, changes in response to corporate actions and market developments can be made at any time. Constituent changes are typically announced one to five days before they are scheduled to be implemented.

Source: spglobal.com Index Methodology

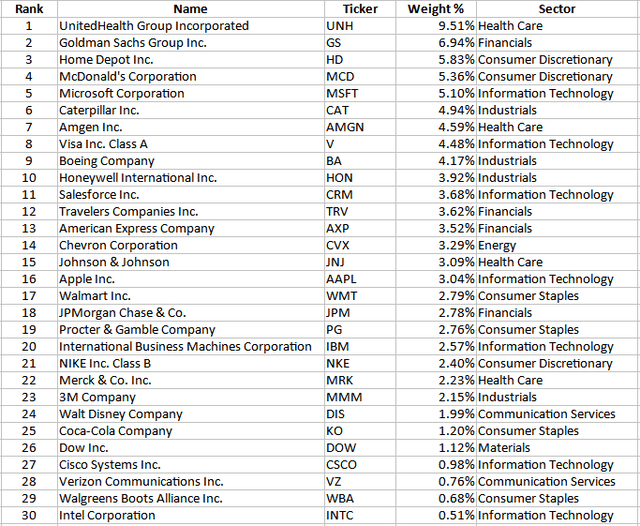

DIA holdings review

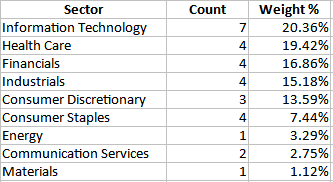

The sector allocations are:

ssga.com; compiled by Author

The Top 5 sectors are 85% of the portfolio weight. The complete holdings are as follows, with the Top 10 stocks representing 55% of the weight.

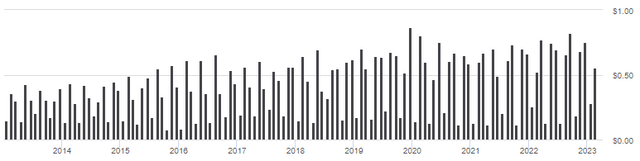

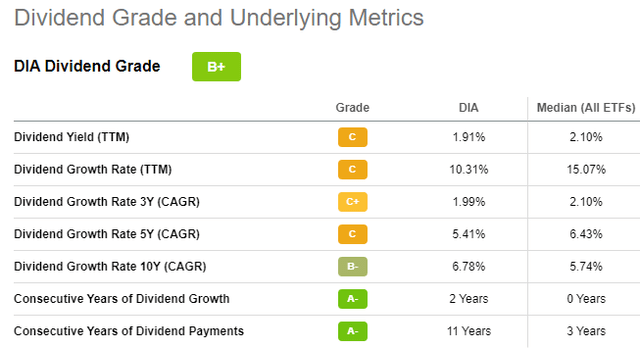

DIA distributions review

While the yield is not much, checks are monthly, with the 1st payment each quarter the smallest. Seeking Alpha has given this pattern a "B+" grade.

seekingalpha.com DIA scorecard

Nuveen Dow 30SM Dynamic Overwrite Fund review

DIAX has $593m in AUM and provides investors with a 7.5% yield. For that bonus in income strategy, the managers collect 92bps in fees.

Seeking Alpha describes this CEF as:

Nuveen Dow 30 Dynamic Overwrite fund is designed to offer regular distributions through a strategy that seeks attractive total return with less volatility than the Dow Jones Industrial Average (DJIA or “Dow30”) by investing in an equity portfolio that seeks to substantially replicate the price movements of the DJIA, as well as selling call options on 35%-75% of the notional value of the Fund’s equity portfolio (with a 55% long-term target) in an effort to enhance the Fund’s risk-adjusted returns. DIAX started in 2005. DIAX Blended Benchmark: 55% Cboe DJIA BuyWrite Index (BXD) and 45% Dow Jones Industrial Average (DJIA).

Source: seekingalpha.com DIAX

Index review

While the CEF does invest 100% based on this index, it does provide a guide to their strategy.

The Cboe DJIA BuyWrite Index (BXD) is a benchmark index that measures the performance of a theoretical portfolio that sells DJX call options, against a portfolio of the stocks included in the Dow Jones Industrial Average. They provide study results on benefits of this strategy while pointing out that the option-writing strategy will underperform during strong markets.

- Diversification and Reduced Volatility. The volatility of the BXD was 25% less than that of the DJIA and 46% lower than the Russell 2000. The study found that if an investor had allocated 25% of an otherwise all-stock portfolio to the BXD, the portfolio volatility would have declined by about 9%.

- Income Generation. Selling index options 12 times per year can produce significant income. Over the 109-month period studied, the average monthly options premium received was 1.84%, or an annualized rate of 24.46%.

- Improved Risk-Adjusted Returns. Incorporating a 10% allocation to the BXD could have improved the risk-adjusted returns (as measured by the Sharpe Ratio) of all four comparative portfolios studied (i.e., all-stocks, all fixed income, aggressive and conservative portfolios).

Source: cboe.com BXD Index

DIAX holdings review

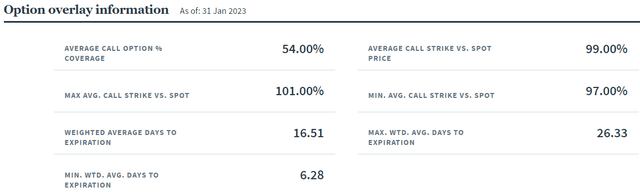

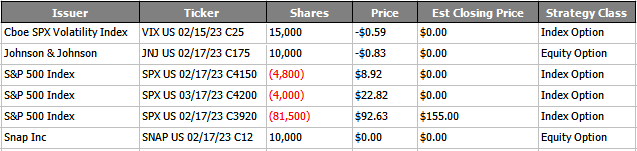

I chose not to present the stock holdings as they should match what is shown for DIA. I capture this 1/31/23 data to see how it changed once the February data was posted. Unfortunately, Nuveen has not yet provided an update.

The options held at that time were the following; all but one expired OTM.

nuveen.com; compiled by Author

The C3920 was about $60 ITM at purchase so DIAX might have made money on that trade even though it had to be repurchased; depends on the premium earned.

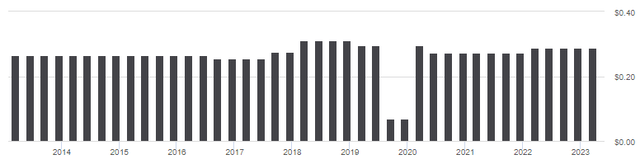

DIAX distribution review

Author's note: Seeking Alpha's data vendor in the process of fixing what appears to be two reduced payouts, when in reality they matched the surrounding ones.

For 2022, payouts were 19% income, 40% LT/St gains, and 41% from ROC. A large percent from ROC is common for option-writing funds as that is how premium income is classified.

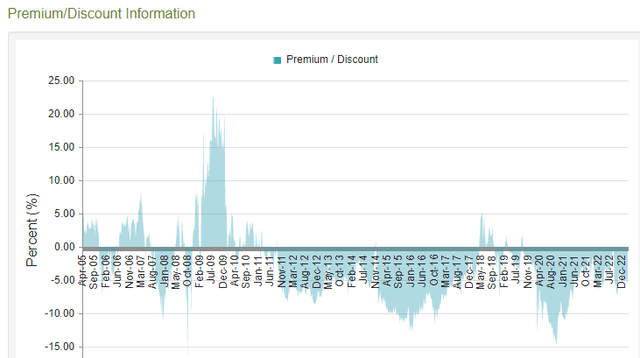

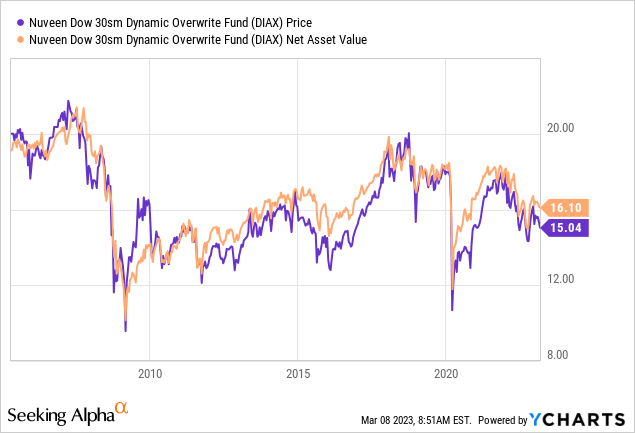

Price to NAV review

The next chart represents the movement between the two in better form.

The current discount is 6.58%, with 7% being the best discount over the past year. Notice that during the GFC, the premium spiked, but during the COVID crisis, the opposite occurred. No Z-score data was provided.

Fund comparison

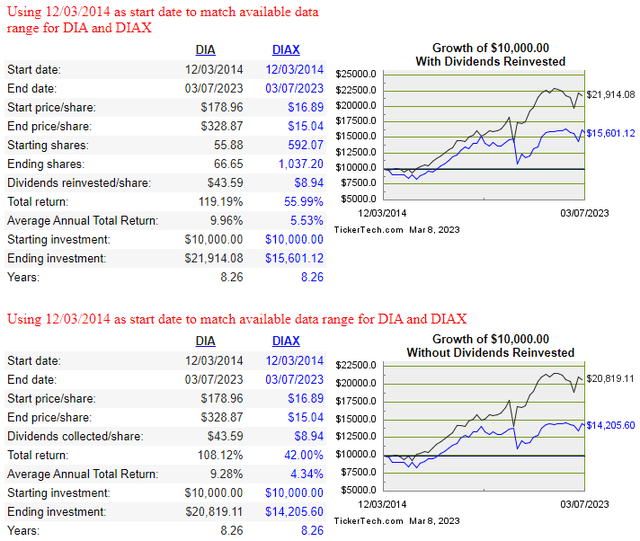

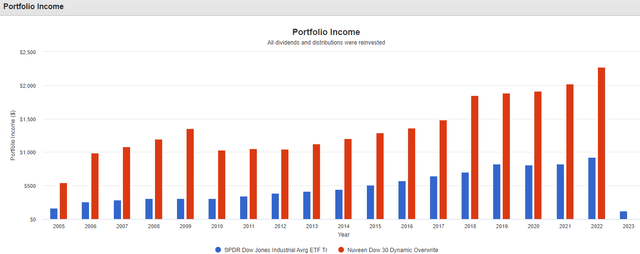

Since they own the same thirty stocks, no reason to spend time reviewing how the holdings match up. This is how returns match under two scenarios: whether dividends were reinvested or not.

In either case, DIA provided investors with better returns. Each person has to decide if the extra income is worth the lower performance.

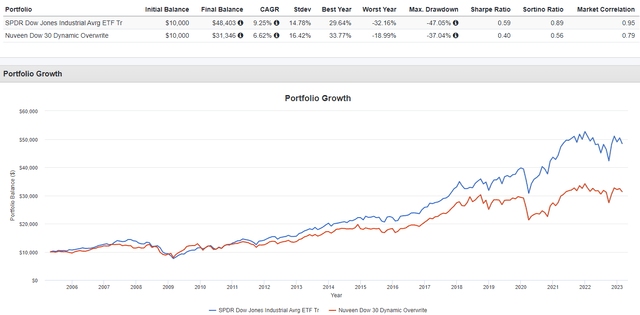

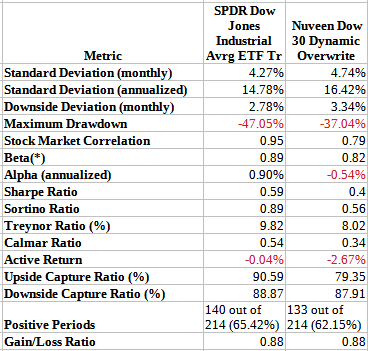

For risk analysis, Portfolio Visualizer is what I use even though it truncates data to complete months only for me.

This provides the following results I thought were instructive in analyzing the two funds.

PortfolioVisualizer.com

When looking at the 214 monthly periods, I found the following results:

- DIA had positive returns 140 times, in which DIA also had the better return 78 times.

- DIA had negative returns 74 times, in which DIA still had the better return 34 times.

- DIAX had positive returns 133 times, in which DIAX also had the better return 75 times.

- DIAX had negative returns 81 times, in which DIAX still had the better return 27 times.

So while DIAX has achieved a lower Beta, a measure of risk. The option strategy failed to capture 20+% of the upside, versus DIA only missing 8.4%. While the DIAX option strategy did reduced the Max Drawdown, overall DIAX's downside capture was barely better than DIA's. Notice the positive periods for DIAX are slightly less too. While DIAX might make income seekers happy, risk-adverse investors gain little from owning DIAX over DIA and suffer in Total Return for that choice.

Portfolio strategy

If an investor's goal is income with some equity return possible, the JPMorgan Equity Premium Income ETF (JEPI) should be considered. If equity exposure with lower risk is primary goal, the Core Alternative ETF (CCOR) should be considered. Those two factors were examine in a recent article of mine: CCOR Vs. JEPI: Trading Income And Some Return For Much Less Risk.

For investors looking for higher risk exposure to the Dow Jones Industrial, there are these strategies based on the DJIA.

spglobal.com Index

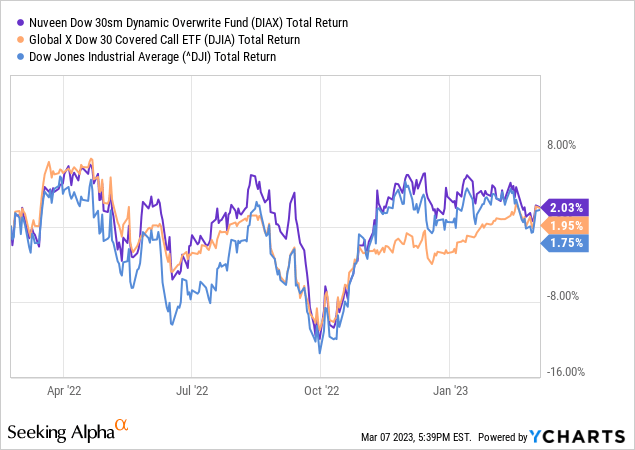

There is at least one other DJIA options fund, the Global X Dow 30 Covered Call ETF (DJIA), which was recently reviewed by another Seeking Alpha Contributor. This ETF uses one-month, at-the-money call options, meaning more income, less upside potential. Here are how the two option-writing funds compare return wise.

Final thoughts

While providing a higher yield and more downside protection, DIAX is giving up 400bps in return consistently. There are better income-generating equity funds to own: I would sell DIAX, but others might feel differently as their investments goal do not match mine or my other investments.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have a beneficial long position in the shares of JEPI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.