VMBS: Modest Yields Becoming Unattractive

Summary

- The VMBS provides exposure to agency-MBS securities.

- Historically, MBS have provided modest returns and low volatility. However, 2022 was especially bad for the VMBS ETF due to the portfolio's 6.9-year duration.

- Looking forward, I worry a 'higher for longer' Fed may prove to be a headwind for the MBS market due to elevated duration risk.

- With t-bills yielding north of 4%, VMBS's distribution is looking unattractive.

Zolak

The Vanguard Mortgage-Backed Securities Index ETF (NASDAQ:VMBS) provides exposure to agency-MBS securities. The VMBS ETF has historically provided modest returns and low volatility. However, 2022 was a bad year due to interest rate losses from the portfolio's 6.9yr duration.

Looking forward, MBS securities may continue to struggle, as I continue to see interest rates staying 'higher for longer'. With treasury bills yielding north of 4%, VMBS's 2.6% distribution yield is fast becoming unattractive. Finally, with the Fed in the early days of its quantitative tightening program, MBS securities may face additional headwinds as the Fed turns from being a large net-buyer of MBS securities into a net-seller.

Fund Overview

The Vanguard Mortgage-Backed Securities ETF invests primarily in U.S. agency mortgage-backed pass-through securities ("MBS") to generate modest level of current income to investors.

Securities eligible for purchase by VMBS are mortgage-backed securities issued by Ginnie Mae (GNMA), Fannie Mae (OTCQB:FNMA), and Freddie Mac ("FHLMC").

The VMBS ETF has $16.5 billion in assets and only charges a 0.04% expense ratio.

Portfolio Holdings

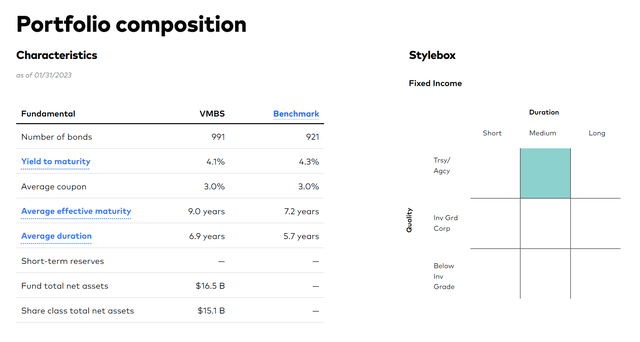

Figure 1 shows the portfolio composition of the VMBS ETF. The fund holds close to 1,000 bonds with a portfolio duration of 6.9 years. Since the fund only holds U.S. agency MBS, there is no credit risks associated with the ETF. However, the portfolio still has interest rate risk, as shown by its moderately high duration.

Figure 1 - VMBS portfolio composition (vanguard.com)

Returns

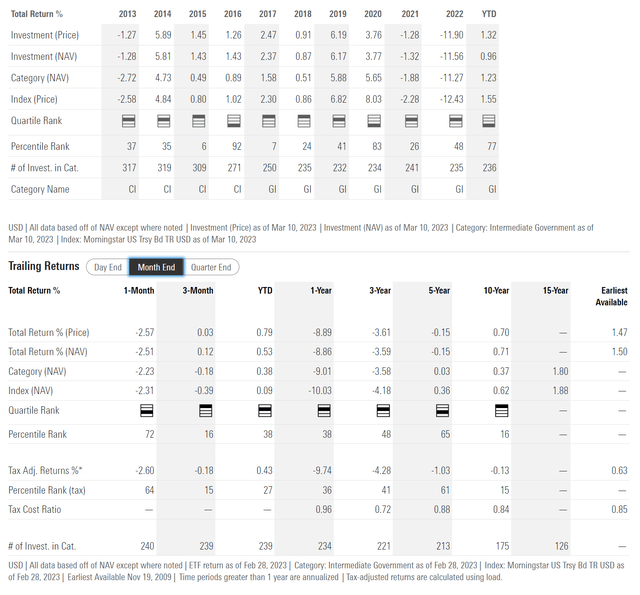

In fact, elevated duration caused the VMBS to suffer a 11.6% drawdown in 2022. Historically, the VMBS has delivered very modest returns, with 1/3/5/10Yr average annual returns of -8.9%/-3.6%/-0.2%/0.7% respectively to February 28, 2023 (Figure 2).

Figure 2 - VMBS historical returns (morningstar.com)

The poor returns in 2022 wiped out many years of historical performance.

Distribution & Yield

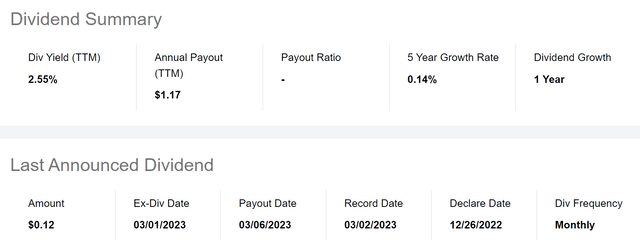

The VMBS ETF is marketed as a fund suitable for investors who seek moderate levels of income. The VMBS ETF pays a monthly distribution with a trailing 12 month distribution of $1.17 or a trailing yield of 2.6% (Figure 3).

Figure 3 - VMBS distribution yield (Seeking Alpha)

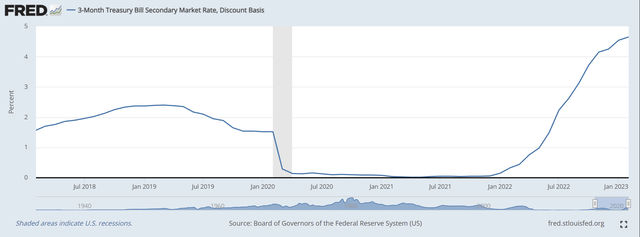

With treasury bills now yielding north of 4%, VMBS's distribution yield is fast becoming unattractive (Figure 4).

Figure 4 - 3Month treasury bill yield (St Louis Fed)

VMBS vs. IEF

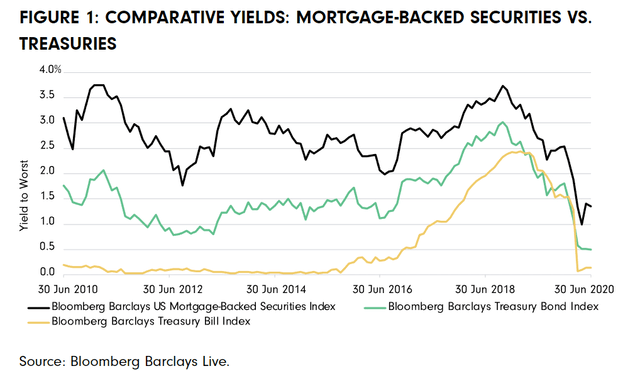

Historically, mortgage-backed securities have generated yields that are higher than treasuries with an equivalent maturity (Figure 5).

Figure 5 - MBS historically have attractive yields compared to treasuries (diamond-hill.com)

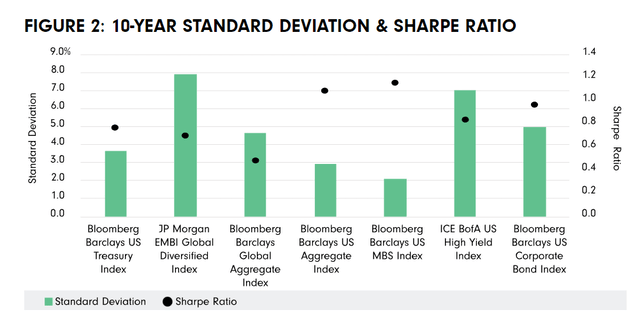

Some investors even claim it is a superior asset class compared to treasuries, as it has exhibited lower volatility and higher Sharpe Ratios (Figure 6).

Figure 6 - 10Yr volatility and Sharpe Ratios of various asset classes (diamond-hill.com)

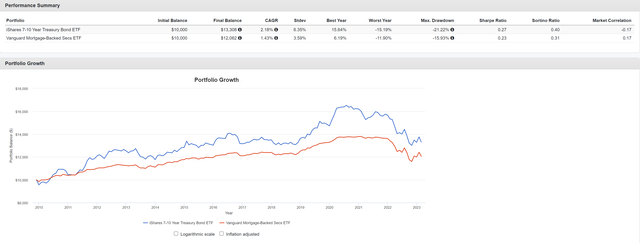

Therefore, it might be instructive to compare VMBS with a treasury bond ETF with a similar duration profile, such as the iShares 7-10 Year Treasury Bond ETF (IEF). The IEF ETF has a 7.7 year duration and has paid a trailing 2.2% distribution yield.

Comparing VMBS to IEF using Portfolio Visualizer, we can see that VMBS indeed does have a lower volatility compared to the IEF ETF, in the period from December 2009 (VMBS inception) to February 2023, with volatility of 3.6% vs. 6.4% for IEF (Figure 7).

Figure 7 - VMBS vs. IEF (Author created using Portfolio Visualizer)

However, the IEF ETF has superior CAGR returns of 2.2% vs. only 1.4% for VMBS. Therefore, this results in IEF having superior Sharpe Ratios of 0.27 vs. 0.23 for VMBS. This result is contrary to the conclusion drawn by the Diamond-Hill analysis cited above. The discrepancy could be from the particular index Diamond-Hill used to compare the two asset classes, as well as using a specific historical period.

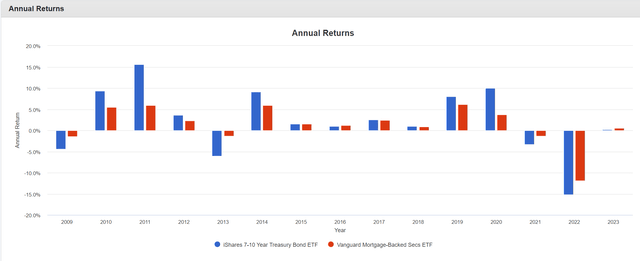

For example, looking at annual returns, we can see IEF significantly outperformed VMBS in 2010 and 2011, years which would have dropped out of a 10-year lookback (Figure 8).

Figure 8 - VMBS vs. IEF annual returns (Author created with Portfolio Visualizer)

MBS Have Skewed Interest Rate Risk

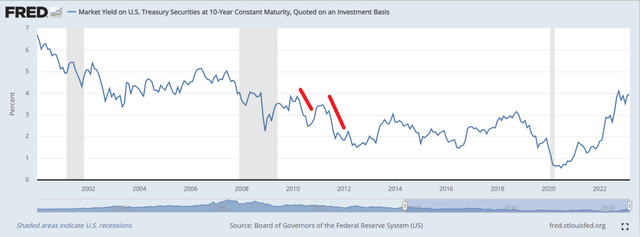

One reason why VMBS may have underperformed the IEF in 2010 and 2011 even though the funds have similar duration profiles is because of pre-payment risk. 2010 and 2011 were characterized by a significant decline in long-term interest rates, modeled as the 10Yr treasury yield in figure 9 below.

Figure 9 - 10Yr treasury yields (St. Louis Fed)

Declining long-term interest rates may cause elevated mortgage pre-payments, as mortgage borrowers refinance their mortgages at lower interest rates. When pre-payments occur, MBS investors must reinvest their principal at the market interest rates, which are usually lower.

On the other hand, when interest rates rise, mortgage-borrowers will have lower than average propensity to refinance. Therefore, in effect, MBS securities have interest rate risk that is skewed to the downside, from higher long-term interest rates.

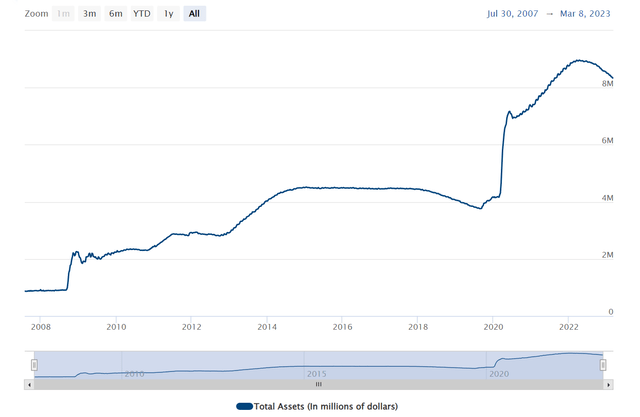

Quantitative Tightening Could Be Headwind For MBS Markets

Another important aspect of the MBS market that investors should be aware of is that after years of quantitative easing ("QE"), the Federal Reserve recently began quantitative tightening ("QT"). During QE, the Fed massively expanded its balance sheet by buying investment securities like MBS in order to stimulate the economy. However, since June 2022, the Fed has begun running off its massive $8 trillion balance sheet, turning from a net buyer of MBS securities to a net seller of MBS securities. Currently, the Fed is allowing $60 billion of treasuries and $35 billion of MBS securities to roll off its balance sheet each month (Figure 10).

Figure 10 - Fed is in process of rolling off its balance sheet (Federal Reserve)

All things equal, the MBS market will face headwinds from the Fed flipping from being a net buyer to a net seller of MBS securities.

Conclusion

The VMBS ETF provides exposure to MBS securities issued by U.S. government agencies like Fannie Mae. The VMBS ETF has historically provided low volatility and modest returns. However, 2022 was a bad year due to interest rate losses from the portfolio's modestly high duration.

Looking forward, MBS securities may continue to struggle, as I fear interest rates will stay 'higher for longer'. With treasury bills yielding north of 4%, VMBS's 2.6% distribution yield is fast becoming unattractive. Finally, with the Fed in the early days of its quantitative tightening program, MBS securities may face additional headwinds as the Fed turns from being a large net-buyer of MBS securities into a net-seller.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.