Enphase Is Transforming Itself Into A One-Stop Solar Solutions Company

Summary

- Transformation into a solar energy management systems company bodes well for future growth.

- Continued strong solar installation demand and inverter capacity growth will power growth in 2023.

- While growth prospects are strong, the stock isn't cheap.

Sundry Photography

Enphase (NASDAQ:ENPH) is currently in the midst of transforming itself from a simple producer of microinverters in the solar industry into a fully integrated home energy solutions company that not only provides inverters, but also offers solar batteries, EV chargers, and IOT solutions. Continued strong solar installation growth along with new product offerings and a continued push into Europe bode well for future growth.

Company Profile

Enphase is primarily a supplier of microinverters to the solar industry, although it has started to migrate to a fully integrated home energy solutions consisting of four key parts: microinverters, AC batteries, communications gateways, and cloud management systems. Solar microinverters take the direct current (DC) power from solar panels and coverts it to alternating current (AC), which is the form of electricity a home uses.

Inverter market

To understand ENPH, it is good to have a basic understanding of the solar inverter market.

Up until about 2019, string inverters had traditionally been the standard in the solar industry. They send the power produced by solar panels to a central inverter that changes it from DC to usable AC power for your home.

On the other hand, microinverters, like the kind ENPH produces, convert DC to AC power at each individual panel and allow for monitoring and power regulation at the panel level. This is useful for homes that are located somewhere that get shade from trees or other buildings, and it's easier to expand a system with microinverters. However, they are more expensive than string inverters.

A third option is to use power optimizers, which are a combination of both string and microinverters. According to solar.com, a power optimizer is "a module-level power electronic (MLPE) device that increases the solar panel system's energy output by constantly measuring the maximum power point tracking (MPPT) of each individual solar panel and adjusts DC characteristics to maximize energy output. The panel optimizers relay performance characteristics via a monitoring system to facilitate operations and any necessary solar panel maintenance." The inverters from competitor SolarEdge (SEDG) use power optimizers.

Opportunities

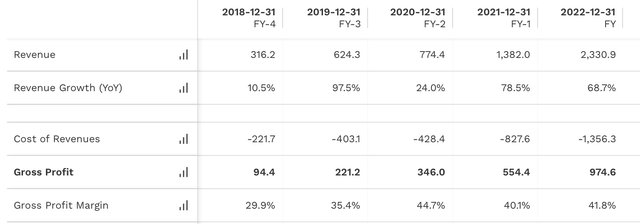

One of ENPH's biggest opportunities is continued production capacity expansion to meet the strong demand for solar invertors. ENPH began to see explosive growth in the microinverter market in 2019 following a 2018 deal with SunPower (SPWR), the 4th largest solar installer in California, to be their sole supplier of microinverters for a period of five years. The company quickly expanded capacity to meet strong demand, and the combination of increased scale and strong demand also led to stronger margins.

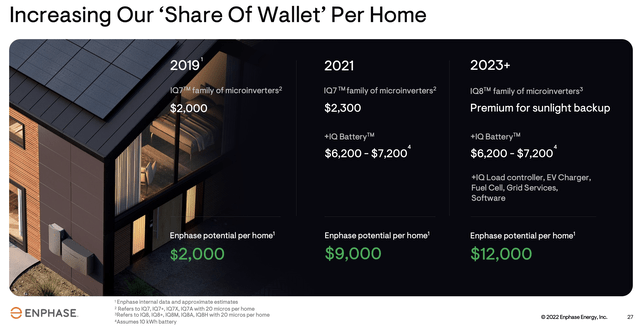

ENPH's foray into batteries is another big opportunity. Its IQ batter costs about 3x the $2,300 its inverters cost for a typical solar installation, and it's still in the early phases of adoption. The company has seen strong battery growth and should continue to see strong growth following the introduction of its new IQ Battery 5P, which delivers twice the continuous and peak power at lower cost, this year.

Europe has been strong for the company, with ENPH doubling its European revenue in 2021 and then again in 2022. However, it's notable that the company only sells its batteries in Germany and Belgium. Given the European energy crisis, the trend to whole home electrification should help drive battery sales for ENPH as it expands its offerings into more European countries.

Meanwhile, ENPH has been on an acquisition spree the last few years, making 7 acquisitions in 2021 and 2022. These deals have given the company technology related to EV chargers, IOT solutions, testing solutions, home energy management software, and installation proposals. These new offerings should help the company continue in its transformation into a solar energy management systems company that provides multifaceted solutions to residential and commercial customers.

Risks

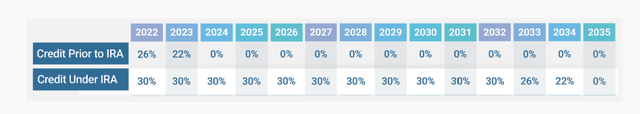

Approximately 70-80% of ENPH revenue comes from the U.S., and solar installations are currently subsidized by the U.S. government. The ITC recently extended its incentive to allow a qualifying homeowner to deduct 30% of the cost of installing residential solar systems from their U.S. federal income taxes until 2032. While this is a positive, there could have be some pull-forward of demand ahead of the ITC extension. That, of course, would be a negative for ENPH.

The company is also very dependent on California, and thus any changes to net energy metering tariffs in the state could negatively impact solar system sales. California recently proposed updating its Net Energy Metering policies in December. The proposed tariff, called NEM3, would charge new solar customers a Grid Access Fee of $8/month per kW of solar installed. This could impact solar installations in the state, although it could also promote the use of battery storage.

Any change in the customer relationship with solar panel installers, including SPWR, is also a risk. At the end of the day, installers are the gateway to the end customer, not an inverter maker like ENPH. And it's unlikely that most customers would ask for a specific type of inverter, let alone one made by a specific company.

Valuation

ENPH currently trades at nearly 29x 2023 EBITDA estimates of $977.7 million. Based on the 2024 consensus projecting EBITDA of $1.34 billion, its trades at a 21x multiple.

On a PE basis, the stock trades at a 38x forward PE ratio. The current consensus is that the company will generate EPS of $5.53 in 2023. For 2024, it is projected to produce EPS of $7.43, which would be good for a PE of 28x based on 2024 estimate.

The company is projected to grow its revenue by 36% in 2023, compared to 69% growth in 2022. For 2024, sales growth is forecast to be a robust 28%.

Q4 Results

For Q4, ENPH recorded revenue of $724.7 million, up 76%. Sequentially revenues rose 14%, with U.S. sales increasing 15% and Europe 21%. It shipped 4,873,702 microinverters and 122.1 megawatt hours of IQ Batteries. Analysts were looking for revenue of $703.2 million.

Gross margins were 42.9%, while adjusted gross margins came in at 43.8%.

The company reported adjusted EPS of $1.51 versus the $1.26 consensus.

Looking forward, ENPH guided for Q1 2023 revenue of between $700-740 million, with adjusted gross margins between 41-44%. The consensus was for sales of $682.3 million.

Conclusion

From 2014 through 2018, ENPH sales fell ($344M, $357M, $323M, $286M, $316M) -8%, before nearly doubling in 2019 ($624M) and growing strongly since. Prior to the company's renaissance, its product offering was generally viewed as better than string inverters, but more expensive. Thus, solar panel installers often chose strong inverters to better compete on price.

Pricing is still about 20% more expensive for microinverters, but the overall advantages of microinverters have seen them become more popular for installers in recent years, allowing ENPH to ride the solar panel installation wave.

In the meantime, the company has smartly begun transforming itself from just a simple microinverter producer into a solar energy management systems company with numerous related offerings for residential and commercial end users. Being able to provide whole home solar solutions including solar with battery and EV chargers makes a lot sense, and should continue to power ENPH's growth for years to come.

Trading at ~38x on a forward PE basis and 29x EBITDA, the stock does not appear cheap. However, those number are likely low given the company's momentum. I like the direction the company is headed; however, I still think we could see a stock market correction later this year. As such, I'd prefer to be a buyer under $180 if we do indeed get a market correction.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.