Cleveland-Cliffs: Steel Is Hot And The Stock Is Cheap, But There's More

Summary

- Cleveland-Cliffs Inc. is well positioned for a stronger steel market. Steel prices are way past the lows of 2022.

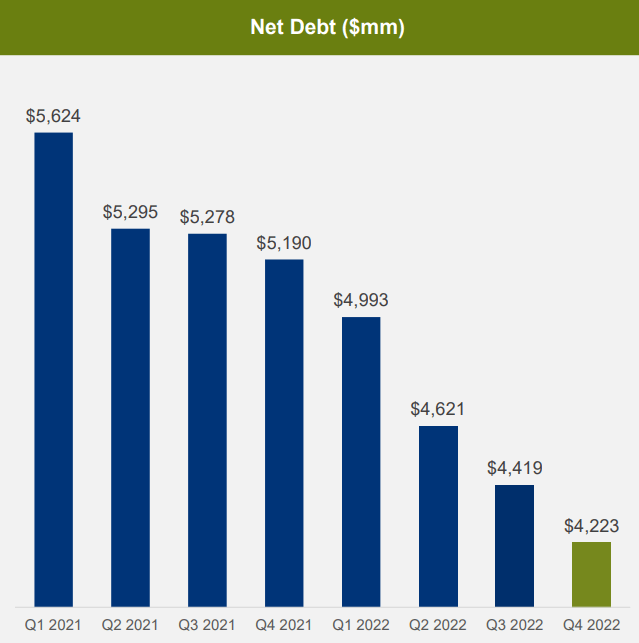

- Cleveland-Cliffs' balance sheet carries more than $5 billion in debt plus pensions. This will get in the way of significant shareholder returns.

- Cleveland-Cliffs is cheaply priced on a trailing basis. But how should we think looking ahead?

- I do much more than just articles at Deep Value Returns: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

AlexLMX

Investment Thesis

Cleveland-Cliffs Inc. (NYSE:CLF) has seen its stock take a breather in the past several weeks. But I believe that 2023 is likely to be even better than 2022.

Not only because steel prices are much stronger than how prices ended in 2022. But also, CLF's production costs will not be a headwind for its income statement.

Even though there are some blemishes to this investment thesis, overall it's difficult not to be bullish on Cleveland-Cliffs Inc. stock.

Getting Context, Why Steel Stocks?

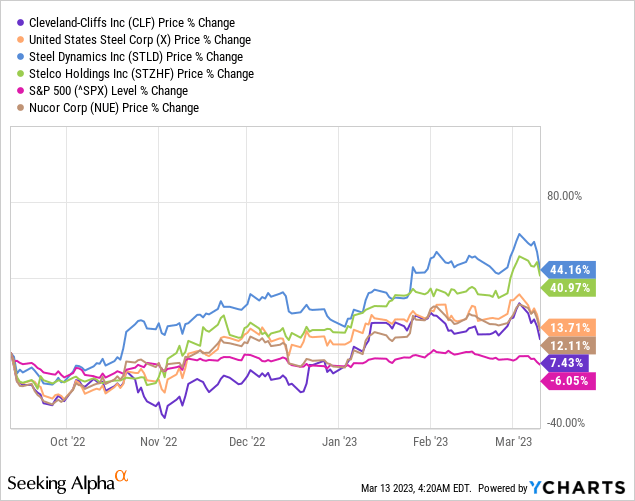

Above is a random basket of steel stocks. I've not cherry-picked my data, I've simply displayed the performance of the past 6 months for steel stocks. And to be sure, past performance is no guarantee of future results.

My point here is to highlight two considerations.

Firstly, without being a genius, simply being invested in steel stocks in the past 6 months would have seen an investor outperform the S&P 500 (SP500) by a wide margin. In fact, recall the past 6 months have been brutal for investors.

If we put aside the mega caps which have been masking a lot of the carnage in a market cap-based index, investors have been left licking their wounds.

Secondly, steel's fundamentals are solid, with steel prices making a comeback.

Now, to be clear, even though the narrative facing steel prices has revolved around China's property market, I contend that there's more to the steel demand story than just China's property market.

Let me put steel demand into context. China is the biggest consumer of steel. Some estimates put China's annual consumption at 50% of demand, and with China's real estate perhaps reaching 40% of its total annual consumption.

Essentially, this means that China plays a big role in steel prices, but it's not the only driver for steel.

Why Cleveland-Cliffs?

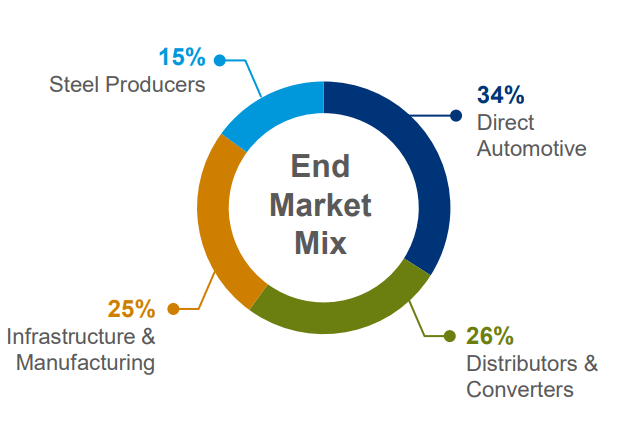

CLF Q4 presentation

There are two main reasons why CLF is an attractive investment.

Firstly, its end markets. CLF is one of the largest suppliers of steel to the automotive industry in North America. This led CLF's charismatic CEO Lourenco Goncalves to state:

The ability of our company to service the automotive industry is at our deepest core. Our team's knowledge of automotive clients enables us to effectively anticipate their needs.

We have a proven track record of consistent performance.

Accordingly, if one believes that demand for vehicles will continue to rise, that would directly impact CLF's prospects. Goncalves continued:

So in an environment where commodity flat rolled steel pricing decreased 65% in a little over one year time period, we were able to achieve decent increases on our automotive contracts without sacrificing sales volume.

We are actually expecting higher sales volume to the automotive sector in 2023 than in 2022.

Secondly, steel manufacturers in North America had a horrible cost structure in 2022. Not only were natural gas prices soaring high, which were one of the main input costs in steel production, but also, there was ravaging inflation percolating through the whole steel sector.

As we now look forward to 2023, I believe that most sensible estimates call for more muted inflation, plus significantly lower natural gas prices.

Together, these two considerations support strong prospects for CLF.

CLF is Cheaply Valued

On a trailing basis, CLF reported $1.5 billion of free cash flow in 2022. This puts the stock at less than 7x trailing free cash flows and that's the end of this story, right?

Well, not so fast. Here's the main bearish concern facing CLF.

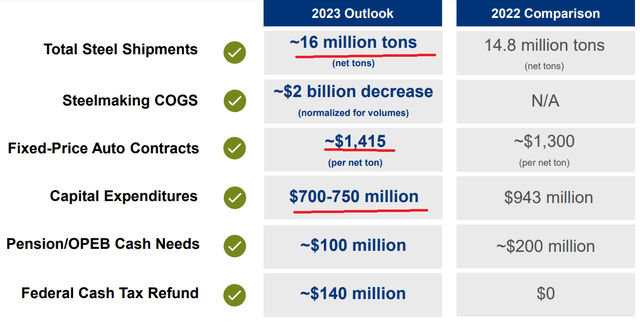

CLF Q4 presentation

Including its pension liabilities, CLF holds $5 billion in debt plus liabilities. This implies that if CLF were to aggressively pay down its debt and pensions over the next 2 years, the business would still be significantly leveraged.

That being said, consider its outlook for 2023.

CLF has already guided that it's going to benefit from higher steel prices in 2023 compared with 2022 and that it's going to increase its shipments this year by around 8% y/y.

Furthermore, it's able to increase its steel output while bringing down its total capex requirements.

The Bottom Line

In conclusion, Cleveland-Cliffs is well-positioned for a strong steel market. Meanwhile, the stock is still cheaply valued. That being said, there are a lot of nuances that investors must be aware of.

The main bearish concern is that CLF's balance sheet doesn't leave CLF with much flexibility to dramatically ramp up shareholder returns. Indeed, CLF's management implies this much in its recent earnings call.

That being said, if one is of the opinion that steel prices are way past the trough prices of 2022 and that 2023 steel prices will be stronger than 2022, paying 7x trailing free cash flows, makes Cleveland-Cliffs Inc. an attractive investment opportunity.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.