Biotechs Reel From SVB Collapse, But Not All May Be Bad

Summary

- The collapse of Silicon Valley Bank led to a market-wide selloff and caused significant volatility in biotech and technology stocks.

- Regulators are expected to take swift action this week to contain the crisis.

- Treasury yields experienced a sharp decline due to a flight to safety, which may benefit biotech stocks.

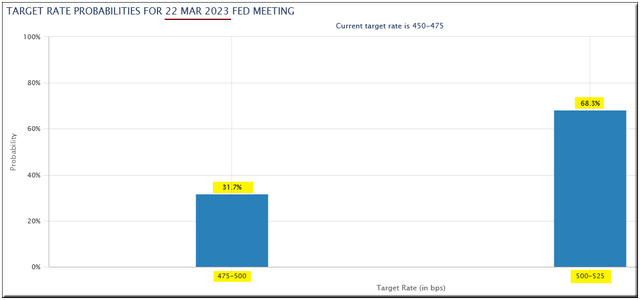

- In light of the developing bank crisis, the Federal Reserve may opt to raise rates by a quarter point at its March 22 meeting, instead of the expected half-point hike.

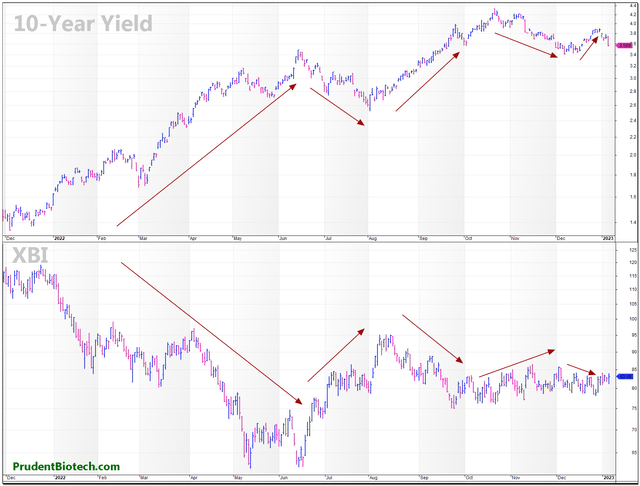

- A lower 10-year yield can support biotech valuations due to a high degree of correlation.

- Looking for a portfolio of ideas like this one? Members of Prudent Healthcare get exclusive access to our subscriber-only portfolios. Learn More »

Henrik5000

SVB Rattles The Market

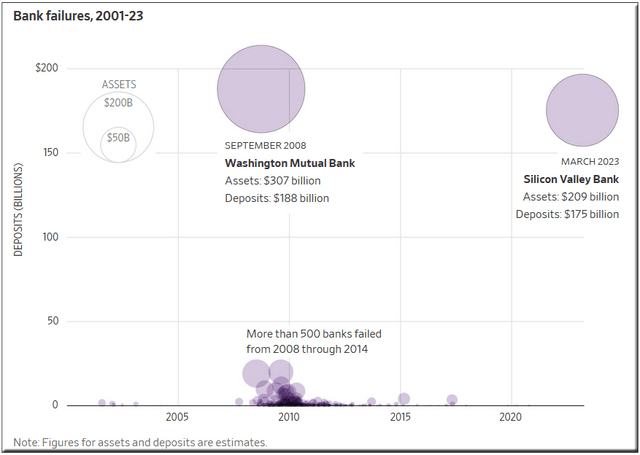

The financial markets were jolted last week by the collapse of Silicon Valley Bank (SVB), the 16th largest lender in the US with assets over $200 billion. The speed with which the bank crumbled under a run on its deposits was astonishing and highlighted how systemic risks can rapidly evolve in a risk-averse environment. This was the second bank failure of the week after Silvergate Bank, which was focused on serving crypto clients and traders, causing investors to worry about where the risk will bubble up next.

Banks are built on trust, and if depositors begin to doubt that their deposits will be available when needed, they will attempt to withdraw their funds, leading to bank runs that can convulse the entire system.

The question that financial markets will attempt to answer this week is whether the closing of two banks in a row indicates the beginning of a contagion. Investors and depositors will now use stricter yardsticks to gauge the health of a bank, and any doubts will trigger a withdrawal first and ask questions later approach. Already, First Republic Bank and Signature Bank are under stress with rapidly falling stock prices and there may be more. Regulators will be hard-pressed to contain the fallout quickly and prevent it from turning into a domino effect that targets smaller regional banks.

Fed Policy Now Likely To Maintain Its Pace Instead of Accelerating It

The Federal Reserve, as the central bank of the nation, is responsible for promoting the stability of the U.S. financial system and containing systemic risks.

It is our belief that the developing bank crisis will nudge the Fed to maintain its pace of rate hikes at its March 21-22 meeting to a quarter-point increase instead of a half-point, as is the present expectation. The Fed must be cautious in containing the banking crisis, even though recent economic data and inflation reports have been stronger than anticipated which has raised expectations for a half-point increase. This adjustment could support market valuations and soothe the financial markets as the crisis is resolved. If the majority expectation shifts down during the coming week, that will be favorable for the stock market.

CME Group, QuikStrike, PrudentBiotech.com

Biotechs Hit Hard For Now, But Lower Yields Should Benefit

SVB's collapse caused major volatility in technology and life sciences stocks, as it had focused on serving clients in these industries (QQQ). Corporate clients of SVB will have limited access to the bank deposits until the situation resolves, and may have additional risk if a large portion of their cash reserves were held at the bank.

The bank failure also caused a sharp selloff in biotech stocks (IBB) (XBI). While the exposure to SVB will begin to be publicly addressed this week by companies, the crisis has also depressed yields, due to increased demand for safe-haven assets, which should benefit biotech valuations. The 10-year yield and biotech valuations have a high inverse correlation, as discussed in the 2023 biotech outlook, and if the yield remains below 4%, it will be helpful for biotech valuations. The 10-year yield ended last week at 3.7%.

Negative Correlation of S&P Biotechnology Index and 10-Year Yield (PrudentBiotech.com)

Biotech portfolios will need to be adjusted based on exposure to SVB. The broad-based selling of biotech stocks last week may prove unjustified for most companies. If no further issues emerge this week and regulators can contain the crisis, the market is likely to stabilize and recover. However, if the banking crisis is not contained and begins to snowball, a shift away from risk will punish riskier industry groups, like biotechs and technology growth companies, more.

| The Best Time to Plant an Oak was 20 Years Ago. The Next Best Time is Now! |

Prudent Healthcare is focused on seizing the promise of healthcare through its quantitatively-driven model portfolio. Based on a systematic investing approach, the monthly updated portfolio targets strong risk-adjusted returns outperforming benchmarks.

- How is the Healthcare portfolio doing?

- Leading Healthcare Service, up 64% in 2021

- Leverage the strengths of quantitative investing

- An approach with a strong track record

- Fully refundable offer

- Understand how it works & if it can work for you

The Market Doesn't Wait!

To learn more about building wealth & claim your free trial, please click here.

__________________________________

This article was written by

I have worked as an Analyst on both the Buy (Asset Management) and Sell (Investment Brokerage) sides, as well as in Strategy and Finance roles for technology services companies. For many years, I have been publishing risk-adjusted, return-driven quantitative model portfolios.

We have 3 services - Prudent Healthcare, which is available only on Seeking Alpha, Prudent Biotech, and Prudent Small Cap. You may even register for a Free Monthly Pick from the model portfolios for biotech and small caps on those pages.

We have collaborated with Seeking Alpha to launch a Prudent Healthcare model portfolio, available exclusively in the SA Marketplace. It's a monthly service with a leading track record in healthcare performance.

If you have any questions, please feel free to write to support@PrudentHealthcare.com.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Although there are no personal account positions, SOME STOCKS MENTIONED CAN ALREADY BE PART OF THE PORTFOLIOS OF FAMILY AND ASSOCIATES and retirement accounts like IRAs and can be bought/sold in the next 72 hours. The stocks mentioned may already be part of the Prudent Biotech, Prudent Healthcare, or Prudent Small Cap model portfolios.

As always, kindly do your due diligence. Biotechs and small caps carry a higher risk of losses than the broader market. Opinions can change with time and additional data, with no obligation to update. Companies mentioned here may not be favored in the future as market trend changes and/or new information emerges, and no relevant portfolio updates will be provided unless you are a model portfolio subscriber.

PrudentBiotech.com, PrudentHealthcare.com, PrudentSmallCap.com, Graycell Advisors, or any other associated names and entities are not registered investment advisors (RIA) and publish quantitative-driven model portfolios for investors and RIAs. Stocks mentioned in the article may be in the past, present, or in the future, be part of the various model portfolios for subscribers. Past performance is not a guarantee of future results. The information here is only provided for a general informational purpose and not as a recommendation and is not guaranteed to be complete or accurate.