Pfizer Buys Seagen - Why This Deal May Not Please Shareholders

Summary

- Pfizer Inc. has agreed to acquire Seagen Inc. in a deal worth ~$43bn.

- Pfizer is issuing ~$31bn in long-term debt to finance the deal and paying the remainder in cash.

- Seagen is an antibody drug conjugate ("ADC") pioneer with 4 approved drugs that earned revenues >$2bn in FY22. Guidance for 2023 is $2.3bn.

- Pfizer has had cash to burn after the resounding success of its Comirnaty COVID vaccine and COVID antiviral Paxlovid. The company has been on an M&A spree.

- This is not necessarily a deal to get shareholders excited, however. Pfizer has promised Seagen could add $10bn to its top line by 2030. There are obvious risks, however, that may outweigh benefits.

- We're about to raise prices at my private investing ideas service, Haggerston BioHealth, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Drew Angerer/Getty Images News

Investment Overview - Pfizer Had The Answers In The COVID Era & Has Been On A Spending Spree Culminating In The Seagen Buy

Due to the Pfizer Inc. (NYSE:PFE) colossal share count - of listed companies, only Apple (AAPL), Alphabet (GOOG), Amazon (AMZN), Bank of America (BAC), Microsoft (MSFT), and AT&T (T) have more issued shares - and static share price, which is +12.5% over the past 5 years, and rarely sinks lower than $30, or higher than $40, Pfizer stock is often compared to a fixed-income security.

Pfizer's dividend yield of 4.2% (at the time of writing) supports that view - it is comparable to current short-term U.S. Treasury Bill yields and higher than longer-dated T-bills. For years, Pfizer's earnings and operating income was broadly flat, with top line revenues falling between the years 2013 - 2020 from $51.5bn, to $41.7bn, and operating income from $17bn, to $9.8bn.

Since the appointment of current CEO Albert Bourla in late 2018, however, a lot has changed at the company - most significant being the company's partnership with Germany-based biotech BioNTech SE (BNTX) which allowed Pfizer to develop and deliver the Comirnaty vaccine - the most successful vaccine of the pandemic.

Comirnaty revenues totaled $36.8bn in FY21, and $37.8bn in 2022, and Pfizer launched another highly successful COVID drug - the antiviral Paxlovid - in 2022, which earned $18.9bn in revenues globally last year.

The additional ~$57bn of revenues these 2 drugs generated in FY22 allowed Pfizer to report total revenues of $100.3bn - up 23% year-on-year, and up a staggering 140% from its FY21 total of $42bn.

Incredibly, however, Pfizer stock had been in such a slump prior to the pandemic - barely budging in value between 2013 - 2020 - that as the end of the pandemic has brought an end the mega-blockbuster antiviral and vaccine drug revenues.

FY23 guidance is for company-wide revenues of $67 - $71bn, and a decline in earnings per share from $6.58 in FY22, to $3.25 - $3.45 - the share price has lost practically all of the momentum it had gained.

In late 2021, Pfizer's stock price achieved an all-time high value of ~$60, and as recently as January it was still worth >$50 per share. However, the end of the pandemic has triggered pessimism and selloffs, as investors start to wonder how the Pharma will cope without the additional revenue boost of >$55bn per annum?

Pfizer management - led by Bourla - would have been well aware that such a scenario was likely to materialize - governments were not going to keep buying vaccines and anti-virals ad infinitum - and since the company has been generating breathtaking amounts of cashflow, they have been on an M&A spree, culminating in this morning's news that Pfizer will be acquiring Seattle-based cancer drug developer Seagen Inc. (NASDAQ:SGEN) for $229 per share, or $43bn in total, in a cash for share deal.

Pfizer "Invests $43bn To Battle Cancer" - Breaking Down The Seagen Deal

Prior to making today's deal to acquire Seagen, Pfizer made a succession of smaller deals, as I discussed in a recent note on the company:

Since mid-2021 Pfizer has completed: a $2.3bn deal for Trillium Therapeutics and its 2 CD-47 targeting blood cancer drug candidates; a $7bn deal for Arena Pharmaceuticals and its late stage autoimmune candidate Etrasimod; an $11.6bn deal for Biohaven and its lead candidate Nurtec, indicated for migraine treatment; a $5.4bn deal for Global Blood Therapeutics and its ~$200m per annum commercial stage drug Oxbryta, indicated for Sickle Cell Disease ("SCD"), and lead candidate GBT601, which may offer a functional (permanent) cure for SCD; and, finally, a $525m deal for Reviral and its antiviral therapeutics targeting respiratory synctial virus ("RSV").

To add to this near $27bn outlay, Pfizer has now opted to - in the words of the press release announcing the Seagen deal - "Invest $43bn To Battle Cancer."

Seagen is a pioneer within the "Antibody Drug Conjugate" ("ADC") field. Their mechanism of action is described as follows by ADCReview.com:

Antibody-drug conjugates or ADCs are a new class of highly potent biopharmaceutical drug composed of an antibody linked, via a chemical linker, to a biologically active drug or cytotoxic compound.

These targeted agents combine the unique and very sensitive targeting capabilities of antibodies allowing sensitive discrimination between healthy and cancer tissues with the cell-killing ability of cytotoxic drugs.

According to Pfizer's press release, Seagen is responsible for 4 of the 12 ADCs approved by the FDA for commercial use. Seagen markets and sells ADCETRIS, approved to treat Hodgkin's Lymphoma and T-cell Lymphoma, PADCEV, approved for Urothelial (bladder) cancer, and TIVDAK, approved for Cervical Cancer. These 3 drugs earned, respectively, $839m - up 23% year-on-year - $451m - up 33% year-on-year - and $63m - up 923% yoy - in 2022.

Seagen also markets and sells the small molecule tyrosine kinase inhibitor TUKYSA - indicated for breast and colorectal cancer - which earned $353m of revenues last year, up 6% yoy.

Effectively, then, Pfizer is paying a pretty high premium of >25x 2022 revenues to acquire Seagen, and interestingly, despite generating cash flow from operations of $32.5bn and $29.3bn in 2021 and 2022 respectively, the New York based Pharma says it plans to finance the transaction via "$31bn of new, long-term debt, and the balance from a combination of short-term financing and existing cash."

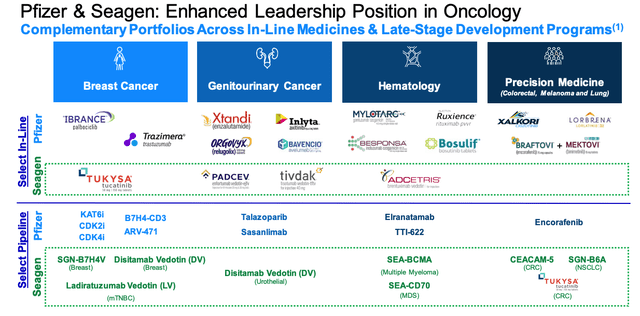

Of course, Pfizer is not just buying Seagen's commercial stage assets but its entire pipeline, also, which it says complements its own Oncology franchise - which consists of an:

industry-leading portfolio of 24 approved innovative cancer medicines that generated $12.1 billion in 2022 revenues, including the best-selling therapies for metastatic breast cancer and prostate cancer. Pfizer's in-line portfolio is focused on four broad, key areas: breast cancer, genitourinary cancer, hematology and precision medicine, complemented by an extensive pipeline of 33 programs in clinical development.

Pfizer says the Seagen acquisition will "double" its early-stage oncology pipeline, and provides more detail in a slide from a presentation discussing the proposed acquisition.

Pfizer / Seagen combined commercial and pipeline assets (Pfizer presentation)

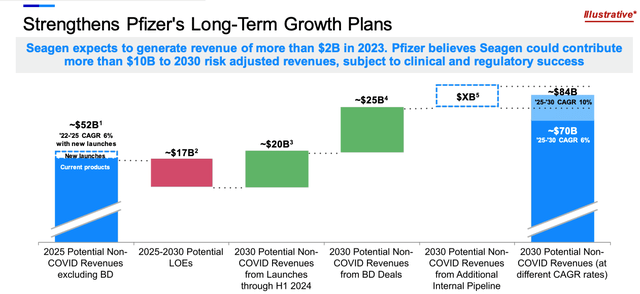

In fact, Pfizer believes that Seagen could contribute >$10bn to its 2030 risk-adjusted revenues, as the company plots its way to grow from a forecast ~$52bn of non-COVID revenues in FY25, to nearly $85bn in revenues by 2030.

Pfizer's long-term growth plans (Pfizer presentation)

Breaking this growth plan down, the math is interesting. Of the $25bn in new revenues from business development, Pfizer expects to generate ~$10bn in peak sales from Seagen, which it plans to spend $43bn acquiring, and presumably, the remaining $15bn per annum from its other buyouts e.g. Arena, Biohaven, Global Blood Therapeutics etc. - which its spent ~$27bn acquiring. Effectively, Pfizer is spending ~$16bn more on Seagen, for a return of ~$5bn less.

The Logic Behind The Deal - A Massive, Potentially Misguided Investment In R&D

1 year ago, rumors were circulating that Seagen was in advanced stage talks with Merck & Co over a buyout, the price under discussion ~$40bn, or >$200 per share. Seagen's ADCs would no doubt have been highly complimentary to Merck's mega-blockbuster cancer drug Keytruda, the immune checkpoint inhibitor ("ICI"), and help grow Merck's oncology pipeline, which consists of just 2 other drugs marketed and sold by a third party.

For whatever reason, however, that deal fell through. Meanwhile, Seagen said goodbye to its long-term CEO - one of the best paid in the biotech, Clay Siegall - who resigned after being arrested for domestic abuse.

Seagen is forecasting for ~$2.2bn of revenues in FY23 - or 12% annual growth, which represents attractive if not spectacular growth. Pfizer says the immediate financial impact of its deal will be "neutral to slightly accretive to adjusted EPS in the 3rd / 4th year post-close," and that it will realize ~$1bn in cost efficiencies by the 3rd year post-close.

For a $43bn outlay, shareholders could be forgiven for hoping for more than "neutral to accretive" bottom-line growth. One of the longstanding issues that Pfizer has arguably had is a lack of firepower in its pipeline that would aid growth in its share price.

I have often compared Pfizer and Eli Lilly & Company (LLY) in the past, to illustrate the effect a strong pipeline can have. Lilly enjoys a market cap valuation of ~$300bn, compared to Pfizer, whose market cap is $221bn, yet Lilly generated just $28.5bn of revenues in FY22, versus Pfizer's >$100bn. Lilly's 2022 price to earnings ratio is ~46x, whilst Pfizer's is ~7x.

The reason? Analysts believe that Lilly's drug Tirzepatide - already approved under the brand name Mounjaro, and likely to be approved in the additional indication of weight loss - could be an all-time best-selling drug. Lilly's Alzheimer's drug Donanemab could also be approved this year or next, and could be a long-term $10 - $20bn seller, analysts have suggested.

In other words, investors are buying Lilly stock in anticipation of "jam tomorrow" - an explosion in revenues going forward. Pfizer has just experienced its own revenue explosion thanks to Comirnaty and Paxlovoid, but whilst Tirzpeatide and Donanemab could be around for decades, Pfizer's vaccine and antiviral may never make >~$5bn sales per annum again.

In that context, it's easy to be critical of Pfizer's deal for Seagen. ADCs are an exciting new field of drug development, but they have not had the impact on the oncology field that some may have hoped, at least in terms of revenue generation.

Based on Pfizer's forecast for a maximum of $10bn in Seagen product revenues by 2030, it seems Pfizer does not believe Seagen's ADCs have genuinely transformative revenue generation potential like a Tirzepatide, or an HIV drug like Gilead Sciences (GILD) Biktarvy for example. So why issue >$30bn of new debt and pay an additional >$10bn in cash to buy the company?

An optimist would likely argue that CEO Bourla wants to invest in genuinely transformative drugs and sees ADCs as the future of cancer therapy, although they tend to have greater efficacy when used in combo with existing drugs.

There are some attractive market opportunities - non-small cell lung cancer ("NSCLC"), breast cancer, and hematological cancers such as multiple myeloma ("MM"), but it is worth noting that, as much as it is impressive that Seagen is responsible for 4 of 12 ADC drug approvals, that conversely means rival drug developers are responsible for the majority of all ADC drug approvals.

Pfizer is not apparently buying a company with an iron grip on its MoA, or patent protection stretching into the next decade, nor it is buying a stand out drug that can drive >$10bn per annum in revenue long term, as, for example, AbbVie did when buying Pharmacyclics and its blood cancer drug Imbruvica for ~$21bn.

If anything, the ~$7bn that Pfizer paid for Arena and its lead drug Etrasimod may end up driving more revenues - given its best-in-class MoA and target markets within the $100bn per annum auto-immune markets - than Seagen and its ADCs ever will.

Conclusion - A Confusing Deal For Pfizer To Make, Unlikely To Drive Share Price Upside

To summarize, today's news that Pfizer Inc. intends to acquire Seagen for $229 per share - a premium of 33% to its Friday close price - I would argue that it is an intriguing deal from an R&D perspective, but not necessarily one that will drag Pfizer out of its post-COVID share price slump.

In fact, to return to my introductory paragraphs, if anything this returns Pfizer stock to the status of "more fixed income than equity", given that Seagen may produce just enough benefit for Pfizer to justify the outlay over a decade or more.

When we consider the risks of the deal - namely that ADCs fail to deliver on their early promise, are overtaken by potentially more effective oncology therapies in development such as cell therapy, gene editing, or messenger RNA driven personalized cancer vaccines ("PCVs"), or become marginalized within Pfizer's very large, if slightly unproductive cancer pipeline - then paying in excess of $40bn for the Seagen almost seems misguided.

The financing of the deal also seems odd. Pfizer reported >$51bn of near-term assets as of YE22, current liabilities of $42bn, and long term liabilities of >$100bn. Why not use some of that cash to reduce debt, initiate a share buyback program to offer shareholders some guaranteed value, or use the cash to buy Seagen, rather than taking on even more debt amidst an uncertain prevailing economic environment?

In some respects, the Seagen buyout may be an admirable deal to make - Pfizer has the size and scale to extract the maximum possible value from these ADC programs, develop the technology and roll it out to as many patients as possible. As mentioned, however, that plan only works if ADCs offer a best-in-class therapeutic option, which is not yet established in fact, or if Seagen has a monopoly on ADCs which it does not.

In some ways, Pfizer's Seagen buyout does make a great deal of sense, at least from a Wall Street analysts' perspective, and possibly even from an R&D perspective - unless Pfizer's pipeline is thinner than the company has been making out.

Clearly, Pfizer has taken the time to consider what the best M&A options in the biotech market were, having become flush with cash, and oncology is every large Pharma's favorite investment to make, due to the size and scale of the markets and the unmet need (even if, e.g., autoimmune markets are just as large, and potentially less risky, and weight loss / diabetes offers untold reward).

From a shareholder's perspective, this may, therefore, be a deal that is hard to love, that offers less from a top and bottom line perspective and is more risky than any other deal Pfizer Inc. has done since the COVID cash came rolling in.

When, in a decade's time, the peak revenues per annum are finally extracted from Seagen, investors buying shares today will likely be able to sell them for the same price they bought them, having benefitted from a decade of ~4% per annum dividend yields. That is not necessarily the best sales pitch within the Big Pharma field, or even close to the best, but it is a pitch nonetheless.

After its sensational COVID era highlights, Pfizer Inc. appears to have returned to the same value proposition it was offering last decade, when investors rarely needed to bother checking the share price, because it hardly ever moved.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.

This article was written by

I write about Biotech, Pharma and Healthcare stocks and share investment tips. Find me at my marketplace channel, Haggerston BioHealth - model portfolio + 4 exclusive stock tips every week. I'm on twitter @edmundingham

Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.