IBM: Total Returns May Surprise You

Summary

- IBM's share price weakness belies its underlying strengths and forward potential.

- It's transitioning into growth areas including hybrid cloud and AI, a move that's been validated by tech peers.

- Long-term value and income investors may see potentially strong returns from the current discounted price and high yield.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

Khosrork

IBM (NYSE:IBM) is a stock that's definitely seen its ups and downs over the past few years. That's why it pays to buy it when it's trading at a trough, when market sentiment is working against it.

This appears to have worked since my last bullish take on the stock in October of 2020. Since then, the stock has given investors a total return of 20%, surpassing the 12% change in the S&P 500 (SPY) over the same timeframe.

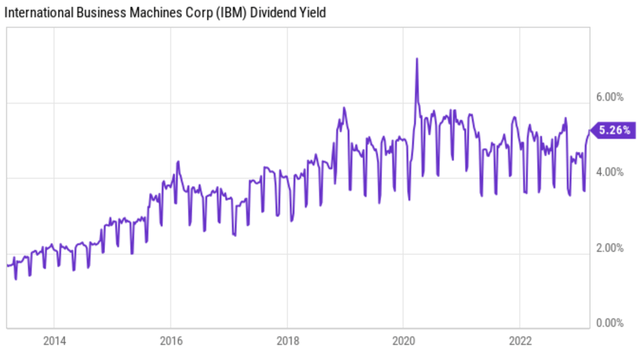

As one might guess, much of the return was driven by dividends, and buying a stock when the yield is high is very helpful for long-term returns, especially when that dividend is maintained or raised.

Such appears to be the case again with IBM which as shown below, is now trading well below its 52-week high of $153, pushing its dividend yield up to 5.3%. Let's explore why now may be an ideal time to start layering into IBM while it's in value range.

Why IBM?

IBM has been a value stock in the tech sector for quite some time, with the only question being how much of a value it is. This is reflected by IBM's current PE of just 13.2, sitting just under half of that of cloud computing juggernaut, Microsoft (MSFT), which carries a hefty forward PE of 26.6x.

Despite no longer being one of the premier names in tech, IBM does hold its own in many respects. This includes having a hand in many aspects of its customers' IT needs, including software, IT services, consulting, and hardware.

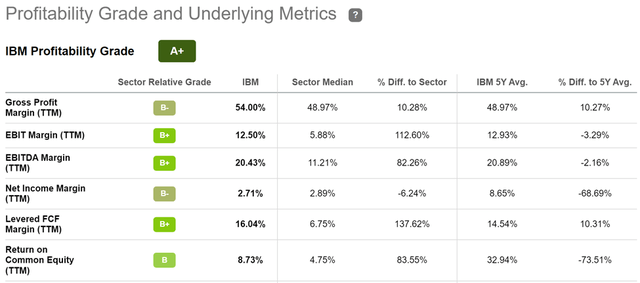

More recently, IBM has been investing heavily in its cloud offerings, including hybrid cloud, with Red Hat and OpenShift, and is building AI and machine learning expertise. IBM's scale and reach enables solid profitability, as reflected by it's A+ grade. As shown below, IBM carries gross profit and EBITDA margins that are in excess of the sector median.

Meanwhile, IBM isn't exactly doing as poorly as its share price performance would suggest, as it managed to grow revenue by 6% on a constant currency basis during the fourth quarter. This was driven by growth in software, consulting, and infrastructure lines of businesses, all three of which saw constant currency revenue growth in the 7% to 9% range.

Management also noted that clients in all geographies were increasingly embracing its hybrid cloud and AI solutions. This makes sense, as public cloud growth with the likes of Amazon (AMZN) has slowed down this year. Hybrid cloud gives customers more flexibility and control over their cloud environments, and may continue to gain traction with enterprises.

Looking ahead, IBM continues to transform itself, as it made over 30 acquisitions since the current CEO took the helm, while disposing of 17 legacy businesses. The underlying objective has been to transform IBM into a more hybrid cloud and AI-centric company. Management highlighted the portfolio repositioning during this month's Morgan Stanley (MS) Tech Conference:

We have now a hybrid cloud platform-centric business model that has a compelling value proposition around an economic multiplier of software, consulting and infrastructure. We have repositioned our portfolio. Now our growth vectors that being software and consulting is now over 70% of our revenue profile, driving nice sustainable growth. And we've got a high-value recurring revenue book of business that's over 50% of IBM's revenue that's growing nicely. So a lot of work around the portfolio to get streamlined, focused on where we can win and how we can win.

It appears that in addition to hybrid cloud, the continued move towards AI is a right one, as IBM was an early pioneer in the space with Watson. This appears to be validated by traction in the space from Microsoft, Google (GOOG), and even Meta Platforms (META), as Mark Zuckerberg has been quietly moving away from the Metaverse with investments into AI.

Importantly, IBM appears to be well-positioned in the current high interest rate environment, as it carries an A- rated balance sheet. The recent share price weakness has also pushed IBM's yield to 5.3%. The dividend is covered by a 72% payout ratio and comes with 23 years of consecutive growth. As shown below, IBM's dividend yield is now again sitting toward the high end of its historical range.

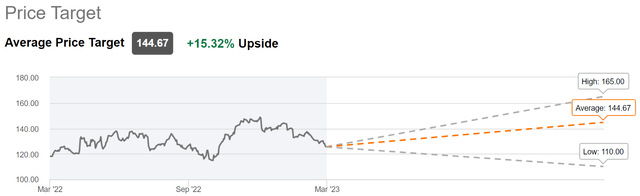

Lastly, I see value in IBM at the current price of $125.45 with a forward PE of 13.2. While analysts' forecast of 6% annual EPS growth over the next two years isn't particularly high, it doesn't have to be, considering the low valuation and IBM's steady dividend track record. Analysts also have an average price target of $144.67, which could translate to a potential 21% total return over the next 12 months.

Investor Takeaway

IBM's share price weakness has pushed the stock into value territory with a dividend yield of 5.3%. IBM is no longer a 'tech dinosaur' as it appears to be on the right track with its hybrid cloud and AI investments. With a high yield and low expectations from the market, IBM could deliver potentially strong returns for investors going forward. As such, long-term income and value investors may want to consider layering in at present levels.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we've got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have a beneficial long position in the shares of IBM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.