Tracking David Tepper's Appaloosa Management Portfolio - Q4 2022 Update

Summary

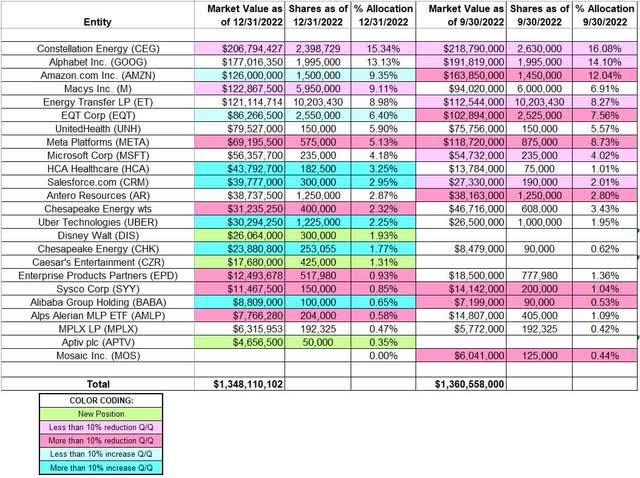

- David Tepper’s 13F portfolio value decreased from $1.36B to $1.35B this quarter.

- Appaloosa increased HCA Healthcare, Salesforce.com, and Uber Technologies while reducing Meta Platforms, Enterprise Product Partners, Sysco Corp, and Alps Alerian MLP ETF.

- Constellation Energy, Alphabet, Amazon.com, Macy's, and Energy Transfer LP are the five largest positions.

Brad Barket

This article is part of a series that provides an ongoing analysis of the changes made to David Tepper's 13F portfolio on a quarterly basis. It is based on Appaloosa Management's regulatory 13F Form filed on 2/14/2023. Please visit our Tracking David Tepper's Appaloosa Management Portfolio series to get an idea of his investment philosophy and our previous update for the fund's moves during Q3 2022.

This quarter, Tepper's 13F portfolio value decreased marginally from ~$1.36B to ~$1.35B. The number of holdings decreased from 29 to 23. The top five positions are Constellation Energy, Alphabet, Amazon.com, Macy's, and Energy Transfer LP. They add up to ~56% of the portfolio. To know more about Tepper's distress investing style, check out the book Distress Investing: Principles and Technique.

New Stakes:

Walt Disney (DIS), Caesars Entertainment (CZR), and Aptiv PLC (APTV): These are the new positions this quarter. The 1.93% of the portfolio DIS stake was purchased at prices between ~$84 and ~$107 and the stock currently trades at ~$94. CZR is a 1.31% of the portfolio position established at prices between ~$32 and ~$54 and it is now at $47.31. APTV is a very small 0.35% of the portfolio stake established during the quarter.

Note: all three stakes are back in the portfolio after a quarter's gap.

Stake Disposals:

Mosaic (MOS): MOS was a minutely small 0.44% of the portfolio stake eliminated this quarter.

Stake Increases:

Amazon.com (AMZN): The large (top three) ~9% AMZN stake was purchased in Q1 2019 at prices between ~$75 and ~$91. The next three quarters saw a ~75% stake increase at prices between ~$84.50 and ~$101. There was a ~50% selling from Q1 to Q3 2020 at prices between ~$84 and ~$177. Q4 2020 saw an about turn: ~40% stake increase at prices between ~$150 and ~$172. There was a two-thirds selling over the next three quarters at prices between ~$148 and ~$187. Q1 2022 saw a ~20% stake increase while last quarter there was similar selling. The stock currently trades at ~$91. This quarter saw a minor ~3% stake increase.

EQT Corp. (EQT): EQT is a 6.40% of the portfolio position built over the two quarters through Q3 2021 at prices between ~$16 and ~$23. There was a ~50% reduction over the last three quarters at prices between ~$20 and ~$50. The stock is now at $30.41. This quarter saw a marginal increase.

Chesapeake Energy (CHK) & wts: The ~4% net stake saw the leverage through the warrants decreased and the common stake increased this quarter. The original position is from the conversion of senior debt they held as the company emerged from Chapter 11 bankruptcy in Q1 2021. Since then, both the common and warrant stakes were reduced substantially.

HCA Healthcare (HCA): HCA is a 3.25% of the portfolio position that saw a ~140% stake increase this quarter at prices between ~$185 and ~$245. The stock currently trades at ~$247.

Salesforce.com (CRM): CRM is a ~3% of the portfolio position established in Q2 2022 at prices between ~$156 and ~$221 and the stock is now at ~$173. There was a ~60% stake increase this quarter at prices between ~$128 and ~$165.

Uber Technologies (UBER): UBER is now a 2.25% of the portfolio position. The original large stake was purchased in Q2 2021 at prices between ~$44 and ~$61. Q4 2021 saw that stake almost sold out at prices between ~$36 and ~$48. The position was rebuilt next quarter at prices between ~$29 and ~$44.50 but was again sold down in Q2 2022 at prices between ~$20.50 and ~$36.50. The stock currently trades at ~$31. There was a ~23% stake increase this quarter at prices between ~$24 and ~$32.

Alibaba Group Holding (BABA): The very small 0.65% stake in BABA saw a ~11% increase this quarter.

Stake Decreases:

Constellation Energy (CEG): CEG is currently the largest position in the portfolio at ~15%. It was established in Q2 2022 at prices between ~$53 and ~$67 and the stock currently trades well over that range at ~$78. There was a ~12% trimming in the last two quarters.

Note: Constellation Energy is Exelon's (EXC) power generation and marketing business that was spun off last February.

Macy's, Inc. (M): The large ~9% Macy's stake was almost doubled in Q3 2021 at prices between ~$16 and ~$25. There was a ~45% stake increase next quarter at prices between ~$22 and ~$37. H1 2022 saw a ~40% reduction at prices between ~$17.50 and ~$28. The stock is now at $19.59. There was marginal trimming this quarter.

Meta Platforms (META): META is a ~5% of the portfolio stake established in Q3 2016 at prices between $114 and $131 and increased by ~50% in the following quarter at prices between $115 and $133. H2 2017 saw a stake doubling at prices between $148 and $183. The position has since wavered. Recent activity follows. Q1-Q3 2020 had seen a ~40% selling at prices between $146 and $304 while next quarter saw a ~14% stake increase. The five quarters through Q1 2022 had seen a ~55% selling at prices between ~$187 and ~$382. The stock is currently at ~$180. There was a roughly one-third selling this quarter at prices between ~$89 and ~$142.

Note: META has seen several previous roundtrips in the portfolio. The latest was a 3.28% of the portfolio position established in Q1 2016 at prices between $94 and $116 and sold the following quarter at prices between $109 and $121.

Alps Alerian MLP ETF (AMLP), Enterprise Products Partners (EPD), and Sysco Corp. (SYY): These three very small (less than ~1% of the portfolio each) stakes were reduced this quarter.

Kept Steady:

Alphabet Inc. (GOOG) (GOOGL): GOOG is currently the second largest 13F position at ~13% of the portfolio. It has been a significant presence in the portfolio since Q1 2012 and the original purchase was at prices between ~$14.50 and ~$16.25. The stake has wavered. Recent activity follows: Q1-Q3 2020 saw a ~40% reduction at prices between ~$53 and ~$86. That was followed with a ~60% reduction over the six quarters through Q2 2022 at prices between ~$87 and ~$151. The stock currently trades at ~$91.

Energy Transfer LP (ET): Energy Transfer Partners merged with Energy Transfer Equity and the resulting entity was renamed Energy Transfer LP. The transaction closed last January, and terms were 1.28 shares of ETE for each ETP. Tepper held shares in both and those got converted to ET shares. There was a stake doubling in Q4 2019 at prices between $11 and $13. Next three quarters saw the stake again doubled at prices between $4.55 and $13.75 while Q2 2021 saw a ~45% selling at prices between ~$7.70 and ~$11.35. The stock is now at $12.60, and the stake is at ~9% of the portfolio.

UnitedHealth (UNH): UNH is now a ~6% of the portfolio position. The stake was built in Q4 2020 and Q1 2021 at prices between ~$305 and ~$377. The next five quarters saw a ~45% selling at prices between ~$367 and ~$546. The stock currently trades at ~$460.

Microsoft (MSFT): The ~4% MSFT stake was built in 2020 at prices between $152 and $232. The two quarters through Q2 2021 had seen a ~45% selling at prices between ~$212 and ~$272. Q1 2022 saw a ~25% stake increase at prices between ~$275 and ~$335 while next quarter there was a roughly one-third reduction at prices between ~$242 and ~$315. The stock currently trades at ~$249. Last quarter saw a ~6% trimming.

Antero Resources (AR): The 2.87% stake in AR was established in Q1 & Q3 2021 at prices between ~$6 and ~$19. There was a ~55% reduction over the last three quarters at prices between ~$17 and ~$48. The stock currently trades at $23.40.

MPLX LP (MPLX): The very small 0.47% stake in MPLX was kept steady this quarter.

The spreadsheet below highlights changes to Tepper's 13F stock holdings in Q4 2022:

David Tepper - Appaloosa's Q4 2022 13F Report Q/Q Comparison (John Vincent (author))

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.