Logitech: Long-Term Growth Opportunity Reaffirmed With Latest Analyst Day

Summary

- I have some concerns about LOGI's near-term performance due to potential weakness in the second half of 2024.

- The Video Collaboration business may be weak due to cautious enterprise spending, but I expect it to continue growing.

- LOGI is also well-positioned to capitalize on the long-term trend of increasing interest in gaming.

- Once revenue growth picks up, LOGI will be in a strong position to experience operating leverage.

Araya Doheny/Getty Images Entertainment

Summary

Post Logitech (NASDAQ:LOGI) recent analyst day, I have come away with a "cautiously optimistic" view of the stock despite some concerns about the company's near-term performance due to a potentially weaker than expected 2FH24, but I remain positive long-term (on a pre-covid trendline). Given the multiple positive takeaways I made from the most recent update, I am recommending a buy rating with a cautious view on 2FH24.

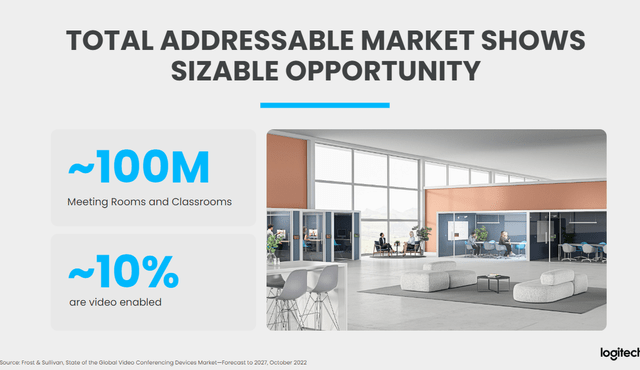

Video Conferencing

Enterprise customers are being conservative with their spending and delaying decisions until later quarters, according to the company's management, which has led to the Video Collaboration business remaining weak. I guess this is especially true in light of recent layoffs and cost-cutting initiatives implemented by a number of large corporations. That said, I see these challenges as short-lived, and I expect LOGI to continue growing at a faster rate over the long-term thanks to the extremely large addressable market. In addition, I think that the long-term growth prospects are reinforced by a shift in customer preferences. I expect more quicker upgrade cycles, as users are seeking more capabilities, and advancements in hardware are enabling more frequent technology upgrades by the company. New mounting options for things like whiteboards show promise for increasing the overall profit of how much each room can fetch. In total, Logitech has doubled its revenue per room over the past few years, and I expect this trend to continue as the large price gap between Logitech and some of its competitors' solutions continues to widen.

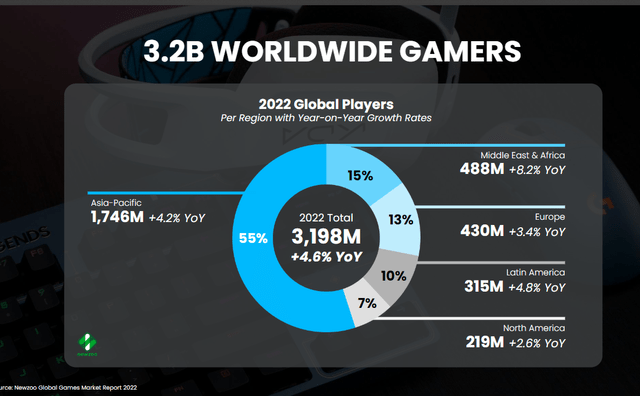

Gaming should help with long-term growth

Using figures from LOGI's investor day, the global gaming population is estimated to be around 3.2 billion, and is expected to continue increasing at low to mid-single digits (I ballpark this at ~4% using last year's growth rate). Despite the recent macroeconomic challenges faced by the gaming industry, I hold the belief that LOGI is in a favorable position to capitalize on the enduring trend of growing interest in gaming and its varied range of products. Additionally, I expect the launch of LOGI Cloud gaming peripherals to significantly expand its addressable market as they launch the cloud streaming gaming service. Moreover, Logitech can benefit from growth prospects in the content creator market as the rising number of users leads to an increased need for Logitech's hardware and software products.

Inventory and margins

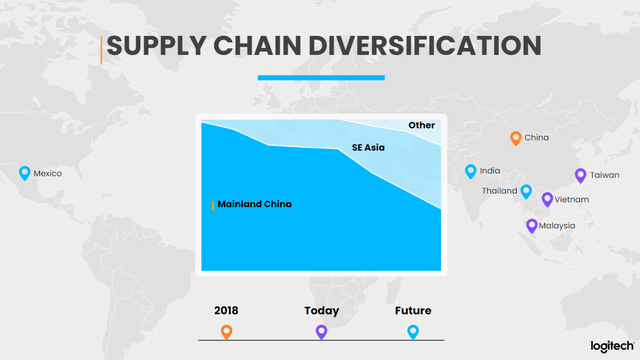

It is heartening to see that, internally, management is working to decrease stockpiles after deliberately building them up to meet surging demand during the pandemic. I see that inventory levels have been going down sequentially for three quarters, and I believe that channel stock is at a manageable level. In my opinion, the company will be in a strong position to reap the benefits of margin upside once growth resumes thanks to its adaptable approach to managing operating costs and inventory during the transition period. Last but not least, I'd like to point out that LOGI has already automated about 75% of its own factory's operations and is on track to relocate production capacity outside of China. In my opinion, these measures will help the company avoid the supply chain disruptions that have plagued it in recent months. Long-term increases in revenue will also lead to improved gross margins thanks to factors like declining freight costs, a shift in the product mix toward Video Conferencing, and the ability to leverage fixed costs.

Guidance

While management only provided guidance for 1FH24 revenue and operating income due to lack of visibility, normal seasonality suggests that FY24 revenue will decline low-double digits on an annual basis and FY24 operating income will be close to around $400+ million. The result would be a revenue and operating income trendline for LOGI that is relatively close to what it was before COVID. This guidance is great because it has helped to reset investors' expectations. Yet, my main concern is that management is only providing guidance based on 1FH24 outcomes. I understand that predicting the outcome of 2FH24 is a challenging task, however, considering the fact that the management began to acknowledge the vulnerabilities of the enterprise only in the latter part of January and the possibility of high channel inventories, it can be inferred that the growth rate of 2FH24 might not meet the seasonal rate. Because of the uncertainty surrounding 2FH24, I believe the stock may experience elevated levels of volatility until more clarity is provided.

Nevertheless, I believe that Logitech's continued investment in R&D will allow the company to keep or expand its market share in key areas like video conferencing and gaming. In my opinion, once LOGI's revenue growth picks up, it will be in a strong position to experience operating leverage thanks to its emphasis on cost control to offset some of the higher costs. Another good news item is that management has reaffirmed its commitment to the long-term goals of its business model.

Conclusion

Post the analyst day, despite some concerns about LOGI near-term performance due to potential weakness in the second half of 2024, I recommend a buy rating with cautiously optimistic view, taking into account the multiple positive takeaways from the update. Specifically, the Video Collaboration business may be weak due to cautious enterprise spending, but I believe these headwinds are temporary, and the business will grow at a rate higher than the group average growth rate. Logitech is also well-positioned to capitalize on the long-term trend of increasing interest in gaming, and the launch of Logitech Cloud gaming peripherals is expected to expand its addressable market. I also believe Logitech's continued investment in R&D will allow it to keep or expand its market share in key areas, and the company will be in a strong position to experience operating leverage once revenue growth picks up. Overall, I have a positive long-term view of LOGI's growth prospects.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.