3 Companies To Ride An Inevitable Trend

Summary

- There are top-down and bottom-up investors. We explain how they differ.

- The top-down approach can focus on riding a long-term trend through investments in companies in different industries.

- We explain the trend of more advanced and cleaner vehicles and how 3 companies in completely different industries should benefit from it.

- This idea was discussed in more depth with members of my private investing community, Best Anchor Stocks. Learn More »

gorodenkoff/iStock via Getty Images

Introduction

There are many ways to source investment ideas. Some investors decide to take a top-down approach, while others choose to take a bottom-up approach. In the top-down approach, an investor will first analyze the economics of a particular industry, and if deemed to be investment-worthy, they will then look for outstanding companies inside this industry or invest in the industry as a whole (through an exchange-traded fund ("ETF"), for example). Bottom-up investors take a different route and look for individual companies regardless of industry dynamics.

One approach is not necessarily superior to the other, as an investor can be successful with either or even with a mix of both. In several of our podcast interviews, you can see both approaches at play. François Rochon is more of a bottoms-up investor, where he looks for individual companies regardless of industry appeal (emphasis added):

We don't really focus on industries. We focus on companies and trying to find companies that we believe have something special.

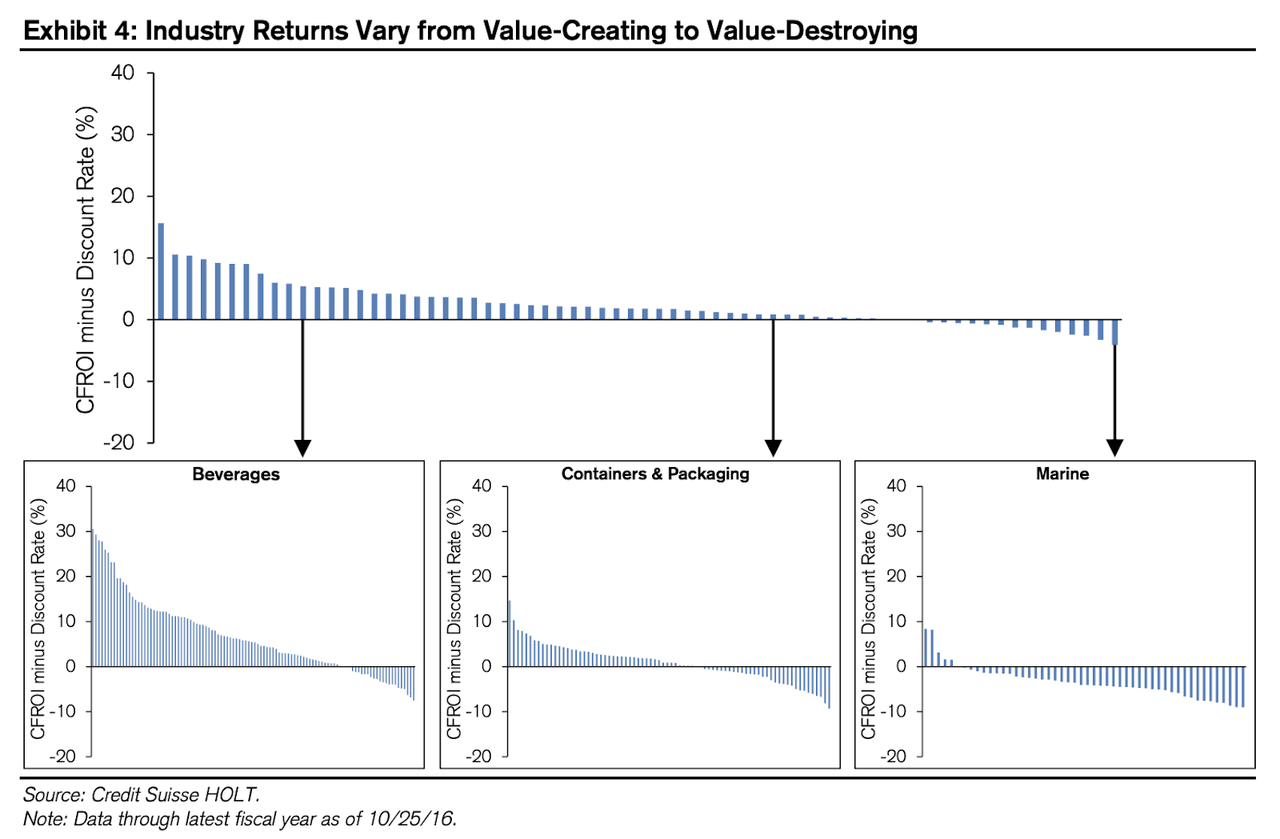

Besides his track record, there’s evidence to support this approach. Michael Mauboussin shared the following image in his paper “Measuring The Moat:”

Michael Mauboussin's "Measuring the Moat"

We can learn two things from these graphs. First, it’s obviously easier to find high-quality companies in industries that enjoy attractive economics. The second lesson, which is also important, is that we can also find high-quality companies in apparently unattractive industries.

Of course, more things have to be taken into account besides industry economics. For example, companies in very attractive industries will likely command an “industry premium” (i.e., they’ll be more expensive) compared to those good companies in unattractive industries. The rationale for this premium is that, in the former, management can have some missteps and still perform well, whereas execution is extremely important in the latter.

Christian Billinger (Chairman of Billinger Forvaltning) is an example of a top-down approach to investing. I think that his portfolio already exemplifies this:

Billinger Forvaltning

You can see how he owns a good number of companies in specific industries. For example, he owns Diageo (DEO), Remy Cointreau (OTCPK:REMYF), Campari (OTCPK:DVDCF), and Heineken (OTCQX:HEINY) in the Total Beverage Alcohol Industry. In the Elevator Industry, he holds Kone and Schindler. In the luxury industry, he owns LVMH (OTCPK:LVMHF) and Hermes (OTCPK:HESAY). When we asked Christian about the benefits of this approach, he answered the following (emphasis added):

There's significant sort of economies of scale if you own two companies, especially if it's a slightly oligopolistic environment.

So elevators for instance, there's four large companies. If I know Kone, I will have a very good understanding of what drives Schindler's returns, the sort of growth dynamics, the risks, et cetera. And so if you know one company, you often know an awful lot about the other leading players in that industry already. And that also means you're better able to keep on top of industry developments.

It also means that just owning two large companies or leading players in an industry, you can meaningfully reduce the company specific risk.

Such benefits do look quite attractive for any investor looking to build a strong and “sleep-well” portfolio. It helps with time efficiency and a narrow circle of competence. This said, you shouldn’t try to group yourself in any of these strategies, as you can always use a mix of both (i.e., focusing on an industry and looking for the most appealing player).

In fact, there’s a different type of top-down strategy that, rather than focusing on an industry, focuses on a trend. An investor can identify a durable and inevitable long-term trend and invest in different companies expected to benefit from it. These companies might or might not belong to the same industry, and sometimes you’d be surprised as to how many industries a given trend can “touch.”

In this article, we’ll explain how we used this method of identifying a trend and then looking at companies expected to benefit from it. The trend is the rise of more advanced and “cleaner” cars.

Before going into the companies, let's briefly explain this trend.

Why and how are getting cars more technologically advanced

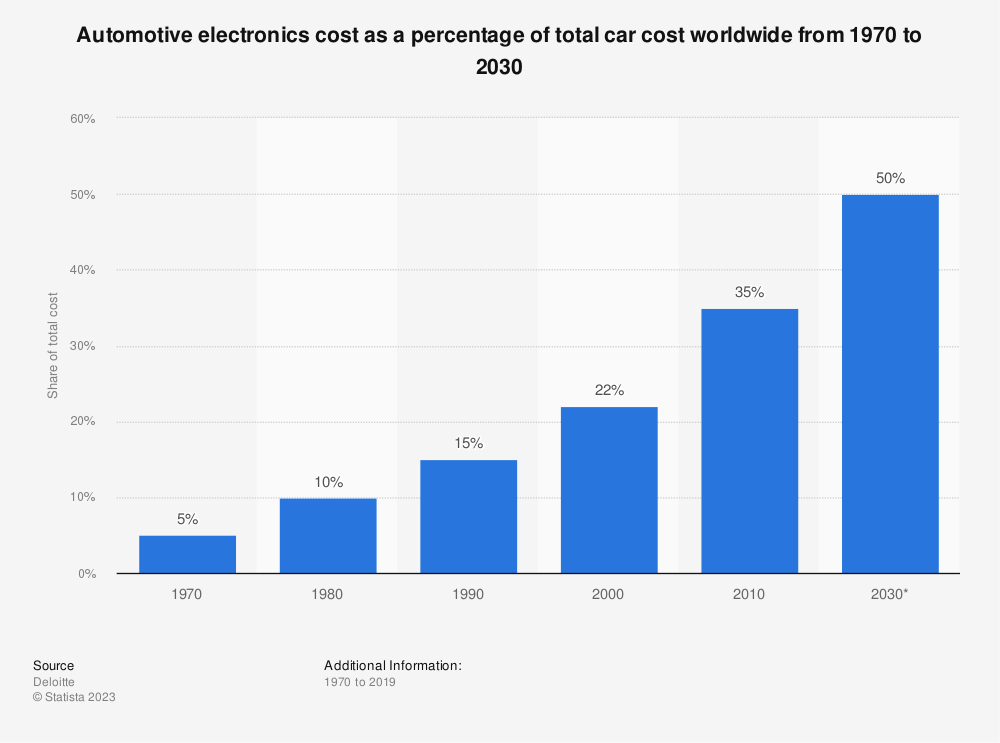

You might have heard somewhere that the semiconductor content in newly manufactured cars is exploding. According to Statista, the electronics cost as a percentage of the total cost of a vehicle is expected to surpass 50% by 2030:

Statista

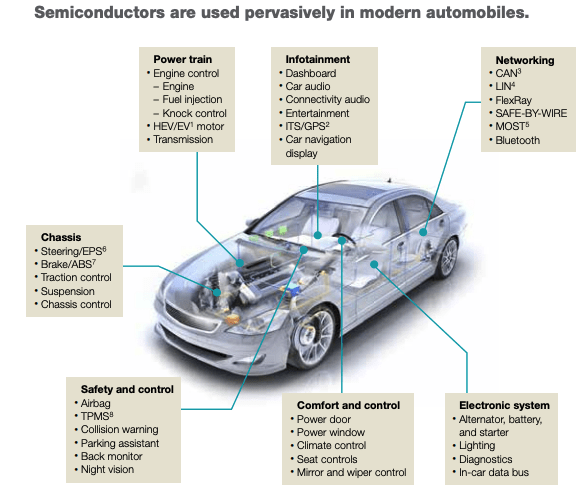

The rise of electronic content in cars comes from several sources and it’s pretty clear that semiconductors are becoming pervasive in cars. You can find semiconductors in almost any part of the car today:

McKinsey

Why have cars gone from little electronic content to being almost entirely dominated by it? We could highlight many sources, but we’ll go with the three most important and obvious ones:

Increased connectivity and infotainment

Increased ADAS features

The shift to electrification.

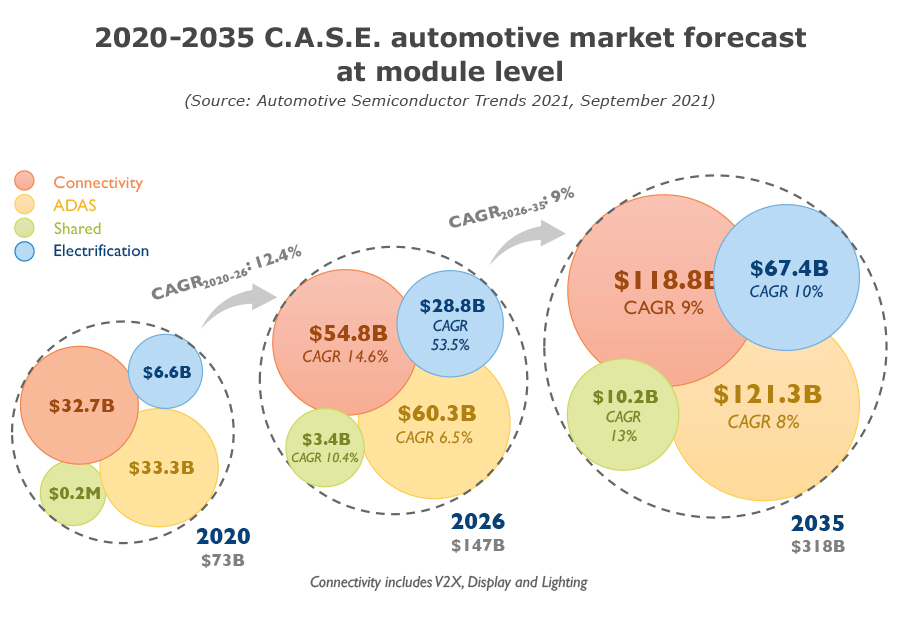

These have grown fast over the last decade, but growth continues. Several research papers see these three trends growing at high-digit/low-double digits CAGR up until 2035:

Automotive Semiconductor Trends 2021

“Connectivity and infotainment” refers to the ongoing trend of cars becoming more connected to the internet (connectivity) and the interior display becoming more modern (infotainment). The rise of connectivity and infotainment basically means going from the left image below to the image on the right. Quite a change, right?

Google

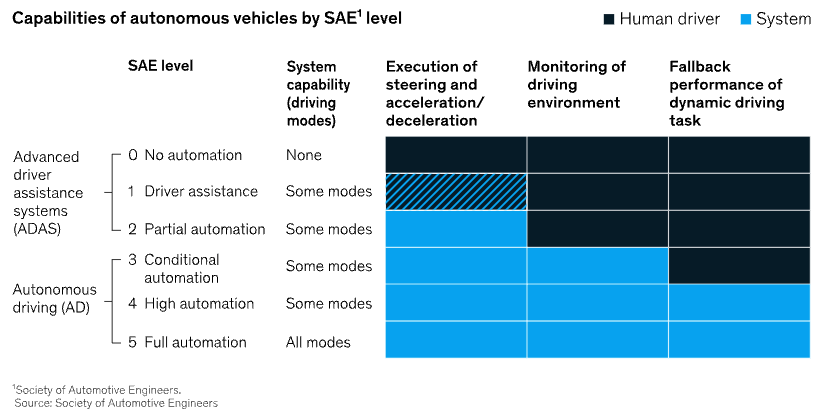

“ADAS” stands for “Advanced Driver Assistance Systems” and currently focuses on collision avoidance technologies. For example, if a car stops automatically to avoid a collision, that’s ADAS. If your rearview mirror lights up when there’s a car in the blind spot, that’s ADAS too.

Many people talk about autonomous driving indistinctly of ADAS, but autonomous driving can be understood as the most advanced ADAS type. There are different ADAS levels, ranging from less to full automation (autonomous driving):

Society of Automotive Engineers

ADAS aim to mitigate the consequences of driver mistakes, and as drivers act based on what they see, ADAS requires cars to have “eyes.” These eyes come in the form of sensors and cameras placed all over the vehicle’s exterior. And yes, you guessed correctly, these sensors and cameras require an increasing amount of electronic devices.

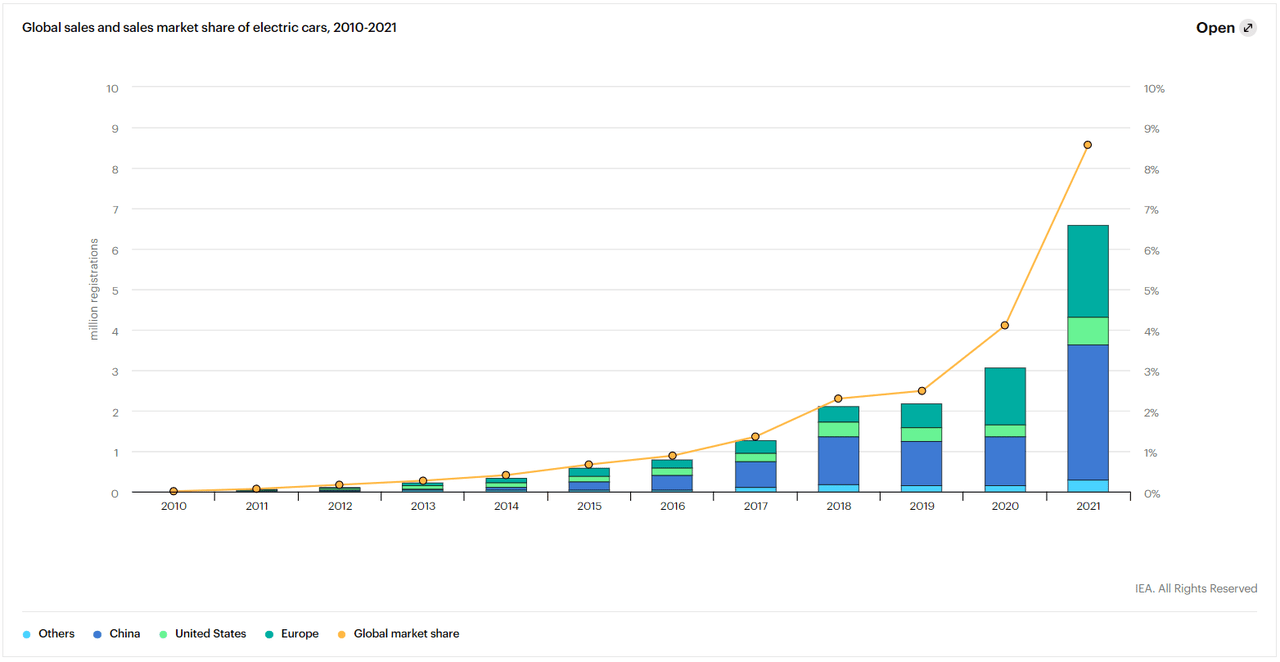

Lastly, we have electrification, which is probably the most straightforward to understand because we see it daily in the news. Electrification refers to the shift from ICE (Internal Combustion Engine) to EV (Electric Vehicles). This shift is already underway and growing almost exponentially:

The World Economic Forum

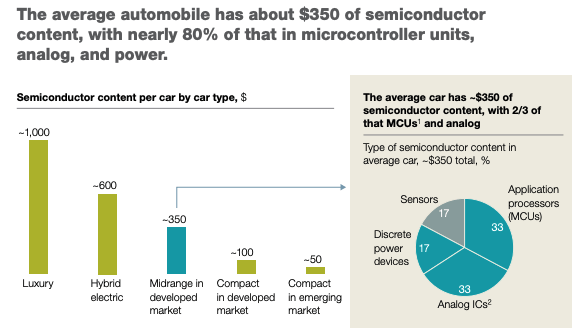

ICE vehicles are made up mostly of mechanical parts, whereas EVs are made up mostly of electronic components, which require a growing number of semiconductors. According to a McKinsey study, the average Hybrid electric vehicle has almost double the semiconductor content of an ICE vehicle:

McKinsey

With the above said, the trend of more advanced tech and growing semiconductor content in cars is pretty evident and probably unstoppable at this point. We’ve already seen how this trend has been underway for some time now, but the runway is still long. Regulation and environmental consciousness lead people to renew their vehicles, and this is just the beginning.

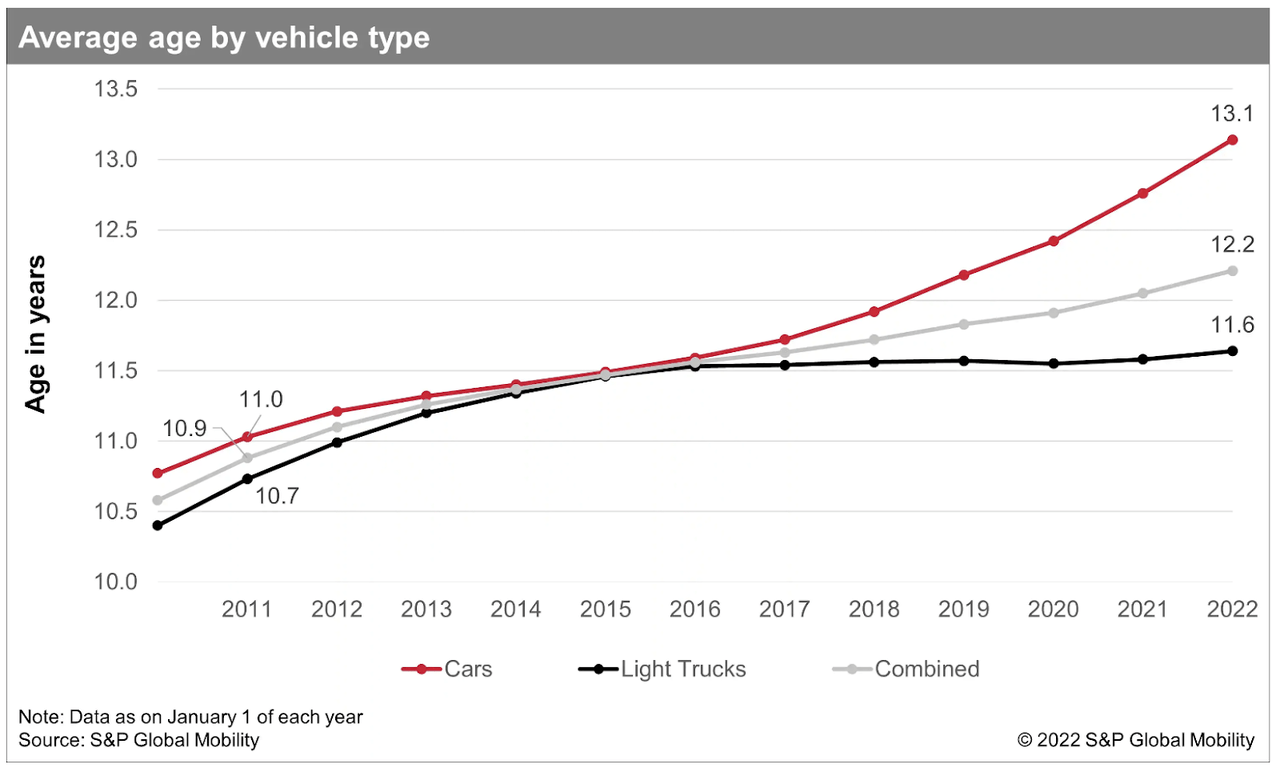

For starters, there are still a lot of cars to be renewed. In many developed economies, the car fleet remains very old (and getting older). The average U.S. vehicle is 13 years old:

S&P Global Mobility

Add this high age to the fact that there’s only so much one can defer the purchase of a new vehicle. Renewing a car is indeed a discretionary purchase, but what if the government “forces” you to upgrade?

Governments around the world are pushing hard to get this renewal underway. For example, in Spain, you can’t drive into Madrid’s city center unless your car is somewhat environmentally friendly. The good news is that if you wish to salvage your current car and buy an electric or hybrid car, you are eligible for up to €7.500 in government grants. Join these government “incentives” with skyrocketing fuel prices, and you get more people in the renewal queue.

The vehicle fleet renewal seems inevitable over the coming decades, and we have identified three companies that are well positioned to take advantage of it. Let’s see how.

Texas Instruments Incorporated (TXN) - Riding the growth of semiconductors

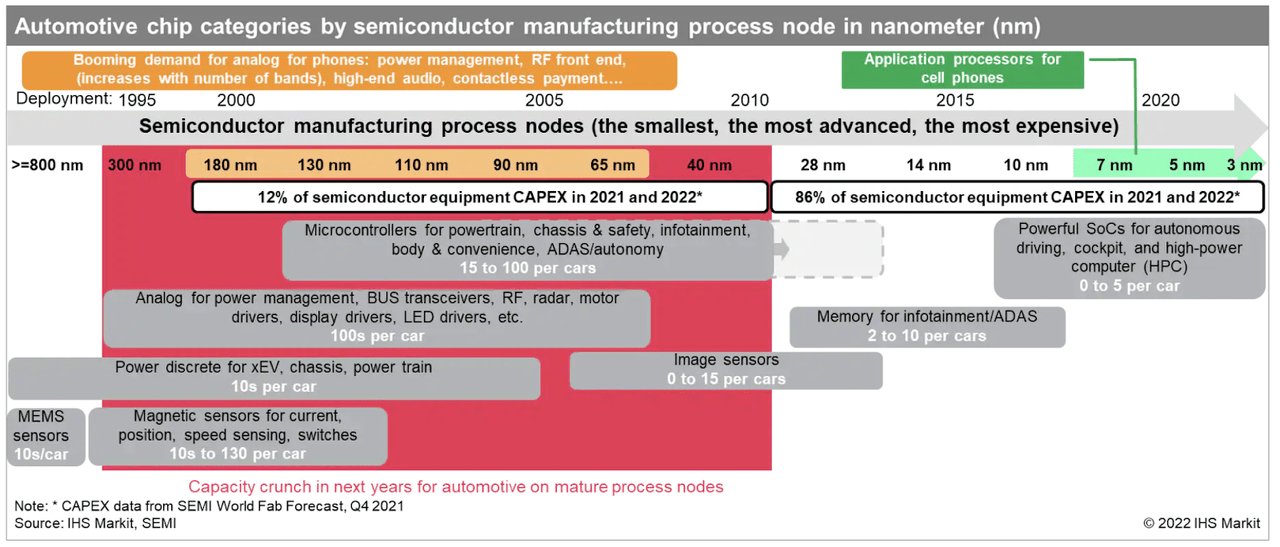

Texas Instruments is an integrated device manufacturer ("IDM") in the analog industry, and it’s well-positioned to ride the trend of rising semiconductor content in cars. Before explaining how, let's understand why analog chips are becoming vital in cars.

Analog is not a less advanced version of a digital chip, even though many people think they are. There’s some truth to this because digital chips are manufactured in leading-edge nodes, whereas analog chips are primarily manufactured in mature nodes, but a digital chip can’t replace an analog chip. Despite differences in technology, they are complementary.

Analog chips can interpret continuous variables (such as distance, temperature, pressure, battery levels…), whereas digital chips can only interpret binary variables (1s and 0s). This means that a digital chip cannot tell you the distance between two objects or the pressure inside the vehicle's wheels; both situations are analog territory. An analog chip interprets these continuous variables and “translates” them to a data stream that a digital chip can interpret and process.

As discussed above, ADAS requires a vehicle to have “eyes” that replace those of the driver. Once ADAS has seen something worrying, there has to be a way to transmit this information to a “central system” that ultimately will make the car do something (break, stay on its lane…). Having “eyes” requires the interpretation of continuous variables, and this is precisely why analog is so critical in ADAS and (if we ever get there) in autonomous driving. The bottom line is that a sensor (made up of analog chips) can tell you how close you are to an object, but a digital chip can’t do this.

The other tailwind for analog chips is electrification. Electric powertrains require a good deal of analog chips compared to ICE cars. Battery Management Systems ("BMS") monitor and manage the state of charge and health of a multicell battery string, and as you might have imagined, will be key in the transition to electric vehicles. The charge is a continuous variable and thus requires analog chips.

These trends make analog chips pervasive in cars, especially in new ones:

S&P Global Mobility

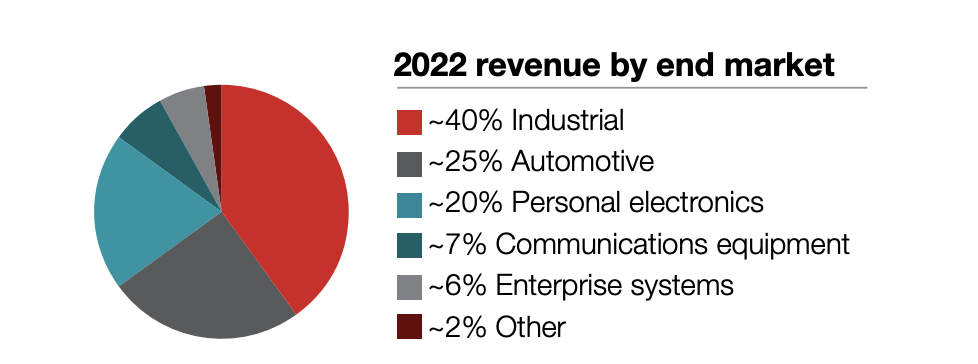

Texas Instruments' management saw this trend coming and pivoted the company to the automotive industry. Automotive made up “only” 15% of total revenue in 2015, but it now makes up more than 25% and judging by management’s recent Capex plans, the company expects to see strong growth going forward:

Texas Instruments Investor Whitepaper

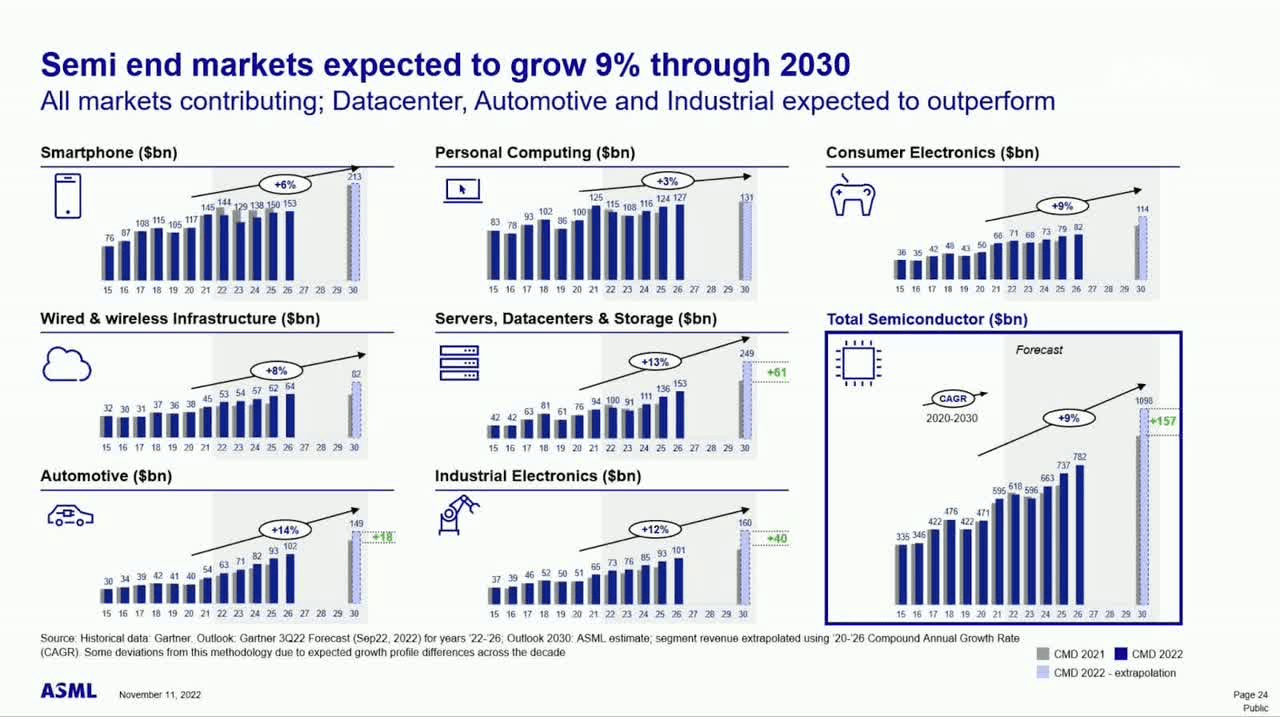

Other semiconductor companies such as ASML Holding N.V. (ASML) should also see tailwinds from this trend, as it dominates lithography, which is used to manufacture analog chips, too. In the most recent Capital Markets Day, management revised guidance upwards and said they had under-appreciated the growth in mature technology. They highlighted automotive as one of the fastest-growing semiconductor markets through 2030:

ASML Investor Day Presentation

ASML also benefits, but the impact on Texas Instruments is much more straightforward and will probably move the needle for the company. In ASML’s case, what will move the needle is probably high-NA EUV, which is not required for analog manufacturing.

Copart, Inc. (CPRT) - More technology means a higher salvage probability

Copart leads the salvage industry. The salvage industry is not pretty at all (which is good), but it’s a very important one in the modern world. When a car is involved in an accident or a catastrophic event (such as Hurricane), insurers must decide if repairing the car is worth it or if they are better off totaling it. Totaling the car means selling it as salvage and paying the owner a certain amount stipulated in the insurance contract (known as the “Pre Accident Value” or “PAV”). These insurers can choose many ways to recover funds for the car, but in most cases, they auction them in Copart’s or IAA’s platform and pay a fee for the service.

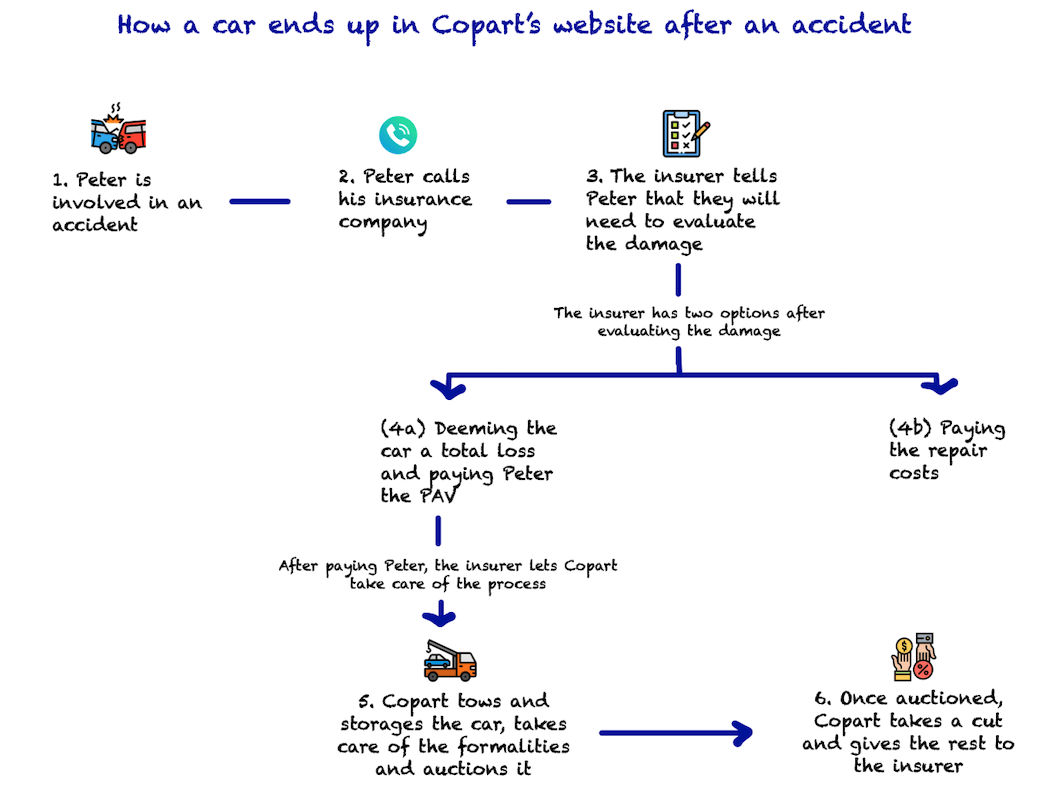

This is how a car ends up in one of Copart’s facilities (in a nutshell):

Made by Best Anchor Stocks

So, which of the above trends will Copart take advantage of? Even though it might sound counterintuitive, the answer is ADAS. We say it might sound counterintuitive because ADAS supposedly reduces accident severity, so cars should not be totaled at the same rate, right? Well, it turns out that’s not the full picture.

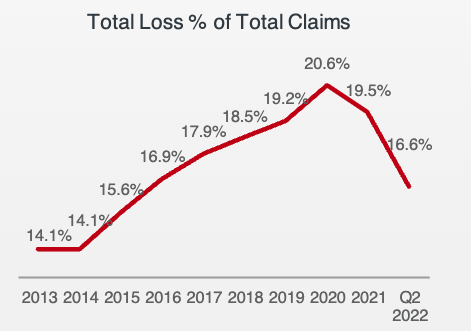

As discussed above, ADAS requires more technology, which makes minor accidents much more expensive to repair, thereby increasing the total loss ratio (the percentage of crashed cars that are totaled). The total loss ratio has decreased lately due to high used car prices, but it’s stabilizing now and expected to return to its long-term trend once used car prices normalize:

IAA Investor Presentation

ADAS requires placing sensors and cameras on the outside of the car, or what we previously called the car’s “eyes.” These sensors and cameras are expensive (both to replace or repair), are typically fragile (don’t have extensive protection), and increase labor costs because repair shops have to be more specialized and have expensive tools to recalibrate them. Fragility and higher repair costs mean a higher likelihood of total despite a lower accident severity.

Not only will Copart get more cars due to a higher total loss, but it might also benefit from higher selling prices on its platform. The rationale is that, after minor accidents, cars are in a pretty good condition to be sold in other geographies where safety standards are not as stringent as in developed countries. So, for example, a vehicle that is not fit to drive in the US after a minor accident is most likely fit to be driven in some countries of the Middle East, Asia, or Africa.

Of course, ADAS is a tailwind but fully autonomous driving would be terrible for Copart. Autonomous cars should technically completely avoid accidents and a future with no accidents offers a bleak future for Copart.

We think it’s pretty evident that Copart is a high-quality company, but the difference between being a bear or a bull in Copart probably resides in how long investors think autonomous driving will take to become a reality. We'll leave here the thoughts we shared in another article:

For autonomous driving to reduce accidents in a substantial way, almost all the car fleets of all countries need to be autonomous. So not only does the technology has to work (which it still doesn’t and is hitting significant roadblocks), but autonomous cars have to take over non-autonomous vehicles, which currently make up 99.9% of the existing vehicle fleet.

Judging by the average age of the current fleet (12 years), it would take many years until the population opts for an autonomous vehicle. So the complete renovation of the whole fleet would take several decades since the tech was good enough to be approved by regulatory bodies. Don’t get me wrong, autonomous driving will probably come one day, but it will take several decades we will be fully there, in my opinion. It will be a slow and steady evolution, not a sudden revolution. Then the roll-out of fully autonomous will take several more decades, which should give us time to reassess the thesis and how it affects Copart.

Atlas Copco AB (OTCPK:ATLCY) - Benefiting from supply chain transformation

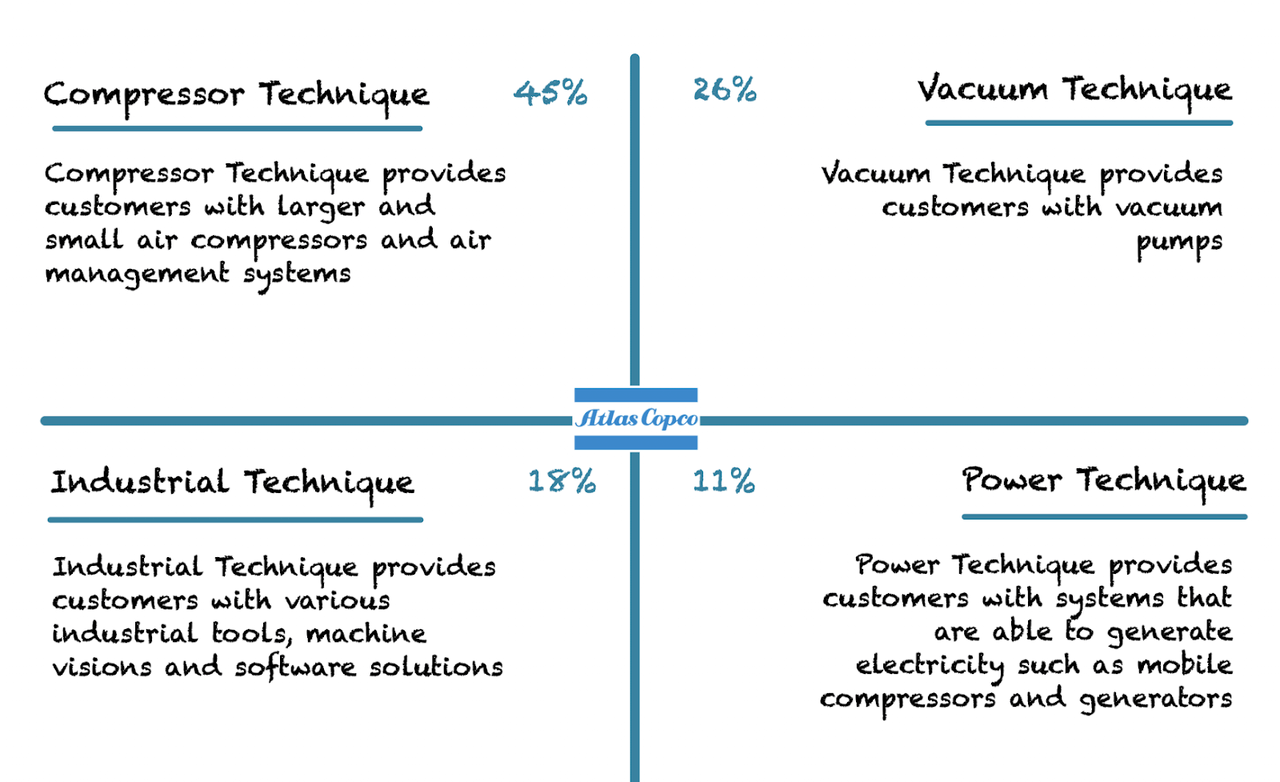

How Atlas Copco can benefit from the above trends is probably not as straightforward to understand as in the case of Texas Instruments and Copart. Atlas Copco is an industrial conglomerate that operates across 4 mostly independent segments called “techniques.”

Made by Best Anchor Stocks

The company will benefit from the electrification trend thanks to its industrial technique and, to a lesser extent, from the other two trends (connectivity and infotainment and ADAS) through its Vacuum Technique. Let’s start with electrification.

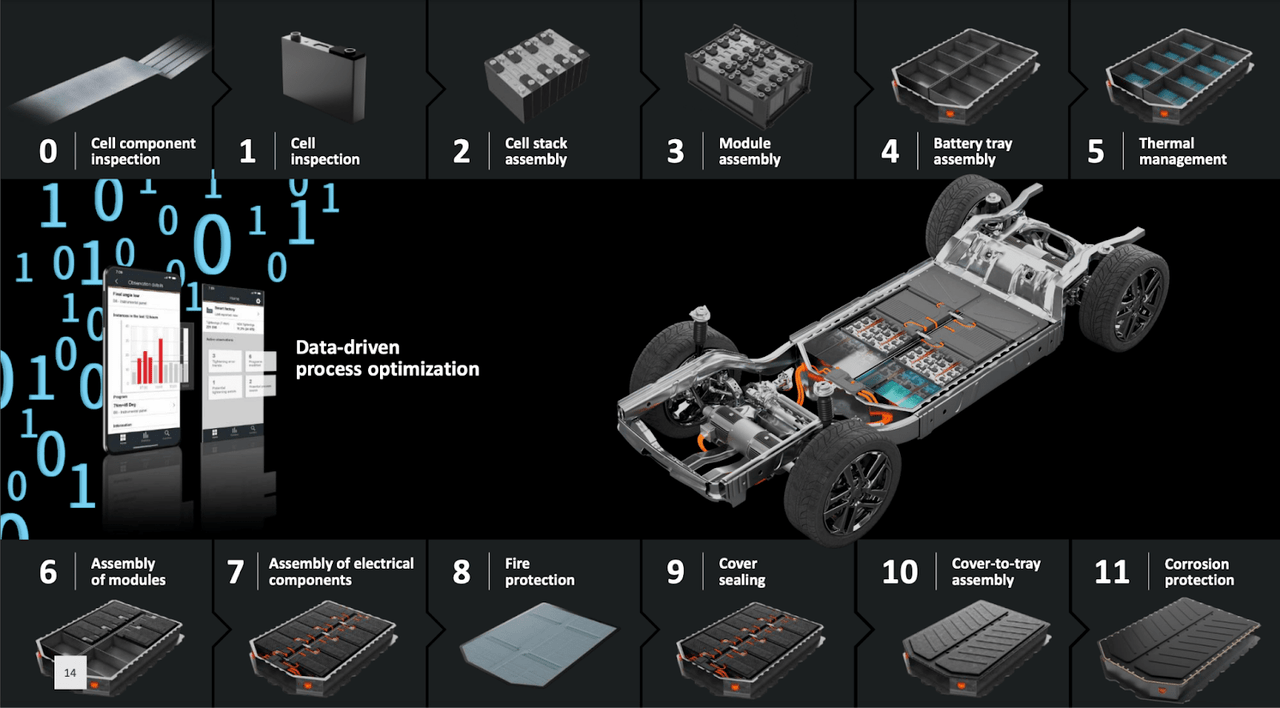

Manufacturing an ICE vehicle differs significantly from manufacturing an EV. For starters, the former has a mechanical engine while the other is powered by batteries. These changes in the production process will drive car manufacturers to redesign their supply chains, and Industrial Technique is expected to have an active role in at least 11 steps in battery production:

Atlas Copco's 2022 CMD Presentation

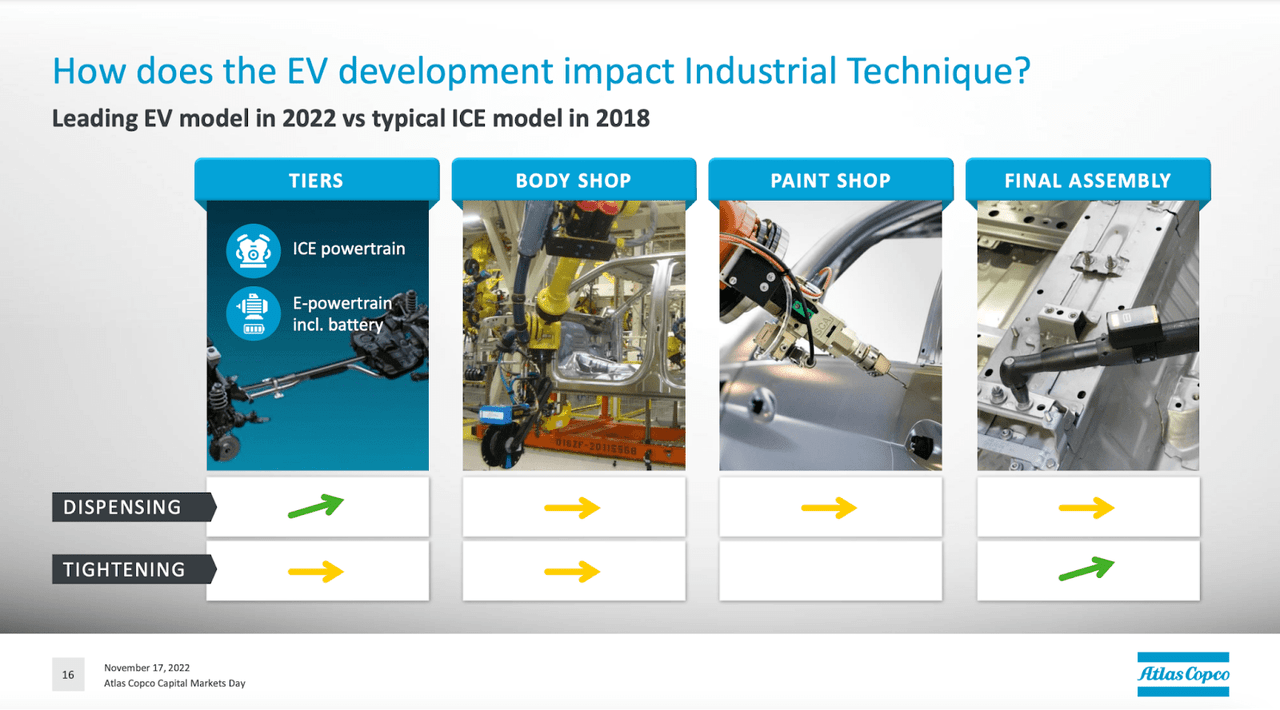

If we zoom out and look at the entire manufacturing process of an EV (not just the battery), Atlas Copco’s management believes it will see heightened activity in the powertrain and the final assembly:

Atlas Copco's 2022 CMD Presentation

The change in supply chains that electrification will bring is the primary trend that Atlas Copco will benefit from through industrial technique. This said, the Vacuum Technique business (which builds vacuum pumps for semiconductor companies) should also benefit “indirectly” from the growing semiconductor content in cars, although Vacuum plays a greater role on leading edge chips than mature nodes.

Conclusion

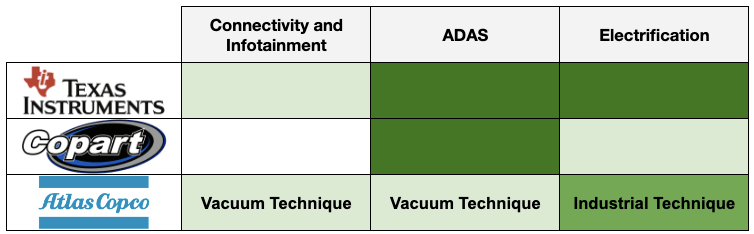

In this article, we have explained how 3 (4 if you include ASML) companies are expected to benefit directly from several trends in the automotive industry. We have prepared the following summary table to portray from what trend each will most likely benefit and to what extent (the greener the larger the benefit):

Made by Best Anchor Stocks

One would think that buying a car manufacturer is the best way to take advantage of these trends in the automotive sector, but truth is that the supply chain also holds very interesting companies with strong moats and high switching costs, such as those we have discussed here.

In the meantime, keep growing!

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Best Anchor Stocks helps you find the best growth stocks to outperform the market with the lowest volatility. They can anchor your portfolio on the stormy market sea, still allowing you to outperform.

Best Anchor Stocks have a long track record of revenue growth combined with below-average volatility. The first pick is up 16,000% from its IPO but has never been down 30%, not even during in 2008-2009.

Best Anchor Stocks can serve several purposes: stabilize your high-growth portfolio, or add low-volatility growth to your index, dividend or value investing.

There's a 2-week free trial, so don't hesitate to join Best Anchor Stocks now!

This article was written by

But you get much more: spreadsheets, a live portfolio, chat with fast response for all your questions, webinars (we just did one to explain DCFs) and much more.

Best Anchor Stocks was founded by Kris and Leandro. Kris is known as From Growth To Value and his marketplace Potential Multibaggers and is also a finfluencer with 85k followers on Twitter.He is 45-year old and always focuses on the long term.

Leandro is the main contributor and he has a background is in Economics with a specialization in Finance. He prepared for the CFA exam for two years and, although he didn’t end up taking the exam due to two cancellations during the pandemic, it has helped him achieve a more detailed understanding of financial markets and accounting.

Both Kris and Leandro are both calm and steady in their approach and character when it comes to investing. They focus on the next years, not the next month. Price action doesn’t affect their decisions, fundamentals do. This can help investors who act based on emotions weather difficult times in the markets.

Disclosure: I/we have a beneficial long position in the shares of ATLCY, CPRT, TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.