Nordstrom: Further Retail Issues Ahead

Summary

- Nordstrom is a Fashion retailer, operating predominantly in the US.

- With high inflation and interest rates, demand will likely continue to fall in the coming year. Nordstrom may do moderately well but growth is unlikely.

- The retail industry has been impacted by many trends, such as e-commerce and brands shifting to DTC, with Nordstrom seemingly failing to respond in most cases.

- Nordstrom's valuation is reasonable but we see no real upside even if growth picks up.

Dimensions

Company description:

Nordstrom (NYSE:JWN) is a fashion retailer, specializing in apparel, shoes, beauty, accessories, and home goods. They offer a range of brands name and private-label products through an omnichannel approach. The business operates predominantly in the US, but ships globally.

Nordstrom operates through 2 main brands, Nordstrom and Nordstrom Rack. Rack operates as an off-price division, offering clearance merchandise.

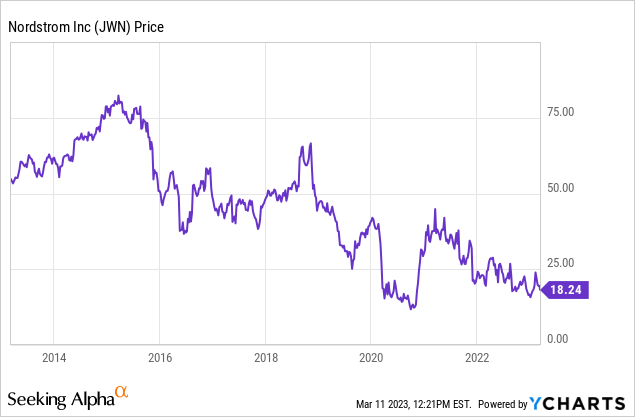

Nordstrom's stock price has languished over many years, falling every year for 5 consecutive years. The business has been a victim of structural changes in the industry, which it has been slow to adapt to.

With the stock price bottoming out in late 2022, now is a good time to assess the quality of the business. We will consider the financial quality of the business and how management intends to take the business forward, with an eye on short-term market conditions and how these will affect the business.

Ryan Cohen:

Nordstrom's shares rose several weeks ago on the news that Activist investor Ryan Cohen had purchased a stake in the business. He has been involved in other retail plays, including GameStop (GME) and Bed Bath & Beyond (BBBY). It is far too early to discuss what impact Ryan Cohen will have and is very dependent on whether the board will entertain him.

Macro-economic conditions:

Macroeconomic conditions are a vital indicator for the health of the retail industry, as it is a great measure of demand in an economy. Post-COVID-19 demand was strong, but things quickly soured as 2022 developed.

The driving force of this has been inflation. Inflation is above 5% in most of the western world, remaining at elevated levels for most of 2022. In response to this, Central Banks with the ability to do so have increased interest rates to cool demand. The problem with this is that much of the inflation is driven by energy prices, which is a knock-on impact of the Russian invasion. Interest rates are far less useful in this case. The net impact has been a cost-of-living crisis for many consumers, who face rising prices and increased borrowing costs.

For this reason, it is not surprising to see economic conditions turn negative. Consumer sentiment is at a level not seen since 2008 and the 10Y / 3M yield curve has inverted for the first time in recent months. Our view is that things will continue to worsen in 2023, with inflation being the primary indicator for a reversal of fortunes. Once it has fallen sufficiently, it is likely governments will be quick to initiate an expansionary policy to kick-start their economies.

It should be noted that the US economy will likely fare better than Europe. Europe has been heavily reliant on Russian oil and is more financially precarious, meaning increasing rates is far more difficult. On the other hand, the US has a tight labor market and is an energy major. For this reason, we could see the US narrowly avoid a recession.

This is bearish for Nordstrom, as demand for fashion is generally elastic. Therefore, as disposable income falls, Nordstrom will likely see sales fall. This puts greater pressure on Nordstrom to conduct effective marketing and to be price competitive to improve its competitive positioning. Looking back at 2008 and 2020, sales fell 5.6% and 2% respectively (Source: Tikr Terminal).

Fashion industry:

Outlook:

The fashion industry experienced unprecedented growth between H2 2020 and H1 2022, driven by pent-up demand and expansionary government policy during the COVID-19 period. The global industry grew by 21% in 2021, and 13% in the first half of 2022. Both online and brick-and-mortar (B&M) businesses benefited from this.

Since then, things have begun to slow quite considerably. The reason for this is the weakening of economic conditions for the reasons outlined above. Much demand was brought forward into 2020/2021, with consumers lacking places to spend their money during the lockdowns. This has a negative compounding effect now and is a reason for the dramatic slowdown. McKinsey expects global fashion sales growth of 5%-10% for luxury, and -2%-3% for the other segments in 2023. Nordstrom is a traditional department store, offering both luxury and non-luxury. This does not mean Nordstrom's growth will fall in this band. As they are a department store, they are subject to the competition of other retailers, and their pricing decisions, with the brands benefiting regardless.

Looking beyond the near term, the fashion industry is expected to grow at a healthy CAGR between 5-10%, with luxury leading the way. This follows a decade of impressive brand-led growth, through innovative marketing. The market has shown great resilience and the ability to grow beyond inflation. Based on Nordstrom's positioning, there is no reason why the business could not achieve 2-4% in the coming decade.

Direct-to-consumer:

Direct-to-consumer is an additional factor facing Nordstrom. In recent years, there has been a greater focus on DTC by brands / investing in their own retail footprint, moving away from traditional retailers. This has been negative for Nordstrom, whose B&M focus is driven by attracting customers through the best offering. As an example, Gucci does not sell any apparel through Nordstrom, as Kering (OTCPK:PPRUF) utilizes its own channels. BoF believes this may be changing, however, as consumers have shown they appreciate B&M and desire the shopping experience. It has yet to be seen what the impact of this will be but could be bullish for department stores going forward.

Consumers trading down:

With market conditions weakening, consumers will likely "trade down" for purchases that will continue to be made. This will mean a greater focus on value retailers, marked-down items, and off-price channels. This is a good opportunity for Nordstrom Rack, which has a greater footprint than Nordstrom, to grow where the main line shows weakness. The reality is that although we may face a recession, those most impacted are not high earners. Nordstrom is positioned well to sell to both sides, but the onus is on them to ensure marketing reflects this.

Sustainability:

The fashion industry has changed in the last few decades for many reasons, but a driving force has been sustainability. Consumers want their products to be created sustainably and are increasingly rejecting fast-fashion culture. McKinsey found 67% of people found this an important factor in their purchase 2 years ago, and things have only increased since then.

Nordstrom scores poorly in this regard. Goodonyou.eco has conducted an extensive overview of Nordstrom and has concluded that they are not good enough. The key takeaway is that not enough has been done to improve labor rights and animal welfare.

Not only is this a problem for sales, but also for brand relationships. Brands will not want to be associated with retailers who are viewed negatively by the public, even if they do not have a great track record. This is clearly an area that Nordstrom must improve.

Digital and Online:

B&M remains king in the US retail market, however, this trend has been changing consistently. Online is seen as the future and growth supports this. For this reason, investment is required in digital marketing and building an attractive online offering. It is not enough to just have a website, when everyone else does, but to have a focused online strategy. Once again, this is an area Nordstrom lack. They are very much a traditional department store, which for much of its recent history has under-invested in online sales. They have made efforts in recent years to change this and are seeing some success, but trail behind competitors.

Overall, the long-term quality of the fashion industry remains high, although 2023 may be tough. There are key themes to be aware of going forward and continued trends observed in previous years. Nordstrom is positioned well, without really standing out. Management seems to have rested on its laurels, not making considerable improvements to the business itself. We do not expect sales to fall considerably due to its Rack offering, but then question its long-term growth due to poor online penetration and sustainability performance. Then we have factors that are difficult to assess, such as if brands will continue to focus on DTC or backtrack.

Financials

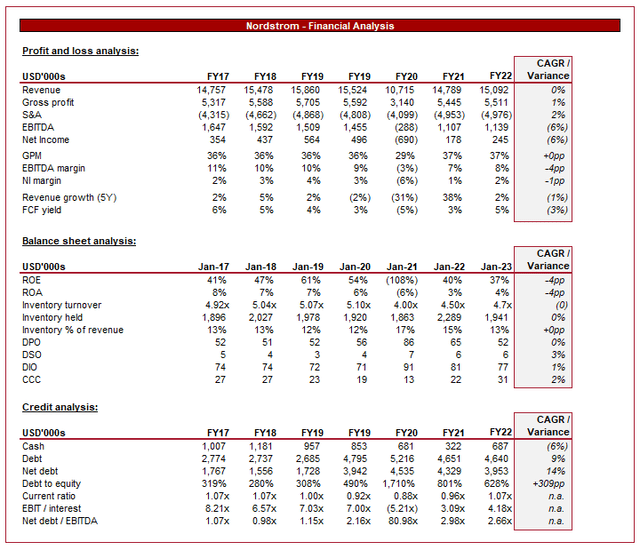

Nordstrom financial analysis (Tikr Terminal)

Revenue growth has been flat in the last 6 years, with a CAGR of exactly 0%. This is below inflation during the period, suggesting the company has been unable to exert pricing power. The growth between FY16-FY18 looks positive but unusually dips in FY19. This stagnation of growth is a reflection of the current industry dynamics. Retailers have been generating the majority of their growth in the last decade from the online channel, a segment in which Nordstrom underperforms. Sales by B&M have trailed behind online except for the post-pandemic period, where Nordstrom unsurprisingly performed well.

Nordstrom's most recent performance has been extremely disappointing, with growth continuing to decline Q/Q through to Q4-22. Although we believe Nordstrom Rack can do well, Management has specifically noted that it underperformed their expectations. This suggests a potential misstep in execution, given that many discount retailers have done well.

Online sales have grown moderately from 24% of sales in 2016 to 38% in FY22. The problem with this is that the growth in the market is online, and so seeing Nordstrom reach 38% by 2022 seems several years too late (Source: Annual accounts).

Nordstrom has attempted to right this, investing in marketing but this has not yielded any benefit. The company has been unable to pass on these costs, resulting in a fall in margin across the historical period.

Nordstrom's S&A expenses have trended up in recent years due to inflationary pressures impacting operating costs. This has contributed to a decline in EBITDA margin from a respectable 10% to an underperforming 8%. Once inflationary pressures subside, this margin deficit can be righted.

From an efficiency perspective, the pandemic has caused a slight change in the company's profile. Inventory turnover, inventory held and CCC have all negatively changed. Having said this, Nordstrom has seen its inventory turnover tick up in FY22, reducing the risk of discounts being offered to consumers to sell merchandise. This goes against the trend we have seen in the industry, suggesting Management have got it right where many have mis-stepped.

Credit analysis shows a concerning trend, although is not currently an issue. Debt has been increasing and Nordstrom's debt coverage remains low. The company is CFO-positive and comfortably so, reducing the risk associated with liquidity. The bigger problem is that the company has no growth while growing its debt balance. This is driven by large dividends and share buybacks (relative to CF before financing activities), with these activities partially funded by debt. In 4 of the last 6 years, the net change in cash was negative. This seems like an unfortunate decision when the fashion industry is going through much change and investment could kickstart growth.

Outlook

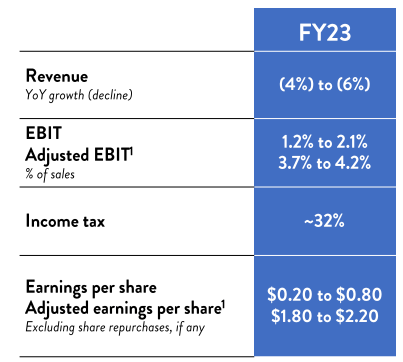

Nordstrom FY23 forecast (Nordstrom)

Management is forecasting quite poor results in the coming year, supporting our assertion that the business will struggle with declining demand. It is very difficult to see any positives for investors in Nordstrom, or the company itself, in the coming year.

Peer group comparison

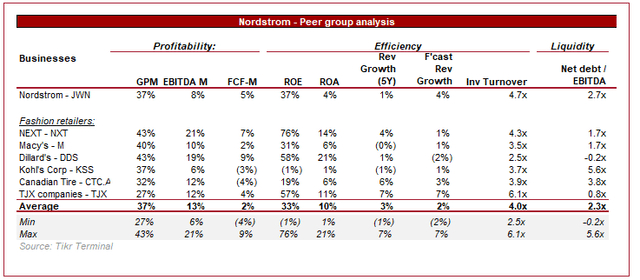

Peer group analysis (Tikr Terminal)

When comparing the retailers we have presented above, we see a degree of uniformity. Thin margins are observed across the board, growth is minimal, and debt can be high.

This reflects the industry profile as a whole; it is highly competitive. Price competition is king, and it has driven down margins. The push towards DTC by brands has not helped growth.

Our view is that Nordstrom stacks up fairly well, primarily because it is producing greater FCF conversion. As we mentioned previously, Management was shrewd with their inventory management, reflecting an above-average performance. Going forward, Nordstrom's focus should be on improving its EBITDA margin to better align with the other traditional retailers.

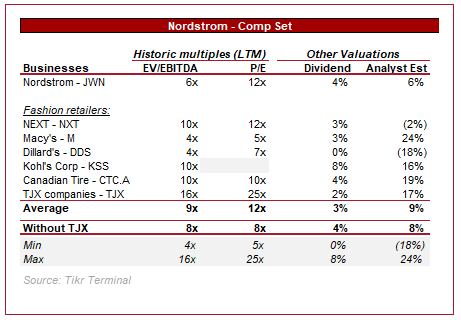

Valuation:

Retailer valuation (Tikr Terminal)

Due to the lack of growth and poor profitability in the industry, it is unsurprisingly to see low valuations for the majority of the businesses. Nordstrom is trading at a slight discount to its peers but our view is that this reflects the delta in its EBITDA margin. FCF conversion can be more volatile due to changes in WC and capex but the EBITDA margin for a mature business is far more likely to be sticky. With this in mind, it suggests Nordstrom is trading in the vicinity of its fair value, potentially slightly undervalued given that a 6% EBITDA margin delta (EBITDA-M avg. excl. TJX) is likely not worth a 2x EBITDA discount.

Conclusion:

The retail industry has shown impressive growth and resilience in the last decade as it has faced changing trading conditions. Nordstrom was unable to capitalize on this, relying on its draw with customers which has waned. The coming 12-24 months will likely be ugly for Nordstrom, as demand continues to trend down.

We see some scope for long-term value as Nordstrom improves their online offering, B&M demand shows its resilience and Nordstrom Rack gains market share.

The valuation is fair and allows for some upside should growth pick up, the problem is that with sales continuing to trend down, it is likely negative sentiment will remain around the business. The valuation is the only reason this stock is not currently a sell.

We thus rate this stock a hold, seeing some value once the current environment improves in 12-24 months.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.