Here We Go Again? Bank Failures Spook Markets

Summary

- We highlight some of the key dynamics of the two bank failures this week and whether we are seeing a replay of the GFC.

- In short, SI and SIVB had a number of unusual features which made them particularly vulnerable to rising interest rates on both sides of the balance sheet.

- Although these features were not unique to these two banks, other banks, particularly the larger too-big-to-fail institutions are much less vulnerable.

- Much hinges on what regulators do with uninsured depositors next week. Worst case scenario is a cascade of bank runs in the weaker institutions.

- We would look to pick up assets not directly exposed to these developments such as mortgage REIT preferreds, BDCs, and higher-quality corporate credit CEFs.

- We're currently running a sale for our private investing group, Systematic Income, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

-slav-

This week brought two bank failures, in a worrying reminder of what investors experienced during the GFC. In this quick recap we highlight some of the key dynamics behind the failures and the implications for the broader sector. The key takeaway is that absent a backstop of uninsured depositors we could see continued pressure on smaller / community banks that rely more on deposits for their funding as well as those banks with a relatively high level of uninsured deposits.

Ultimately, regulators will not allow a wave of small bank closures however a solution to this problem could take some time. Given the price drops we have seen so far we are looking to pick up securities in unrelated sectors like mortgage REIT preferreds, BDCs and CLOs that don't have a direct link to this still developing crisis.

What Just Happened

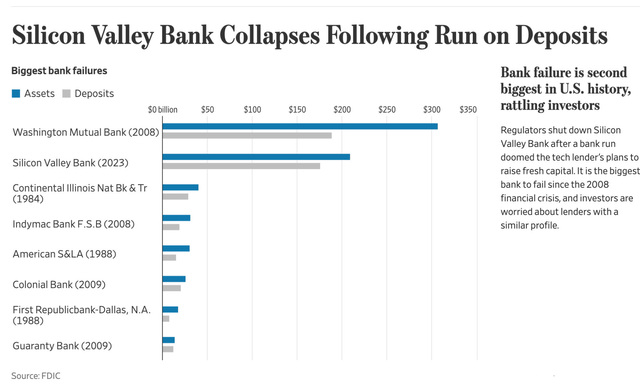

What happened is we had two bank failures (the latest one being the second biggest in US history). This all sounds very 2008 however we need to keep in mind that both Silvergate Capital (SI) and SVB Financial (SIVB) were very unusual banks.

One, they had an unusually large amount of securities in their asset portfolio - they were buying longer-duration Treasuries / Agencies with their deposit cash. The reason they did this was that they had too much deposit cash to use in the normal banking kind of way like making mortgages / corporate loans etc. They also didn’t just want to put it in TBills because, until last year, TBills paid nothing and you can’t run a bank where you make nothing on your assets. So they instead bought longer-duration bonds like Agencies and Treasuries. By the time TBills paid a decent yield, the banks had accumulated losses on their longer-duration bonds which was painful to crystallize as it would have pushed their capital levels significantly lower.

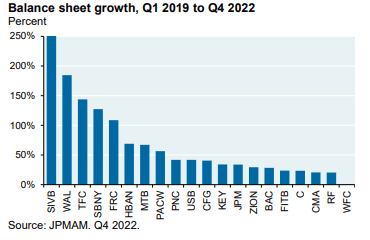

The chart below shows that SIVB saw enormous growth in its balance sheet from 2019 to end-2022. For most of this period short-term rates were unusually low which is what pushed the bank to generate income from longer-duration bonds instead.

JPAM

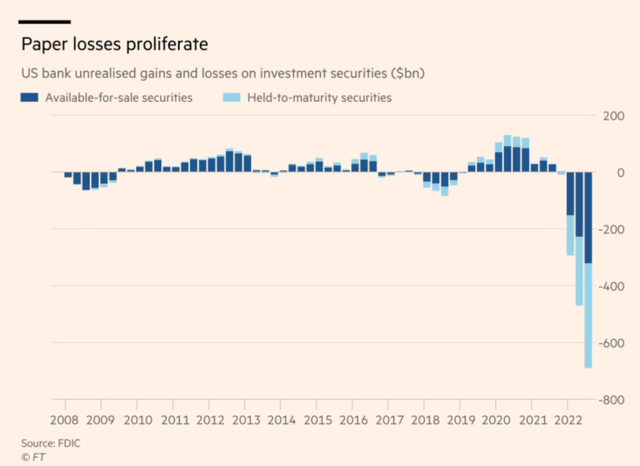

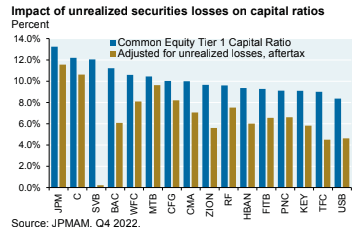

Two, loading up on bonds before 2022 was pretty bad timing because interest rates rose a lot in 2022. That drove a significant amount of unrealized losses in their portfolios - a broader dynamic that occurred in the banking sector we see in the chart below. These weren’t immediately apparent because the bonds were in hold-to-maturity portfolios which don’t have to be marked-to-market (the financial disclosures do make everything clear however).

Three, they were extremely undiversified in their depositor base - crypto firms for SI and Tech / Venture firms for SIVB.

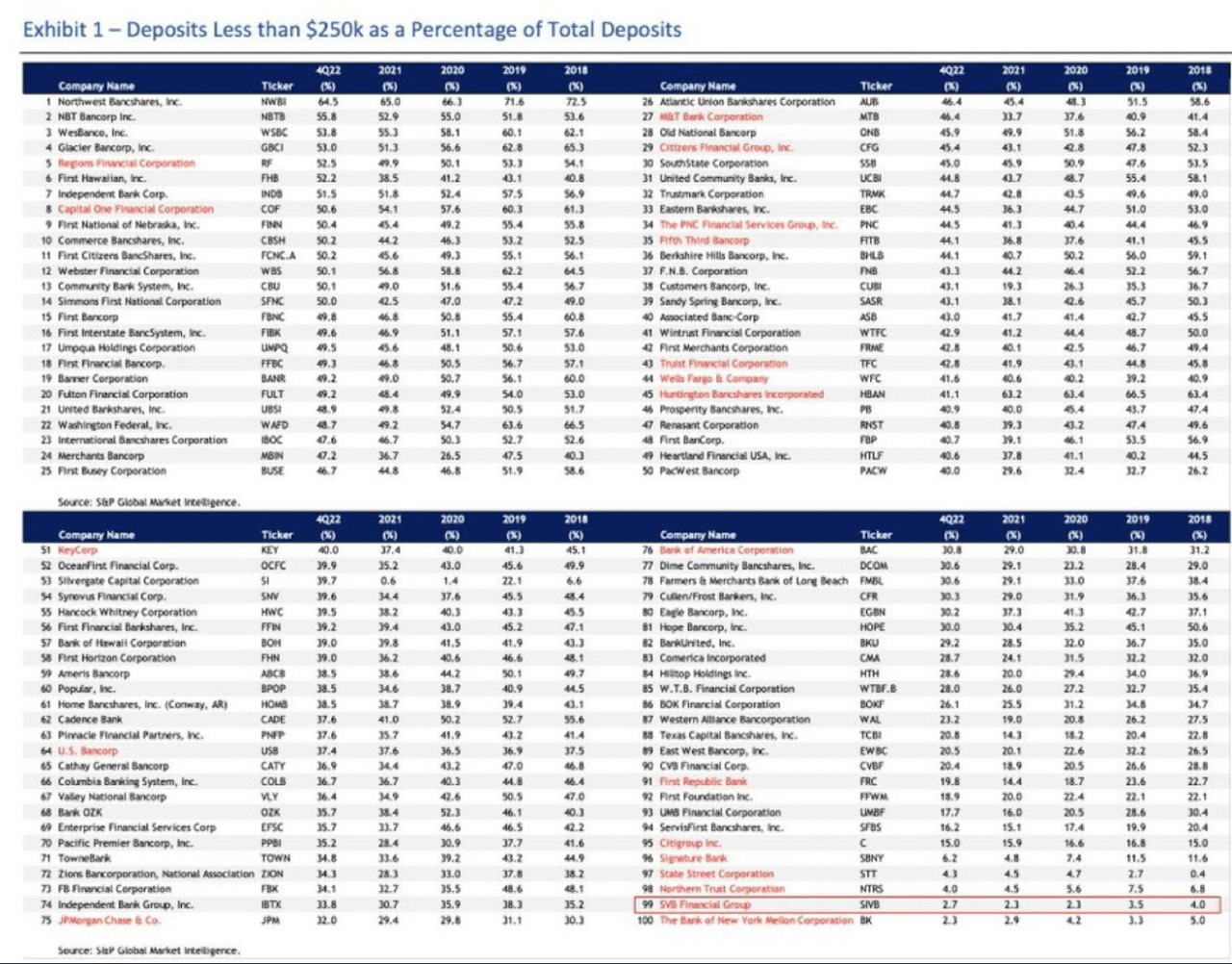

Four, they had very little sticky / retail / insured deposits. Insured deposits don't run because there is FIDC. Uninsured deposits do run. SIVB had next to no insured deposits.

S&P

Five, the depositor base of both firms was also hurt by rising rates - venture funding dried up, creating large cash burn for SIVB depositors (requiring them to take deposits out) while crypto flamed out as well causing that industry to grab the cash.

This drop in deposits required the banks to sell assets, which then required them to mark-to-market their hold-to-maturity portfolios, which created a capital problem, which caused a larger deposit flight when the capital problem was noticed which then spiraled into where we are now.

What’s clear is that all banks to some extent have this problem. It’s just that the problem is not as big as the ones at these two banks. For SIVB the amount of equity was basically equal to its unrealized losses, meaning it had no capital left. This is far from the case elsewhere.

JPAM

In short, other banks don’t hold as many securities in their portfolios and the securities they hold are not as interest-rate sensitive. Their depositor base is stickier because a greater proportion is insured. They also have other ways to fund themselves than with deposits. Their corporate depositors are also not all from one sector and those sectors do not start to claim their deposits back when rates start to rise.

What’s Next

A lot hinges on what happens to SIVB and specifically if uninsured depositors get all their money back or if they have to eat some losses. Regulators cannot afford for uninsured deposits to suffer a loss because that will trigger a race for the exits at the weaker banks towards stronger banks which will create a self-fulfilling spiral, leading to more stress. This doesn’t necessarily mean more banks will fail (since even with unrealized losses, bank equity levels should be high enough to pay out depositors) but it will be super painful for markets.

In terms of things to focus on. In the financial space, the more lightly-regulated smaller / community banks could face some pressure as they also have a greater reliance on deposits for funding. Too-big-to-fail banks like JPM, WFC and others look fine and will probably end up benefiting from this, further increasing their moats. Investment banks like GS and MS won’t face the kind of bank runs as they aren't traditional banks. Custodians and brokerages like BONY, State Street and Schwab should also be OK as they have a different business model entirely.

All of that said, we could see more volatility even across names that are fine so no reason to be a hero at the open on Monday. It might be best to focus on stuff that’s a safe distance away from the action be it mortgage REITs, BDCs or broader credit like CLO Debt.

Specifically, we'd be looking to pick up more (NLY.PF) which is trading at a very attractive 10.4% yield already with (AGNCN) a close substitute. We could see some pressure on Agency MBS as these holdings are sold down by both SIVB and other banks, however, the Fed is unlikely to allow the sector to seize up.

In the BDC sector, Ares Capital (ARCC) looks more compelling now after an 8% drop. It trades at a 10.9% yield. Owl Rock Capital (ORCC) and Golub Capital (GBDC) are also worth a look. BDCs tend to have little exposure to financials, focusing more on Software, Biotech and other sectors. There is a non-zero chance that some of the BDC portfolio companies will have their cash locked up in SIVB however the recent drop across BDCs more than compensates for this risk in our view.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Disclosure: I/we have a beneficial long position in the shares of NLY.PF, ARCC, GBDC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.