ZIM: Last Dividend

Summary

- ZIM Integrated Shipping reports Q4'22 earnings prior to the open on Monday.

- The container shipping company is likely to announce the last dividend of the cycle with the BoD unlikely to pay the large 20% true-up dividend.

- The stock isn't a buy at $20 with no dividend payments the next couple of years.

- Looking for a helping hand in the market? Members of Out Fox The Street get exclusive ideas and guidance to navigate any climate. Learn More »

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) investors were warned last year that dividend payments were coming to an end. The container shipping company reports earnings prior to the open on Monday and the company should provide details on the last dividend payment for this cycle. My investment thesis is more Bearish on the stock with clear signs losses are the likely outcome of the next couple of years.

Container Shipping Indexes Collapsing

ZIM reported Q3'22 results back in mid-November and already guided to the most likely outcomes for Q4. The guidance forecasted a dip in adjusted EBITDA in the 2H of Q4 to the extent of where the shipping company will be producing limited positive EBITDA heading into 2023.

The guidance was for the following Q4'22 numbers:

- Adjusted EBITDA - $0.8 to $1.1B

- Adjusted EBIT - $0.5 to $0.8B

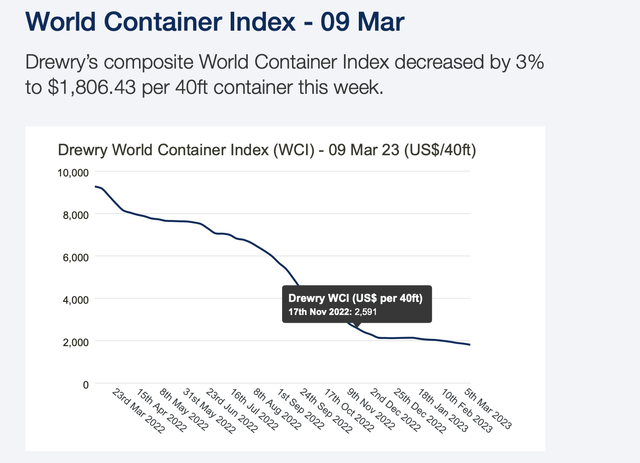

What is crucial about guidance is that world shipping container indexes continue to collapse. The Drewry World Container Index for March 9 fell to $1,806 per 40ft container. The index was at $2,591 right after ZIM reported Q3'22 numbers for a massive 30% dip in just the 4 months since the company reported quarterly numbers.

In the last week alone, the index fell $53 per 40ft container. The spot rate on most routes continue to fall 2 to 3% per week.

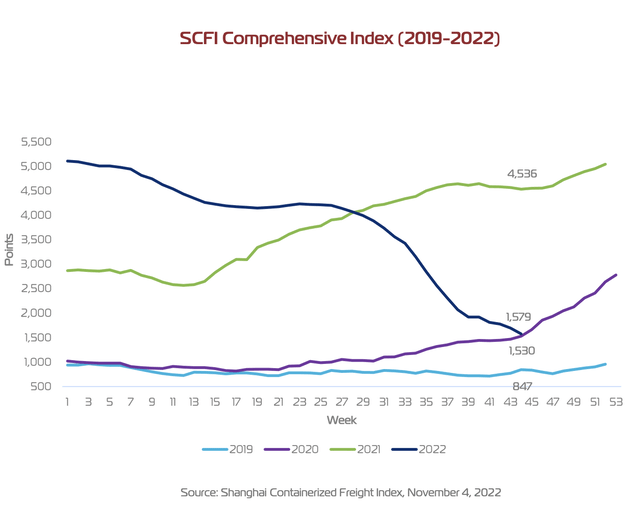

The SCFI Index dipped to $906 on March 10 and ZIM provides this handy chart of how the index generally traded at this level or above in 2019.

Source: ZIM Q3'22 presentation

Not only are the commonly used container indexes back to 2019 levels, but the prices are still falling fast. At the same time, a lot of new ships are contracted to be built over the next couple of years.

Last Dividend

The consensus analyst estimates project ZIM to earn $3.05 in Q4'22, though the company has several analysts that only forecast annual EPS estimates. Based on this EPS estimate, the company will pay a dividend at the 30% announced dividend rate of $0.92.

The market isn't focused too much on this dividend. The question is whether ZIM pays the nearly 20% dividend true-up for 2022. The company is projected to earn $37.65 for the year based on these projections and strong earnings through the first 3 quarters of the year.

ZIM has paid the following dividends in 2022 with only a $0.75 payout based on the annual EPS target:

- Q1'22A - $2.85 (20%)

- Q2'22A - $4.75 (30% + 10% Q1 one-time catch up)

- Q3'22A - $2.95 (30%)

- Q4'22E - $0.75 (30%)

- 2023E - $11.30 (30%)

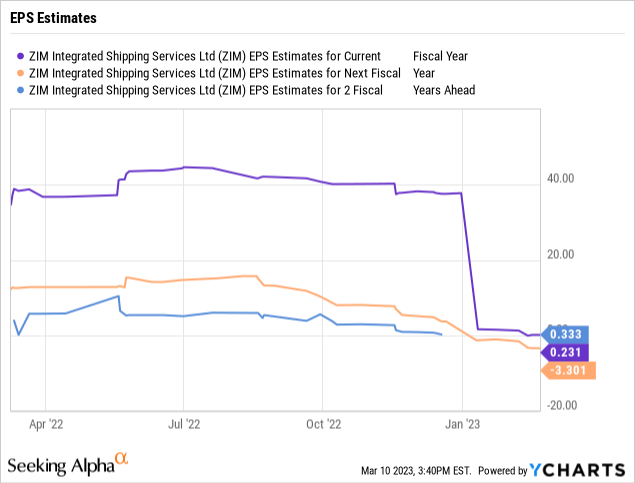

The key here is that dividend pay-outs are likely to end with this quarter with the company now projected for breakeven EPS in 2023 leading to a loss of $3 per share in 2024. Technically, ZIM might earn a small profit in Q1'23 leading to a tiny dividend payout, but for all practical purposes an investor shouldn't expect the container shipping company to pay much in the way of dividends in 2023.

A very important aspect of the sudden collapse in EPS estimates of 2023 and 2024 is that the lowest analyst estimates forecast ZIM losing $8 and $12 per share, respectively. Management may be unwilling to pay the true-up dividend with losses mounting going forward.

Barclays Analyst Alexia Dogani noted how ZIM faces much higher unit shipping costs now while charter rates are collapsing. The firm estimates costs are up by at least 45%.

ZIM has a ton of cash, but a full 20% true-up dividend for 2022 would amount to a $7.53 dividend payout per share. The company has ~120 million shares outstanding leading to a massive dividend payment of over $900 million, on top of the Q4'22 dividend payment in the $90 million range.

In total, ZIM would need to make a $1 billion dividend payout in order to meet the 20% true-up payment. The current financial conditions with a larger bank closure in the U.S. doesn't appear supportive of the BoD freely agreeing to a large dividend payout.

Takeaway

The key investor takeaway is that ZIM trades at $20 and the shipping company is unlikely to pay dividends in excess of $1 over the next couple of years. With the company likely reporting large losses through 2024, the stock isn't appealing at these levels.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.