LendingClub: Low Risk For A Bank Run

Summary

- The SVB collapse has dented confidence in the U.S. banking industry.

- Investors are trying to identify the next bank to collapse.

- In this article, I assess the vulnerability of LC.

- I believe it is a lower risk for a bank run but remain vigilant should circumstances change.

Michael Vi

There is a Twitter storm brewing currently with respect to many banks given the debacle arising from the SVB Financial Group (SIVB) collapse on Friday. It seems that every pundit has been trying to identify the next most likely candidate to short in case a contagion scenario plays out. Currently, most of the focus has been on Signature Bank (SBNY) and First Republic Bank (FRC).

In this article, I will focus on LendingClub (NYSE:LC) and undertake a dispassionate review of its vulnerability to a bank run and more broadly the impact of the SVB fallout.

Unrealized Losses In The Securities Portfolio

Most readers would be aware of the key reason for SVB collapse. In recent years, it accumulated an outsized, long-duration, securities portfolio of "seemingly" safe assets (Treasuries and Agency MBS). This was done when interest rates were low and as the Fed raised rates in 2022, this bond portfolio suffered large unrealized losses. The losses, however, due to applicable capital rules for smaller banks, are not included in the capital base of SVB. As such, whilst it was effectively insolvent for many months, as the unrealized losses grew larger than its capital base, it was still regarded as being a well-capitalized banking institution. Incredibly, this is due to a very short-sighted exemption granted by the Fed to banks with total assets smaller than $700 billion. Last week, these unrealized losses crystallized as SBV sold some of the securities and tried to raise capital to plug the hole. All of a sudden, the market understood that SBV was effectively insolvent, and a classic bank run manifested. This played out quite rapidly and the game was over very quickly.

LC Securities Portfolio

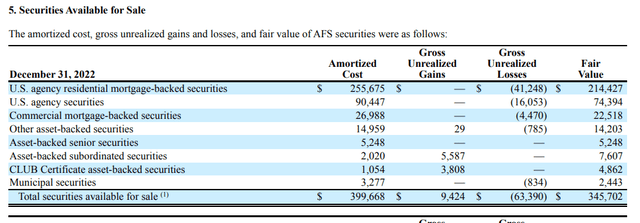

As of 31 December 2022, the LC Securities portfolio composition as per the latest 10-K:

LC Investor Relations

As one can see from the above extract, the total unrealized losses for the securities portfolio are ~$63 million out of a total of ~$400 million. It also reflects ~6% of its equity base. So by all means, not that material.

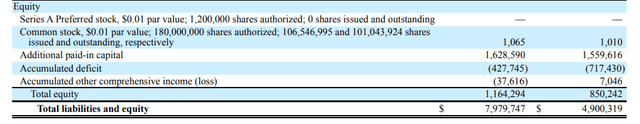

Additionally, the total unrealized losses included in equity (i.e. AOCI line) is only a loss of $37.6 million.

LC Investor Relations

Note that banks that are currently scrutinized would typically have unrealized losses ranging between 25% and 45% of their equity base. LC seems to benchmark rather well in that context.

Deposits Mix

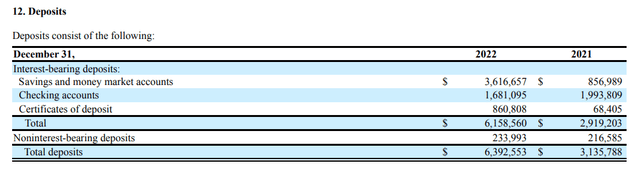

The deposit mix is clearly imperative in the context of a bank run. Large commercial deposits that are not insured by the FDIC are more of a flight risk.

LC appears to fare quite well as most of its deposit growth in the last 18 months has been in the high-yield savings account. Whilst it doesn't break down the deposits by type, it is fair to assume that the percentage of FDIC-insured deposits should be relatively a large proportion.

The below extract from the 10-K sets out LC's deposits base:

LC Investor Relations

As can be seen from above, the checking accounts have reduced year-on-year, predominantly due to the departure of specific Radius acquisition commercial deposits.

Direct Exposure to SVB

As LC disclosed in the latest 8-K, it has a $21 million deposit with SVB and commented on the following:

LendingClub’s relationship with SVB is limited to funds on deposit of $21 million, which amount is not material to the Company’s liquidity position or capital levels, and does not pose a risk to the Company’s ongoing business or operations. The recovery of the funds will be subject to the FDIC process.

It is likely that LC would recover the majority of the $21 million in the short to medium term. As reported by Bloomberg, some hedge funds are offering to buy the claim rights at 60 to 80 cents on the dollar. All in all, whilst quite unfortunate to be caught in this, this is not material at all for LC.

Final Thoughts

As I mentioned in my previous article, LC is currently experiencing material headwinds due to the Fed's rapid hiking of rates. This latest debacle is not helpful and one cannot rule out contagion across various commercial and regional banks. My current assessment is that LC is at a lower risk of experiencing a bank run given the circumstances listed above and $1 billion of cash on the balance sheet.

I remain a firm believer in its future once the macro environment normalizes and the current stress in the financial markets has not altered my view. I remain very bullish.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of LC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.