The Shale Revolution Is Dead, Long Live EOG Resources And ConocoPhillips!

Summary

- In this article, I start by explaining why I believe that peak shale production growth in the US is an underestimated long-term issue, providing oil with a massive tailwind.

- Energy investors need to be picky as challenges persist. A focus on high-quality inventories and efficient operations is important.

- Hence, I present EOG and COP, two top-tier energy stocks with a focus on shareholders that should continue to outperform their peers on a long-term basis.

zhengzaishuru

Introduction

Markets are tanking. Economic growth is slowing, consumers are in a bad spot, inflation is sticky, and the Federal Reserve is far away from a pivot. In this environment, it makes sense to look for opportunities. Especially opportunities that will benefit once demand expectations improve.

That's where oil comes in. It's one of my favorite macro themes for a reason. We're witnessing the end of the shale revolutions as production growth is declining. Even worse, it could soon turn into contraction as major basins are running out of steam. I believe this is one of the biggest issues for decades to come, which is still flying under the radar.

In this article, we'll discuss these developments in light of what could be short-term demand destruction from recession fears.

I will also give you two companies that should thrive for many years to come. Both EOG Resources (NYSE:EOG) and ConocoPhillips (NYSE:COP) come with efficient operations, high-quality resources, and a focus on shareholder returns.

So, let's get to it!

The Shale Revolution Is Dead

I first learned about the shale revolution in the aftermath of the Great Financial Crisis when I was a teenager with an interest in global energy markets. At the time, my understanding of the topic was limited, but I was fascinated by the potential of this new technology to transform the industry. This technology made the United States an energy-independent nation during the Trump Presidency.

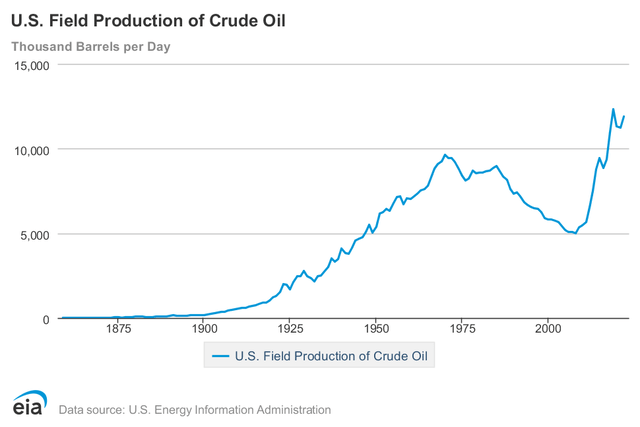

In 2007, the United States produced roughly 5 million barrels of crude oil per day. That number rose to 11.9 million barrels per day in 2022.

Energy Information Administration

The major driver of this production surge was the shale revolution. Tight oil production in the United States is currently at 8.0 million barrels per day. In 2011, that number was roughly 1.0 million barrels per day. Major drivers have been operations in the Permian, Eagle Ford, and Bakken Basins. Especially prior to 2020, production growth rates were absolutely wild.

Energy Information Administration

If you're not familiar with the term tight oil, tight oil is also known as shale oil. This is oil contained in unconventional petroleum-bearing formations.

To extract oil from tight formations, a process known as hydraulic fracturing is required. This method is very similar to the one used to extract shale gas and involves horizontal drilling.

However, and for what it's worth, it is important to note that tight oil is not the same as oil shale, which is rich in kerogen, or shale oil, which is produced from oil shales. In order to avoid confusion, the International Energy Agency recommends the term "light tight oil" when referring to oil extracted from shales or other low permeability formations.

The reason why I bring this up is the fact that the shale revolution was the oil production growth engine of the world. That is now changing.

On March 8, the Wall Street Journal reported that frackers are hitting fewer big gushers in the Permian Basin. Major operators are running out of good wells.

Oil production from the best 10% of wells drilled in the Delaware portion of the Permian was 15% lower last year, on average, than top 2017 wells, according to data from analytics firm FLOW Partners LLC. Meanwhile, the average well put out 6% less oil than the prior year, according to an analysis of data from analytics firm Novi Labs.

Last year, the growth of oil production in the United States was lower than many experts had predicted. This was due to investors pressuring companies to cut back on spending and focus on generating higher returns instead of expanding production. Additionally, weaker-than-expected well-production results in the Delaware basin also contributed to a flattening of output. As a result, the Energy Information Administration is forecasting that U.S. oil production will increase at about the same rate this year as it did last year, which is about half of what was initially expected.

For example, one of the world's largest players, Chevron (CVX), saw 42% less oil production in wells brought online in the Permian last year compared to wells that started production in 2018. The top 10 wells brought online were about 25% less productive.

Chevron is expected to boost Permian production to about 1 million barrels per day by 2025. That number is expected to plateau at 1.2 million barrels later this decade.

Devon Energy (DVN), a producer operating in the Delaware basin, had previously drilled extremely productive wells in an area called Boundary Raider. In 2020, these wells produced an impressive average of over 342,000 barrels over nine months. However, according to FLOW President Tom Loughrey, the average output of these wells dropped significantly to roughly 167,000 barrels in the following year.

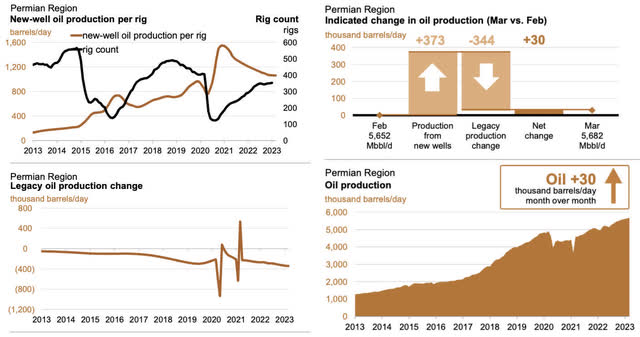

When looking into the most recent Permian report from the EIA, we see that production growth is indeed declining.

The rig count has recovered since the pandemic, yet it remains below pre-pandemic highs. New-well oil production per rig has come down a lot since 2021. While total oil production in the region is further rising, growth is significantly weakening, as new production is now barely able to offset legacy production declines.

Energy Information Administration

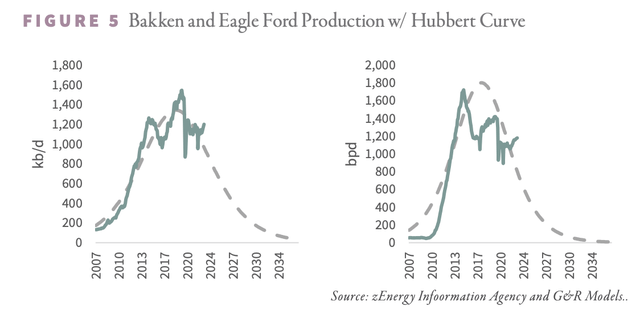

Energy experts Goehring & Rozencwajg have been on top of this issue for a while. The company predicted the production decline in Barnett and Fayetteville production and now sees similar developments in Bakken and Eagle Ford. These basins could soon see a decline in growth.

The worst part is that G&R confirms my fears that production in the Permian is likely to encounter a similar fate.

Interestingly, the Permian has been the only basin to grow drilling activity since the end of 2019. In the Bakken and Eagle Ford, activity remains 10% below pre-COVID levels, whereas, in the Permian, activity is 5% above late-2019 levels. The answer is the superior inventory of remaining Tier 1 locations. Unfortunately, this superior inventory is being drawn down. We estimate that closer to 45% of all Tier 1 Permian locations have been drilled. The Permian is quickly approaching the same level of development as the Bakken and Eagle Ford in 2019. Our models tell us the results will be similar: Permian production will peak, plateau, and decline much sooner than anyone expects.

G&R makes the case that investors should familiarize themselves with the theory of peak production growth and the major impact this could have on energy prices.

Needless to say, I agree, which is why I cannot stop talking about this topic.

In light of this, Goldman Sachs (GS) just came out making the case that OPEC's stance on oil production could cause oil prices to rise to $107 by the end of this year - despite economic challenges.

At the end of last year, OPEC responded to slowing global growth and the increased risk of recession among developed countries by announcing a production cut of 2 million barrels a day. However, Goldman Sachs predicts that this decision may be reversed at OPEC's June meeting due to the expected increase in demand from China as it lifts COVID-19 restrictions, along with little anticipated growth in non-OPEC production this year.

Needless to say, slow non-OPEC growth is likely going to turn into a bigger issue in the years ahead.

If OPEC increases production by 1 million barrels a day, as predicted, it could result in prices for Brent crude, the global benchmark, hovering around $90 a barrel in the second quarter before gradually rising to $100 by the end of the year.

Note that even in a slowing-demand scenario, the bank expects oil prices to remain strong. This is a huge deal, and it somewhat indicates where oil prices might be headed in a situation where global economic demand is rebounding.

Still, other uncertainties are clouding the outlook for oil prices. OPEC ministers are on guard against the possibility that China’s rebound in demand proves temporary or that other developed nations experience a slowdown in growth or slip into recession. And the US and Russia could increase output even if OPEC sticks to its production levels. In the weakening demand scenario, prices could fall short of the $90 forecast in the next few months. But GS Commodities Research still predicts prices would still hit $100 by year’s end.

To summarize this first part:

- The oil price supply growth engine of the world is slowing. Production has rolled over in less-efficient basins, with peak inflation looming in the Texas/New Mexico Permian Basin.

- ESG initiatives and a deterioration in high-quality drilling locations are set to put tremendous pressure on output in the years ahead, risking an even wider supply gap.

- Even though global economic demand is slowing down, oil prices are set to refrain from breaking down.

- While I believe that severe economic weakness could damage energy stocks, I'm a consistent buyer during major corrections, as I believe that higher demand expectations in the future could propel oil prices above triple digits.

- Needless to say, pitfalls persist. Investors should only buy oil stocks with efficient production, low debt levels, and high production inventory to prevent management from being forced into risky M&A deals to expand production.

That's where the stars of this article come in.

1. EOG Resources

In the past few months, we have discussed a wide range of oil and gas stocks. Hence, in this article, I wanted to focus on two companies that we haven't talked about as much. However, they are still high-quality plays that I expect to beat their benchmark on a long-term basis.

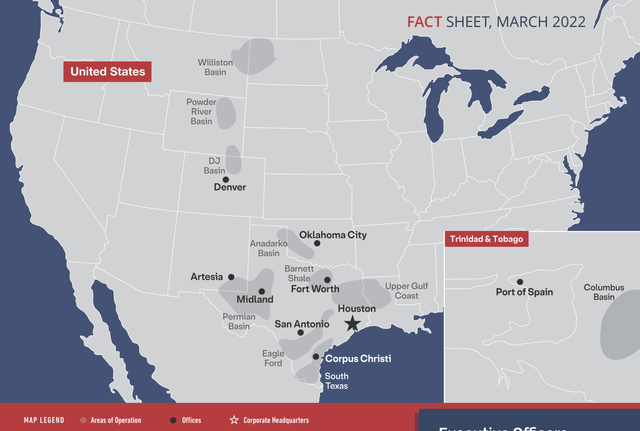

EOG Resources is a Houston-based exploration and production company. Founded in 1985, the company is one of America's largest crude oil and natural gas producers, with a market cap of $66 billion.

In 2021, the company produced 303 million barrels of oil equivalent, and 288 million barrels were produced in the United States. Moreover, the company has roughly 3,800 million barrels of oil equivalent in proven reserves. 41% of this is crude oil. 99% of these reserves are located in the United States.

On top of this, the company has good access to buyers, with multiple transportation options in each basin. This allows the company to maximize margins. Over the past few years, the company has always sold its products at a premium over its peers. In 2022, the average peer sold its crude oil and condensate for $94.4 per barrel. EOG got a $2.84 premium. This is the highest premium since its $2.91 premium in 2019.

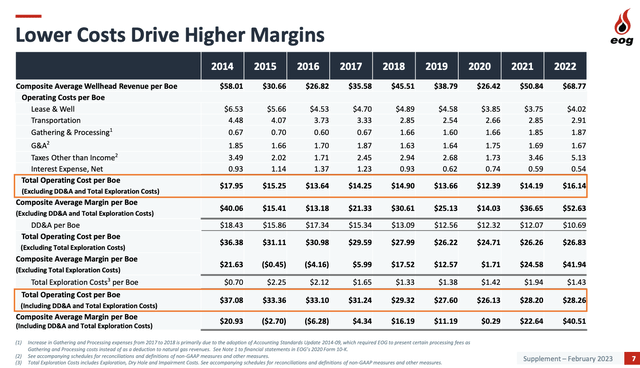

Moreover, the company has become increasingly efficient. In 2014, it cost around $37 in operating costs to produce a barrel of oil equivalent. That number came down to $28.2 in 2021. 2022 was slightly higher and the first year without an improvement since at least 2014. The company's current capital program is based on $44 WTI, which is slightly higher than previously expected. Higher inflation is causing breakevens to rise. The good news is that EOG is still incredibly efficient. If anything, this is a bullish development, as it will prevent the market (competitors) from boosting output (where possible).

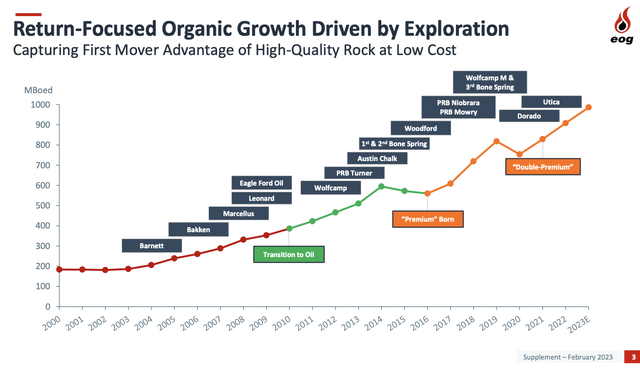

During EOG's earnings call, the company revealed that their exploration teams had uncovered a new premium play, the Ohio Utica combo, as well as advanced two emerging plays, the South Texas Toronto and Southern Powder River Basin. They also progressed several exploration prospects including the Northern Powder River Basin. The company expanded its LNG agreement, estimated to take effect in 2026, to 720,000 MMBtu per day which will provide JKM-linked pricing optionality for 420,000 MMBtu per day, resulting in a revenue uplift of over $600 million net to EOG last year.

What this means is that the company has export access and additional benefits linked to (much higher) overseas natural gas prices. This is an incredibly smart move.

Adding to that, EOG's multi-basin portfolio provides several high-return investment opportunities, and they remain focused on disciplined investment across each of their assets. They invest at a pace that allows each asset to improve year-over-year, lowering costs and expanding margins. This is in addition to their premium well strategy, in which wells must generate a minimum of 30% direct after-tax rate of return at a flat $40 oil and $2.50 natural gas price for the life of the well.

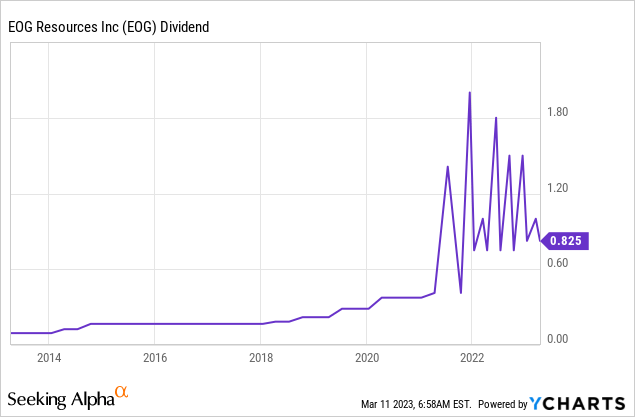

Moreover, EOG is a strong focus on shareholder returns.

In terms of dividends, the company has increased its regular dividend by 10% and paid four special dividends (the latest was $1 per share), which is an indication of the company's commitment to returning a minimum of 60% of annual free cash flow to shareholders.

The company paid out 67% of its free cash flow, which exceeded the commitment to shareholders. This is a great achievement, especially in a challenging inflationary environment.

Based on its base dividend alone, the company is yielding 2.9%. That's not a lot. Including its special dividend, that number rises to 6.5%, which is a big deal. Needless to say, these numbers will vary based on the price of oil.

Furthermore, the company has strengthened its balance sheet by reducing net debt by nearly $800 million. The company has an A- credit rating.

The company's 2023 plan is set to generate another year of strong returns, with an expected growth of oil volumes by 3% and total production on a BOE basis by 9%. At $80 WTI and $3.25 Henry Hub, the company expects to generate about $5.5 billion of free cash flow for nearly 8% yield at the current stock price and produce a ROCE (return on capital employed) approaching 30%.

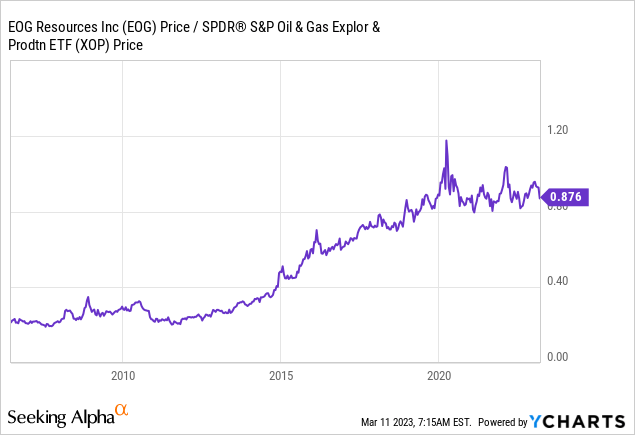

Based on this context, it is no surprise that EOG is a long-term outperformer, using the Exploration & Production ETF (XOP) as a benchmark.

Even excluding its dividend, the company has consistently performed better than its peers, as the ratio below shows.

I expect this outperformance to continue.

The same applies to stock number two.

2. ConocoPhillips

With a market cap of $129 billion, ConocoPhillips is a bigger player than EOG or pretty much any other oil company in the world.

Founded in 1917, this Houston-based energy giant produces more than 1.7 million barrels of oil equivalent per day (2022 numbers). The company has 6.6 billion barrels of oil equivalent in proven reserves, which translates to more than ten years in reserves - without incorporating slower production growth down the road, new discoveries, and/or other adjustments.

Slightly more than half of COP's production mix is crude oil. Natural gas exposure is roughly a third of total production.

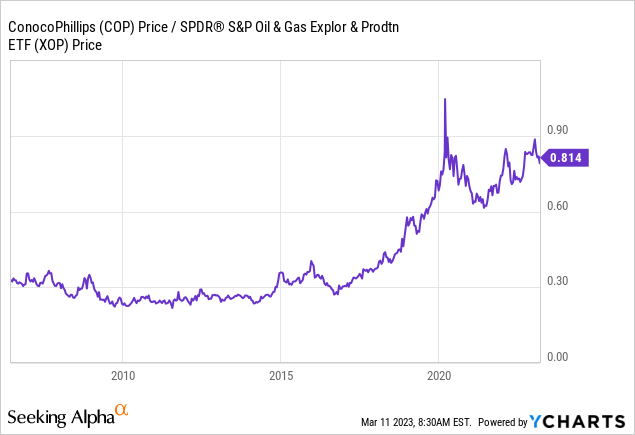

Just like EOG Resources, COP is one of the few energy companies that has consistently outperformed its peers.

In 2023, the company expects to boost production to 1.8 million barrels of oil equivalent per day. This will likely cost between $9.1 billion and $9.3 billion in capital expenditures, excluding new investments in LNG and Willow. Willow is the company's drilling project in Alaska.

According to ConocoPhillips, their CapEx for 2022 was $8.1 billion, and for 2023, they forecast an increase to a range of $9.1 billion to $9.3 billion for base capital spending, as I just briefly mentioned. The remaining $1.6 billion to $2.0 billion will be allocated to longer-term projects, with $1.5 billion to $1.6 billion dedicated to LNG projects, including Port Arthur, North Field East, and North Field South.

For Port Arthur, after accounting for expected project financing, ConocoPhillips expects its net investment to be just under $2 billion over a five-year investment period. However, more than half of this capital investment will occur in 2023.

Regarding Willow, ConocoPhillips is guiding $100 million to $400 million of incremental spending, with the higher end of this range assuming that the project is sanctioned this year.

Moreover, the company commented on both demand and supply in its earnings call.

While the energy sector is not immune to potential macro headwinds, our fundamental outlook remains constructive.

On the demand side, we think that growth will continue in 2023 aided by normalization in China mobility following the loosening of COVID restrictions.

On the supply side, we believe the continued producer discipline and the expected impacts of Russian oil and product sanctions are likely to keep balances tight.

So while commodity prices are currently not as high as they averaged in 2022, we see duration to this up-cycle.

In other words, this is in line with my own expectations.

With that said, there's more good news for shareholders. During the earnings call, ConocoPhillips announced a plan to return $11 billion to shareholders, which represents about 50% of their forecasted operating cash flow at $80 WTI. This $ 11 billion program translates to a return of 8.5% of its current market cap. That is a big deal.

In 2022, the company returned $5.1 billion to shareholders.

On February 2, the company declared a $0.51 per share per quarter regular dividend. It also announced a $0.60 VROC dividend. VROC stands for the variable return of cash. While the special dividend is variable, the implied full-year yield is 4.3%.

Moreover, in 2022, the company reduced its share count by 3.8%.

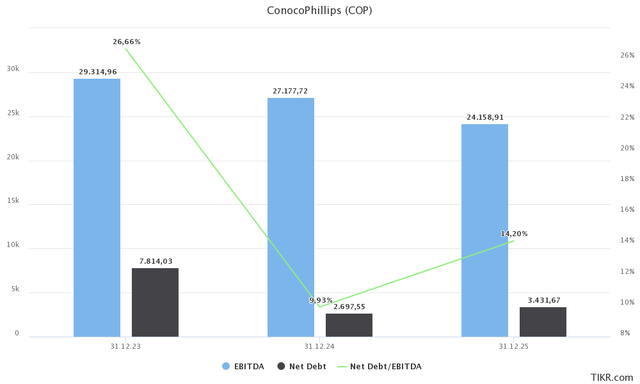

One of the reasons why the company can distribute cash so eagerly is its balance sheet. In the years ahead, the company is expected to maintain a net debt ratio of less than 0.3x EBITDA. The company has an A-rated balance sheet, which is far from common in the energy industry.

With that said, there are some risks.

Risks

The two biggest risks to this thesis are cyclical economic growth weakness and OPEC+ policies. While I believe that OPEC will not create a situation where it allows oil to sell off, it cannot be underestimated how severe the current economic environment is. I discussed that in a number of articles this month, including this one.

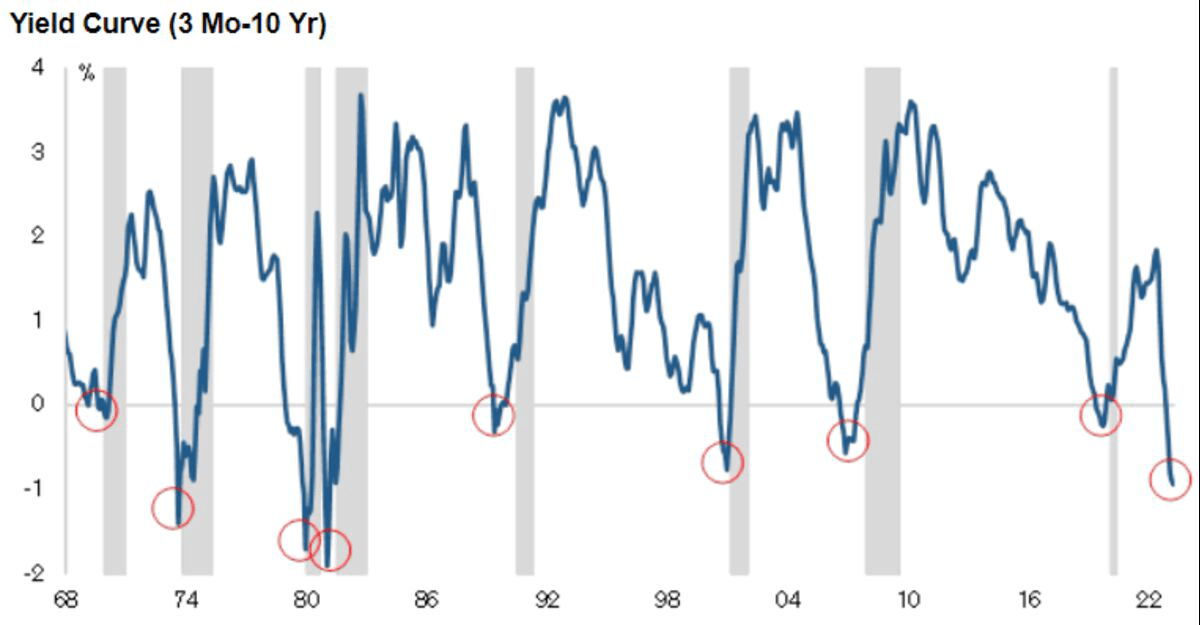

The implied recession probability is sky-high, which could hurt oil demand and related oil equities.

Credit Suisse

That said, oil is in a different place. Unlike in 2015/2016 and 2020, oil supply growth isn't as strong as it was back then.

While oil prices are likely going to weaken if economic growth falls further, I do not foresee an implosion.

Hence, my thesis remains unchanged. I'm adding to oil and energy equities on weakness, as this allows me to bet on my high-conviction long-term oil thesis.

Needless to say, investors should refrain from going overweight energy stocks. Not just in light of macroeconomic risks, but in general.

Takeaway

In this article, we discussed one of the most important developments in global energy. The shale revolution has died, as even the last places of above-average growth (the Permian) are now seeing slowing growth. If history is any indication, the next few years will see slower output on top of steadily rising global demand.

While current economic challenges keep a lid on oil prices, I remain convinced that triple-digit oil prices will be the norm as soon as demand expectations rebound.

Hence, in light of these developments, I presented two stocks that should allow investors to generate outperforming returns in the energy industry.

Both EOG Resources and ConocoPhillips have efficient US-focused operations, high inventories, healthy balance sheets, and a focus on shareholder returns.

While the mid-term outlook remains uncertain, I rate both stocks as buys.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of CVX, DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice