Ranger Energy Services: Capital Allocation In The Spotlight

Summary

- Ranger Energy Services has put in place a new share buyback program, and it also intends to initiate dividend payments after it meets its financial leverage target.

- RNGR's prior acquisitions have supported its capacity expansion and revenue growth plans, and it has highlighted that it will continue to focus on inorganic growth in the future.

- I am rating RNGR stock as a Buy, as I have a favorable view of the company's 2023 outlook and its balanced capital allocation approach.

- Looking for more investing ideas like this one? Get them exclusively at Asia Value & Moat Stocks. Learn More »

Diy13

Elevator Pitch

My investment rating for Ranger Energy Services, Inc.'s (NYSE:RNGR) shares is a Buy. RNGR expects to generate significantly higher EBITDA and cash flow in 2023, and it also plans to strike a good balance between capital investment and capital return as part of its new capital allocation policy. These factors support my Buy rating for RNGR.

Company Description

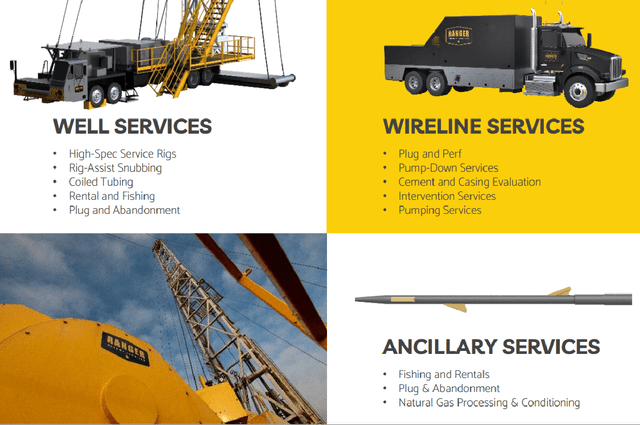

In the company's media releases, RNGR describes itself as a services provider in the "U.S. oil and gas industry" which supports "operations throughout the lifecycle of a well." Ranger Energy Services highlighted in the company's November 2022 investor presentation that it boasts a 15%-20% share of the well servicing rig market based on the number of rigs it services.

The Key Solutions Offered By Ranger Energy Services

RNGR's Q4 2022 Earnings Presentation

Ranger Energy Services derived 48%, 32% and 20% of the company's full year fiscal 2022 revenue from the high-specification rig (well services), the wireline services, and the processing solutions & ancillary services business segments, respectively.

Shareholder Capital Return For RNGR

Ranger Energy Services has new plans in place to return excess capital to the company's shareholders in the current year and beyond, as disclosed in RNGR's Q4 2022 earnings press release issued recently on March 7, 2023.

RNGR has initiated a three-year share buyback plan with a repurchase authorization of $35 million that is equivalent to a meaningful 12% of its current market capitalization.

It is noteworthy that Ranger Energy Services will take an opportunistic approach towards buying back its own shares, which is much better than repurchasing shares on a regular basis without regards for valuations.

At its Q4 2022 earnings call on March 7, 2023, RNGR stressed that it doesn't "have a defined timeline" for the buybacks to be completed, and it emphasized that the timing of its share repurchases will be dependent on "market conditions." In my opinion, it is likely that Ranger Energy Services will be able to engage in value-accretive share buybacks with its flexible and opportunistic stance on share repurchases.

Separately, RNGR has guided for a quarterly dividend of $0.05 per share to be initiated and distributed to shareholders, when the company successfully deleverages to achieve a zero net debt financial position.

Ranger Energy Services' net debt was roughly halved from $45.2 million as of end-Q3 2022 to $22.4 million as of end-2022, and the company noted at its recent quarterly results briefing that it expects to cut its net debt to zero by the middle of the current year.

Based on RNGR's last traded share price of $11.37 as of March 10, 2023 and an annualized dividend payout per share of $0.20, Ranger Energy Services could potentially offer a dividend yield of 1.8%. This suggests that Ranger Energy Services is in a good position to expand its shareholder base by attracting institutional and individual investors who have dividends as one of their key investment criteria.

Both RNGR's share repurchase program and its plans to pay out dividends in the future (once the zero net debt goal is achieved) are part of the company's new capital return policy to distribute a quarter of its annual excess cash flow to shareholders.

Ranger Energy Services' Inorganic Growth Plans

RNGR has a balanced capital allocation strategy. Besides returning more excess capital to its shareholders, inorganic growth in the form of acquisitions is also an area of focus for Ranger Energy Services.

In its Q4 2022 financial results presentation, Ranger Energy Services revealed that it will be focusing on "M&A to create value through consolidation" and seeking out acquisition targets boasting attractive characteristics like "lower capital intensity."

The company's prior acquisitions have allowed it to expand capacity to support top line growth. As mentioned in its November 2022 investor presentation, RNGR's wireline capacity grew from 20 trucks for 2020 to 96 trucks in 2021 as a result of acquisitions. Ranger Energy Services' expanded wireline truck capacity was the key driver of the company's +56% and +108% top line growth for FY 2021 and FY 2022, respectively.

Looking forward, I am of the opinion that Ranger Energy Services' balanced capital allocation approach, which doesn't ignore M&A growth opportunities, bodes well for the company's medium to long-term outlook.

Positive Financial Outlook For 2023

Ranger Energy Services' capital allocation strategy can only be successful if it has sufficient free cash flow to meet both its capital return and capital investment priorities. In that respect, RNGR's 2023 financial guidance is encouraging.

The mid-point of Ranger Energy Services' management guidance points to the company's EBITDA increasing by +26% to $100 million in FY 2023. RNGR also expects its free cash flow conversion rate (free cash flow divided by EBITDA) to improve from 39% in 2022 to 63% for 2023, which translates into an expected free cash flow of $62.5 million in this year.

The projected increase in RNGR's 2023 free cash flow conversion rate is reasonable considering the company's Q4 2022 performance. Ranger Energy Services' actual free cash flow conversion rate was as high as 97% for the most recent quarter. RNGR's free cash conversion rate for 2022 was temporarily depressed due to expenses related to the integration of prior acquisitions transactions.

Bottom Line

My rating for RNGR's stock is a Buy. I think that Ranger Energy Services can create value for its shareholders with its balanced capital allocation strategy, which should eventually push the company's share price up.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like "Magic Formula" stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

This article was written by

Those who believe that the pendulum will move in one direction forever or reside at an extreme forever eventually will lose huge sums. Those who understand the pendulum's behavior can benefit enormously. ~ Howard Marks

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.