Customers Bancorp: Northeast Regional Bank A Risk With USDC And Modest VC Lending Exposures

Summary

- Regional banks were slaughtered last week with a "sell first, ask questions later" mindset.

- One small Pennsylvania-based bank has some operations tied to stablecoins and the tech/VC space.

- Following USDC's depeg this weekend, more volatility is ahead this week.

- I see shares trading at a discount to typical valuation multiples right now, but risk management must be the focus.

- I outline key technical price levels to watch.

Hero Images Inc/DigitalVision via Getty Images

Amid the carnage that is the regional bank niche, spotting firms that should have no to extremely limited exposure to tech and VC lending may prove to be the winning strategy. One small bank located in the Northeast with some VC exposure was sold off indiscriminately last week. I see value in Customers Bancorp (NYSE:CUBI), but risk management must be employed given its ties to USDC and its lending mix. I outline a trading idea with risk top of mind.

According to CFRA Research, Customers Bancorp operates as the bank holding company for Customers Bank that provides financial products and services to individual consumers, and small and middle market businesses. The company provides deposit banking products, which includes commercial and consumer checking, non-interest-bearing and interest-bearing demand, MMDA, savings, and time deposit accounts.

The Pennsylvania-based $722 million market cap Banks industry company within the Financials sector trades at a low 3.5 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. The stock has a 6% short interest, so the short sellers are not targeting this one.

Back in January, CUBI reported an earnings and revenue miss, but the stock rallied following the announcement after a quick dip. Despite a 32% YoY revenue decline, the company’s management team sees growth ahead, which I will show later. Perhaps more troubling news came when stablecoin issuer Circle Internet Financial said it would voluntarily liquidate assets held at CUBI. So, there is modest exposure to the DeFi landscape which is a risk in this regional bank saga.

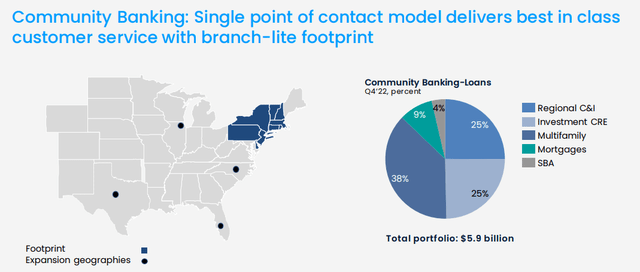

CUBI primarily engages in banking operations in the Northeast, well away from the turmoil in Silicon Valley.

Northeast Banking Activities

CUBI

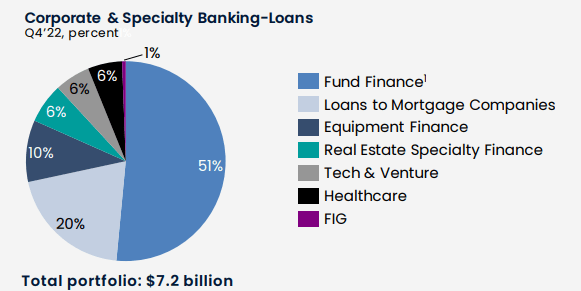

But it’s really the portfolio of loans that CUBI owns that matters. Notice in the image below that the bank has a material, but not major, exposure to tech and venture borrowers. So, while there could be capital at risk, the impact should be held in check. I'm concerned about how the stock may open tomorrow given its ties to USDC. Waiting a few days for the dust to hopefully settle may be the best approach here.

A Small Slice to Tech Lending

CUBI

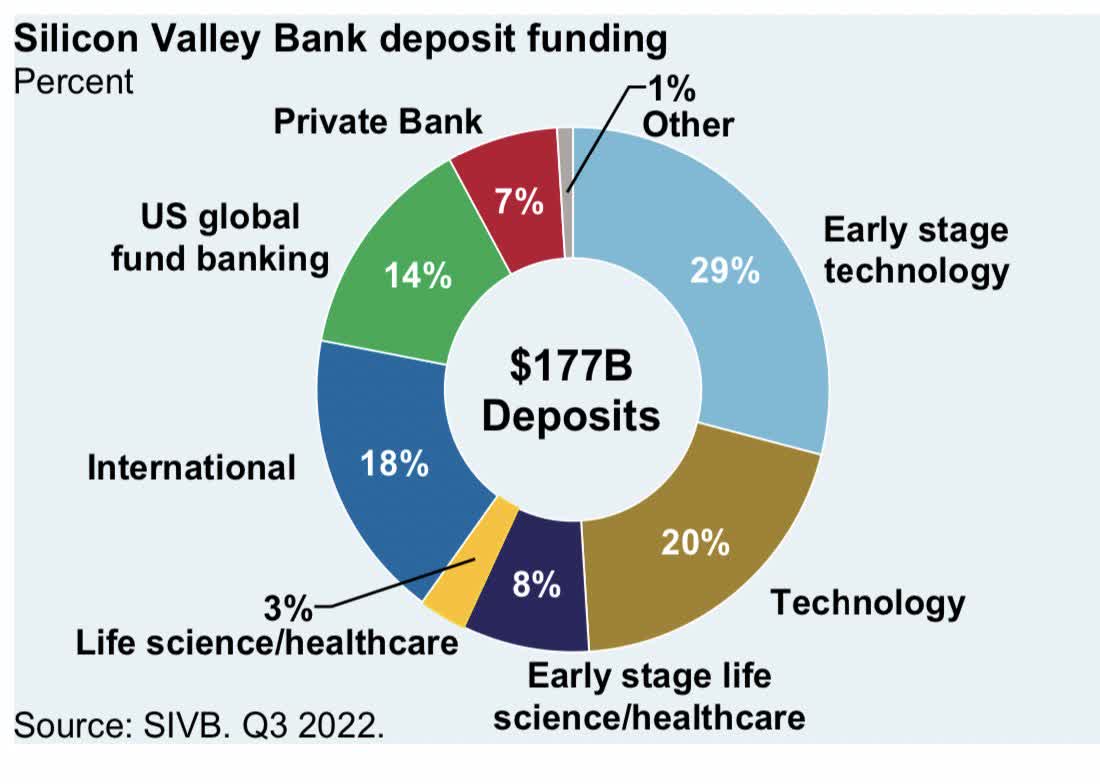

Much Different Exposure Compared to SIVB's Deposits

SIVB

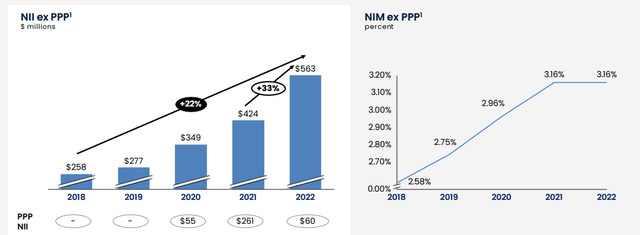

What’s encouraging for CUBI is that the trend in its net interest income and NIM are decent, but the NIM may drop this coming year.

Rising Net Interest Income, Flat NIM Trend

CUBI

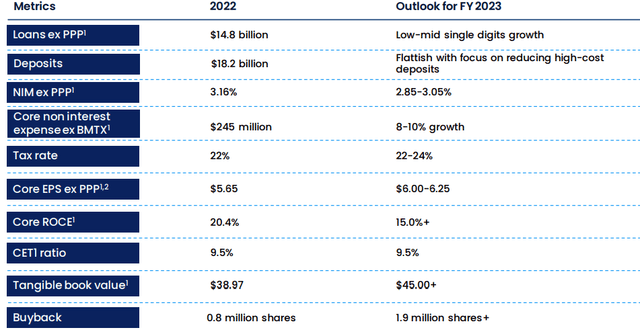

The management team sees a modest drop in its NIM this year with about 10% earnings rise and a flat 9.5% CETI ratio. The company also plans to repurchase shares.

EPS Growth and Share Buybacks in 2023 Seen

CUBI

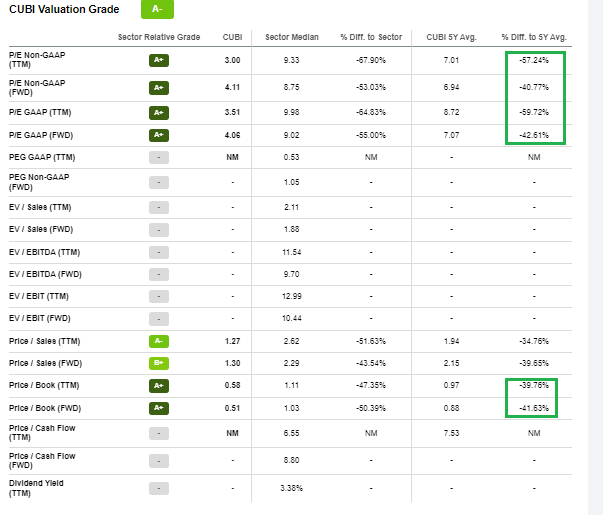

With a forward P/E now near 4 – a 41% discount to its five-year average, and with a price-to-book ratio of just 0.51, the stock clearly is cheap here so long as cascading risks do not enter the picture any more than they have already. A fair value would be near $38 if shares simply reverted to their historical valuation multiple figures.

CUBI: Attractive on Valuation

Seeking Alpha

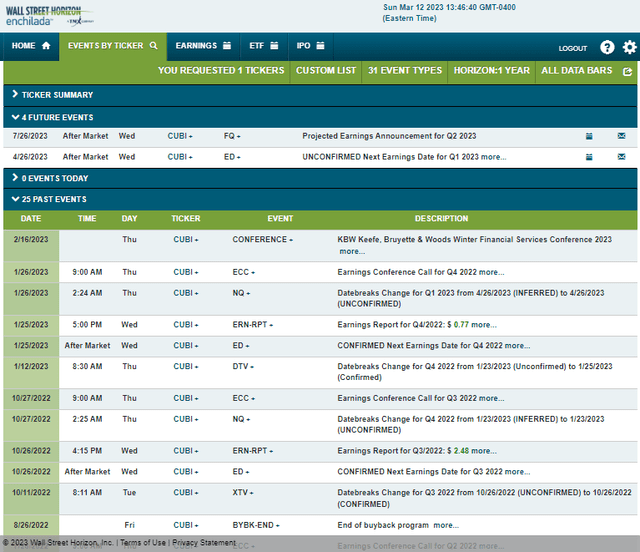

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1 2023 earnings date of Wednesday, April 26, after market close.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

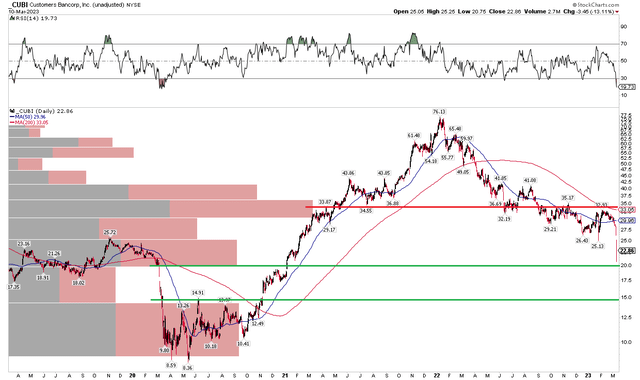

While I see some high-risk exposure to CUBI’s banking activities, the chart also is a major warning sign. For this reason, traders and investors should carefully step in with small positions due to the volatility. What’s more, having an exit plan is critical. For long-term investors, price action suggests there is a non-zero chance of a major continued fall. Knowing that going in, I see support on the chart at the COVID breakdown level just under $20. That’s a key spot since it is near where shares bottomed out on Friday and there’s an old breakaway gap from late 2020 that may be filled around $19.

I see resistance in the low to mid-$30s, so some gains should be booked there. With the RSI momentum indicator firmly in a bearish range and with ample volume by price in the $30s, the bulls have their work cut out for them. Further downside support begins near $14, but that is a sizable drop from here should it happen. Overall, the chart screams risk. A recovery above $35, which is also higher than the falling 200-day moving average, would help support a stronger risk-aware long play.

CUBI: Bearish Downtrend In Place

Stockcharts.com

The Bottom Line

I don’t think CUBI stock will be a disaster from here, but there are many unknowns. Dipping in with a small long position as a speculative wager is fine, but I want to wait to see how things shake out with this one.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.