Failure Fallout

Summary

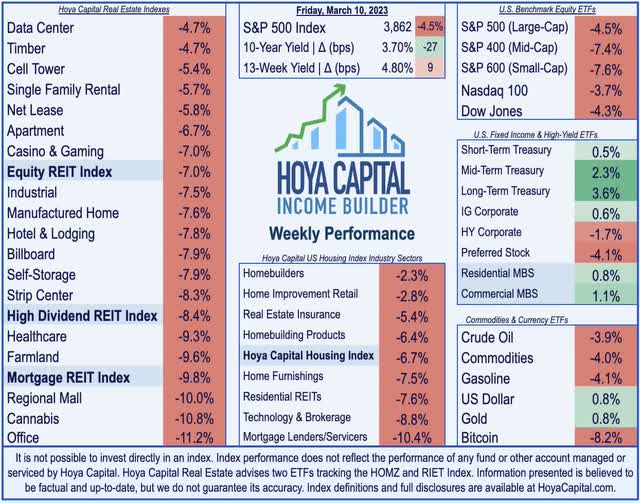

- U.S. equity markets tumbled this week after the sudden collapse of a pair of technology-focused banks sparked concerns over financial stability and overshadowed a generally solid slate of employment data.

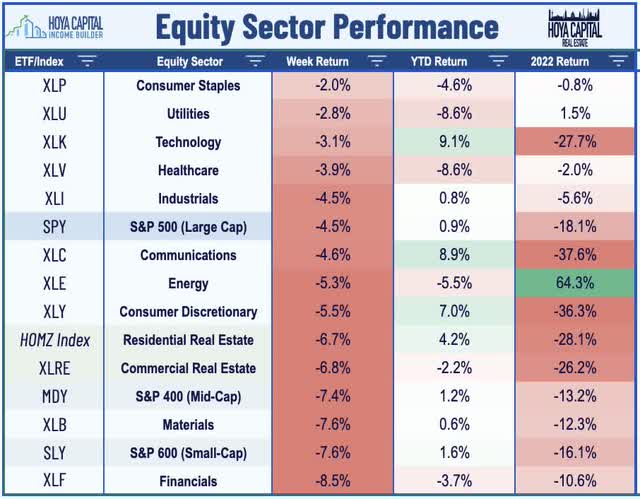

- Effectively erasing all of its gains for the year and posting its worst week since September 2022, the S&P 500 dipped 4.5% while the Mid-Cap and Small-Cap benchmarks plunged 7%.

- Real estate equities were slammed particularly hard as investors drew parallels to the early stages of the 2008 financial crisis when locked-up credit markets created a cascade of distress.

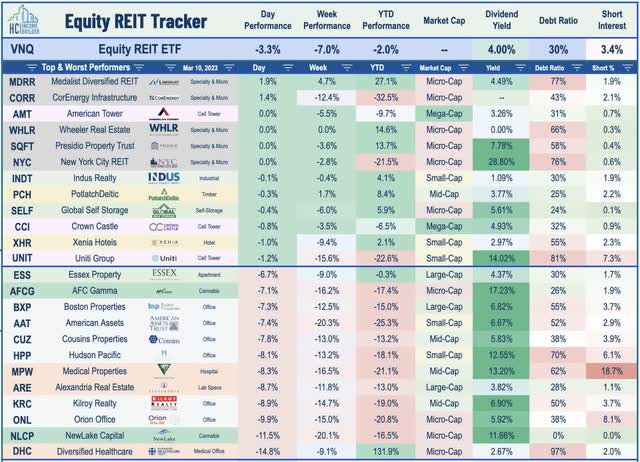

- The Equity REIT Index dipped 7% this week. Sixteen office REITs plunged over 10% on concerns that the SVB fallout could intensify headwinds on both the demand and financing side.

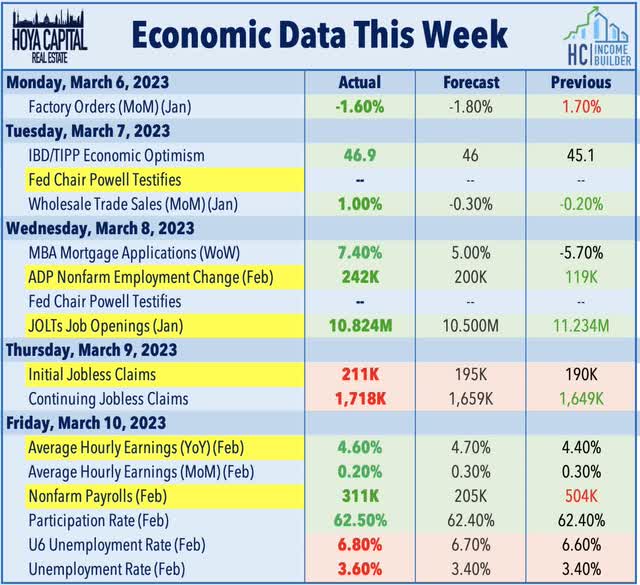

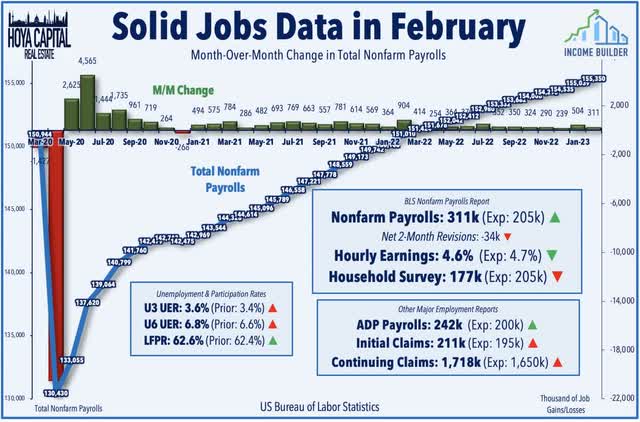

- The U.S. economy added 311k jobs in February - above expectations of 205k, but the relevant inflation-related metric - Average Hourly Earnings - was cooler than expected while the unemployment rate increased.

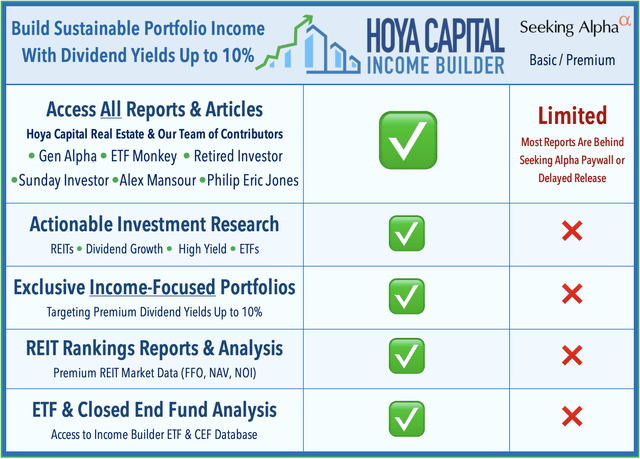

- Hoya Capital Income Builder members get exclusive access to our real-world portfolio. See all our investments here »

franckreporter

Real Estate Weekly Outlook

This is an abridged version of the full report and rankings published on Hoya Capital Income Builder Marketplace on March 10th.

U.S. equity markets tumbled this week after the sudden collapse of a pair of tech-focused banks sparked concerns over financial stability and overshadowed a generally solid slate of employment data. The second-largest banking collapse in history behind Washington Mutual in 2008, the collapse of Silicon Valley Bank (SIVB) - which focuses its lending on high-risk startups and technology firms - was remarkably swift, triggered initially by a seemingly mundane credit rating downgrade, but cascaded into a "run" on deposits that the firm was unable to contain. The collapse followed a liquidation of crypto-lender Silvergate Capital earlier in the week, which together raised questions over the health of lenders focused on more highly-speculative businesses and the potential contagion effects on depositors and the broader banking industry.

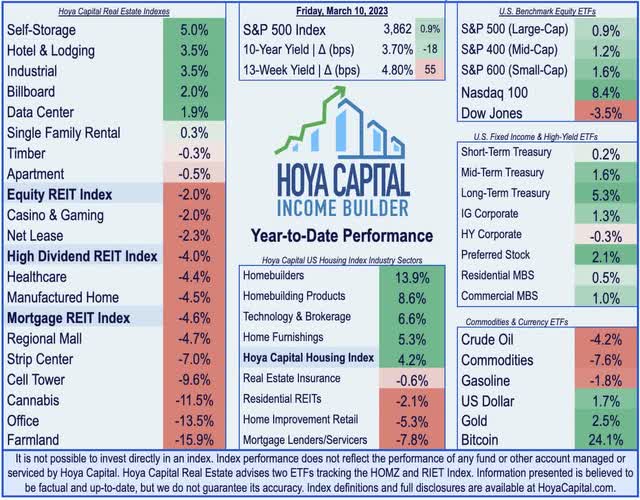

Effectively erasing all of its gains for the year and posting its worst week since September 2022, the S&P 500 dipped 4.5% on the week while the Mid-Cap 400 and Small-Cap 600 each slid by over 7%. The Dow erased nearly 1,500 points in its worst week since June. Despite all signs pointing toward SVB's speculative tech-related investments as the root of the firm's implosion, the tech-heavy Nasdaq 100 was ironically an outperformer on the week. Real estate equities were slammed particularly hard as investors drew parallels to the early stages of the 2008 financial crisis when locked-up credit markets created a cascade of distress in credit-sensitive industry groups. The Equity REIT Index dipped 7.0% on the week, with all 18 property sectors finishing in negative-territory, while the Mortgage REIT Index dipped by nearly 10%.

Bond markets were particularly volatile this week as financial stability concerns prompted traders to re-evaluate Fed rate hike expectations. After climbing to the highest level since 2007 earlier this week at 5.07%, the policy-sensitive 2-Year Treasury Yield plunged nearly 50 basis points over the subsequent two days to close the week at 4.59%, while the 10-Year Treasury Yield dipped by 27 basis points on the week to close at 3.70%. Market-implied odds of a 50 basis point hike in the March meeting began the week at 20%, surged to 70% after Jay Powell's Congressional testimony, then dipped to as low as 35% early Friday before recovering to above 50% by Friday evening. All eleven GICS equity sectors finished lower on the week, with Financials (XLF) stocks posting their worst week since April 2020. Ahead of the critical CPI report next week, commodities prices were also sharply lower on the week, with Crude Oil dipping 4% - now lower by 5% on the year - while Natural Gas futures dipped nearly 20% to drag its year-to-date declines to over 35%.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

Financial stability concerns seized the headlines from the most closely-watched report of the week - the BLS' nonfarm payrolls report for February, which showed that the U.S. economy added 311k jobs in February - above expectations of 205k. The most relevant inflation-related metric in determining the path of Fed policy - Average Hourly Earnings - was cooler-than-expected, however, rising at a 4.6% annual rate, which was below the forecast of 4.7%. Over the past three months, the annualized increase in AHE has averaged 3.5%, which is only slightly above the 2015-2019 average of 2.9%. There was more "good news" on the inflation front, as the unemployment rate also increased to 3.6% from 3.4% in the prior month as the labor force participation rate recovered to its highest level since March 2020.

Perhaps skewing the AHE numbers a bit, job gains in recent months have been concentrated in sectors with lower average hourly earnings, including in the leisure and hospitality sector - which added 105k jobs in February - and in the retail sector - which added 50k in February. The information technology industry, meanwhile, lost 25k jobs in February, and has decreased by 54k since last November. Earlier in the week, ADP Research reported that private payrolls rose 242,000 last month, which was above the median estimate of 200,000. The Labor Department, meanwhile, reported that there were 10.8 million job openings in January - down from 11.2 million a month earlier, but well above the median estimate of 10.5 million. Underscoring the labor market tightness that has been a concern of Fed officials, the ratio of openings to unemployed people remained historically elevated at 1.9x in January - significantly above the 1.2x level in late 2019 before the pandemic.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

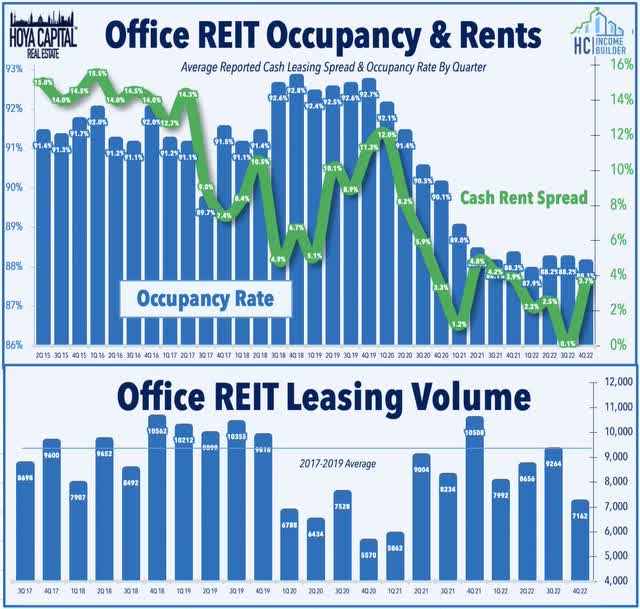

Office: The single hardest-hit property sector this week, sixteen office REITs plunged by at least 10% on the week over concerns that the SVB fallout could intensify headwinds on both the demand and financing side. Fitch reported that 56% of new real estate delinquencies in February were in the office sector. While CMBS delinquencies rates in the office sector remain relatively low at 1.4% - and below the average of around 5% from 2015-2019 and well below the peak of 9% in 2012 - the past month has seen a wave of mega-sized loan defaults from Pimco, Brookfield, and RXR. In the public markets, Orion Office (ONL) dipped 15% on the week after reporting downbeat results, noting that its full-year FFO declined 4.3% in 2022 and provided a weak outlook for 2023 which calls for an 11.7% decline in FFO at the midpoint of its guidance range. While ONL did achieve a relatively solid 4% cash rent spread for full-year 2022, it did comment that its continuing to see "headwinds" as "tenants continue to push leasing decisions out, are shrinking their space needs, and new tenants are waiting to commit to new space." Alexander's (ALX) was one of the best-performing names in the space after it announced that it reached a deal to sell its Rego Park III land parcel in Queens for $71M.

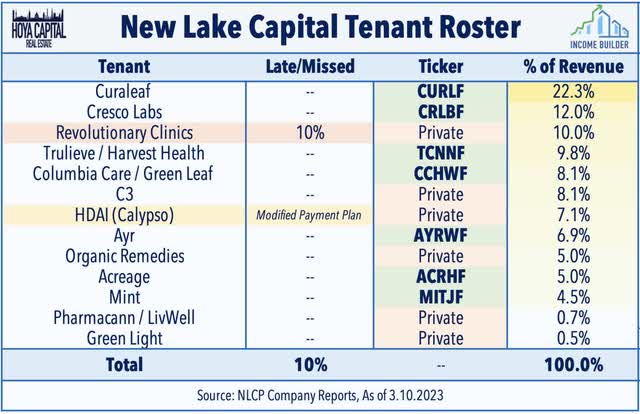

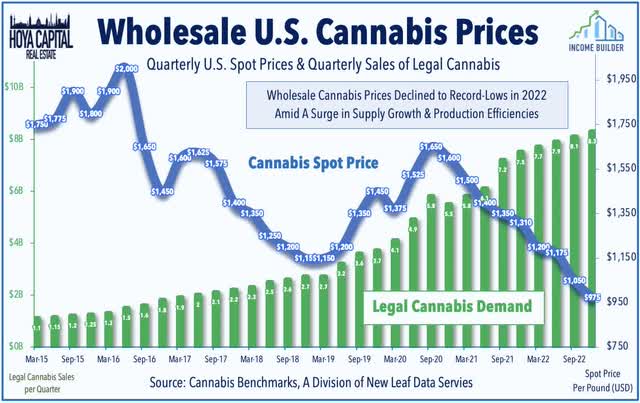

Cannabis: Fittingly, one of the more speculative segments of the real estate sector was in focus this week amid a busy slate of earnings reports from three cannabis REITs. NewLake Capital (OTCQX:NLCP) dipped more than 15% on the week after it reported that it expects its rent collection rate to dip from 100% in Q4 to between 90-93% in Q1 due to nonpayment from Revolutionary Clinics - its third-largest tenant representing roughly 10% of its monthly rents. NLCP commented, "we can’t underestimate the difficult environment the operators are enduring" and cited regulatory setbacks, price compression, and financing challenges as the major headwinds. Earlier in earnings season, its peer Innovative Industrial (IIPR) reported that it collected 92% of rents in February due to nonpayment from three operators. As noted in Cannabis REITs: Smoked Out, cannabis operators have been pressured by plunging wholesale cannabis prices, limited access to financing, and setbacks on federal legalization. IIPR and NLCP have focused recent leasing and lending efforts on larger multi-state operators ("MSOs") and publicly-traded firms, and three of the four non-paying tenants are single-state private operators.

Sticking in the cannabis sector, AFC Gamma (AFCG) dipped over 14% after reporting that one borrower is now on non-accrual status - Flower One - which represents about 1% of its portfolio. AFCG also increased its Current Expected Credit Loss reserve ("CECL") reserve from 1.8% to 4.97% in Q4. Citing industry headwinds and lack of "risk-adjusted" opportunities, AFCG has not originated any new cannabis debt investments over the past nine months and anticipates closing its first non-cannabis commercial real estate loan "in the next 90 days." Management indicated that its portfolio could be "more balanced towards 50-50 by the end of this calendar year" and specifically cited multifamily and industrial as the property sectors it is currently targeting. Chicago Atlantic Real Estate (REFI) was an outperformer after reporting that all loans are performing but did increase its credit loss reserve from roughly 1% to 2%. REFI noted that the increase wasn't the result of any specific loan, but rather "a culmination of multiple factors including third-party evaluations...[responding] to the headwinds that not just the cannabis space is exhibiting." REFI reported distributable EPS of $0.57 in Q4 - covering its $0.47/share dividend - while its full-year outlook stated that it expects its quarterly dividend to "be a minimum of $0.47/share" in full-year 2023.

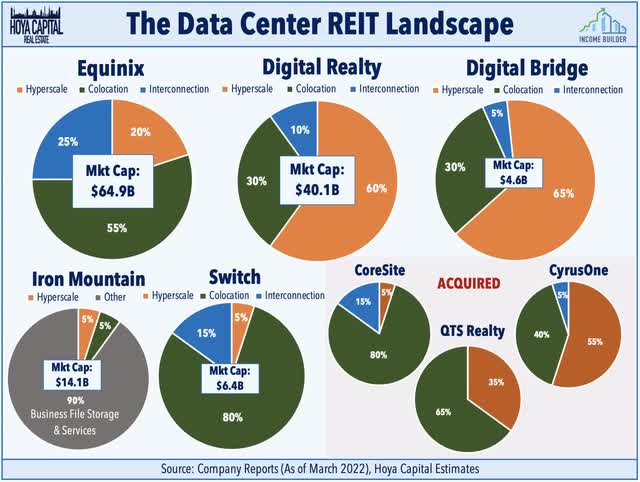

Data Center: DigitalBridge (DBRG) was in focus this week following reports that the company is considering a sale of its minority stake in Vantage Data Centers. Citing people with knowledge of the matter, Bloomberg noted that DigitalBridge is seeking to sell its stake for $1.5 billion - a move that is consistent with its strategy shift towards an "asset-lite" business model that included the transition last year from a REIT to a taxable C Corporation. Vantage Data Centers is among the largest operators in the sector, operating about 26 campuses across Europe, the Middle East and Africa. Bloomberg reports that Vantage is expected to garner interest from private equity firms and infrastructure funds. The two major data center REITs - Equinix (EQIX) and Digital Realty (DLR) - were not specifically named in the report. These two REITs were notably quiet on the acquisition front amid the frenzy of M&A activity during the pandemic. Their patience appears to be quite prudent in hindsight, positioning them to be aggressors as other more-highly-levered private players seek an exit.

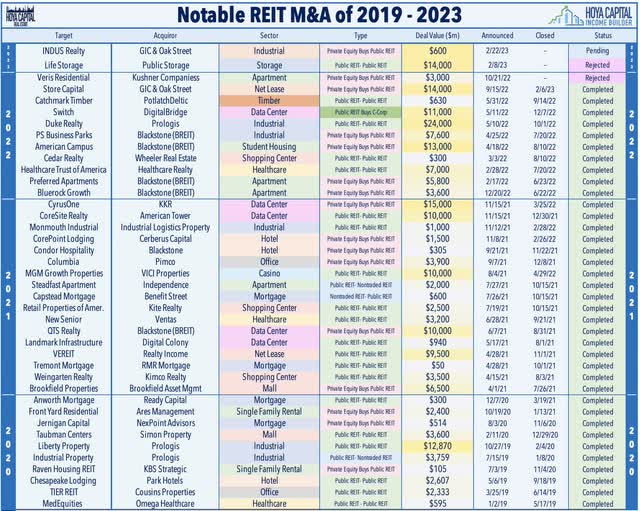

Industrial: On the topic of M&A, INDUS Realty (INDT) was little changed this week after reporting Q4 results - likely its final report as a public company - as it confirmed that its acquisition by GIC Real Estate at $67.00/share is expected to close in the summer of 2023. Previously known as Griffin Industrial Realty before its REIT conversion back in 2021 - Indus is a small-cap REIT that owns 42 industrial/logistics buildings aggregating 6.1 million square feet in Connecticut, Pennsylvania, North Carolina, South Carolina, and Florida. For GIC, the deal is its second major acquisition of the past year following its $14B takeover of net lease REIT Store Capital last September. INDT reported results that were largely in line with its peers, noting that it achieved same-store NOI growth of 9.5% for full-year 2022 driven by a nearly 30% rental rate spread for the year. Also this week, iStar (STAR) and Safehold (SAFE) announced that their stockholders voted to approve their proposed merger and are currently targeting closing the transactions on or about March 31, 2023.

There was some positive news amid the market carnage. W. P. Carey (WPC) - which we own in the REIT Focused Income Portfolio - became the 38th REIT to hike its dividend this year. With REIT earnings season winding down, last week we published our REIT Earnings Recap, which we split into two reports: In Winners of REIT Earnings Season, we noted that rising rate concerns overshadowed a surprisingly strong slate of reports across most property sectors. Roughly two-thirds of REITs beat earnings expectations, the third-best among the 11 industry groups tracked by FactSet. In Losers of REIT Earnings Season, we focused on the worst-performing property sectors, noting that variable rate debt expense was a common threat across these sectors. While REITs as a whole are substantially better-capitalized than their peers in the private markets, the handful of REITs that 'gambled' with higher levels of variable rate debt have been forced to either ride out the volatility and hope for some rate relief, or to fix their interest rate exposure using hedges and/or new bond issuance - usually at a high cost.

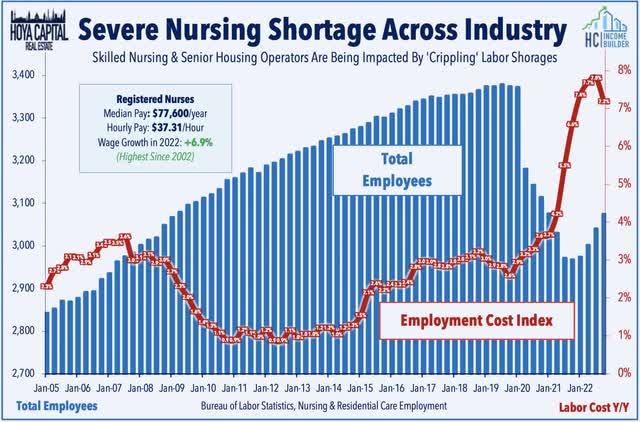

Healthcare: This week, we published Healthcare REITs: Life After The Pandemic, which discussed our updated sector outlook and recent portfolio allocations. For Healthcare REITs - the physical epicenter of the pandemic - the road to recovery has remained inconsistent across its distinct sub-sectors, with "private-pay" segments now showing notable improvement while "public-pay" segments relapse. For Senior Housing REITs, the long-awaited recovery is finally taking hold. Robust rent growth is being fueled by rising resident incomes from record-high Cost-of-Living-Adjustments (“COLA”) to Social Security benefits. Lab Space fundamentals remained stellar into late 2022 despite sluggish biotech fundraising activity and a slowdown in life sciences hiring, but an expected wave of supply growth comes at a less-than-ideal time - particularly given the potential direct impact of the SVB collapse on its smaller life sciences tenants. Public-pay segments - Hospital and Skilled-Nursing - have seen a re-intensification of tenant operator issues amid pressure from soaring labor costs and waning government fiscal support, triggering some missed rents and lease renegotiations.

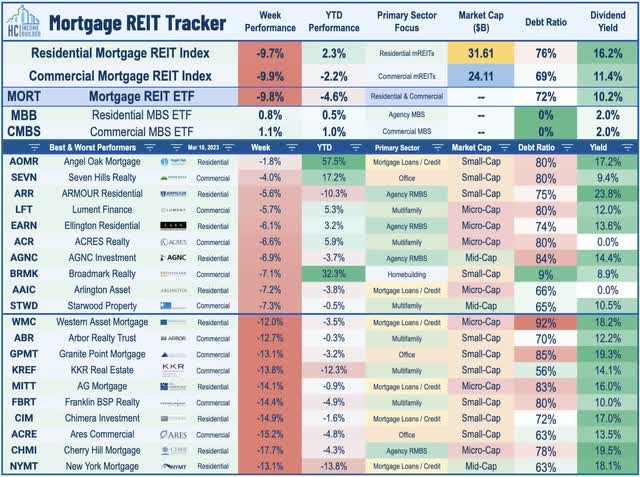

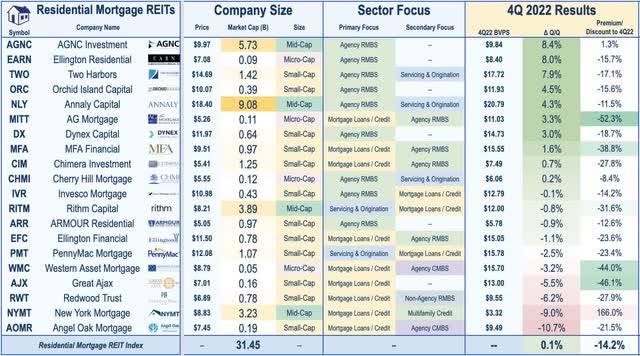

Mortgage REIT Week In Review

Mortgage REITs were slammed this week on concern over the potential fallout from the collapse of Silicon Valley Bank, which held a relatively large portfolio of residential and commercial mortgage-backed securities. The Mortgage REIT ETF (REM) dipped nearly 10% despite a surprisingly strong week of the performance from the underlying mortgage-backed bonds, reflected in the 1% rally from the iShares MBS ETF (MBB) and the CMBS ETF (CMBS). Mortgage REIT earnings season wrapped up with a handful of mixed reports. Ellington Residential (EARN) was among the top performers this week after reporting that its Book Value Per Share ("BVPS") jumped 8% in Q4 to $8.40 - the second-highest increase in the mREIT sector this earnings season behind AGNC Investment (AGNC) - and reported that its BVPS increased to $8.56 at the end of February - up about 2% since the end of December.

Elsewhere, Angel Oak (AOMR) finished lower by 2% after reporting mixed fourth-quarter results, noting that its Book Value Per Share ("BVPS") declined about 10% in Q4 to $9.49, but the majority of the loss ($0.77) was driven by a large loan sale in November and excluding the sale, its book value was roughly flat in Q4. When asked about its dividend, AOMR noted that its "still comfortable" with its current level. Curiously, AOMR plunged by nearly 20% in the final hour of trading ahead of its public earnings release but recovered nearly all of those losses in the subsequent two trading sessions. On the downside this week, Cherry Hill Mortgage (CHMI) dipped more than 17% after reporting downbeat results, noting that its distributable EPS was $0.24 in Q4 - shy of its $0.27 quarterly distribution - while its Book Value Per Share ("BVPS") increased fractionally to $6.06, which was below the average increase of 6% from its Agency-focused peers.

2023 Performance Check-Up

Through the first ten weeks of 2023, the Equity REIT Index is now lower by 2.0% on a price return basis for the year, while the Mortgage REIT Index is lower by 4.6%. This compares with the 0.9% gain on the S&P 500 and the 1.2% advance on the S&P Mid-Cap 400. Within the real estate sector, 6-of-18 property sectors are in positive territory on the year led by Self-Storage, Hotel, Industrial, and Billboard REITs. At 3.70%, the 10-Year Treasury Yield has declined 18 basis points since the start of the year - above its closing low of 3.39% in early February - but well below its 2022 highs of 4.30%. The US bond market has stabilized following its worst year in history as the Bloomberg US Aggregate Bond Index has gained 1.5% this year.

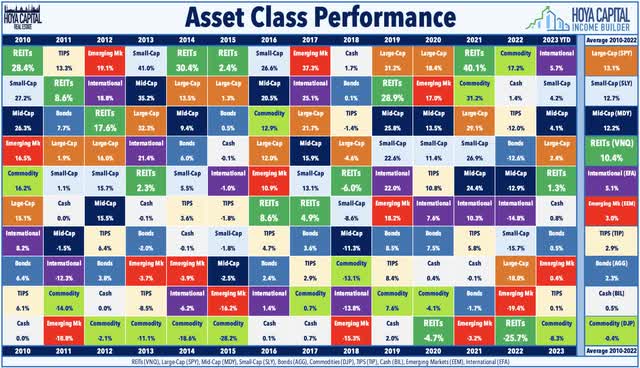

Good riddance, 2022. There were few places to hide across financial markets in a historically brutal year for investors that wiped out nearly a fifth of global financial wealth. The typically-steady US bond market delivered its worst year in history in 2022 with a loss of 13.01% on the Bloomberg US Aggregate Bond Index, which is over 4x larger than the previous worst year back in 1994 (-2.9%). Closing at 3.88%, the 10-Year Treasury Yield surged 237 basis points from the start of the year. Among the ten major asset classes, Commodities (DJP) were the only segment to see positive inflation-adjusted returns for the year. After leading the charge in the prior year, REITs finished in the basement of the performance tables among the ten major asset classes on a total return basis with declines of roughly 25%.

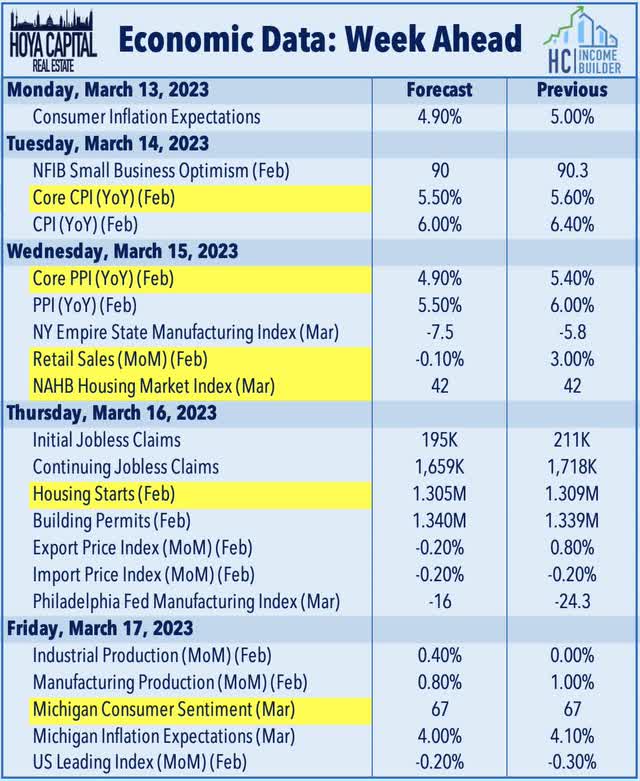

Economic Calendar In The Week Ahead

Inflation, retail, and the U.S. housing market are in the spotlight in another jam-packed week of economic data in the week ahead. The main event comes on Tuesday with the Consumer Price Index for February, which investors and the Fed are hoping will show a cooling of inflationary pressures. The headline CPI is expected to moderate to a 6.0% year-over-year rate, while the Core CPI is expected to decelerate to 5.5%. As with recent months, the metric we're watching most closely is the CPI-ex-Shelter Index - which has been in deflationary territory over the past six months. Later in the week on Thursday, we'll see the Producer Price Index, which is expected to slow to similar signs of cooling. The headline PPI is expected to slow to a 5.5% year-over-year rate - down from the recent peak in March at 11.8%. We'll also see an important slate of housing market data with NAHB Homebuilder Sentiment data on Wednesday and Housing Starts and Building Permits data on Thursday, which have been closely correlated to changes in mortgage rates. On Wednesday, we'll also see Retail Sales data, which is also expected to show a decline in spending in February after a strong January.

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read The Full Report on Hoya Capital Income Builder

Income Builder is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and 'Dividend Champions' across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

This article was written by

Real Estate • High Yield • Dividend Growth.

Visit www.HoyaCapital.com for more information and important disclosures. Hoya Capital Research is an affiliate of Hoya Capital Real Estate ("Hoya Capital"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut.

Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns.

Collaborating with ETF Monkey, Retired Investor, Gen Alpha, Alex Mansour, The Sunday Investor, and Philip Eric Jones for Marketplace service - Hoya Capital Income Builder.Hoya Capital Real Estate ("Hoya Capital") is a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations is an affiliate that provides non-advisory services including research and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital has no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.

Disclosure: I/we have a beneficial long position in the shares of RIET, HOMZ, AFCG, AGNC, AMT, ALX, DLR, EPR, EARN, HPP, EQIX, OPI, KIM, IVR, SLG, SRC, WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receive compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.