Silicon Valley Bank - Crisis Averted

Summary

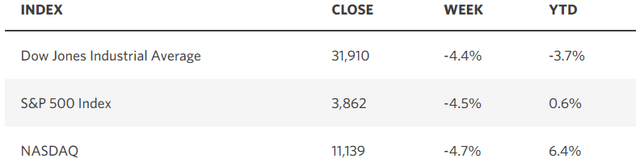

- The collapse of Silicon Valley Bank sent bank stocks reeling last week, with several regional bank stocks falling more than 20% on Friday.

- The issue is horribly managed balance sheets not positioned for a rising interest-rate environment.

- The Fed intends to resolve the issue by accepting underwater Treasury debt as collateral for cash through an emergency lending facility.

- That won't save SVB, but it should put to rest concerns investors have about the banking system and allow us to refocus on the economy.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect. Learn More »

Justin Sullivan

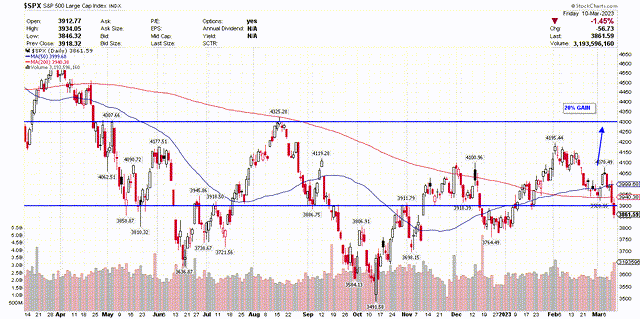

I clearly spoke too soon in thinking that the pullback to 3,900 for the S&P 500 was behind us and that the next move would be a rally to 4,300. While the technical backdrop for the market may be bruised after last week’s carnage, the fundamental picture has not changed in my view. In fact, the jobs report on Friday strengthens it from the standpoint that disinflation ensues, while the economy continues to power ahead. Businesses continue to hire on a net basis, which should assuage recession fears, as wage growth continues to slow, easing inflationary pressures in the service sector. Unfortunately, last week’s good news was overwhelmed by headlines of the largest bank failure since the financial crisis of 2008. Yet I do not think SVB Financial Group (SIVB) collapse poses systemic risk, and it's not the canary in the coal mine to another financial crisis.

Edward Jones

Banks have no choice but to invest their cash in the safest and most liquid of investments, which means they own a lot of Treasuries, despite the fact that yields over the past several years have been very low. When the money supply surged after the pandemic and deposits soared, there was even more demand for Treasuries, but at what were some of the lowest yields on record. As the Fed raised short-term rates over the past year, and long-term rates rose, the value of those Treasuries fell, resulting in significant unrealized losses. That is not a problem so long as the bank has enough liquidity to meet demands from depositors, but if the bank is forced to sell Treasuries at a loss, it's another story. Depending on the duration of the investment portfolio held by the bank, and the nature of the depositor base, the result could be catastrophic, as it was for Silicon Valley Bank.

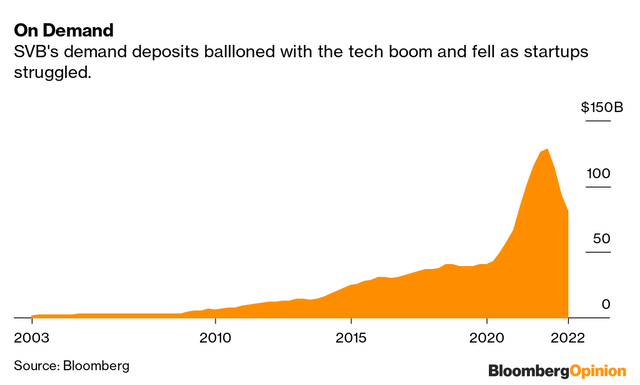

Bloomberg

Silicon Valley Bank is no ordinary bank, as it was primarily focused on private-equity firms, venture capitalists, and the start-up businesses they fund with a focus on technology. That's not a diversified customer base. In addition, it seems it was running its operation like one of its customers and not the 18th largest bank in the country. When the money supply soared after the pandemic, deposits for this bank soared as well, and management invested a tremendous amount of capital in long-term Treasury bonds at all-time low yields. As rates have risen, the value of the Treasuries has fallen, and now that financial conditions are tightening and the economy is slowing, their depositors are in need of cash. This forced the bank to sell Treasuries for heavy losses to fund those withdrawals, which led to more fear-driven outflows of deposits. The bottom line is that there was a run on the bank. This bank did a horrible job managing its balance sheet, taking on tremendous interest-rate risk, which forced it to take losses that the vast majority of banks should not be forced to take. The largest money-center banks have far more diversified customer bases and much stronger balance sheets, as do most regional banks.

That said, there are surely other financial institutions suffering from similar balance sheet issues, given the rapid surge in interest rates, but that doesn’t mean we see more runs on banks. We had a preview of which institutions may be dealing with these issues from the stock price declines in regional bank names like First Republic (FRC), Signature Bank (SBNY), and Western Alliance (WAL) on Friday.

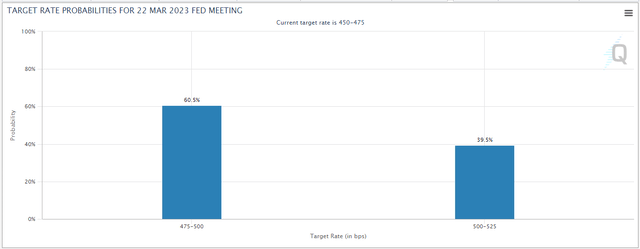

The irony is that the panic this situation created last week drove investors into the safety of U.S. Treasuries, which serves to lessen the damage that the price declines in Treasuries caused in the first place. The yield on the 10-year Treasury plunged last week by 30 basis points from 4% to 3.7%. This event also is disinflationary from the standpoint that it is tightening financial conditions, which is exactly what the Fed wants to see. That's why Fed Funds futures now show expectations for a rate increase at the Fed’s March 21-22 meeting have fallen back down to just 25 basis points from what was 50 shortly after Chairman Powell testified before Congress on Tuesday of last week.

CME Group

Monday morning could be tumultuous at the open, as fear pervades and investors sell now only to ask questions later, but cooler heads should prevail as the week progresses, if not by the end of trading on Monday. All parties involved have been busy over the weekend working on a solution. The Federal Reserve has already proposed opening its discount window where banks that are facing depositor flight can use Treasury bonds that have unrealized losses as collateral to obtain cash. That solves the issue of additional runs on banks, and it should greatly reduce volatility. The Fed’s emergency lending program requires approval from the Treasury Department, but that should not be an issue.

Hopefully, we can put this crises behind us on Monday so that investors can refocus on the economic fundamentals come Tuesday. That's when the Consumer Price Index report for February will be announced, which when combined with last week’s favorable jobs report, should dictate the Fed’s next monetary policy move. I sit firmly in the camp that we will see a 25-basis-point rate increase. The Fed is likely to more tempered in its aggressive monetary policy stance until it sees how the fallout from Silicon Valley Bank impacts the incoming economic data. That’s good news, because it gives Fed officials more time to recognize the disinflationary trend that is already firmly in place.

StockCharts

I do not expect the S&P 500 to vacation long beneath the 3,900 level I saw as support. That should form another higher bottom off the December low of approximately 3,750 and begin a recovery to what I think could be as high as 4,300 in the weeks and months ahead.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

This article was written by

Lawrence is the publisher of The Portfolio Architect. He has more than 25 years of experience managing portfolios for individual investors. He began his career as a Financial Consultant in 1993 with Merrill Lynch and worked in the same capacity for several other Wall Street firms before realizing his long-term goal of complete independence when he founded Fuller Asset Management. He graduated from the University of North Carolina at Chapel Hill with a B.A. in Political Science in 1992.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice.

Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.