Blackstone: Be The Advisor, Instead Of The Client

Summary

- Blackstone has suffered from the 2022 bear market in financial products on Wall Street and now bank solvency/contagion worries in March 2023.

- All the while, underlying operations, including sales and cash flow, continue to rise.

- A solid valuation and improving technical momentum performance in 2023 argue in favor of ownership.

Ridofranz/iStock via Getty Images

Blackstone Inc. (NYSE:BX) has been hit in March by the bank and broker selloff tied to the realization interest rates may stay higher longer (hurting financial market pricing), on top of the sudden failure and FDIC seizure on Friday (March 10th) of the California technology lender Silicon Valley Bank - SVB Financial (SIVB).

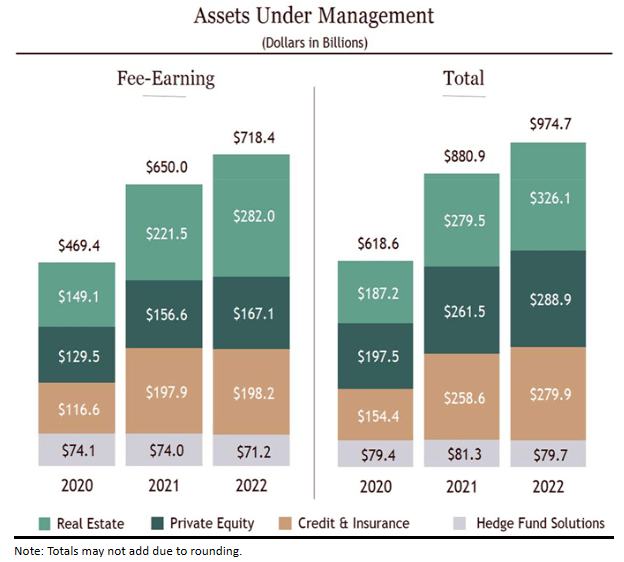

Blackstone Inc. is one the largest global alternative asset management firms, with $975 billion in AUM at last report. It is quite diversified as a financial-product middle man, specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies. The firm also invests in early-stage companies, and provides capital market services. You may have exposure to some of their income, trust, real estate and alternative energy funds available on trading exchanges. However, it mostly works behind the scenes with private investors and hedge funds.

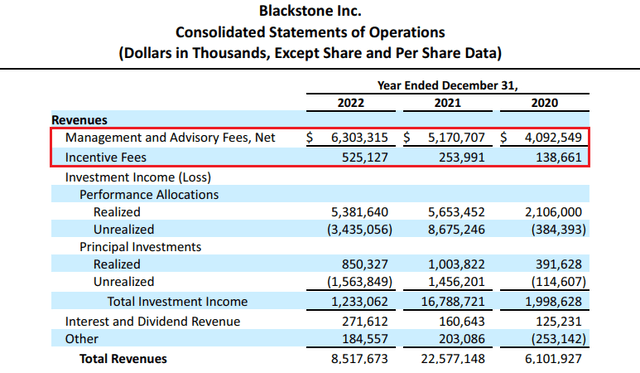

Blackstone 2022 10-K

Two factors have me interested in the company. First, I have been hearing and reading lots of gripes about how investors are losing brokerage account value, but they feel slighted that advisors continue to receive a management fee. Here's my suggestion. Why not own the advisor, and take the other side of the fee setup?

I remember when I first visited Las Vegas on my 21st birthday, legal gambling age, a long time ago. I was worried about losing money at the blackjack table and on slot machines. So, I decided to buy a stake in the other side of the table through Caesars World stock ownership. Caesars Palace was the premier high-rolling casino back then, and one I planned to visit. In our capitalistic society, you can do that. If you want to complain about Disneyland prices when you visit, take the other side of the transaction and buy Disney (DIS) shares. If you drink or smoke all of the time, buy shares in those businesses to get some of your money back!

The positive "cyclical" news and immediate secondary reason for investors to consider ownership is Blackstone has just experienced an emotion-based selloff, while technical momentum indicators have survived far better. Decent value is now present, reviewing the trailing 5.5% dividend yield on 10%+ in free cash flow generation. Today's quote around $80 (or possibly an even lower entry number next week if panic selling continues) may have opened a smart opportunity for long-term buyers.

For sure, shares have suffered after the peak in U.S. stock and bond markets was reached in late 2021. Investors are concerned regular fee revenue will not grow on a stagnate to lower total asset base. At least for the time being, this has not been the company's experience. Below is a graph of the +25% increase in management, advisory, and incentive fees achieved in 2022 vs. 2021.

Worthwhile Valuation Setup

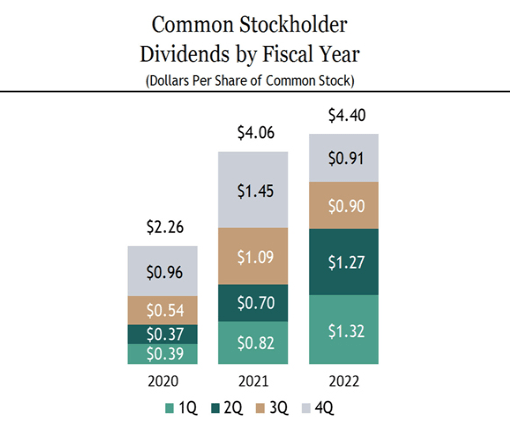

I believe the primary fundamental reason investors should look at Blackstone is its record of paying out cash flow as a dividend to common shareholders. With inflation rates running hot, and the U.S. equity market cash yield still incredibly low at 1.7% for the S&P 500, finding stocks with "both" business growth potential and a high upfront yield is a paramount goal of mine right now.

Blackstone's trailing 5.5% cash distribution is one of the highest in the bank, insurance, and finance industries. While the odds favor a prolonged bear market and recession cutting the payout in 2023-24, a soft landing in the economy and/or trading markets that surprise on the upside could support the yield around 5%. To me, if you want to hold exposure in a large-cap financial name, Blackstone ranks up there with my favorites of JPMorgan Chase (JPM), Goldman Sachs (GS), and Citigroup (C) currently, especially graded on safety, quality, diversification and high cash yield in combination.

Blackstone 2022 10-K

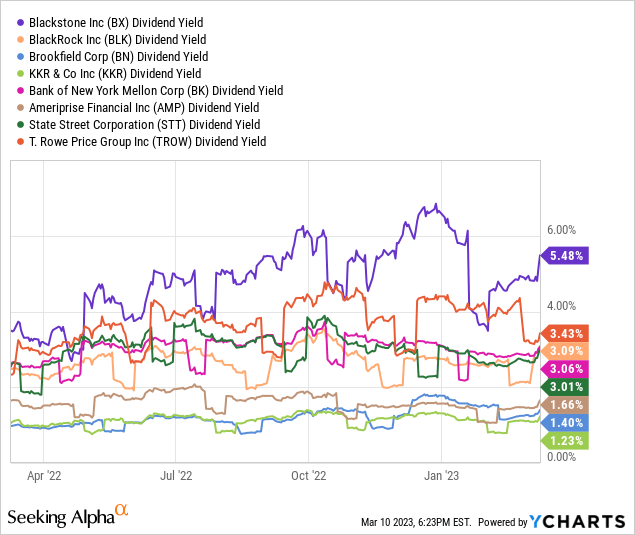

Below is a graph of dividend yield fluctuations as a function of trailing annual cash pay-outs vs. stock price. Blackstone owns the leading number out of its large-cap peer group, including the main U.S. asset managers, equity investors, bank custodians, and mutual fund organizations. My sort list includes BlackRock (BLK), Brookfield (BN), KKR & Co. (KKR), Bank of New York Mellon (BK), Ameriprise Financial (AMP), State Street (STT), and T. Rowe Price (TROW).

YCharts - Large U.S. Asset Managers, Dividend Yields, Past Year

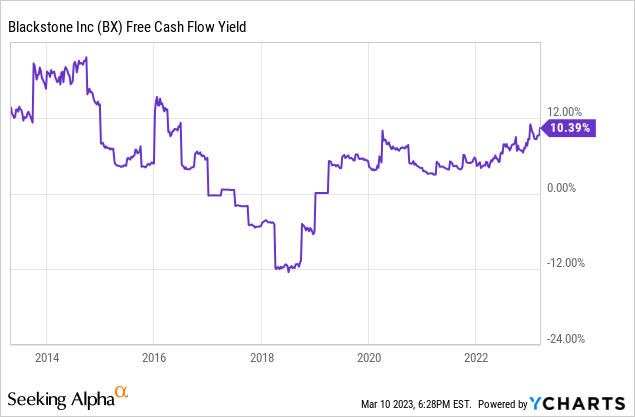

Even better news is the latest 5.5% yield has been supported by free cash flow generation of 10%+ over the past 12 months, on the current $80 share quote. Trailing free cash flow yield is now the highest since early 2016 for this advisory and trading firm.

YCharts - Blackstone, Trailing Free Cash Flow Yield, 10 Years

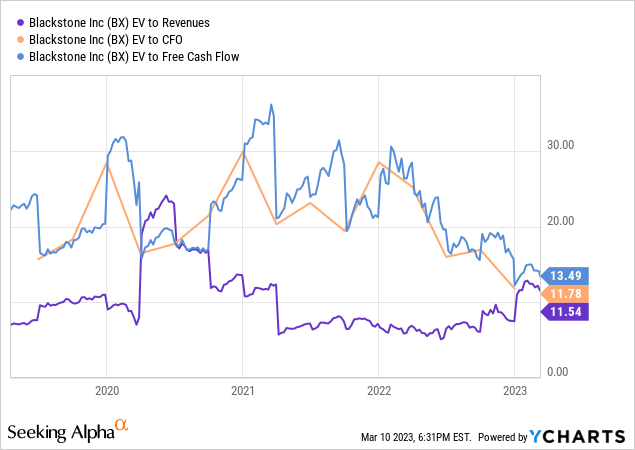

Further, on enterprise valuations (equity capitalization plus total debt minus cash holdings at the operating business) of trailing sales, cash flow and free cash flow, Blackstone is now essentially the least expensive it has been since 2019, before the pandemic began.

YCharts - Blackstone, Enterprise Value Stats, 3 Years

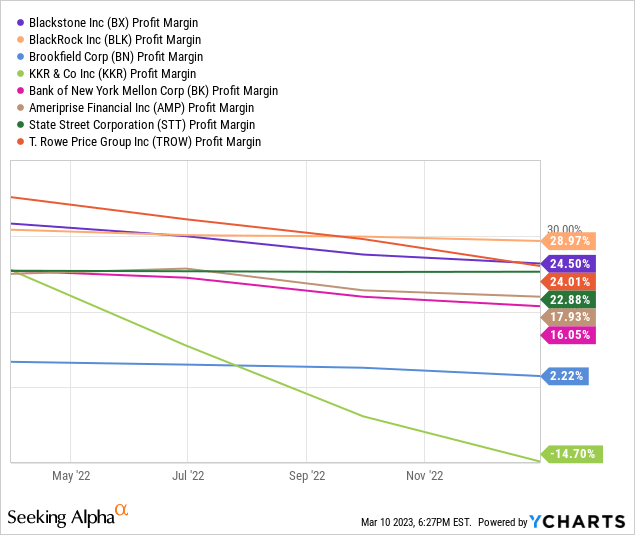

Lastly, profit margins are important for a margin of safety, if the business finds rougher times. Blackstone checks off that box as well, with a trailing final income margin of 24.5% on sales, often sitting in the top tier of my peer group over the past decade.

YCharts - Large U.S. Asset Managers, Final Profit Margins, Past Year

Technical Buy Argument

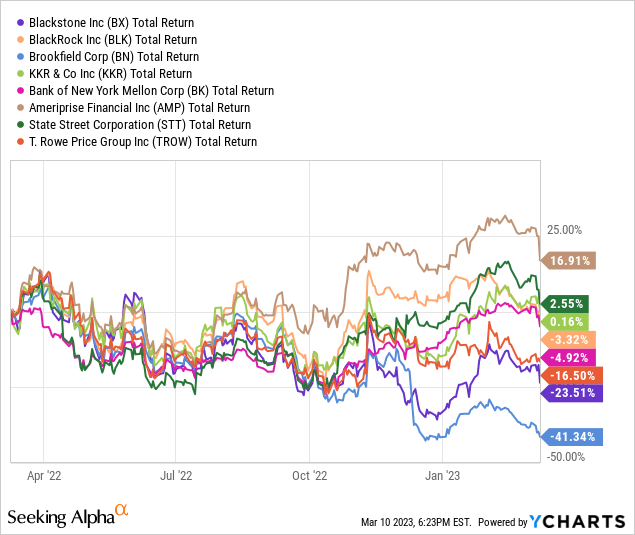

Unfortunately for 2022 share owners, on a 1-year chart Blackstone has been one of the worst total return performers vs. competitors and peers. With extensive real estate and financial market exposure, the sharp rise in interest rates has caused an exodus of investor confidence. Plus, the late 2021 Wall Street valuation of the business was quite extended, meaning plenty of potential downside was present.

YCharts - Large U.S. Asset Managers, 1-Year Total Returns

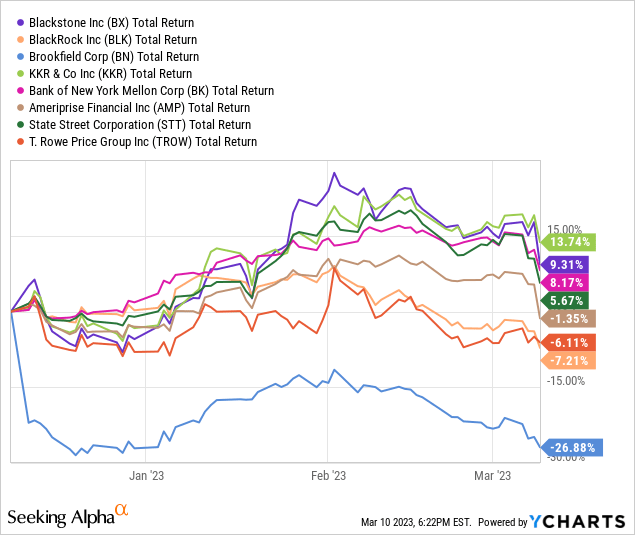

Nevertheless, November 2021's record share price above $149 has nearly been cut in half. On a 3-month total return graph, Blackstone has seen improving relative performance vs. the peer group. It appears investors are starting to look more closely at the company's long-term value proposition.

YCharts - Large U.S. Asset Managers, 3-Month Total Returns

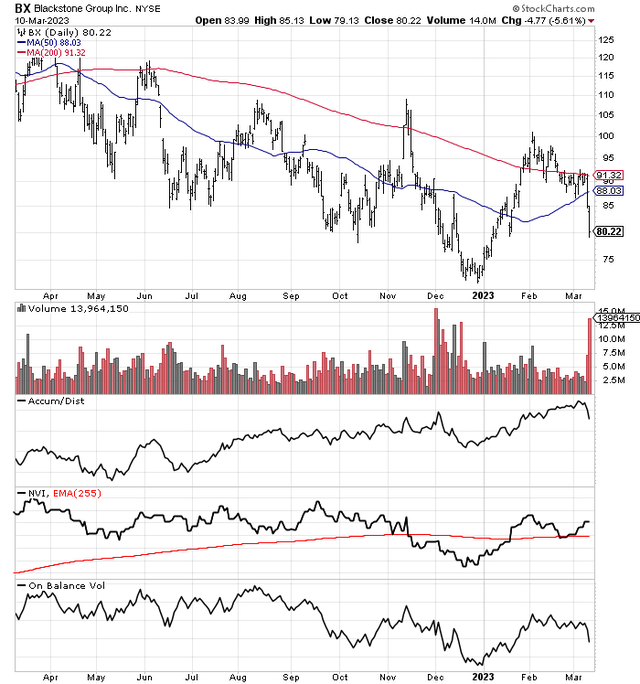

Adding to this bullish slant, healthier movements in various underlying momentum indicators are taking place vs. what price would suggest. Since the December 2022 price bottom, the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume are acting quite strongly. Solidly rising trends in all 3 indicators have not been part of the investment equation since the late 2021 price peak. So, I would gauge progress in these indicators as noteworthy positives.

StockCharts.com - Blackstone, 1 Year of Daily Price & Volume Changes

Final Thoughts

If you have ever wanted to act as the advisor on the other side of the high-finance negotiation table, collecting fees no matter which direction the market or your portfolio moves, now may be your chance! Purchasing Blackstone around $80 a share could prove a wise investment decision, especially if rising dividend pay-outs are the future.

What are the risks? That's an easy question to answer. Blackstone's business health will fluctuate with the financial and real estate markets. If we are entering a deep recession, shares will surely languish during the rest of the year under $100.

However, management has done an admirable job of riding the topsy-turvy markets in 2022 and early 2023, with business growth continuing overall. Assuming a severe recession and a monster drop in stock prices generally in America can be avoided, Blackstone could be a wonderful buy near $80.

Another operating catalyst is also lurking. Several members in Congress have proposed starting a sovereign wealth fund that invests Social Security payments in assets outside of safer Treasury securities. Such would be terrific news for Blackstone, as it may be one of a limited number of firms tapped to receive capital in a new, huge-dollar asset management service. You can read more on this angle from Seeking Alpha contributor Samuel Smith here.

The uber-bullish argument in summary is the stock market and economy survive 2023 without a material catastrophe, while growth in the business appears from new government administered sources. The best news would be today's robust dividend yield upfront continues unabated as operations (sales, cash flow, earnings) stay in a long-term growth pattern. Under this scenario, a return back to all-time highs, and a price closer to $150 in 2-3 years is entirely possible.

I rate Blackstone a Buy. It is a top income choice in the financial sector, with upside price appreciation potential as a kicker.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of C, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may purchase a long position in BX, GS over the next 72 hours.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. When investing in securities, investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but the author’s opinion written at a point in time. Opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.