IAT: SIVB's Failure Could Lead To Lower Profitability For Regional Banks

Summary

- IAT provides targeted exposure to U.S. regional banks.

- SIVB's failure shows the scope of the issue, as deposits leave regional banks due to higher-yielding money market funds.

- Going forward, banks must either raise deposit rates or raise equity capital. Both courses of action will hurt profitability.

BrianAJackson

As we watch in real time the implosion of SVB Financial Group (SIVB), I think there are important investment implications for the regional banking sector that investors need to be aware of.

The failure of SIVB may prove to be an inflection point for regional banks that make up the holdings of the iShares U.S. Regional Banks ETF (NYSEARCA:IAT). SIVB is merely an extreme example showing the flight of deposits away from regional banks and into higher yielding money market funds. This compounds the problem for regional banks, as they have large unrealized securities losses that may be turned into realized losses if liquidity dries up.

Going forward, I worry profitability for regional banks will suffer, as they must either raise deposit rates to compete against money market funds, or raise equity capital to fund outgoing deposits. Both courses of action will reduce returns on equity. I would avoid the IAT ETF until we get more clarity on the scope of the issue.

Fund Overview

The iShares U.S. Regional Banks ETF provides targeted exposure to the U.S. regional bank sector. The ETF has $578 million in assets and charges a 0.39% expense ratio.

Portfolio Holdings

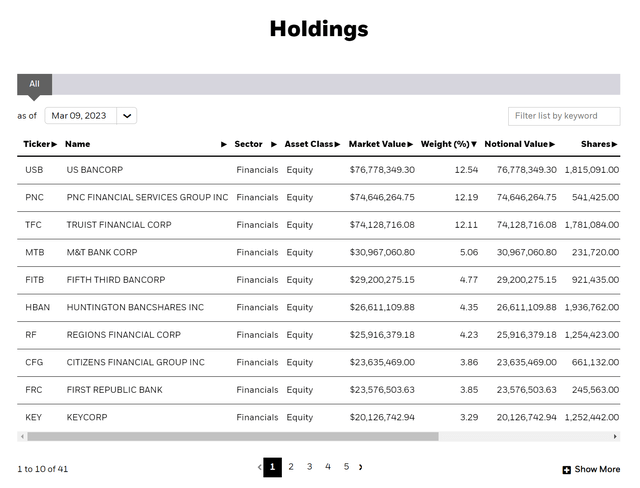

The IAT ETF tracks a market-cap weighted index of U.S. regional banks. Figure 1 shows the top 10 holdings of the ETF.

Figure 1 - IAT holdings (ishares.com)

Distribution & Yield

The IAT ETF pays a modestly high quarterly distribution, with trailing 12 month distribution of $1.49 or 3.5% trailing yield.

Returns

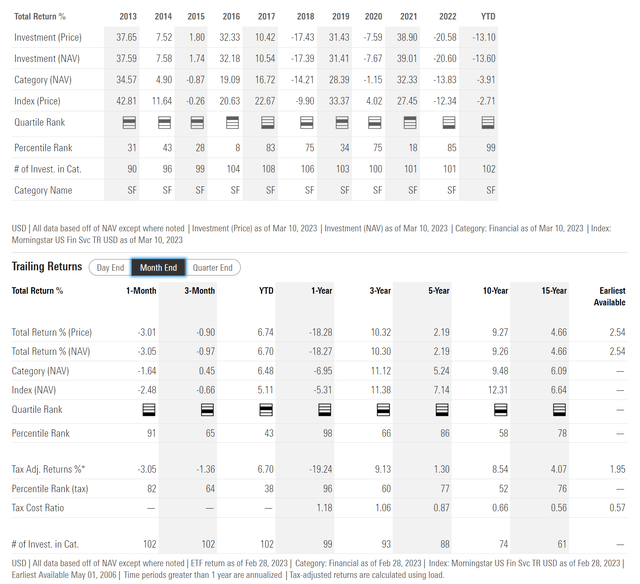

Historically, the IAT ETF has delivered mixed performance, with 1/3/5/10Yr average annual returns of -18.3%/10.3%/2.2%/9.3% respectively to February 28, 2023 (Figure 2).

Figure 2 - IAT historical returns (morningstar.com)

In general, regional banks perform well during economic expansions and when the yield curve is expanding, as banks earn a spread between long-term investments like loans and mortgages and short-term deposits funding those investments. When the economy does poorly, banks tend to suffer like in 2018 and 2020. A compressed yield curve also hurts banks' profitability, as it reduces the spread, they can earn between loans and deposits.

SIVB Is The Tip Of The Iceberg

First, a quick recap of what happened at SIVB. SIVB, or Silicon Valley Bank, as it is commonly called, is a mid-sized regional bank specializing serving venture capital ("VC") companies based out of Silicon Valley.

On March 9th, 2023, SIVB shares plunged dramatically after it announced plans to raise $1.75 billion in equity capital to shore up its balance sheet. The bank, like many other FDIC-regulated banks, had run up billions in unrealized mark-to-market losses on mortgage bonds and other securities. As it became evident that the Federal Reserve was not going to 'pivot' any time soon, SIVB decided to offload its available for sale ("AFS") securities portfolio, recognizing a $1.4 billion after-tax loss in the process and prompting the equity raise.

Unfortunately, the capital raise started a 'bank run' as many VC firms urged their portfolio companies to withdraw deposits from SIVB. By March 10th, news broke that SIVB's capital raise had failed, and by the afternoon, SIVB was placed into FDIC receivership.

Why Now?

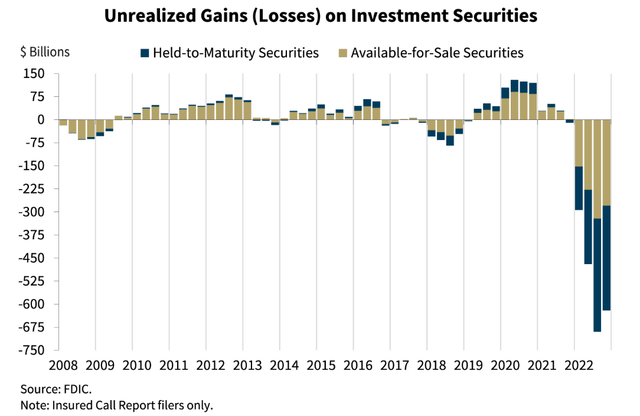

Unrealized losses on AFS and held to maturity ("HTM") securities have been building on FDIC-regulated bank balance sheets for many months. According to FDIC Chairman, commercial banks under his purview have accumulated $620 billion in unrealized losses on their balance sheets at the end of the fourth quarter (Figure 3).

Figure 3 - FDIC-regulated banks have $620 billion in unrealized losses on securities (FDIC)

If these unrealized losses were not an issue in 2022, why are they suddenly becoming an issue and causing banks like SIVB to fail?

There Is An Alternative To Deposits

The answer could be because of changing consumer behavior.

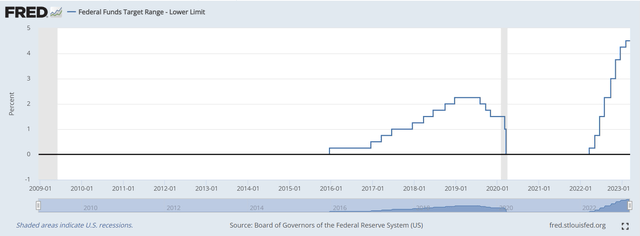

For years after the 2009 Great Financial Crisis, the Fed kept the Fed Funds rates at zero, an extraordinarily accommodative monetary policy rate (Figure 4). Although they made a brief attempt to normalize interest rates in 2016, the COVID pandemic caused them to lower interest rates to zero again in 2020.

Figure 4 - Fed kept Fed Funds rate at zero since 2009 (St. Louis Fed)

With rock bottom short-term interest rates, investors who desired ultra-low risk had no choice but to keep their money in savings accounts paying them 0.10% or money market funds paying 0.15%. These ultra-low rate deposits became a cheap source of funding for banks, as they could raise almost unlimited amounts of deposits by paying an extra 5 or 10 basis points and lending it to companies at a 3-4% net interest margin ("NIM").

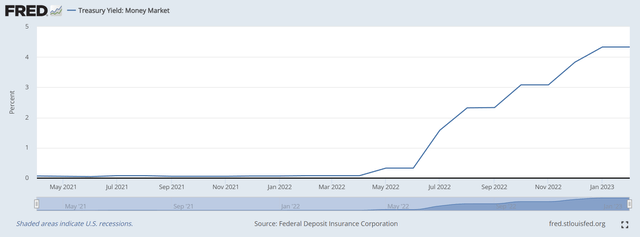

However, that business model began to unravel in 2022, as the Fed embarked on the fastest pace of interest rate hikes in history in response to soaring inflation. Suddenly, money market funds that had been yielding next to nothing were starting to yield 1%, 2%, 3% or more. In fact, by the end of 2022, money market funds were yielding 4 to 5% (Figure 5).

Figure 5 - Money market funds began paying competitive rates in 2022 (St. Louis Fed)

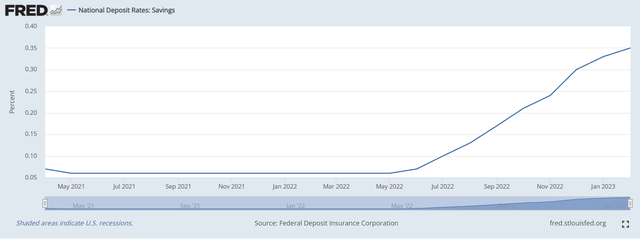

At the same time, banks continued to pay next to nothing to savers, with national deposit rates barely rising to 0.35% by year-end (Figure 6). Banks were reluctant to raise deposit rates, as that would eat into their NIM. (Author's note, Bloomberg's Odd Lots podcast went over this issue in a recent episode)

Figure 6 - Savings rate barely rose in response to Fed rate hikes (St. Louis Fed)

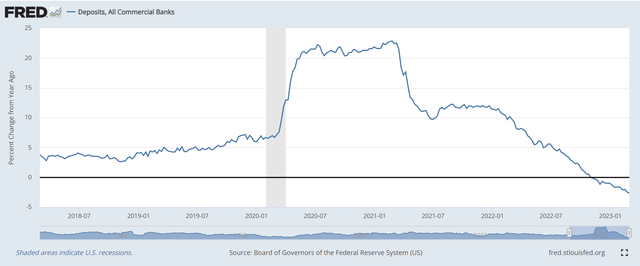

However, for savers and investors, an ultra-low risk 4-5% from money market funds became very attractive, especially compared to 0.35% yielding deposits. Therefore, by November, we saw a mass exodus of deposits, as savers withdrew their money from low-paying deposits and invested into higher yielding money market funds (Figure 7).

Figure 7 - Deposits fell YoY by end of 2022 (St. Louis Fed)

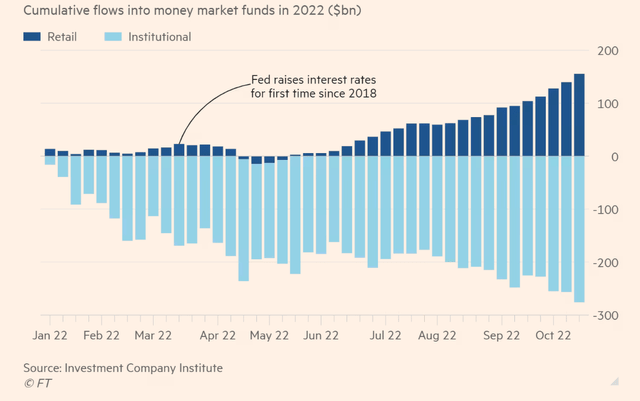

For savers, finally 'there is an alternative' ("TIAA") to savings accounts that pay nothing (Figure 8).

Figure 8 - As investors moved money into high yielding money market funds (Financial Times)

Deposit Flight Caused Fire Sale

Normally, unrealized losses on AFS and HTM securities can be held indefinitely, as the securities will 'earn' their way back to par at maturity. However, this unexpected outflow of deposits suddenly meant that the banks have a 'liquidity' issue.

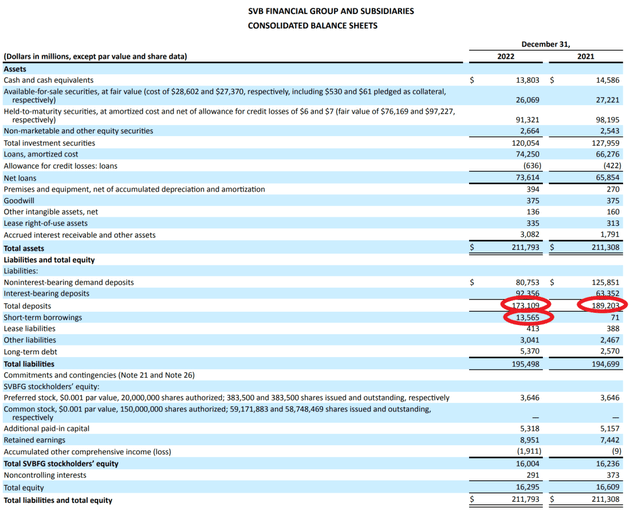

For example, in figure 9 below, we can see that SIVB's deposits shrank by $16 billion in 2022, while assets remained constant at ~$211 billion. SIVB tried to plug this hole with short-term borrowings, which is unsustainable.

Figure 9 - SIVB deposits shrank by $16 billion in 2022 (SIVB 2022 10K report)

Therefore, SIVB had no choice but to sell their AFS portfolio to increase liquidity and fund outgoing deposits.

Expect Lower Profitability For Banks

While SIVB's issues were extreme, the general idea of an exodus of deposits to higher yielding assets is real. Obviously, there is a simple solution to this problem for banks. They can raise interest rates on their deposit accounts to stem the outflow. However, this will compress their profitability, since deposit interest is a cost.

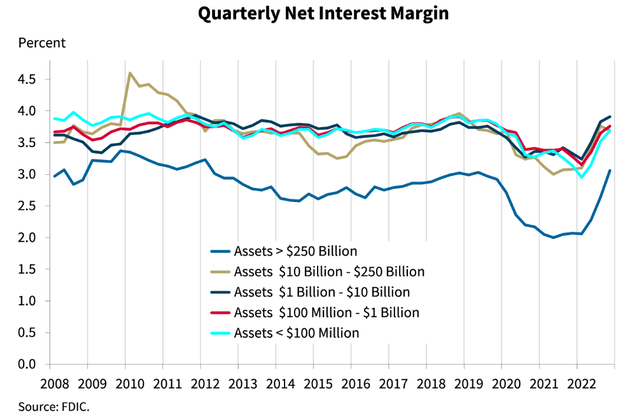

In Figure 10 below, we can see that NIMs generally rose in 2022 for FDIC banks, as they captured the rise in yields without passing it on to savers. Going forward, we should expect to see NIMs contract as banks must compete with money market funds for savings.

Figure 10 - FDIC banks kept interest rate increases for themselves (FDIC)

Will Deposits Flow To Money Center Banks?

The prospect of potential haircuts for uninsured depositors at SIVB also raises another potential issue for regional banks.

Currently, the FDIC is guaranteeing SIVB deposits up to their $250,000 threshold. According to receivership rules, any uninsured depositors will be paid from liquidating the assets of the failed bank. Some well-informed commentators like former Fed trader, Joseph Wang, speculate that uninsured SIVB depositors may get back 80 cents on the dollar.

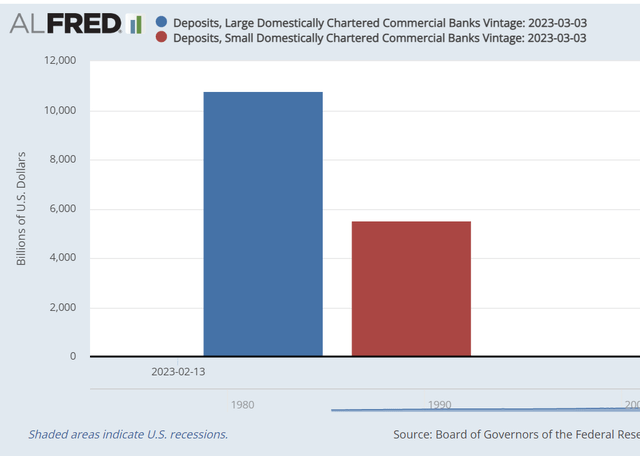

If large depositors do get a haircut, then going forward, there will be an impetus for large deposits to flow to the big money center banks like JPMorgan, Bank of America, Citigroup, and Wells Fargo, since they are literally 'too big to fail'. Already, large, chartered banks have almost twice the deposits of small, chartered banks (Figure 11). This ratio could dramatically increase as depositors rush to place their deposits with 'too big to fail' banks, causing a 'bank run' on regional banks.

Figure 11 - Large banks have almost twice the deposits of small banks (St. Louis Fed)

A Bailout Could Incentivize Poor Management Practices

On the other hand, a bailout of SIVB uninsured depositors could incentivize bad management practices at regional banks since profits can be reaped by management but losses will be socialized by the government.

Regulators like the FDIC are literally caught between a rock and a hard place with respect to how they treat the uninsured depositors at SIVB.

Valuation

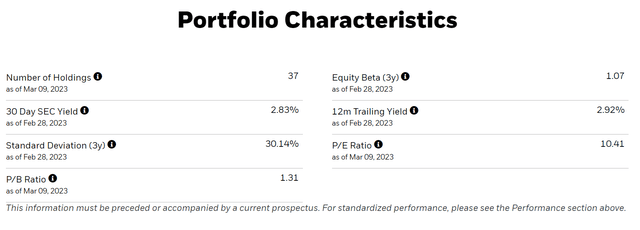

Looking at the IAT ETF, we see that the portfolio is currently trading at a 10.4x P/E ratio, which may appear cheap compared to the market at ~18x (Figure 12).

Figure 12 - IAT portfolio characteristics (ishares.com)

However, given the profitability challenges I noted above, I believe the forward profitability of regional banks could be much lower. Either banks will have to raise deposit rates (which will hurt their NIMs and profitability), or they must raise equity capital (which will increase their equity base) to offset the crystalized securities losses if they sell AFS and HTM securities to raise liquidity. Regional banks could be 'cheap' for a reason.

Conclusion

The failure of SIVB could prove to be a key inflection point for regional banks. Although extreme, SIVB merely highlights the flight of deposits away from small regional banks as money market funds are yielding much higher rates than deposit accounts. This flight of deposits act as a catalyst forcing regional banks like SIVB to crystallize unrealized securities losses, as they must offload securities to raise liquidity to pay outgoing deposits.

Going forward, I worry profitability for regional banks will suffer, as they must either raise deposit rates to compete against money market funds or raise equity capital to fund outgoing deposits. Both courses of action justify low P/E ratios for regional banks. I would stay away from the IAT ETF until we get more clarity on the scope of the issues.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.