Alaska Airlines Stock Set To Take Flight

Summary

- Alaska Airlines was considered one of the world's best-run airlines for years.

- Alaska acquired Virgin America in 2016 and faced years of weaker financial performance.

- With the last vestiges of Virgin America behind Alaska, the Seattle-based airline has solid strategies to return to its former position of financial leadership.

kameraworld/iStock Editorial via Getty Images

Alaska Air (NYSE:ALK) has long been considered one of the airline industry’s choicest picks as an investment. However, its merger with Virgin America is considered one of the few recent strategic failures of the surviving Seattle-headquartered airline. That merger derailed ALK’s finances for years, punctuated by the pandemic. Thankfully, though, the close of the Virgin America chapter at Alaska also signals an expected and welcome return to strong profitability as ALK once knew – but the uptick in margins likely won’t take place for another quarter.

Overcoming a Messy Acquisition

Airline mergers and acquisitions often do not deliver as they were at least publicly intended and the Alaska-Virgin America merger also fit that description. Alaska’s pursuit of Virgin America was justified as a means to expand ALK’s presence into the California market, diversifying away from the Pacific Northwest which Alaska Airlines has long called home. ALK took on billions of dollars in debt in order to acquire Virgin America and stressed what was considered at the time of the merger one of the more pristine balance sheets in the airline industry. Virgin America’s focus was on the premium transcontinental market while Alaska used a traditional legacy carrier mixed class domestic first/economy class configuration in its all-Boeing (BA) fleet, a nod to its hometown and Southwest Airlines’ (LUV) use of Boeing’s stalwart domestic aircraft. In order to keep its product consistent and to facilitate fleet simplicity, ALK chose after the merger to not maintain a dedicated fleet of transcon aircraft as Virgin America and many other carriers in the transcon market used; ALK’s revenue in the transcon markets fell, and because so many of the markets which ALK gained in San Francisco and Los Angeles were transcon routes to the major airports in the Northeast US, ALK lost share in major markets on both coasts as it returned to its core strengths in the Pacific Northwest. Realizing that it did not need the Airbus (OTCPK:EADSY) aircraft and the complexity to Alaska’s operation that those aircraft created, ALK accelerated the retirement of those aircraft with the final Airbus aircraft leaving Alaska’s fleet just five years after the merger. While Alaska has added other routes on the west coast, it is below every one of the four largest U.S. airlines at Los Angeles in market share and just a few market share points above Delta (DAL) in San Francisco.

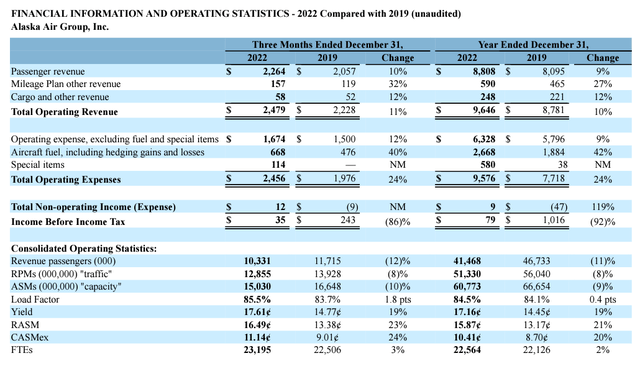

Alaska Airlines 2022 summary financials (Alaska-Air.com)

Financial Recovery in Progress

Alaska Airlines reported operating and net income margins below 1% for both the 4th quarter and the full year 2022, well below other airlines. The big 3 global carriers – American (AAL), Delta, and United (UAL) saw double digit operating margins in the 4th quarter and single digit net margins while Southwest posted losses due to its Christmas operational problems. LUV is expected to post losses again in the first quarter while each of the big 3 global carriers are expected to post low single digit margins. The return of passenger revenue slowed in the final quarter of 2022 but capped a year of relative normality compared to the pandemic period. Fuel cost spikes bit, offset by successful fuel hedging that saved the company about 7% in the price per gallon. ALK ended 2022 with the ingredients and a game plan to return to stronger profitability in 2023.

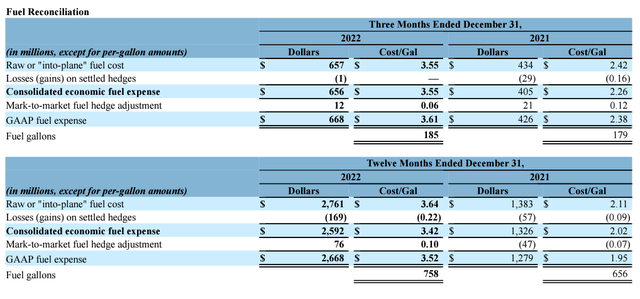

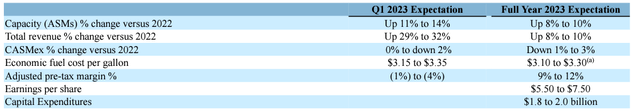

ALK fuel reconciliation 2022 (Alaska-Air.com) ALK guidance 1Q2023 (Alaska-Air.com)

Alaska’s guidance for the first quarter and full year 2023 show that margins will expand throughout the year but the 1st quarter will trail 4th quarter 2022 levels driven heavily by fuel costs and slower revenue growth. While ALK expects year over year 1st quarter capacity to grow in the low single digits, there will be only a low single digit increase in sequential quarter over quarter capacity, indicating that ALK intends to return to a more stable approach to capacity growth that is better aligned with macroeconomic factors. ALK’s fuel hedging might not contribute as much in 2023 as it did in 2022, in part because refinery margins remain elevated even though crude oil prices – which ALK hedges – have eased.

Solid strategies will fuel ALK's margin growth

There are a number of factors that will help ALK in 2023 reach its goals along with a few challenges. First, industry capacity is expected to stabilize esp. in ALK’s key markets. While Alaska and Delta used to have a partnership, the latter chose to build a competing hub in Seattle which it has used as one of its two west coast transpacific hubs. ALK and DAL are both rational competitors and some of the excess capacity which each has placed into some competitive markets does not look like it will exist in 2023. In addition, the Seattle airport is nearing capacity; although the airport has built and renovated facilities that benefit both airlines and their operations, there is less and less physical space for the passenger terminals to be expanded. The airport has fairly strict rules for gate usage which incentivizes lease holders to use the space they are allocated but also makes it unlikely that there will be large spikes or dips in flight numbers. As markets in Asia reopen, Delta is expected to use more Seattle capacity to feed its transpacific flights rather than compete in the domestic market. Delta also operates several transatlantic flights from Seattle and bills itself as Seattle’s global airline. In addition, Delta has used some of its widebody aircraft in domestic markets from Seattle and those aircraft are expected to return to international service across Delta’s network.

ALK signed a new contract with its pilots in 2022, one of the early carriers to agree to a post-covid pilot contract. Historically, Alaska has paid less than larger nationwide carriers but has thrived on its location in the Pacific Northwest and Alaska which is an attractive place to live for many people. ALK’s flight attendant union contract is amendable; airline labor contracts are governed by the Railway Labor Act and do not expire. Most U.S. airlines have not settled new labor contracts for flight attendants even though many smaller airlines and Delta have settled pilot contracts. Delta raised the pay of most of its non-union, non-pilot personnel which include its flight attendants but threw a wrinkle to the rest of the industry by adding pay during flight boarding for the first time among large U.S. airlines. Since ALK predominantly flies shorter haul flights, adding pay during boarding could disproportionately increase ALK’s flight attendant costs compared to larger carriers with more nationwide networks.

Alaska Airlines - oneworld (Alaska-Air.com)

Alaska joined the oneworld airline alliance during the pandemic, extending its partnership with American Airlines. While the Dept. of Justice is suing AAL’s partnership with JetBlue (JBLU) in the Northeast, ALK’s relationship with AAL has none of the features which the DOJ found problematic with the AAL/JBLU partnership. ALK is unique among carriers in an alliance in that it has a number of foreign airline partners with which it has partnerships, although on a lesser level than American or other oneworld airlines. In fact, ALK has partnerships with most foreign airlines that serve Seattle meaning that ALK is the de facto domestic airline for most international flights other than for Delta and its alliance partners. As international travel returns, including to Asia, ALK should be able to fill higher percentages of its capacity with partner connecting traffic.

Alaska’s retirement of the Airbus aircraft it acquired from Virgin America will simplify its operations and reduce its pilot training and maintenance costs. In addition, ALK’s wholly owned regional carrier has retired its Q400 turboprop aircraft, leaving Horizon with an all-regional jet fleet. Alaska’s fleet simplification dovetails with its other initiatives that mark the finalization of the Virgin America merger era and the return to ALK’s historically strong financial position and its maximization of its niche position in the Pacific Northwest.

Alaska stock should be a solid winner in 2023

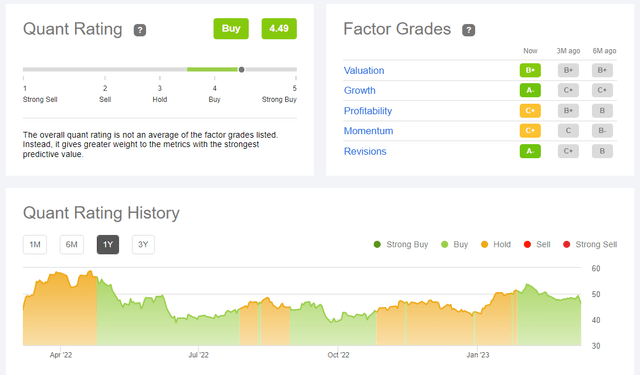

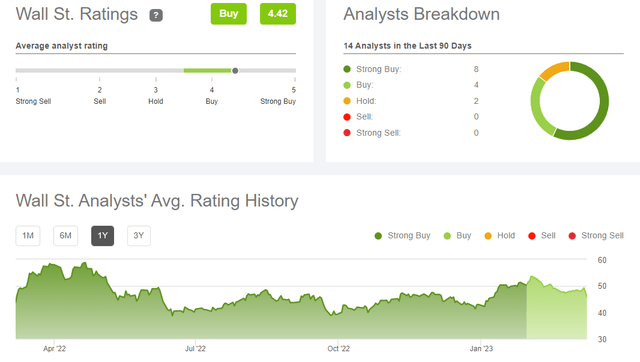

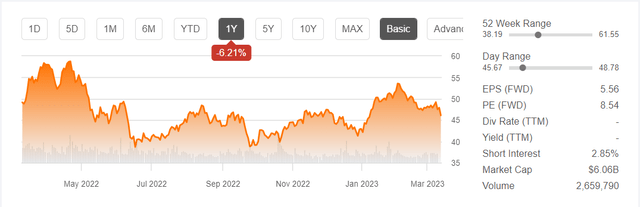

Alaska Airlines stock continues to see significant movement along with much of the stock market based on macroeconomic factors that often outweigh company performance. While no company can isolate itself from its external environment, ALK’s strategies are not only sound but are certain to further improve its performance relative to its peers in an industry that is otherwise perceived as not only volatile but also subject to external influences. While macroeconomic concerns remain that high interest rates might depress consumer stocks, the airline industry has provided no indication that the current high levels of demand relative to supply will decline or that there is a softening of pricing. In addition, ALK’s strong position in the Pacific Northwest and Alaska which is approaching seasonal travel strength means that any weakness will be felt for ALK later than it will be for other carriers. ALK sports a buy using Seeking Alpha’s Quant Rating, by SA authors, and by Wall Street analysts.

ALK Quant Rating (Seeking Alpha) ALK Wall Street ratings (Seeking Alpha) ALK chart 10 Mar 2023 (Seeking Alpha)

With the end of the first quarter in site and likely improving guidance and margin performance for the 2nd quarter of 2023 and beyond, ALK deserves another close look which should lead to a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.