CrowdStrike Q4 Earnings: Not As Expensive As You Think

Summary

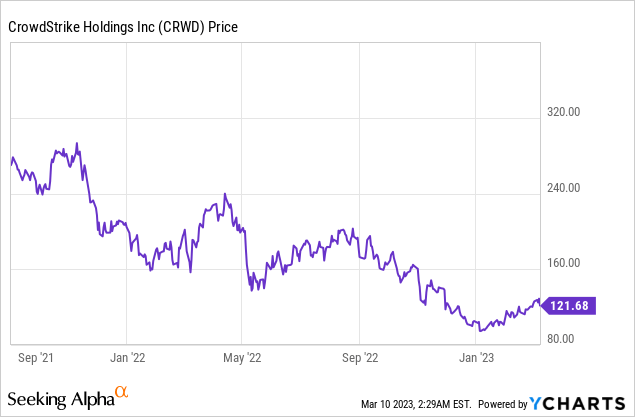

- CrowdStrike is now down over 50% from its all-time high.

- The cybersecurity company has massive market opportunities that should continue to drive growth.

- Its Q4 earnings showed strong growth and upbeat guidance despite facing a tough macro backdrop.

- Current valuation is discounted compared to high-growth peers.

- I rate the company as a buy.

KanawatTH

Investment Thesis

After a historical bull run in 2020, CrowdStrike (NASDAQ:CRWD) has now pulled back over 50% from its all-time high in 2021. Although shares have plummeted, the company’s fundamentals remain rock solid. It is well-positioned to benefit from the rapid expansion of the cybersecurity market and it is also entering other adjacent markets which could further fuel growth. The company continues to execute with the latest earnings reporting strong top-line growth and upbeat guidance. After the drop, the current valuation looks pretty compelling as multiples are lower than peers with similar growth rates. I believe the drop offers a solid buying opportunity and I rate the company as a buy.

Why CrowdStirke?

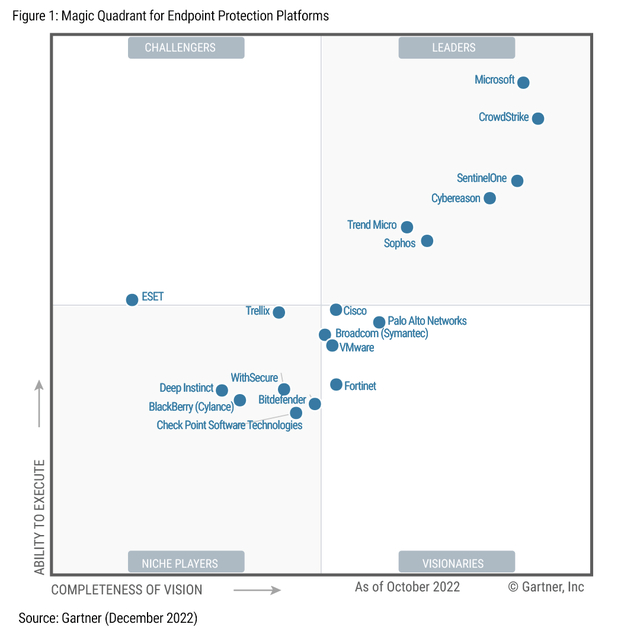

CrowdStrike is a US-based cybersecurity company founded by George Kurtz in 2011. The company specializes in endpoint security via its Falcon Platform, a single-agent solution that stops breaches, ransomware, and cyberattacks. According to Gartner's latest report, it is the leader in the space alongside Microsoft (MSFT) and SentinelOne (S), as shown below. It currently has a 17.7% market share and the figure has been growing rapidly thanks to its simplicity and its cloud-native nature that enable easy deployment.

George Kurtz, CEO, on market position

Our market leadership continues to grow as customers are voting for their platform of choice with their wallets. CrowdStrike ranked first in IDC’s annual Worldwide Modern Endpoint Security Market Share report for the third consecutive year with 17.7% market share, outpacing all vendors by posting the largest increase in revenue and market share.

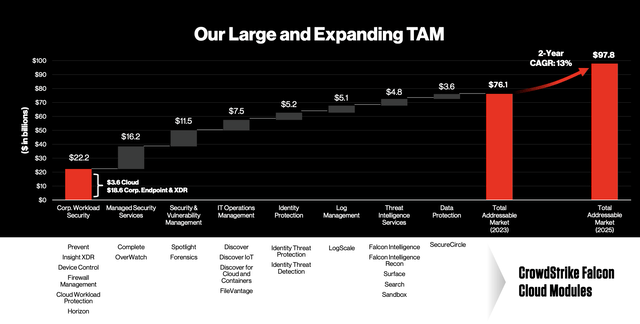

The endpoint security market alone is pretty huge. According to Fortune Business Insights, its TAM (total addressable market) is estimated to grow from $12.3 billion in 2021 to $24.6 billion in 2028, representing a CAGR (compounded annual growth rate) of 8.3%. The market continues to benefit from the digital transformation tailwind, which substantially increased the number of connected devices. CrowdStrike has also been actively expanding beyond endpoint security into other adjacent markets such as cloud security, managed services, Identity, and log management, which significantly increases its market opportunity, as shown in the chart below. The company estimates its TAM to be $76.1 billion in 2023 and is forecasted to grow at a 13% CAGR to $97.8 billion in 2025. I believe the company is just getting started and there are massive opportunities ahead.

Q4 Earnings

CrowdStrike recently announced its fourth-quarter earnings and the results continue to demonstrate strong top-line growth, although the bottom line was a bit disappointing. The company reported revenue of $637.4 million, up 48% YoY (year over year) compared to $431 million. ARR (annual recurring revenue) also increased 48% YoY to $2.58 billion, with $221.7 million being net new ARR.

The growth is driven by both the increase in customers and higher spending. The number of subscription customers was 23,019, up 41% YoY from 16,325. The net dollar retention rate also grew 140 basis points YoY from 123.9% to 125.3%. This is due to customers adopting more and more modules such as identity protection and log management. 62% of customers now subscribe to 5 or more modules, up from 57% in the prior year. Gross profit was $461.8 million compared to $318.4 million, up 45% YoY. The gross profit margin dipped by 1% from 76% to 75%.

The bottom line was the Achilles Heel of the report once again. Operating expenses were $523.3 million compared to $341.9 million, up 53% YoY. Most of the increase is attributed to R&D (research and development) and S&M (sales and marketing). R&D expenses grew 82.7% from $105 million to $191.8 million. While S&M expenses grew 51.5% from $162.6 million to $246.4 million. This resulted in operating loss worsening from $(23.5) million to $(61.5) million, or (9.6)% of revenue. The net loss only widened by 17.3% YoY from $(41.7) million to $(48.9) million, as it benefited from an interest income of $27 million. Net loss per share was $(0.20) compared to $(0.18).

The company also initiated upbeat guidance for FY24. It expects revenue to be $2.96 billion to $3.01 billion, which translates to strong growth of 32% to 35%. The non-GAAP EPS is expected to be in the range of $2.21 to $2.39.

Investors Takeaway

All things considered, I think the earnings this quarter were solid. Top-line growth was superb and the guidance was surprisingly strong considering the macro headwinds. The bottom line was underwhelming as loss widened again. Unlike other SaaS companies that are cutting spending, CrowdStrike continues to increase its spending at a rapid pace. However, the company can afford to do so as it has over $2.7 billion in cash and is already close to being profitable. Therefore it makes sense for them to capture more market share aggressively while competitors are scaling back. I hope we can start to see some operating leverage in the coming quarters.

After the drop, CrowdStrike stock's valuation does look pretty appealing compared to other high-growth SaaS peers. The company is currently trading at a fwd EV/sales ratio of 8.9x, which is quite low among peers with similar growth. For context, Zscaler (ZS), Datadog (DDOG), and Cloudflare (NET) are trading at 9.8x, 10.2x, and 14x respectively, which represent a premium of at least 10%. The company isn’t necessarily cheap on a traditional basis but it seems to offer the most attractive risk-to-reward within its peer group. It also has strong prospects and is forecasted to grow revenue at a 30% CAGR moving forward, which is rare for a company of its size. I like its growth opportunities and I think the current price offers some downside protection thanks to its discount compared to peers. Therefore I rate the company as a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.